|

市場調查報告書

商品編碼

1439745

條碼列印機:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Barcode Printer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

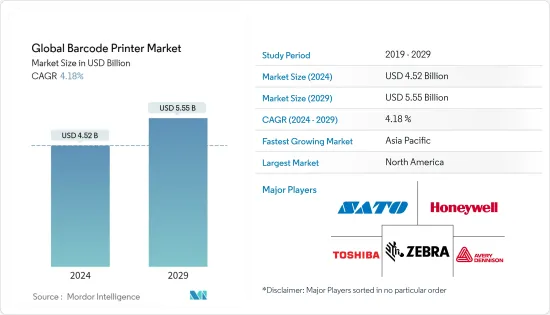

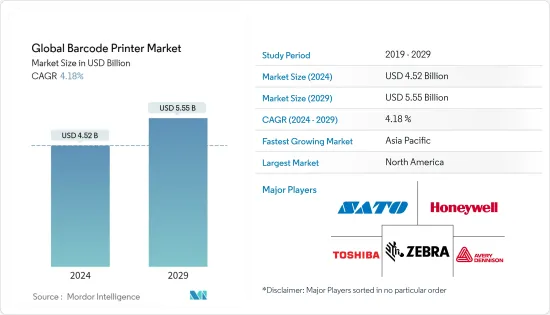

2024年全球條碼印表機市場規模估計為45.2億美元,預計到2029年將達到55.5億美元,在預測期間(2024-2029年)以4.18%的複合年增長率增長。

資產追蹤應用的成長以及列印和印表機技術的不斷進步是推動全球條碼列印機市場成長的一些關鍵因素。許多行業依靠標籤和條碼來追蹤資產並提供有關產品的資訊。

主要亮點

- 依產品類型分類,工業印表機預計將在預測期內佔據主要市場佔有率。然而,無線連接等最新技術進步也推動了行動印表機領域的發展。熱感條碼印表機被小型到大型企業廣泛用於標記和追蹤出貨的產品。

- 除了擴大採用自動識別和資料擷取技術來提高生產力之外,對產品安全和防偽的日益關注也推動了熱感印表機市場的發展。由於熱感列印技術在現代客製印刷應用中的使用越來越多,熱感式條碼印表機的範圍正在進一步擴大。

- 此外,直接熱感技術利用熱量在熱敏基板上產生影像,主要服務於零售市場,例如定量食品標籤。它為短壽命應用提供了易用性和可靠性,並以合理的列印速度提供優質、低成本的條碼。這些特性使熱感技術成為運輸產品上識別和追蹤標籤的理想選擇,例如小包裹遞送以及標記外殼和托盤。

- 電子商務的興起增加了對條碼列印的需求。這是透過供應商和市場投資者的各種努力來實現的。開發範圍廣泛,從列印條碼到條碼印章,以最大限度地減少浪費。在某些情況下,可能會在小冊子的外部列印條碼,以識別內部郵票上的條碼。

- 2021 年 7 月,International Security Printers (ISP) 投資了先進的混合印刷、印後加工和偵測系統,以加速條碼印章的開發。這項投資正在多元化,以允許郵政當局在郵票上添加獨特的彩色編碼條碼,透過穿孔分隔並沿著郵票放置。

- 此外,冠狀病毒感染疾病(COVID-19)大流行的爆發增加了對醫療保健的需求,並預計受訪市場將進一步推動需求。此外,由於多個地區的封鎖,電子商務銷售額以前所未有的速度激增,提振了所研究的市場。

條碼列印機市場趨勢

零售市場預計將佔據最大佔有率

- 庫存可用性和從電子商務到實體店的有效供應鏈至關重要。美國商務部預計,到年終零售額將達到27.73兆美元。隨著易於訪問的電子商務和行動平台領域的擴大,上述數字可能會進一步增加,從而加速預測期內的市場成長。

- 條碼使零售商能夠追蹤庫存、自動重新訂購產品、比較國內品牌和自有品牌之間類似產品的銷售情況、追蹤對產品屬性(如顏色和尺寸)的偏好,並根據客戶購買情況客製化有針對性的促銷活動。分析習慣並確定特定客戶的購買偏好。

- 全球最廣泛接受的兩種零售條碼格式是 EAN-13(國際商品編號)和 UPC-A(通用產品代碼)。 GS1 提供唯一的 12 位元 UPC(通用產品代碼)或 EAN 公司識別號,必須輸入到產品標籤上的 UPC-A 或 EAN-12 條碼中。預計這將推動零售業參與者遵守此類標準並在預測期內推動市場成長。

- 一些滿足這些要求的行業知名公司已經開發出可以推動市場成長的產品。例如,2021 年 12 月,總部位於班加羅爾的金融科技公司 FloBiz myBillBook 宣布推出零售商和專利權的 POS申請解決方案。零售業佔印度GDP的10%。考慮到該行業的規模和特定需求,該解決方案旨在使用鍵盤快捷鍵和條碼掃描提供更快的申請體驗。

預計北美將佔據最大的市場佔有率

- 由於各行業條碼和標籤的採用率很高,北美是所研究市場的主要投資者和創新者之一。此外,該地區不斷成長的終端用戶產業為供應商投資該地區市場提供了重要機會。許多主要市場供應商主要來自美國。因此,該地區在研究市場的創新率也很高。

- 電子商務行業和線上消費者數量的顯著成長增加了對客製化和個人化行銷策略的需求。根據美國人口普查,由於電子商務的蓬勃發展正在徹底改變零售業,零售額預計將大幅成長。報告也顯示,2021年11月美國零售額較2020年同期成長13.1%,線上銷售成長6.6%。電子商務零售額的成長預計將進一步增加對自動化和先進行銷程序的需求,從而增加對 ABM 解決方案的需求。

- 同樣,2021年,加拿大的電子商務用戶超過2700萬,佔加拿大人口的72.5%。根據政府資料,預計到2025年這一比例將增加至77.6%。預計這將對條碼和標籤產生巨大的需求。此外,亞馬遜還在該國啟動了一項透明度計劃,透過使用 T 形2D碼標籤來識別仿冒品產品,對在其平台上銷售的產品進行序列化。

- 加拿大食品檢驗局於2016年12月實施了營養標籤修正案,要求受監管方在五年過渡期內滿足新的標籤要求,在此期間他們將被要求遵守之前的或新的要求。符合。這些監管措施預計將在未來幾年增加消費包裝食品中條碼和標籤的使用。

- 此外,美國農業部 (USDA) 已採用 Digimarc 條碼作為核准的數位揭露方法,用於包裝生物工程食品(通常稱為基因改造生物 (GMO))。 Digimarc 條碼是新一代視覺上看不見的條碼,可以添加到產品包裝、零售標籤和吊牌上。可使用相容的消費性行動電話、零售條碼掃描器和電腦視覺系統進行掃描。它還消除了在產品包裝設計中添加2D碼技術的需要,並滿足新的聯邦法規。

條碼列印機產業概況

條碼印表機市場競爭對手之間的競爭正在加劇,尤其是斑馬技術公司和艾利丹尼森公司等幾家主要參與者的競爭。 不斷創新產品的能力使他們比競爭對手更具競爭優勢。 預計這些公司將通過戰略合作夥伴關係和併購在市場上站穩腳跟。

- 2021 年 12 月 -Honeywell在「印度製造」舉措下推出了 IMPACT 系列條碼列印機。 4吋桌上型條碼印表機專為輕量標籤列印需求而打造,支援熱轉印/熱感列印,讓您以127mm/s的速度列印。 IMPACT by Honeywell 是專門為迎合印度不斷成長的中階市場而創建的品牌。

- 2021 年 3 月 - Brother Mobile Solutions 宣布擴展 Brother Titan 工業印表機系列,推出五款增強型 4 吋工業條碼標籤印表機,配有內部回捲器,可擴大使用範圍。該產品組合採用金屬製成,包括增加的色帶容量、雙 Wi-Fi/藍牙選項和 PLC 整合。擴展範圍以接近 14 ips2 的速度提供高達 600 dpi1 的清晰條碼標籤。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間敵對的強度

- 替代產品的威脅

- 評估新型冠狀病毒感染疾病(COVID-19)對市場的影響

第5章市場動態

- 市場促進因素

- 不斷提高技術進步

- 電子商務和物流業快速成長

- 市場限制因素

- 列印品質

第6章市場區隔

- 依產品類型

- 桌上型印表機

- 行動印表機

- 工業印表機

- 依列印類型

- 熱轉印

- 直熱感

- 其他印刷類型

- 依最終用戶產業

- 製造業

- 零售

- 運輸和物流

- 衛生保健

- 其他最終用戶產業

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Sato Holdings Corp.

- Zebra Technologies Corporation

- Honeywell International Inc.

- Toshiba Tec Corp.

- Avery Dennison Corporation

- Seiko Epson Corporation

- TSC Auto ID Technology Co. Ltd

- Primera Technologies Inc.

- Brother Mobile Solutions Inc

- Postek Electronics Co. Ltd

第8章投資分析

第9章市場的未來

The Global Barcode Printer Market size is estimated at USD 4.52 billion in 2024, and is expected to reach USD 5.55 billion by 2029, growing at a CAGR of 4.18% during the forecast period (2024-2029).

The growth of asset tracking applications and increasing technological advancements in printing and printer technology are some of the major factors driving the growth of the global barcode printer market. Many industries are adopting labels and barcodes for their asset tracking and providing information about their products.

Key Highlights

- By product type, industrial printers are expected to account for the major market share over the forecast period. However, recent technological advancements, like wireless connectivity, are also boosting the mobile printer segment. Thermal barcode printers are extensively used across small and large enterprises to label and subsequently track the products shipped.

- The rising adoption of automatic identification and data capture technologies for enhancing productivity, along with the growing concerns regarding product safety and anti-counterfeiting, is also boosting the market for thermal printers. The increasing utilization of thermal printing technology in the latest on-demand printing applications further increases the scope of thermal barcode printers.

- Furthermore, the direct thermal technology that produces images using heat on a heat-sensitive substrate primarily serves the retail market, mainly for catchweight food labeling. It offers easy-to-use and reliability for short-life applications and delivers good low-cost barcodes at reasonable print speeds. These characteristics make direct thermal technology a choice for transit product identification and tracking labels, for example, for parcel distribution and outer case and pallet markings.

- Increased e-commerce resulted in an increased demand for barcode printing. This was satisfied through various efforts made by vendors and market investors alike. The development has been widespread, with interests ranging from printing barcodes to barcoding postage stamps to minimize wastage. Sometimes, a barcode is printed outside the booklet to identify the stamp barcodes inside.

- In July 2021, International Security Printers (ISP) invested in advanced hybrid printing, finishing, and inspection systems to further the development of barcoding postage stamps. The investments are diversified toward enabling postal authorities to add distinctive color-coded barcodes to stamps, placed along the stamp and separated by a perforation line.

- Moreover, with the onset of the COVID-19 pandemic, the studied market is further expected to propel demand, with healthcare increasing in demand. Furthermore, with several regions operating in lockdown, e-commerce sales are surging at an unprecedented rate, thus boosting the studied market.

Barcode Printer Market Trends

Retail Market is Expected to Witness the Largest Share

- The availability of inventory and an effective supply chain from e-commerce to brick-and-mortar stores is essential. According to the US Department of Commerce, retail sales are expected to reach 27.73 trillion by the end of 2020. The above number is only likely to increase owing to the global expansion of easily accessible e-commerce and mobile platforms, thereby fueling market growth over the forecast period.

- The barcodes enable the retailers to keep track of inventory, automate product re-ordering, compare sales of similar products of national brands vs. private labels, track product attribute preferences such as color, size, etc., customize targeted promotions based on customer buying habits, and identify what buying preferences a particular customer has.

- The two most widely accepted formats of retail barcodes globally are the EAN-13 (International Article Number) and UPC-A (Universal Product Code). GS1 provides a unique 12-digit UPC (Universal Product Code) or EAN company identification number that has to be entered into a UPC-A or EAN-12 barcode on your product's label. This is expected to make the players in the retail industry comply with such standards, fueling the market growth over the forecast period.

- Some of the industry's prominent players to cater to such requirements are coming up with product developments that enable them to boost the market growth. For instance, in December 2021, myBillBook, the Bengaluru-based fintech FloBiz announced the launch of its Point-of-Sale Billing solution for retailers and franchises. The retail industry accounts for 10% of India's GDP. Keeping this industry's scale and specific needs in mind, the solution has been designed to provide a faster billing experience using keyboard shortcuts and barcode scanning.

North America Is Expected to Hold Largest Market Share

- North America is one of the major investors and innovators in the market studied, owing to the high adoption rate of barcodes and labels across various industries. Moreover, the growing end-user industries in the region provide massive opportunities for vendors to invest in the regional market. Many of the significant market vendors are mainly from the United States. Hence, the region also has a high rate of innovation in the market studied.

- The massive growth of the e-commerce industry and the number of online shoppers have increased the need for customized and personalized marketing strategies. According to the US Census, the e-commerce boom revolutionizing the retail sector is expected to boost retail sales significantly. It also suggested that US retail sales increased by 13.1% in November 2021, compared to the same period in 2020, and online sales increased by 6.6%. The growth in e-commerce retail sales is further expected to increase the need for automated and advanced marketing procedures, thereby increasing the demand for ABM solutions.

- Similarly, in 2021, there were over 27 million e-commerce users in Canada, accounting for 72.5% of the Canadian population. According to the government's data, this is expected to increase to 77.6% in 2025. This is expected to create a massive demand for barcodes and labels. Additionally, Amazon launched its transparency program in the country to serialize the products sold on its platform by using a T-shaped QR-style tag to identify counterfeit items.

- The Canadian Food Inspection Agency, in December 2016, made amendments to nutrition labeling, which mandated the regulated parties to meet the new labeling requirements within a five-year transition period, during which they must comply with either the former or the new requirements. Such regulatory initiatives are expected to increase the use of barcodes and labels in consumer-packaged foods over the coming years.

- Moreover, the US Department of Agriculture (USDA) adopted Digimarc Barcodes as an approved digital disclosure method for packaging containing bioengineered food, commonly known as genetically modified organisms (GMOs). Digimarc Barcode is a new-generation visually imperceptible barcode, which can be added to product packaging, retail labels, and hangtags. It may be scanned by compatible consumer phones, retail barcode scanners, and computer vision systems. It also eliminates the need to add a QR method to the product package design and fulfills the new federal regulations.

Barcode Printer Industry Overview

The competitive rivalry in the barcode printer market is high owing to some key players such as Zebra Technologies Corporation, and Avery Dennison Corporation, amongst others. Their ability to continually innovate their offerings has allowed them to gain a competitive advantage over their competitors. Through strategic partnerships and mergers and acquisitions, these players are expected to gain a strong foothold in the market.

- December 2021 - Honeywell launched its IMPACT series of barcode printers under the "Make in India" initiative. The four-inch desktop barcode printer is built for light-duty label printing requirements, and it supports thermal transfer/direct thermal printing, thereby enabling printing at 127mm/sec. IMPACT by Honeywell is a brand established specifically to cater to the growing mid-segment market in India.

- March 2021 - Brother Mobile Solutions announced the expansion of the Brother Titan Industrial Printer series with five enhanced four-inch industrial barcode label printers featuring internal rewinders for an increased use range. Built with metal, the portfolio includes an increased ribbon capacity, dual Wi-Fi/Bluetooth option, and PLC integration. The augmented range delivers clear barcode labels up to 600 dpi1 at speeds nearing 14 ips2.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Technological Advancement

- 5.1.2 Rapid Growth of E-Commerce and the Logistic Sector

- 5.2 Market Restraints

- 5.2.1 Printing Quality

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Desktop Printer

- 6.1.2 Mobile Printer

- 6.1.3 Industrial Printer

- 6.2 By Printing Type

- 6.2.1 Thermal Transfer

- 6.2.2 Direct Thermal

- 6.2.3 Other Printing Types

- 6.3 By End-user Industry

- 6.3.1 Manufacturing

- 6.3.2 Retail

- 6.3.3 Transportation and Logistics

- 6.3.4 Healthcare

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 South America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Sato Holdings Corp.

- 7.1.2 Zebra Technologies Corporation

- 7.1.3 Honeywell International Inc.

- 7.1.4 Toshiba Tec Corp.

- 7.1.5 Avery Dennison Corporation

- 7.1.6 Seiko Epson Corporation

- 7.1.7 TSC Auto ID Technology Co. Ltd

- 7.1.8 Primera Technologies Inc.

- 7.1.9 Brother Mobile Solutions Inc

- 7.1.10 Postek Electronics Co. Ltd