|

市場調查報告書

商品編碼

1408526

使用者生成內容平台 -市場佔有率分析、產業趨勢與統計、2024年至2029年的成長預測User-Generated Content Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

用戶生成內容平台的市場規模目前為 59 億美元,預計未來五年將達到 212.6 億美元,預測期內複合年成長率為 29.2%。

主要亮點

- 由於各種社交媒體平台的日益普及,用戶生成內容平台多年來經歷了顯著成長。這些平台允許用戶創建和共用內容並參與對話。 Facebook、Instagram、Twitter、YouTube 和 TikTok 等社群媒體平台也是最常使用的 UGC 平台之一。

- 此外,用戶生成的內容平台還允許品牌從社交媒體和其他資訊來源收集公司和視覺產品介紹,包括短影片,並重複使用它們來增加銷售、廣告和行銷力度。這是可能的。

- 近年來,出於品牌廣告和行銷目的而使用用戶生成內容的情況急劇增加。不僅新的網路購物趨勢不斷出現,消費者對侵入性行銷技術的厭惡也與日俱增。許多廣告商和企業正在轉向用戶生成的內容來與客戶互動。

- 例如,2022年5月,Pixlee TurnTo推出了Creator Network,該計畫旨在突出尋求與品牌合作的頂級內容創作者,並最終解決品牌的影響者發現問題。 Pixlee Creator Network 將為已經使用 Pixlee TurnTo for Creators 的品牌提供精心挑選的創作者,從而縮小從影響者發現到宣傳活動管理的差距。

- COVID-19 加速了用戶生成內容平台市場的需求和成長。由於居家隔離和社交距離措施,人們待在家裡的時間越來越多,各個平台上用戶生成的內容數量顯著增加。因此,使用 Facebook、Instagram 和 Twitter 等社群媒體平台的人數增加,這使依賴這些平台接觸受眾的企業和內容創作者受益。

用戶生成內容平台市場趨勢

人工智慧和機器學習的進步

- 人工智慧和機器學習技術的使用可以幫助使用者產生的內容平台改善分析、改善使用者體驗並向使用者提供更多相關內容。此外,這些技術可能有助於識別仇恨言論和虛假新聞引起的潛在問題,因此,我們也許能夠提高該平台上內容的品質。

- 公司透過建立多個合作夥伴關係、投資計劃以及將新產品推向市場來增加其市場佔有率。例如,2022 年 11 月,TaskUs Inc.(一家為快速發展的科技公司提供可信賴、安全、數位客戶體驗外包服務的供應商)對抗毒人工智慧公司 AntiToxin, Inc. (L1ght) 進行了策略性投資。宣布。 L1ght 的技術利用人工智慧來識別和分析有害的線上內容。這項投資將支持安全營運中心的推出。此整合解決方案利用 L1ght 的人工智慧和 TaskUs 的審核專家來保護社交網路、約會應用程式和線上市場的用戶。

- 2022 年 6 月,Claid.ai(一家幫助改善市場用戶生成圖像的人工智慧公司)宣布推出端到端影像處理平台 Claid API 2.0。克萊德的技術可以自動增強照片、去除背景、在畫布上對齊產品以及校正照明。 Claid 已經為美國各大公司最佳化了超過 1 億張用戶生成的照片。

- 用戶生成內容平台市場不斷發展,用戶行為的新趨勢和變化塑造了產業。此外,人工智慧和機器學習可以幫助在用戶生成的內容平台上實現個人化的用戶體驗。

- 透過分析您的行為和偏好,這些技術可以向您推薦相關內容、產品和服務。用戶更有可能繼續使用提供個人化建議的平台,從而提高平台參與度和保留率。因此,人工智慧和機器學習技術的發展可能是使用者生成內容平台未來成功的關鍵因素。

亞太地區成長最快

- 預計到 2022 年,亞太地區將佔據全球用戶生成內容平台市場的主要佔有率。在印度和中國等新興經濟體,這種成長是由智慧型手機使用量的增加和社交網站的日益普及所推動的。

- 此外,由於 IT 和通訊行業的技術開拓和廣泛採用,該地區用戶生成內容平台市場的快速成長。對物聯網及相關設備的需求增加以及寬頻網路平台部署的增加將推動用戶群的積極成長。

- 此外,該地區的網路普及正在迅速提高,越來越多的人透過行動裝置和改進的連接存取網路。由此,UGC平台的用戶群不斷擴大。根據中國網際網路絡資訊中心的數據,2022年12月,農村網路普及為61.90%。這比 2022 年 6 月的 58.80% 有所上升。

- 2022 年 5 月,全球整合行銷與傳播機構 Pink Lemonade Communications 宣布推出用戶生成內容平台。 Pink Lemonade UGC Studio 是由一群真實的日常人士設計的,他們熱衷於創作能夠資訊、教育和娛樂觀眾的內容。

- 同時,同年 2022 年 5 月,元宇宙用戶生成平台 BUD 宣布獲得由紅杉資本印度主導、ClearVue Partners、網易和北極光創投跟投的 3,680 萬美元 B 輪融資。此外,現有投資者紀源資本、啟明創投、源碼資本也參與了本輪融資。

用戶生成內容平台產業概述

2023 年 1 月,百事公司旗下的能量飲料品牌 Sting 將與印度影片應用 Moj 合作,透過圍繞其宣傳活動創建用戶生成的內容來推廣該品牌。具體來說,這項創新增加了用戶內容並促進了宣傳活動。

2022年11月,印度跨國科技公司Jio Platforms與創新服務公司Creativeland Asia合作,印度版滾石推出了一款名為「Platform」的新應用程式。該平台應用程式是一個生態系統,旨在幫助創作者提升排名和聲譽,以名人為目標。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

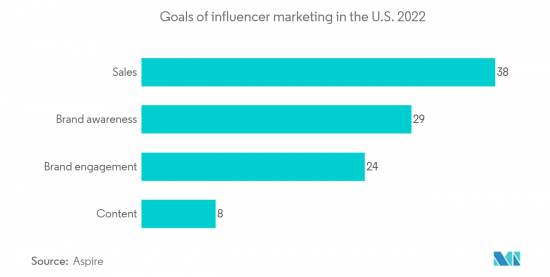

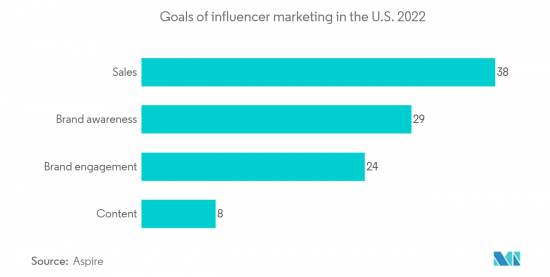

- 增加影響者行銷的使用

- 人工智慧和機器學習的進步

- 市場抑制因素

- 可靠性和安全性問題

第6章市場區隔

- 依產品類型

- 部落格

- 網站

- 廣告和促銷

- 社群媒體

- 音訊和視訊

- 其他產品類型

- 按最終用戶

- 個人

- 公司

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Bazaarvoice

- CrowdRiff

- Monotype Imaging Inc.

- Yotpo Ltd

- Grin Technologies Inc.

- Pancake Laboratories, Inc.

- Pixlee TurnTo

- Taggbox.com

- Curalate, Inc.

- Upfluence

第8章投資分析

第9章 市場機會及未來趨勢

The User-Generated Content Platform Market size is valued at USD 5.90 billion in the current year and is expected to register a CAGR of 29.2% during the forecast period to become USD 21.26 billion by the next five years.

Key Highlights

- User-generated content platforms have witnessed substantial growth over the years due to the rising adoption of various social media platforms. Users can use these platforms to produce and share content as well as engage in its interaction, which will contribute to a vibrant online community. Social media platforms such as Facebook, Instagram, Twitter, YouTube, TikTok, and others are also among the most frequently used UGC Platforms.

- In addition, the User-Generated Content Platform also enables brands to collect company references and visual product references, including short videos from social media as well as other sources for repurposing them in order to increase sales, advertising, or marketing efforts.

- In recent years, the use of User-Generated Content for Brand Advertising and Marketing purposes has increased dramatically; new online shopping trends have emerged, as well as increasing consumer aversion towards invasive marketing techniques. A lot of advertisers and firms are turning to user-generated content in order to interact with their customers.

- For instance, in May 2022, Pixlee TurnTo launched its Creator Network, a program aimed at highlighting top content creators seeking partnerships with brands and ultimately solving the problem of Influencers' discovery for brands. The Pixlee Creator Network will provide a curated selection of creators to brands that have already made use of Pixlee TurnTo for Creators, bridging the gap from influencer discovery to campaign management.

- COVID-19 sped up the demand & growth of the user-generated content platform market. A significant increase in the number of user-generated content took place on different platforms as people started spending more time at their homes due to lockdowns and social distancing measures. It led to a rise in the number of people who engage on social media platforms such as Facebook, Instagram, and Twitter, which is beneficial for businesses and content creators that have relied on these platforms to reach their audiences.

User-Generated Content Platform Market Trends

Development of AI and machine learning

- The use of AI and ML technologies could help user-generated content platforms improve their analysis, enhance the user experience, and offer more relevant content for users. Moreover, these technologies might help to identify problems that may arise from hate speech or fake news and thus improve the quality of content on this platform.

- With the formation of multiple partnerships, investment in projects, and launching new products on the market, companies are increasing their market share. For instance, in November 2022, strategic investment in AntiToxin, Inc., dba, L1ght, an anti-toxicity AI company, was announced by TaskUs Inc., a provider of outsourced trust and safety and digital customer experience services to fast-growing technology companies. L1ght's technology leverages AI to recognize and analyze harmful online content. The investment will assist the launch of the Safety Operations Center. This integrated solution utilizes L1ght's AI and TaskUs' moderation professionals to safeguard the users of social networks, dating apps, and online marketplaces.

- In June 2022, Claid.ai, an AI company that helps marketplaces improve user-generated images, launched an end-to-end image processing platform, Claid API 2.0. Claid's technology automatically enhances photos, removes backgrounds, aligns products on the canvas, and fixes lighting. Claid has already optimized over 100M user-generated photos for some of the major US players.

- The user-generated content platform market is constantly evolving, with new trends and changes in user behavior shaping the industry. Furthermore, AI and machine learning can help to personalize the user experience on user-generated content platforms.

- By analyzing user behavior and preferences, these technologies can recommend relevant content, products, or services to users. This can increase engagement and retention on the platform, as users are more likely to continue using a platform that provides them with personalized recommendations. Therefore, the development of AI and machine learning technologies will be a key factor in the future success of user-generated content platforms.

Asia-Pacific Witness the Fastest Growth

- Asia-Pacific region was expected to have a substantial share of the global user-generated content platforms market in 2022. In emerging economies like India and China, this growth is driven by an increase in the usage of smartphones and the increasing popularity of social networking sites.

- The rapid growth of the User-Generated Content Platform Market in this region is also due to increased technology developments, as well as broad adoption within IT & telecommunications. The positive growth of the user base is driven by an increase in demand for IoT and associated devices, together with increased deployment of broadband network platforms.

- Also, the region has witnessed a rapid increase in internet penetration, with more people gaining access to the internet through mobile devices and improved connectivity. This led to a larger user base for UGC platforms. As per the China Internet Network Information Center, the Internet Penetration Rate of Rural data was reported at 61.90 % in December 2022. This recorded an increase from the previous number of 58.80 % for June 2022.

- In May 2022, the launch of the User Generated Content Platform was announced by Pink Lemonade Communications, a global full-service, integrated marketing and communication agency. The Pink Lemonade UGC Studio is designed by a team of authentic and common people who are enthusiastic about creating content that will inform, educate, or entertain the audience.

- Meanwhile, during the same month of May 2022, BUD, a metaverse user-generated platform, introduced its USD 36.8M Series B round led by Sequoia Capital India with participation from ClearVue Partners, NetEase, and Northern Light Venture Capital. In addition, the round was attended by existing investors GGV Capital, Qiming Venture Partners, and Source Code Capital.

User-Generated Content Platform Industry Overview

In January 2023, PepsiCo Inc.'s energy drink brand, Sting, has teamed up with Moj, an Indian short video app, to create user-generated content around the company's campaign to promote the brand. This innovation, in particular, is to increase user content and promotion of the campaign.

In November 2022, Jio Platforms, an Indian Multinational Technology company, partnered with Creativeland Asia, a creative services company, and Rolling Stone's Indian edition launched a new app called Platform. Platform app aimed to target celebrity entertainers with an ecosystem designed to empower creators to advance through ranks and reputation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Use of Influencer Marketing

- 5.1.2 Development of AI and Machine Learning

- 5.2 Market Restraints

- 5.2.1 Trust and Safety Issues

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Blogs

- 6.1.2 Websites

- 6.1.3 Advertising and Promotions

- 6.1.4 Social Media

- 6.1.5 Audio and Video

- 6.1.6 Other Product Types

- 6.2 By End-user

- 6.2.1 Individual

- 6.2.2 Enterprises

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bazaarvoice

- 7.1.2 CrowdRiff

- 7.1.3 Monotype Imaging Inc.

- 7.1.4 Yotpo Ltd

- 7.1.5 Grin Technologies Inc.

- 7.1.6 Pancake Laboratories, Inc.

- 7.1.7 Pixlee TurnTo

- 7.1.8 Taggbox.com

- 7.1.9 Curalate, Inc.

- 7.1.10 Upfluence