|

市場調查報告書

商品編碼

1851157

殺幼蟲劑:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Larvicides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

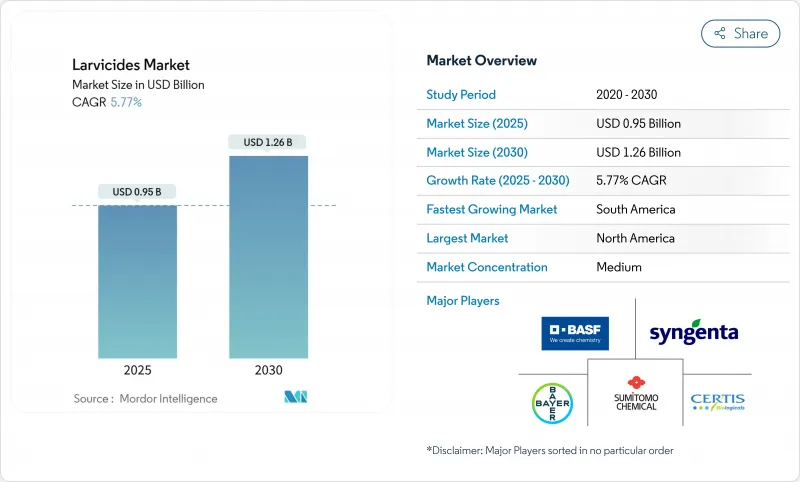

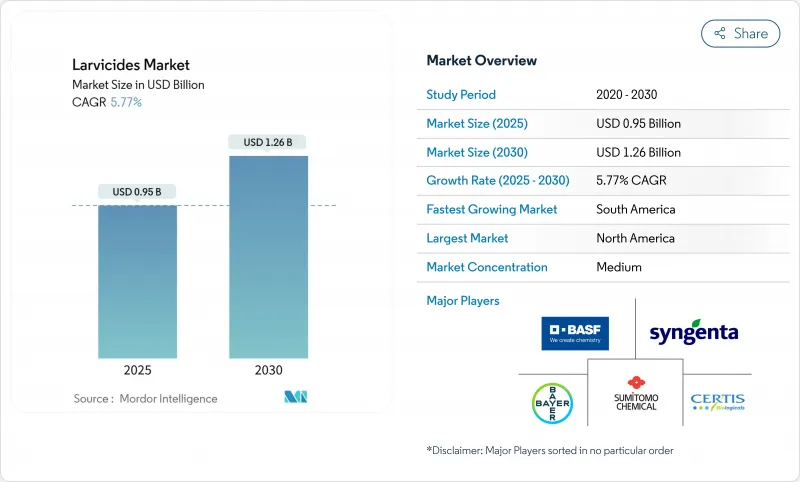

預計到 2025 年,殺幼蟲劑市場規模將達到 9.5 億美元,到 2030 年將達到 12.6 億美元,預測期內複合年成長率為 5.77%。

市場成長的促進因素包括:由於成蚊殺蟲劑效果下降,人們越來越需要針對蚊子幼蟲階段進行防治;美洲地區醫療保健預算不斷成長;以及環境友善生物製劑的持續研發。其他成長因素還包括:溫帶地區蚊子繁殖季節延長;熱帶都市區登革熱持續流行;以及稻魚共作系統的日益普及,這些系統需要適用於水產養殖的安全型殺幼劑。市場面臨的挑戰包括:生物製藥生產成本上升;農村地區應用方法不一致;以及需要基於地理資訊系統(GIS)的監測系統來提高防治效率。

全球殺幼蟲劑市場趨勢與洞察

成蚊對殺蟲劑產生抗藥性的迅速增加,加速了幼蟲期干預措施的實施。

蚊子透過標靶不敏感性和代謝解毒作用產生對殺蟲劑的抗藥性。按蚊和伊蚊透過基因適應、行為改變和代謝抗性來逃避化學處理。目前,病媒控制計畫著重於控制早期蚊群,透過消滅孿生地(例如靜水體和都市區水庫)中的幼蟲來實現。這種方法可以阻止蚊子發育為成蟲,從而阻斷疾病傳播循環。害蟲防治計畫也擴大採用整合策略,輪換使用不同的活性成分,以降低單一藥劑的選擇壓力。這種轉變在一些地區尤其明顯,因為擬除蟲菊酯類殺蟲劑的失效已經危及緊急噴灑預算,促使市政當局投資建設季節性幼蟲殺滅網,以在成蟲大量出現之前保護蓄洪池和雨水排水溝。

登革熱和屈公病預防計劃

拉丁美洲各大城市正加強登革熱和屈公病的防治工作,以應對不斷上升的感染率和都市區蚊蟲數量。世界衛生組織(世衛組織)報告稱,感染病例顯著增加,尤其是在玻利維亞和巴拉圭。防治策略包括控制庫蚊數量、進行公眾宣傳活動,以及結合衛生、城市規劃和教育的綜合方法。泛美衛生組織(泛美衛生組織)正在指導區域各國政府實施社區層面的措施,以減少疾病傳播。為因應2024年巴西可能爆發的登革熱疫情,世界蚊子計畫(WMP)已與Fiocruz基金會合作,共同應對巴西境內的蚊媒疾病。 WMP正在擴大向家養蚊子體內引入天然細菌的規模,以預防登革熱、茲卡和屈公熱的傳播。

嚴格的水生毒性閾值

2026 年農藥通用許可證要求施藥者在處理地表水時記錄施藥量、地點和非目標物種監測。對包括特滅磷在內的有機磷酸酯類法律規範,減少了可用於洪氾濕地和城市流域的製劑選擇。合規成本的增加促使各縣從高風險化學品轉向生物替代品,儘管生物替代品價格更高。雖然提供全面毒理學數據和數位化施藥記錄的供應商保持著市場優勢,但准入障礙影響著小型經營者,並限制了該地區化學殺幼劑的分銷。

細分市場分析

到2024年,合成殺幼劑將佔據殺幼劑市場45%的佔有率。其市場領先地位歸功於成本優勢和已建立的採購合約。生物製劑正以8.4%的年複合成長率高速成長,這得益於政府推廣綜合病媒控制方法的措施。蘇雲蘇力菌以色列亞種(Bti)對蚊幼蟲、麗蠅和蕈蚋具有特異性毒性。 2023年,加德滿都大都會市政府(KMC)實施了一項針對蚊幼蟲的生物殺蟲劑計劃,以預防登革熱疫情的爆發。這種有機溶液透過破壞蚊幼蟲的消化道來殺死它們,而不會傷害其他生物。

目前處於後期試驗階段的RNAi酵母殺幼蟲劑市場開發,可在不影響非目標物種的情況下實現基因特異性控制,預示市場可能轉變。製造商正在改進微膠囊化技術,以提高產品的保存期限和易用性。 2024年的一項研究表明,植物性殺幼蟲劑,特別是萬壽菊萃取物,在作物保護方面具有顯著效果。班加羅爾PES大學的研究表明,萬壽菊(Tagetes erecta)和捲葉萬壽菊(Tagetes patula)含有硫酚,對斜紋夜蛾(Spodoptera litura)和黃粉蟲(Corcyra cephalonica)等作物害蟲具有顯著的殺幼蟲活性。這些技術進步,加上政府對環境永續產品的獎勵,使得生物殺幼蟲劑能夠獲得更多市政合約。

昆蟲生長調節劑(IGRs)已成為一種有效的幼蟲防治方法,尤其是在傳統殺蟲劑抗藥性日益增強的情況下。 IGRs透過抑制蚊蟲蛻皮、繁殖和變態發育來抑制其生長,從而阻止幼蟲發育為成蟲。化學接觸性殺蟲劑預計在2024年將佔銷售額的55%,但田間研究表明,由於抗藥性的發展,其有效性正在下降。主要的IGR化合物-METHOPRENE,在濃度低於10 ppb時即可有效,且在水中的遷移性極低。

由於蚊蟲對擬除蟲菊酯類和有機磷酸鹽殺蟲劑普遍存在代謝和行為抗性,害蟲防治計畫擴大採用基於昆蟲生長調節劑(IGR)的解決方案,例如PYRIPROXYFEN和METHOPRENE。昆蟲生長調節劑具有殘留活性長、環境影響小、抗藥性風險低等優點,使其成為永續蚊蟲控制計畫的重要組成部分。

區域分析

累計到2024年,北美將成為蚊媒控制領域最大的區域,這主要得益於完善的病媒管理框架以及人們對西尼羅河病毒和東部馬腦炎日益成長的擔憂。美國是北美蚊子和幼蟲防治中殺幼劑使用量最大的國家。美國疾病管制與預防中心(CDC)和地方蚊蟲控制區在全國範圍內實施病媒控制計畫。這些計畫將殺幼劑納入綜合蚊蟲管理(IMM)策略,以預防西尼羅河病毒和茲卡等蚊媒疾病。

美國環保署 (EPA) 推薦幾種針對蚊子幼蟲早期階段的殺幼蟲方法:抑制幼蟲消化的細菌殺蟲劑(如蘇雲金芽孢桿菌以色列亞種和球形芽孢桿菌);抑制昆蟲生長發育的昆蟲生長抑製劑,例如METHOPRENE;以及可淹死幼蟲的表面油膜。出於環境方面的考慮,某些控制方法已被停止使用,特別是有機磷殺蟲劑。所有控制方法都必須符合旨在保護弱勢群體的法規。 EPA 於 2026 年發布的《農藥通用許可證》對農藥在地表水體的應用制定了嚴格的要求,並對北美地區的農藥產品開發產生了深遠的影響。

在亞洲,中國和印度正透過噴灑殺蟲劑來確保產量,而東南亞市場則利用補貼政策強制在稻米和魚類養殖系統中使用生物殺幼劑。同時,家貓對有機磷酸酯類和擬除蟲菊酯類殺蟲劑的抗藥性迫使印尼議會輪調使用昆蟲生長調節劑(IGR)和蘇雲金芽孢桿菌(Bti)的組合,這支撐了殺幼劑銷售量的成長。儘管亞洲殺幼劑的市佔率將逐年成長,但由於部分國家對價格較為敏感,利潤率仍可能受到擠壓。

受登革熱和屈公病疫情引發的公共衛生危機影響,南美洲的成長速度最快。巴西2024年登革熱病例達725萬例,是2023年的兩倍。城市衛生部門正將源頭控制舉措與每週噴灑殺幼蟲劑結合,以確保穩定的產品需求,從而維持經銷商的存量基準。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 抗殺蟲劑成蚊數量迅速增加

- 登革熱和屈公病預防方案的製定

- 氣候變遷導致蚊子繁殖季節延長

- 美國政府對綜合性水產養殖的補貼

- 關於殺幼蟲劑的監管政策

- 無人機空中噴灑殺幼蟲劑的應用迅速擴展。

- 市場限制

- 嚴格的水生毒性基準值限制了化學配方的使用。

- GIS繁殖地測繪技術應用率低,阻礙了商業性銷售。

- 芽孢桿菌發酵培養基的供應鏈變異性

- 公眾對合成病媒控制化合物的需求壓力

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特的五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 合成殺幼劑

- 生物殺幼蟲劑

- 透過控制方法

- 化學品

- 生物防治劑

- 昆蟲生長調節劑(IGRs)

- 目標昆蟲

- 蚊子

- 蒼蠅

- 甲蟲

- 螞蟻

- 透過使用

- 農業

- 非農業

- 按劑型

- 顆粒

- 液體和懸浮液

- 顆粒劑和片劑

- 粉劑和可濕性粉塵

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 其他中東地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 亞太其他地區

- 北美洲

第6章 競爭情勢

- 策略趨勢

- 市佔率分析

- 公司簡介

- BASF SE

- Bayer AG

- Syngenta AG

- Sumitomo Chemical Co.

- Clarke Mosquito Control Products Inc.

- Central Life Sciences

- Certis Biologicals

- UPL Ltd.

- FMC Corporation

- Russell IPM

第7章 市場機會與未來展望

The Larvicides Market size is estimated at USD 0.95 billion in 2025, and is projected to reach USD 1.26 billion by 2030, at a CAGR of 5.77% during the forecast period.

The market growth is driven by several factors, like the increasing necessity to target mosquitoes in their larval stage due to reduced effectiveness of adult mosquito control methods, expanded healthcare budgets in the Americas, and continuous development of environmentally compatible bio-rational formulations. Additional growth drivers include extended mosquito breeding periods in temperate regions, persistent dengue outbreaks in tropical urban areas, and increased adoption of integrated rice-fish farming systems requiring aquaculture-safe larvicides. The market faces challenges including higher production costs for biological products, inconsistent application methods in rural areas, and requirements for GIS-based monitoring systems to enhance treatment efficiency.

Global Larvicides Market Trends and Insights

Surge in Insecticide-Resistant Adult Mosquitoes Accelerating Larval-Stage Intervention

Mosquitoes develop resistance to insecticides through target-site insensitivity and metabolic detoxification. Anopheles and Aedes mosquitoes avoid chemical treatments through genetic adaptations, behavioral changes, and metabolic resistance. Vector control programs now focus on early-stage population control by targeting larvae in breeding sites, including stagnant water bodies and urban reservoirs. This approach prevents mosquitoes from reaching adulthood and interrupts disease transmission cycles. Vector control programs increasingly implement integrated strategies that rotate different active ingredients to reduce selective pressure on individual chemical classes. This shift is most visible where pyrethroid failure jeopardized emergency spraying budgets, encouraging municipalities to invest in season-long larvicide grids that protect floodwater pools and storm drains before adult swarms emerge.

Roll-out of Dengue and Chikungunya Prevention Programs

Latin American megacities are strengthening their dengue and chikungunya prevention programs in response to increased infection rates and urban mosquito populations. The World Health Organization (WHO) reports a significant increase in cases, particularly in Bolivia and Paraguay. Prevention strategies include Aedes aegypti mosquito control, public awareness initiatives, and integrated approaches combining sanitation, urban planning, and education. The Pan American Health Organization (PAHO) guides regional governments on implementing community-based measures to reduce disease transmission. In response to the 2024 dengue outbreak in Brazil, the World Mosquito Program (WMP) has partnered with Fiocruz to address mosquito-borne diseases across the country. The WMP is expanding its Wolbachia method, which introduces a natural bacterium into Aedes aegypti mosquitoes to prevent the transmission of dengue, Zika, and chikungunya.

Stringent Aquatic-Toxicity Thresholds

The 2026 Pesticide General Permit requires applicators to document the dosage, location, and non-target species monitoring when treating surface waters. Regulatory oversight of organophosphates, including temephos, has reduced available formulation options for floodwater marshes and urban catch basins. The increased compliance costs have led counties to shift from high-risk chemicals to biorational alternatives, despite their higher prices. While suppliers providing comprehensive toxicological data and digital application records maintain market advantages, the entry barriers affect small operators and limit local chemical larvicide distribution.

Other drivers and restraints analyzed in the detailed report include:

- Climate-Induced Expansion of Mosquito Breeding Seasons in Temperate Regions

- Government Subsidies for Integrated Rice-Fish Farming

- Low Adoption of GIS Breeding-Site Mapping

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic larvicides account for 45% of the larvicides market share in 2024. Their market leadership stems from cost advantages and established procurement contracts. Biological products are growing at a higher rate of 8.4% CAGR, supported by government initiatives promoting integrated vector management approaches. Bacillus thuringiensis israelensis (Bti) demonstrates specific toxicity to mosquito larvae, blackflies, and fungus gnats. In 2023, the Kathmandu Metropolitan City (KMC) implemented bio-larvicide programs to control dengue outbreaks by targeting mosquito larvae. This organic solution eliminates mosquito larvae by disrupting their digestive systems while preserving other organisms.

The development of RNAi yeast larvicides in late-stage testing indicates potential market shifts, offering gene-specific control without affecting non-target species. Manufacturers are improving microencapsulation techniques to enhance product longevity and ease of use. Research in 2024 demonstrated the efficacy of botanical larvicides in crop protection, specifically marigold extracts. A study conducted by PES University in Bangalore revealed that Tagetes erecta and Tagetes patula contain thiophenes, which demonstrate significant larvicidal effects against crop pests Spodoptera litura and Corcyra cephalonica. These technological improvements, coupled with government incentives for environmentally sustainable products, enable biological larvicides to secure more municipal contracts.

Insect Growth Regulators (IGRs) have emerged as an effective larvicide control method, particularly in response to increasing resistance against conventional insecticides. IGRs disrupt mosquito development by inhibiting molting, reproduction, and metamorphosis, preventing larvae from reaching adulthood. While chemical contact poisons generated 55% of revenue in 2024, field studies indicate reduced effectiveness due to resistance development. Methoprene, a primary IGR compound, demonstrates effectiveness at concentrations of <= 10 ppb with minimal aquatic mobility.

Vector control programs are increasingly adopting IGR-based solutions, including pyriproxyfen and methoprene, due to widespread metabolic and behavioral resistance to pyrethroids and organophosphates. IGRs provide extended residual activity, reduced environmental impact, and lower resistance development risk, positioning them as integral components of sustainable mosquito control programs.

The Larvicides Market Report is Segmented by Control Method (Biocontrol Agents, Chemical Agents, and More), by Product Type (Synthetic Larvicides, and Biological Larvicides), by Application (Agricultural and Non-Agricultural), by Target Insects (Mosquitoes and More), by Formulation (Granules, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest regional revenue in 2024, supported by structured vector-management frameworks and rising concern over West Nile and Eastern equine encephalitis. The United States is the primary user of larvicides for mosquito and larva control in North America. The Centers for Disease Control and Prevention (CDC) and local mosquito control districts implement vector control programs across the country. These programs incorporate larvicides within integrated mosquito management (IMM) strategies to prevent diseases such as West Nile virus, Zika, and other mosquito-borne illnesses.

The Environmental Protection Agency (EPA) endorses multiple larval mosquito control methods that target immature mosquitoes in their early stages. These methods include:- Bacterial insecticides (Bacillus thuringiensis israelensis and Bacillus sphaericus) that disrupt larval digestion - Insect growth inhibitors like methoprene that prevent development - Surface oils and films that cause larvae to drown. Environmental concerns have resulted in the discontinuation of certain control methods, particularly organophosphate insecticides. All control methods must comply with regulations to protect vulnerable populations. The EPA's 2026 Pesticide General Permit has established strict requirements for pesticide applications to surface waters, which shape product development throughout North America.

Asia presents a diverse mix; China and India anchor volume through agricultural applications, while Southeast Asian markets leverage subsidies that mandate biological larvicides in rice-fish systems. Simultaneously, Aedes aegypti resistance to organophosphates and pyrethroids forces councils in Indonesia to rotate IGRs and Bti combinations, underpinning incremental unit growth. The larvicide market share attributable to Asia will expand each year of the outlook, yet margins may stay compressed given price sensitivity in several economies.

South America demonstrates the highest growth rate, driven by public health crises related to dengue and chikungunya outbreaks. Brazil reported 7.25 million dengue cases in 2024, exceeding twice the number recorded in 2023, prompting increased Bti investments across federal, state, and municipal governments. Urban sanitation departments combine source reduction initiatives with weekly larvicide applications, ensuring consistent product demand that maintains distributor inventory levels.

- BASF SE

- Bayer AG

- Syngenta AG

- Sumitomo Chemical Co.

- Clarke Mosquito Control Products Inc.

- Central Life Sciences

- Certis Biologicals

- UPL Ltd.

- FMC Corporation

- Russell IPM

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in insecticide-resistant adult mosquitoes

- 4.2.2 Roll-out of dengue and chikungunya prevention programs

- 4.2.3 Climate-induced expansion of mosquito breeding seasons

- 4.2.4 Government subsidies for integrated rice-fish farming

- 4.2.5 Regulatory Policies on Larvicides

- 4.2.6 Rapid scale-up of drone-based aerial application of larvicides

- 4.3 Market Restraints

- 4.3.1 Stringent aquatic-toxicity thresholds limiting chemical formulations

- 4.3.2 Low adoption of GIS breeding-site mapping curbing commercial sales

- 4.3.3 Supply-chain volatility for Bacillus fermentation media

- 4.3.4 Public pressure against synthetic vector-control compounds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Synthetic Larvicides

- 5.1.2 Biological Larvicides

- 5.2 By Control Method

- 5.2.1 Chemical Agents

- 5.2.2 Biocontrol Agents

- 5.2.3 Insect Growth Regulators (IGR)

- 5.3 By Target Insect

- 5.3.1 Mosquitoes

- 5.3.2 Flies

- 5.3.3 Beetles

- 5.3.4 Ants

- 5.4 By Application

- 5.4.1 Agriculture

- 5.4.2 Non Agriculture

- 5.5 By Formulation

- 5.5.1 Granules

- 5.5.2 Liquids and Suspensions

- 5.5.3 Pellets and Tablets

- 5.5.4 Powders and Wettable Dusts

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Africa

- 5.6.4.1 South Africa

- 5.6.4.2 Nigeria

- 5.6.4.3 Egypt

- 5.6.4.4 Rest of Africa

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Qatar

- 5.6.5.4 Rest of Middle East

- 5.6.6 Asia-Pacific

- 5.6.6.1 China

- 5.6.6.2 India

- 5.6.6.3 Japan

- 5.6.6.4 Australia

- 5.6.6.5 Rest of Asia-Pacific

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.3.1 BASF SE

- 6.3.2 Bayer AG

- 6.3.3 Syngenta AG

- 6.3.4 Sumitomo Chemical Co.

- 6.3.5 Clarke Mosquito Control Products Inc.

- 6.3.6 Central Life Sciences

- 6.3.7 Certis Biologicals

- 6.3.8 UPL Ltd.

- 6.3.9 FMC Corporation

- 6.3.10 Russell IPM