|

市場調查報告書

商品編碼

1642213

網路攝影機:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Webcams - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

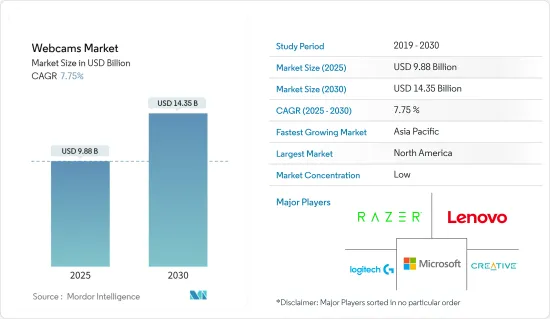

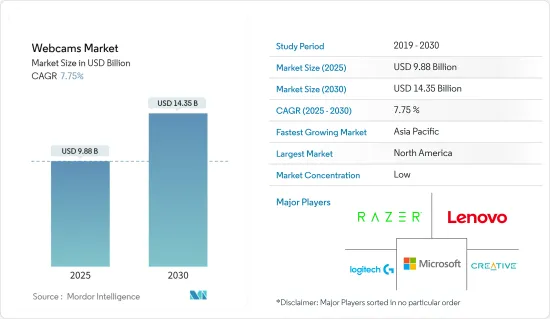

網路攝影機市場規模預計在 2025 年為 98.8 億美元,預計到 2030 年將達到 143.5 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 7.75%。

由於網路攝影機在安全和監控、娛樂、視訊會議、視覺行銷、實況活動等領域的應用日益廣泛,網路攝影機產業越來越受到關注。

關鍵亮點

- 在商業領域,網路攝影機是最有價值的商業溝通工具。由於專業人士越來越傾向於使用虛擬辦公室通訊,預計預測期內對網路攝影機的需求將會增加。醫療保健行業擴大使用網路攝影機進行視訊會議和遠端患者監護可能會推動市場擴張。

- 新冠疫情已迫使全球大多數企業轉向混合辦公或在家工作模式。這種居家辦公模式將在疫情後形成一種混合工作文化,要求在日常會議和活動中使用網路攝影機。此外,自疫情以來,對遠端和混合工作模式的重視程度不斷提高,導致企業環境中對網路攝影機的需求激增。視訊會議已成為開展業務和客戶會議的新常態。網路攝影機製造商正在開發具有尖端技術和功能的鏡頭,以滿足不斷變化的客戶期望和增強的網路存取。

- 此外,全球工業和私營部門對安全監控系統的需求不斷成長,以及對自動導引運輸車(AGV) 和無人機 (UAV) 的需求不斷成長,是預計在預測期內推動網路攝影機市場成長的關鍵因素。由於網路攝影機具有視覺控制、命令方向處理和降低開銷等多種特性,預計網路攝影機市場也將實現成長。

- 根據Guru99統計,美國和歐洲市場佔全球數位學習服務用戶的70%。 63%的美國學生每天都使用線上學習資源。 21%的大學實施了混合式學習模式。 50% 的 K-12 教師採用線上培訓。未來網路攝影機的使用量可能會大幅成長。

- 您的網路速度直接影響您錄製或傳輸的影像和影片的品質。需要最低網路速度以避免影像失真。由於網路速度的波動將成為市場成長的限制因素,因此網路攝影機在偏遠地區和網路連線較弱地區的採用預計會比較緩慢。

- 一些知名製造商正在為他們的數位單眼相機和無反光鏡相機添加 USB 串流媒體支持,這給網路攝影機公司帶來了激烈的競爭。佳能和FUJIFILM提供的應用程式可讓您透過 USB 將其相機用作網路攝影機。Canon的應用程式相容於 Mac 和 Windows,而FUJIFILM的應用程式僅適用於 Windows。Canon開發了新軟體 EOS Webcam 公共產業,可以將CanonEOS 單眼相機、無反光鏡相機和 PowerShot 小型相機轉變為 USB 網路攝影機。

網路攝影機市場趨勢

外部網路攝影機有望發揮重要作用

- 外置攝影機通常有更多空間來容納鏡頭和其他組件,從而獲得更高的解析度和更清晰的影像、影片和音訊。當聲音和影像品質很重要時,高階外部網路攝影機比基本的內建網路攝影機更能滿足您的客戶的需求。用戶可以找到更昂貴的外部鏡頭,這些鏡頭具有一體式設備通常沒有的額外功能,例如多個麥克風、廣角鏡頭和複雜的自動對焦功能。

- 外部網路攝影機領域在視訊會議、電子學習、安全、交通管理和醫療系統等商業應用方面實現了強勁成長。家庭、辦公室和物流安全環境中對即時監控設備以及視訊會議的需求不斷成長是推動網路攝影機市場發展的主要因素之一。這些外部網路攝影機也可用作即時監控工具,記錄破壞行為、反社會行為和亂丟垃圾的行為。

- 政府機構擴大使用監控技術也影響市場。這些設備正在作為我們數位化努力的一部分而被使用。許多政府已經實施了監控系統來保護關鍵基礎設施和公共場所。網路攝影機市場也受到都市化進程加快、生活方式改變、投資增加和消費者支出增加的推動。

- 例如,2023 年 9 月,羅技宣布了兩條新的產品線:1080p 網路攝影機 Brio 105 和 M240,這是一款緊湊、安靜、具有企業級安全性的滑鼠。使用此網路攝影機,您可以輕鬆且經濟地為所有員工配備用於會議的網路攝影機。此網路攝影機可與您的員工每天使用的主流視訊通話平台配合使用,並且經過認證可與 Google Meet 和 Chromebook 配合使用。

- 此外,外接網路攝影機的重大進步也引起了線上串流媒體供應商和視訊部落客(vlogger)等新類別消費者日益成長的需求。在當前的市場情況下,有幾種外部網路攝影機專為部落格和串流媒體活動而設計,並在低照度可見性、解析度和自動對焦特性方面進行了幾項最佳化。

北美佔據主要市場佔有率

- 由於線上學習和遠端教育活動的擴展,北美是收益最高的地區之一。美國遠距教育的一項研究發現,熟悉技術和學習管理系統線上介面的學生更有可能受到激勵,對課程感到滿意,並學到更多知識。

- 據We Are Social稱,截至2023年1月,美國約有3.11億人可以上網,美國是全球最大的線上市場之一。近年來,美國數位人口穩定成長。最常見的解釋之一是寬頻網路的普及率不斷提高。因此,預計未來對網路攝影機的需求將會增加。

- 美國企業每天舉行超過1,100萬次視訊會議,54%的美國勞動力經常參加視訊會議。此外,美國企業每週舉行約 5,500 萬次視訊會議。由於每天都會發生如此多的虛擬會議,對網路攝影機的需求顯著增加,公司正致力於創新,使解決方案和協作更加舒適和方便。預計網路攝影機的需求將會增加。

- 由於可以輕鬆採用新技術來改善安全和監控事件、職場視訊會議、K-12 教育和視覺行銷,該地區對網路攝影機的需求持續成長。產品擴展到多個行業預計將反映網路攝影機市場的成長。

- 美國發生「9·11」恐怖攻擊事件後,對即時運動追蹤和監控的需求和要求日益增加。考慮到北美的銀行和金融業,出於安全目的在場所部署網路攝影機來管理記錄和文件已成為監控的重要組成部分。

網路攝影機產業概覽

網路攝影機市場競爭激烈,由幾家大公司組成。從市場佔有率來看,目前少數幾家大公司佔據著市場主導地位。憑藉著壓倒性的市場佔有率,這些大公司正致力於擴大海外基本客群。這些公司正在利用策略合作措施來增加市場佔有率和盈利。

- 2023 年 6 月:Sky 推出新鏡頭,以增強智慧型電視的社交、健康和遊戲功能。 Sky Live 相機以磁力方式吸附在您的 Sky Glass智慧型電視頂部,並透過 USB-C 和 HDMI 連接。您可以與家人同時看電視、使用 Zoom 進行視訊聊天、記錄您的家庭鍛鍊以及玩 Kinect 風格的動作控制遊戲。

- 2022 年 9 月:Insta360 推出人工智慧驅動的 4K 網路攝影機 Insta360 Link。 Insta360 Link 為企業主管、教育工作者和直播主播提供了卓越影像品質和無縫用戶體驗的強大組合。 Link 的 4K 解析度和業界領先的 1/2 吋感應器可在任何光照場景中提供逼真的影像清晰度、細節和寬動態範圍。透過三軸萬向架和內建 AI 演算法,網路攝影機能夠隨時讓您保持在畫面中並回應您的手勢指令。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 音訊會議和虛擬會議的興起

- 網路攝影機的平均售價大幅下降

- 市場限制

- 新興國家網路普及率低

- 網路攝影機駭客攻擊案例不斷增加(隱私問題)

第6章 市場細分

- 按下網路攝影機類型

- 外部網路攝影機

- 內建網路攝影機

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Logitech International SA

- Microsoft Corporation

- Lenovo Group Limited

- Razer Inc.

- Creative Technology Ltd.

- Ausdom Global

- Vivitar Corporation

- Shenzhen Teng Wei Video Technology Co. Ltd.

- A4Tech Co. Ltd.

- KYE Systems Corp.(Genius)

第8章投資分析

第9章:未來市場展望

The Webcams Market size is estimated at USD 9.88 billion in 2025, and is expected to reach USD 14.35 billion by 2030, at a CAGR of 7.75% during the forecast period (2025-2030).

The webcams industry is gaining prominence owing to the growing adoption of web cameras in security and surveillance, entertainment, video conferences, visual marketing, and live events.

Key Highlights

- In the business sector, webcams are the most valuable business communication tools. Demand for webcams will rise during the projected period due to increased tendencies toward virtual office communication among professionals. The increasing use of webcams in the health industry for video conferencing and remote patient monitoring will likely drive market expansion.

- COVID-19 pushed most companies across the globe towards the hybrid work and work-from-home models. This WFH is now leveraged into a hybrid work culture after the pandemic, mandating the use of a webcam for daily meetings and activities. Furthermore, with the increased emphasis on remote working and hybrid work models post-COVID, the corporate environment is seeing a surge in demand for webcams. Video conferencing became the new norm for conducting business and client meetings. Webcam manufacturers are developing cameras with cutting-edge technology and features in response to changing client expectations and enhanced internet access.

- Additionally, the growing demand for surveillance systems for security and safety purposes and rising demand for automated guided vehicles (AGVs) and unmanned aerial vehicles (UAVs) across industrial and private sectors worldwide are the principal factors expected to drive the growth of the webcams market over the forecast period. Also, owing to several characteristics offered by webcams, such as vision control, command direction process, and decreased overheads, the webcam market is anticipated to grow.

- According to Guru99, the US and European markets account for 70% of the world's e-learning services users. 63% of students in the United States use online learning resources daily. A blended learning model was implemented by 21% of colleges. Online training is used by 50% of K-12 instructors. The usage of webcams might observe significant growth over some time.

- Internet speed directly affects the quality of images and videos recorded and streamed. Minimum internet speed is needed to avoid video distortion. Deployment of webcams is expected to witness slow growth in remote or distant locations and regions with weak internet connectivity, as fluctuations in internet speed act as restraints to market growth.

- Some known manufacturers are adding USB streaming support to their DSLR and mirrorless cameras, giving tough competition to the webcam companies. Cannon and Fujifilm include apps that let users use their cameras as webcams over USB. Canon's app works for Mac and Windows, while Fujifilm's is Windows-only. Canon developed new software, the EOS Webcam Utility, which turns Canon EOS SLR, mirrorless camera, or PowerShot compact into a USB webcam.

Webcams Market Trends

External Webcam Expected to Gain Considerable Significance

- External cameras usually offer higher resolutions and sharper images, videos, and audio because they include more room for lenses and other components. A high-end external webcam will better meet customers' needs than a basic inside webcam if sound and image quality are important. The user can anticipate finding more expensive external cameras with extras like numerous microphones, wide-angle lenses, and sophisticated auto-focus features that aren't normally seen in integrated devices.

- The external webcams segment witnessed considerable growth in commercial applications for video-conferencing, e-learning, security, traffic management, and healthcare systems. The rise in demand for real-time monitoring devices in home, office, and logistical security settings, combined with video conferencing, is one of the major factors driving the webcams market. These external webcam cameras are additionally employed as momentary surveillance tools to record vandalism, antisocial conduct, and fly-tipping.

- The market is also impacted by government agencies' growing usage of surveillance technology. As part of their efforts to go digital, they use these devices. Many governments are implementing surveillance systems to safeguard important infrastructure and public areas. The webcam market is also aided by growing urbanization, changing lifestyles, increased investments, and rising consumer spending.

- For instance, in September 2023, Logitech introduced two new product lines, Brio 105, a 1080p webcam and M240 a compact silent mouse with enterprise-level security for business. This webcam makes easy and affordable to deploy a webcam for every employee for the meetings. It works with leading video calling platforms they use every day and is certified for Google Meet and Works with Chromebook.

- Further, considerable advances in external webcams are finding increasing demand from a new class of consumers, such as online streaming vendors and video bloggers (vloggers). In the current market scenario, several external webcams are purpose-built for vlogging and streaming activities, with several optimizations regarding low light visibility, resolution, and autofocus characteristics.

North America Holds a Substantial Market Share

- North America stands to be one of the highest revenue-generating regions due to the growing online learning and distance education activities. A US study by Distance for Education found that students who are more comfortable with technology and the online interface of the learning management system are more likely to be motivated, satisfied with the course, and learn more.

- According to We Are Social, around 311 million people in the United States accessed the Internet in January 2023, making it one of the largest online markets in the world. In recent years, the digital population in the United States steadily expanded. One of the most common explanations is the increasing availability of broadband internet. Therefore, in the coming future, the demand for webcams is expected to grow.

- The US businesses host more than 11 million video conferencing meetings daily, while 54% of the workforce in the United States take part in video conferences frequently. Furthermore, businesses in the United States hold approximately 55 million video conferences weekly. With such high usage of virtual meetings daily, the demand for webcams rises significantly, and the players are focused on innovating solutions and collaborations for more comfort and convenience. The demand for webcams is expected to rise.

- The demand for web cameras is continuously building in the region owing to an ease in selecting new technology that improves security and surveillance events, video conferencing at work, K-12 education, and visual marketing. Deployment of the product in multiple industries is supposed to witness the growth of the webcam market.

- After the 9/11 attack in the US, the demand for tracking real-time movements and surveillance grew and became compulsory. Considering North America's banking and finance sector, the induction of webcams on the premises for security objectives to control the records and documents became an essential part of surveillance.

Webcams Industry Overview

The Webcam market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent market share are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability.

- June 2023: Sky introduced a new camera to enhance its smart TVs' social, health, and gaming capabilities. Sky Live camera magnetically attaches to the top of Sky Glass smart TVs and connects through USB-C and HDMI. It allows you to watch TV with other families simultaneously, makes video chats using Zoom, tracks home exercises, and includes Kinect-style motion-controlled games.

- September 2022: Insta360 released the Insta360 Link, an AI-powered 4K webcam. Insta360 Link provides a potent combination of superior image quality and a seamless user experience for business executives, educators, and live streamers. Link's 4K resolution and an industry-leading 1/2" sensor give life-like image clarity, detail, and a wide dynamic range in every lighting scenario. The webcam can always keep the user in the frame and respond to gesture commands thanks to a 3-axis gimbal and built-in AI algorithms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Penetration of Teleconferencing and Virtual Meetings

- 5.1.2 Steep Decline in Average Selling Price of Webcams

- 5.2 Market Restraints

- 5.2.1 Poor Internet Penetration in Developing Countries

- 5.2.2 Increasing Cases of Webcam Hacking (Privacy Concerns)

6 MARKET SEGMENTATION

- 6.1 By Webcam Type

- 6.1.1 External Webcam

- 6.1.2 Embedded Webcam

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Logitech International S.A.

- 7.1.2 Microsoft Corporation

- 7.1.3 Lenovo Group Limited

- 7.1.4 Razer Inc.

- 7.1.5 Creative Technology Ltd.

- 7.1.6 Ausdom Global

- 7.1.7 Vivitar Corporation

- 7.1.8 Shenzhen Teng Wei Video Technology Co. Ltd.

- 7.1.9 A4Tech Co. Ltd.

- 7.1.10 KYE Systems Corp. (Genius)