|

市場調查報告書

商品編碼

1432969

環境智慧:市場佔有率分析、產業趨勢、成長預測(2024-2029)Ambient Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

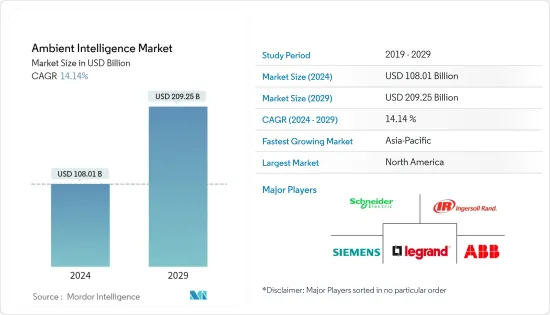

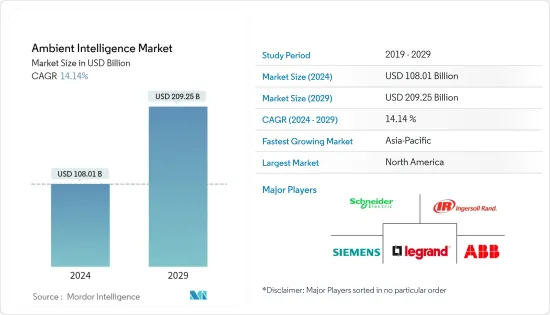

環境智慧市場規模預計到 2024 年為 1,080.1 億美元,預計到 2029 年將達到 2092.5 億美元,在預測期內(2024-2029 年)複合年成長率為 14.14%。

環境智慧是一個新興領域,它將智慧帶入日常環境並使其對使用者做出回應。環境智慧解決方案基於先進的感測器、感測器網路、普適運算和人工智慧。

主要亮點

- 智慧家庭和智慧建築的普及是市場成長的關鍵驅動力之一。智慧家庭和建築利用環境智慧技術來最佳化能源消耗,從而顯著節省能源並減少碳排放。

- 此外,先進感測器的開拓預計將推動市場成長,因為這些感測器能夠即時監控環境。政府和企業增加對物聯網和智慧城市基礎設施的投資也推動了市場成長。

- 然而,由於這些系統收集和分析敏感資料,實施成本很高,而且隱私和安全問題限制了市場的成長。對這項技術及其優勢的認知有限也限制了市場的成長。

- COVID-19 大流行的出現對市場產生了複雜的影響,加速了某些領域環境智慧技術的採用,同時減緩了其他領域的市場成長。醫療保健、製造和物流等行業對遠端監控和自動化的需求不斷增加,對市場成長產生了積極影響。

- 此外,這種需求主要是由在家工作文化的轉變所推動的。隨著公司擴大在家工作安排,人們繼續在家工作並尋求先進的數位解決方案以獲得無縫的工作體驗,這種趨勢仍在繼續。

環境智慧市場趨勢

醫療保健領域預計將推動市場成長

- 醫療保健產業預計將成長環境智慧市場,因為環境環境智慧技術有潛力透過改善患者治療結果、降低成本和提高整體護理品質來改變醫療保健產業,是重要的推動因素之一。

- 在老年人口較多的國家,環境智慧透過環境智慧生活輔助(AAL)技術,可以遠端監控老年人的健康狀況,使他們能夠獨立生活。採用這項技術將改善患者體驗、醫生滿意度和護理品質。因此,環境智慧解決方案的採用預計在明年將會成長。

- 嵌入環境中的被動、非接觸式感測器可以創建環境智慧,識別人們的活動並適應他們持續的健康需求。這種環境智慧可以幫助臨床醫生和家庭看護者完善構成現代醫療保健最後階段的身體運動。

- 由於環境技術的潛力,市場上的參與者正在為醫療保健產業推出技術增強的功能。例如,2022年3月,Nuance Communications宣布擴展下一代環境AI影像診斷能力。 Nuance PowerScribe 平台中改進的人工智慧報告使放射科醫生能夠在更短的時間內使用更具臨床價值的結構化資料創建更準確的報告。

- 預計不斷增加的醫療保健支出也將推動市場成長。根據醫療保險和醫療補助服務中心 (CMS) 的數據,2022 年美國全國醫療保健支出總額為 44,965 億美元,預計 2028 年將達到 61,209 億美元。

預計北美將佔據最大佔有率

- 由於北美地區擁有大量環境智慧主要企業、較早採用先進技術以及該地區各個行業的數位化水平較高等因素,因此在市場研究中佔據很大佔有率。預期的。

- 該地區對智慧建築的需求不斷成長,推動了市場的成長。擴大關注安全和保障、更加關注能源效率和排放預計將推動智慧建築需求的成長,創造對先進環境輔助技術的需求,並推動該地區的市場成長。

- 2021年3月,Nuance Communications Inc.宣布一家獨立門診診所將在伯靈頓加速採用Nuance Dragon 環境 Experience (DAX)環境臨床智慧(ACI)解決方案,以提高醫生和患者的滿意度,並宣布水平有所提高顯著地。借助 Nuance DAX,獨立門診的醫生可以花更少的時間記錄治療,而將更多的時間花在患者身上。

- COVID-19 大流行加速了美國最終用戶對環境智慧和普適運算的認知。環境智慧的實施是為了簡化日常業務,支援醫療保健產業的患者照護,並使用人工智慧來減少體力勞動。

- 此外,智慧家庭的主要應用正在推動該地區對環境智慧的需求。例如,The Ambient 發布的資訊顯示,美國擁有最多的智慧家庭(估計總數為 4130 萬個),而且美國公民比任何其他國家都更喜歡家庭自動化設備,使該地區成為最受歡迎的地區之一預計AmI市場將變得更加普及。

環境智慧產業概況

全球環境智慧市場較為分散,有許多公司參與其中。施耐德電機、英格索蘭、羅格朗、西門子、ABB 集團和霍尼韋爾國際公司等領先公司採用新產品開拓、全球擴張、收購和投資等開拓市場策略。

- 2022 年 3 月 - Nuance Communications 宣布擴展下一代環境AI 影像診斷功能。 Nuance PowerScribe 平台中經過改進的人工智慧彙報使放射科醫生能夠在更短的時間內使用更具臨床價值的結構化資料來建立更準確的報告。

- 2022 年 3 月 - 微軟收購語音辨識公司和會話人工智慧領先供應商 Nuance Communications,以增強其醫療保健人工智慧能力。透過此次收購,微軟將利用人工智慧技術來改善患者治療效果並使醫療保健更實惠。

- 2022 年 3 月 - Cerner 和 Nuance 擴大合作,進一步將 Nuance 的 Dragon Ambient eXperience 技術整合到 Cerner 的千年電子健康記錄中。兩家公司希望擴大 DAX 整合將幫助醫院和衛生系統更好地管理導致臨床醫生倦怠的日益增加的業務負擔。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 產品生命週期分析

- 客戶接受度/適應性

- 比較分析

- 投資場景

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 人工智慧和物聯網設備的普遍使用

- 不斷發展的位置資訊行動應用程式

- 智慧城市和智慧家庭計劃在全球擴展

- 市場挑戰

- 資料安全、隱私和身分問題

- 中小企業缺乏意識

- 市場趨勢

- 最近的創新和產品開發

第6章市場區隔

- 按成分

- 硬體

- 軟體和解決方案

- 依技術

- Bluetooth Low Energy

- RFID

- 感測器 環境光感測器

- 軟體代理

- 情感運算

- 奈米科技

- 生物辨識技術

- 其他技術

- 按最終用戶產業

- 住宅

- 零售

- 衛生保健

- 產業

- 辦公大樓

- 車

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Schneider Electric SE

- Ingersoll-Rand PLC

- Legrand SA

- Siemens AG

- ABB Group

- Honeywell International Inc.

- Tunstall Healthcare Ltd

- Koninklijke Philips NV

- Chubb Community Care

- Caretech Ab

- Assisted Living Technologies Inc

- Getemed Medizin-Und Informationstechnik AG

- Medic4all Group

- Telbios

- Televic NV

- Vitaphone GmbH.

第8章投資分析

第9章市場的未來

The Ambient Intelligence Market size is estimated at USD 108.01 billion in 2024, and is expected to reach USD 209.25 billion by 2029, growing at a CAGR of 14.14% during the forecast period (2024-2029).

Ambient intelligence is an emerging discipline that brings intelligence to everyday environments and makes such environments sensitive to users. Ambient Intelligence solutions build upon advanced sensors, sensor networks, pervasive computing, and artificial intelligence.

Key Highlights

- The increased adoption of smart homes and buildings is one of the main drivers of the market's growth, as smart homes and buildings use ambient intelligence technology to optimize energy consumption, which results in significant energy savings and reduces the carbon footprint.

- In addition, the development of advanced sensors is expected to fuel the growth of the market, as these sensors enable real-time monitoring of the environment. Also, the increase in investment in IoT and smart city infrastructure by the government and businesses are driving market growth.

- However, the higher implementation cost and the concern about privacy and security, as these systems collect and analyze sensitive data, restrain the market growth. Also, the limited awareness of the technology and its benefits is limiting the market growth.

- The emergence of the COVID-19 pandemic had a mixed impact on the market as some sectors accelerated the adoption of ambient intelligence technology while others slowed down the growth of the market. The increased demand for remote monitoring and automation in the industries like healthcare, manufacturing, and logistics positively impacted market growth.

- Furthermore, the demand is mainly attributed to the shift to working from home culture. The trend is still prevailing, as companies have extended the work-from-home policy, and people are continuing to work from home and seeking advanced digital solutions to make the work experience seamless.

Ambient Intelligence Market Trends

Healthcare Segment is Expected to Drive Market Growth

- The healthcare industry becomes one of the key drivers of the ambient intelligence market growth, as ambient intelligence technology has the potential to transform the healthcare sector by improving patient outcomes, reducing costs, and enhancing the overall quality of care.

- In countries with a larger population of senior citizens, through Ambient Assisted Living (AAL) technology, ambient intelligence helps the elderly by remotely monitoring their health, enabling them to have independent living. Employing this technology will enrich patient experience, physician satisfaction, and quality of care. Thus, the adoption of ambience intelligence solutions is expected to grow in the coming year.

- Passive, contactless sensors embedded in the environment can create an ambient intelligence aware of people's movements and adapt to their continuing health needs. This type of ambient intelligence can assist clinicians and in-home caregivers in perfecting the physical motions that comprise modern healthcare's final steps.

- The players operating in the market are coming up with technologically extended capabilities for the healthcare sector due to the potential of ambient technology. For instance, in March 2022, Nuance Communications, Inc. announced the expansion of its next-generation ambient AI diagnostic imaging capabilities. Improved AI-powered reporting features in the Nuance PowerScribe platform would enable radiologists to create highly accurate reports in less time and with more clinically valuable structured data.

- The continuously increasing healthcare expenditure is also anticipated to fuel the market growth. According to the Centers for Medicare & Medicaid Services (CMS), the U.S. total national health expenditure in 2022 was USD 4,496.5 billion and is expected to reach USD 6,120.9 billion by 2028.

North America is Expected to Hold the Largest Share

- The North American region is expected to hold a significant share of the market studied, owing to factors such as the presence large number of key players of ambient intelligence vendors in the country, early adoption of advanced technologies, and considerable digitalization across various sectors in the region.

- The increasing demand for smart buildings in the region is driving the market growth. Rising emphasis on safety and security and growing concerns about energy efficiency and emission reduction are expected to drive growth in smart building demand, creating a need for advanced ambient-assisted technology and boosting the market growth in the region.

- In March 2021, Nuance Communications, Inc. announced that independent ambulatory clinics accelerated their adoption of the Nuance Dragon Ambient eXperience (DAX) ambient clinical intelligence (ACI) solution in Burlington and reported a significant increase in physician and patient satisfaction. Nuance DAX allows physicians at independent ambulatory clinics to spend less time documenting care, allowing them to spend more time with patients.

- The COVID-19 pandemic has accelerated the awareness of ambient intelligence and ubiquitous computing among end users in the United States. It has started adopting ambient intelligence to improve efficiency in daily tasks, assist the healthcare industry with patient care, and reduce manual efforts using AI.

- In addition, its primary application in smart homes mainly drives the demand for ambient intelligence in this region. For instance, as per the information stated by The Ambient, The United States has the greatest number of smart homes (an estimated total of 41.3 million), and citizens of the United States favor home automation devices more than other nations, which in turn is expected to boost the AmI market adoption in the region.

Ambient Intelligence Industry Overview

The Global Ambient Intelligence Market is fragmented with large number of players present in the market. Some major players, including Schneider Electric S.E., Ingersoll-Rand PLC, Legrand SA, Siemens AG, ABB Group, and Honeywell International Inc., are adopting strategies for developing the market, like new product development, global expansion, acquisitions, and investments.

- March 2022 - Nuance Communications, Inc. announced the expansion of its next-generation ambient AI diagnostic imaging capabilities. Improved AI-powered reporting features in the Nuance PowerScribe platform would enable radiologists to create highly accurate reports in less time and with more clinically valuable structured data.

- March 2022 - Microsoft acquired Nuance Communication, a speech recognition company and a leading provider of conversational artificial intelligence to enhance healthcare artificial intelligence. The acquisition would allow Microsoft to leverage artificial intelligence technology for better patient outcomes and more affordable healthcare.

- March 2022 - Cerner and Nuance expanded their collaboration to further integrate Nuance's Dragon Ambient eXperience technology into Cerner's Millennium electronic health record. The companies expect that expanded DAX integration will assist hospitals and health systems in better managing the increasing administrative workloads that contribute to clinician burnout.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Product Life Cycle Analysis

- 4.5 Customer Acceptance / Adaptability

- 4.6 Comparative Analysis

- 4.7 Investment Scenario

- 4.8 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ubiquity of AI and IoT devices

- 5.1.2 Evolving Location-based Mobile Applications

- 5.1.3 Growing Smart Cities and Smart Home Projects Across the World

- 5.2 Market Challenges

- 5.2.1 Data Security, Privacy and Identity Issues

- 5.2.2 Lack of Awareness Among Smaller Enterprises

- 5.3 Market Trends

- 5.4 Recent Innovations and Product Developments

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software and Solutions

- 6.2 By Technology

- 6.2.1 Bluetooth Low Energy

- 6.2.2 RFID

- 6.2.3 Sensors Ambient Light Sensor

- 6.2.4 Software agents

- 6.2.5 Affective computing

- 6.2.6 Nanotechnology

- 6.2.7 Biometrics

- 6.2.8 Other Technologies

- 6.3 By End-User Industry

- 6.3.1 Residential

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 Industrial

- 6.3.5 Office Building

- 6.3.6 Automotive

- 6.3.7 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric S.E.

- 7.1.2 Ingersoll-Rand PLC

- 7.1.3 Legrand SA

- 7.1.4 Siemens AG

- 7.1.5 ABB Group

- 7.1.6 Honeywell International Inc.

- 7.1.7 Tunstall Healthcare Ltd

- 7.1.8 Koninklijke Philips N.V.

- 7.1.9 Chubb Community Care

- 7.1.10 Caretech Ab

- 7.1.11 Assisted Living Technologies Inc

- 7.1.12 Getemed Medizin-Und Informationstechnik AG

- 7.1.13 Medic4all Group

- 7.1.14 Telbios

- 7.1.15 Televic N.V.

- 7.1.16 Vitaphone GmbH.