|

市場調查報告書

商品編碼

1439735

汽車熱管理:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Automotive Thermal Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

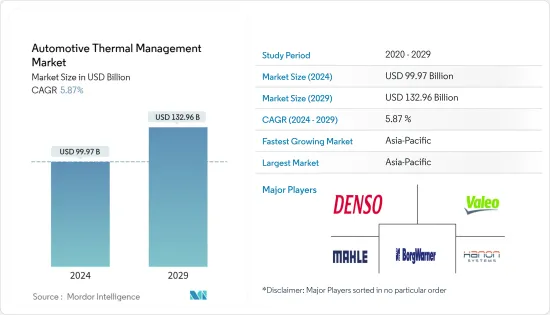

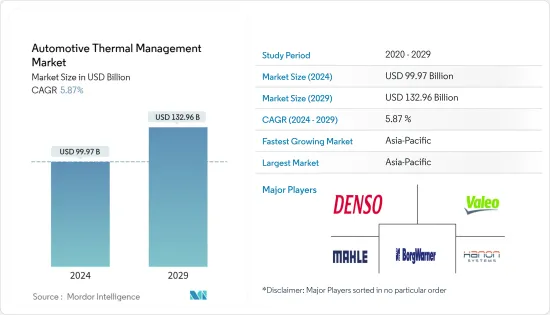

2024 年汽車熱管理市場規模估計為 999.7 億美元,預計到 2029 年將達到 1329.6 億美元,在預測期間(2024-2029 年)以 5.87% 的複合年增長率增長。

COVID-19感染疾病期間的製造業停工、封鎖和貿易限制對汽車溫度控管行業產生了負面影響。此外,汽車產量下降和勞動力短缺也對市場產生了重大影響。例如,2019年全球汽車產量下降15.69%。 2021年全球汽車產量較疫情爆發時的2020年大幅成長,但遠低於2019年的數字,主要是因為半導體短缺。

在汽車行業,由於對提高乘坐舒適性和改善內部舒適性的隔熱性的需求不斷增加,對溫度控管系統的需求正在顯著增加。車輛中電氣和電子元件數量的不斷增加也增加了對更好的溫度控管系統散熱的需求。

從長遠來看,隨著汽車產業轉向電動車,內燃機溫度控管系統預計將完全過時。然而,隨著耐用電池和大電流馬達等耐用電氣元件數量的不斷增加,預計這些方面的需求仍將很高。隨著自動化和動力傳動系統電動的發展,汽車產業對小客車和商用車中的電氣和電子元件的需求急劇增加。

領先的原始設備製造商(OEM ) 專注於開發溫度控管系統,為其電動車提供盡可能最佳的續航里程。

主要亮點

- 2021 年 12 月,沃爾沃測試了一種新型溫度控管系統,該系統使用電氣元件和電控系統來預熱卡車電池。熱感系統的需求量很大,因為即使在極端天氣條件下,它們也能可靠地保持溫度。

隨著汽車電動的進展,汽車零件供應商正在加緊努力,增強其在熱能管理市場的國際競爭力。

主要亮點

- 2022年2月,博格華納簽署了一份供應高電壓冷卻加熱器(HVCH)的契約,用於寶馬集團的iX和i4全電動架構。此解決方案控制電池溫度控管系統和駕駛室加熱,顯著增加電池續航里程和可靠性。

由於擁有領先的汽車溫度控管系統OEM公司、中國、印度、日本和韓國等龐大的汽車市場以及發達的汽車製造業,亞太地區預計將成為最大的市場。

由於汽車持有率高、電動車和自動駕駛汽車銷量不斷增加以及汽車製造業廣泛,預計北美和歐洲將成為第二大市場。

因此,上述因素預計將共同推動汽車溫度控管系統的成長。

汽車溫度控管市場趨勢

電池溫度控管顯著成長

採用全電動或混合動力傳動系統的車輛需要電池溫度控管動力傳動系統。電池在特定溫度下運行,以最大限度地提高電荷儲存和利用效率。因此,純電動車或插電式混合的興起很可能在研究期間推動汽車溫度控管市場。

- 2021年,許多歐洲國家的電動車銷量實現了兩位數成長,該地區約佔全球電動車銷量的34%(2020年為43%)。 2021 年插電式汽車總銷量約 227 萬輛,而 2020 年為 137 萬輛。

銷售量激增是各個組織和政府為控制排放水平和普及零排放汽車而收緊監管標準的結果。

該公司正在投資為即將推出的電池式電動車開發更有效率的電池解決方案。

- 2022年9月,馬勒在德國漢諾威IAA交通運輸展上推出了商用電動車的新型溫度控管系統。

因此,由於上述因素,預計汽車熱感系統市場在預測期內將大幅擴張。

亞太地區繼續獲得主要市場佔有率

隨著印度和中國成為西方汽車巨頭的汽車零件製造地,亞太地區汽車產業的成長預計將推動該地區溫度控管系統市場的發展。

政府加強監管以促進電動車的普及,以及區域OEM和供應商為滿足中國汽車行業不斷成長的需求而採取的大力擴張,都為預測期內的市場成長做好了準備,預計前景將會顯現。

- 2022年8月,舍弗勒集團慶祝在中國生產500萬個溫度控管模組。

印度汽車工業排名世界第四,商用車產量排名世界第七。過去五年,該國的汽車零件業務也大幅成長。例如,

- 2022 年 3 月,位於艾哈默德巴德的技術創新新興企業Matter 宣布開發出一種新型高速中扭矩馬達,該公司專注於提供未來和永續的解決方案。該公司表示,Matter Drive 1.0 馬達是一種新型智慧駕駛傳動系統,具有多種關鍵進步,包括整合式智慧溫度控管系統。

此外,由於中國、印度、日本和韓國等國家電動和混合汽車銷量的增加,亞太地區的汽車熱感系統市場預計將進一步擴大。

因此,在預測期內,亞太地區預計仍將是全球最大的汽車熱感系統市場。

汽車溫度控管產業概況

汽車溫度控管市場適度整合,主要參與者佔據市場主導地位。其中一些參與者包括 Denso Corporation、Valeo、Mahle GmbH、Hanon System 和 BorgWarner Inc.。這些付款人從事新產品發布、合資企業和產能擴張,以擴大其業務活動並建立其市場地位。

- 2022 年 11 月, Denso在澳洲雪梨巴士和客車博覽會上推出了適用於客車和遠距的新型 LD9 電動零排放溫度控管裝置。

- 2022 年 3 月,Hanon Systems 在中國虎柴運作了一家新工廠,生產電動車的暖氣、通風和空調 (HVAC) 模組。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 目的

- 引擎冷卻

- 室溫控制

- 變速箱溫度控管

- 廢熱回收/廢氣再循環 (EGR)溫度控管

- 電池溫度控管

- 馬達和電力電子設備的溫度控管

- 車輛類型

- 小客車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Robert Bosch GmbH

- Dana Incorporated

- MAHLE GmbH

- Gentherm Incorporated

- Hanon Systems

- Denso Corporation

- BorgWarner Inc.

- Valeo Group

- Modine Manufacturing Company

- Schaeffler Technologies AG &Co. KG

- Kendrion NV

- ZF Friedrichshafen

- Aptiv Inc.

第7章市場機會與未來趨勢

The Automotive Thermal Management Market size is estimated at USD 99.97 billion in 2024, and is expected to reach USD 132.96 billion by 2029, growing at a CAGR of 5.87% during the forecast period (2024-2029).

Manufacturing shutdowns, lockdowns, and trade restrictions during the COVID-19 pandemic negatively affected the automotive thermal management industry. Furthermore, the fall in automotive production and lack of labor significantly impacted the market. For instance, worldwide automobile production fell by 15.69% in 2019. Although in 2021, global automotive production increased significantly compared to the pandemic hit 2020, it was well below the figures of 2019, primarily attributed to the semiconductor shortage.

The rising need for better ride quality and heat insulation for cabin comfort is greatly emphasized in the automotive industry, leading to a much higher demand for thermal management systems. The ever-increasing number of electrical and electronic components inside vehicles also drives the need for better thermal management systems due to heat dissipation.

Over the long term, as the automotive industry moves to electric mobility, thermal management systems for IC engines are expected to go completely obsolete. However, the increasing number of heavy-duty electrical components, such as heavy-duty batteries and high-current motors, is expected to continue keeping the high demand in these aspects. With increasing automation and powertrain electrification, the demand for electrical and electronic components exponentially increased, in both passenger cars and commercial vehicles, in the automotive industry.

Major original equipment manufacturers are focusing on the development of thermal management systems to offer the best possible travel range for their electric fleet. For instance,

Key Highlights

- In December 2021, Volvo tested its new thermal management system that pre-heats a truck's batteries using electrical components and electronic control units. The thermal system ensures the temperature is maintained under extreme weather conditions, thus increasing their demand to a large extent.

Auto parts suppliers are accelerating efforts to strengthen their global competitiveness in the thermal energy management market with the advancement of vehicle electrification. For instance,

Key Highlights

- In February 2022, Borgwarner Inc. secured an agreement to supply High-Voltage Coolant Heater (HVCH) to be used in BMW Group's iX and i4 fully electric architecture. The solution controls the battery's thermal management system and cabin heating and significantly increases the driving range and reliability of the battery.

Asia-Pacific is anticipated to be the largest market due to the presence of large OEMs for automotive thermal management systems, large markets for automobiles like China, India, Japan, and South Korea, and a well-developed automobile manufacturing industry.

North America and Europe are projected to be the next biggest markets due to high vehicle ownership rates, growing electric and autonomous vehicle sales, and extensive automobile manufacturing industries.

Thus, the confluence of the aforementioned factors is anticipated to drive the growth of automotive thermal management systems.

Automotive Thermal Management Market Trends

Battery Thermal Management to Witness Significant Growth

Vehicles that run on an all-electric powertrain or hybrid powertrain require a battery thermal management system. The battery is operated under a specific temperature for maximum charge storage and utilization efficiency. Hence, the increase in battery electric vehicles or plug-in hybrid vehicles is likely to drive the automotive thermal management market during the study period. For instance,

- In 2021, many European countries witnessed double-digit growth in EV sales, whereas the European region captured around 34% of global EV sales in 2021 compared to 43% in 2020. The overall plug-in vehicle sales reached about 2.27 million units in 2021 compared to 1.37 million in 2020.

This spike in sales is the result of an increase in regulatory norms by various organizations and governments to control emission levels and propagate zero-emissions vehicles.

Companies are investing in making more efficient battery solutions for the upcoming battery electric vehicles. For instance,

- In September 2022, Mahle launched its new thermal management systems for commercial electric vehicles at IAA Transportation in Hannover, Germany.

Thus, the above factors are estimated to significantly expand the market for automotive thermal systems during the forecast period.

Asia-Pacific Continues to Capture Major Market Share

The growing automobile sector in Asia-Pacific (with India and China emerging as automotive part manufacturing hubs for the western automobile giants) is expected to drive the market for thermal management systems in this region.

The growing government regulations improving electric vehicle adoption and robust expansion adopted by OEMs and suppliers in the region to accommodate the rising demand from the automotive industry in China are expected to create a positive outlook for market growth during the forecast period. For instance,

- In August 2022, Schaeffler Group celebrated the production of five million thermal management modules in China.

The Indian automotive industry is the fourth-largest in the world, and in terms of commercial vehicle production, the country ranks seventh globally. The auto component business in the country has also increased significantly over the past five years. For instance,

- In March 2022, the development of a new high-speed mid-torque electric motor was revealed by Matter, an Ahmedabad-based technological innovation start-up focusing on delivering futuristic sustainable solutions. The company says that Matter Drive 1.0 Motor is a new intelligent drive train that includes a variety of significant breakthroughs, such as the Integrated Intelligent Thermal Management System.

In addition, rising sales of electric and hybrid vehicles in counties like China, India, Japan, and South Korea will further augment the market for automotive thermal systems in the Asia-Pacific region.

Thus, the Asia-Pacific region is predicted to remain the largest market for automotive thermal systems in the world during the forecast period.

Automotive Thermal Management Industry Overview

The automotive thermal management market is moderately consolidated, with the major players dominating the market. Some of these players include Denso Corporation, Valeo, Mahle GmbH, Hanon System, and BorgWarner Inc. These payers engage in new product launches, joint ventures, and capacity expansions to expand their business activities and cement their market position. For instance,

- In November 2022, Denso Corp. launched a new LD9 electric zero emissions thermal management unit for buses and coaches at Bus & Coach Expo in Sydney, Australia.

- In March 2022, Hanon Systems inaugurated a new plant located in Huchai, China, to manufacture heating, ventilation, and air conditioning (HVAC) modules for electrified vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Engine Cooling

- 5.1.2 Cabin Thermal Management

- 5.1.3 Transmission Thermal Management

- 5.1.4 Waste Heat Recovery/ Exhaust Gas Recirculation (EGR) Thermal Management

- 5.1.5 Battery Thermal Management

- 5.1.6 Motor and Power Electronics Thermal Management

- 5.2 Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Dana Incorporated

- 6.2.3 MAHLE GmbH

- 6.2.4 Gentherm Incorporated

- 6.2.5 Hanon Systems

- 6.2.6 Denso Corporation

- 6.2.7 BorgWarner Inc.

- 6.2.8 Valeo Group

- 6.2.9 Modine Manufacturing Company

- 6.2.10 Schaeffler Technologies AG & Co. KG

- 6.2.11 Kendrion NV

- 6.2.12 ZF Friedrichshafen

- 6.2.13 Aptiv Inc.