|

市場調查報告書

商品編碼

1439844

腐植酸:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Humic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

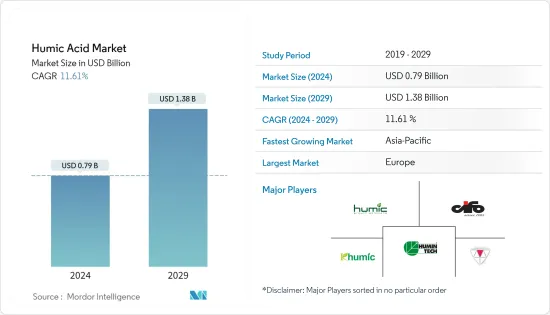

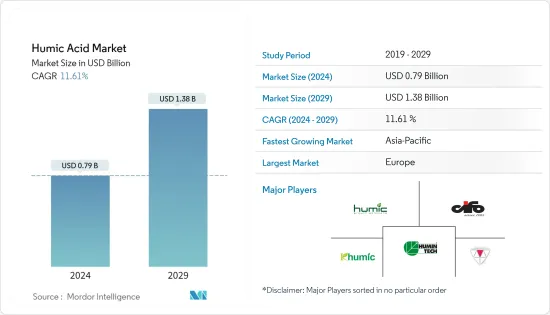

腐植酸市場規模預計2024年為7.9億美元,預計到2029年將達到13.8億美元,在預測期內(2024-2029年)年複合成長率為11.61%成長。

2020年,市場受到COVID-19感染疾病的影響,導致世界各地糧食不安全狀況加劇,家庭菜園百花齊放。目前市場處於大流行前的水平。

主要亮點

- 短期來看,市場的主要驅動力是農業領域的巨大需求。

- 然而,由於農民缺乏意識,市場成長可能會放緩。

- 儘管如此,新興市場人口結構、飲食習慣的變化以及對有機肥料和生物刺激劑的需求不斷成長預計將在預測期內增加對腐植酸的需求。

- 歐洲在全球市場上佔據主導地位,其中法國、德國和英國國家的消費量最大。

腐植酸市場趨勢

有機肥料產業主導市場

- 腐植酸廣泛用於肥料中,以改善養分吸收、保水、微生物生長和土壤結構。它還有助於減少毒素。

- 腐植酸具有廣泛的物理、化學和生物益處。腐植酸還可以提高陽離子交換能力 (CEC) 和氧氣含量。平均持水能力的提升可改善土壤肥力和植物生長。肥沃的土壤中腐植酸含量可能高達 3%,而泥炭中的腐植酸含量在 3% 到 10% 之間。

- 腐植酸提供的物理益處包括增強土壤結構並防止陽光和沙質土壤中水分和養分的大量流失。它有助於透過分解將沙土變成肥沃的土壤。

- 化學益處包括中和酸鹽和鹼鹽以及調節 pH 值。腐植酸的使用提高了有機和無機物質的吸收並保留了水溶性無機肥料。

- 根據經合組織-糧農組織《2021-2030年農業展望》,亞太地區是最大的水產品生產國。據預測,到2030年,該地區農業和漁業產量將佔全球農業和漁業產量的53%,總產值預計將比2018-20年基準水準增加20%。

- 據美國人口普查局稱,由於大規模移民,目前美國人口預計將增加0.7%至0.9%。預計,隨著人均收入的提高和人口數量的增加,對作物和經濟作物的需求也會增加。例如,據聯合國糧農組織稱,到 2050 年,美國的糧食需求預計將增加 50-90%。

- 因此,所有上述因素都可能在預測期內推動有機肥領域中腐植酸的消耗。

歐洲主導市場

- 歐洲已成為腐植酸消費的主要市場,法國、英國和英國等國家的消費量不斷增加。

- 法國擁有歐洲最大的農業部門。該公司是全球農業市場的領先生產商,生產甜菜、葡萄酒、牛奶、牛肉和小牛肉、穀物和油籽。然而,法國遭遇了嚴重乾旱,根據法國主要農業聯盟FNSEA的數據,法國44萬個農戶中,有1.4萬戶遭受春夏季節的酷暑和少雨之苦。許多農民提出了賠償申請。 。這對化肥的需求產生了重大影響,進而影響了腐植酸市場。

- 根據經濟合作暨發展組織,2020-2021年法國農業用地總面積將達964.7萬公頃,鑑於國內糧食需求不斷成長,預計未來幾年還將增加。根據法國INSEE統計,法國農業GDP從2021年第三季的80.33億歐元增加到2021年第四季的80.76億歐元。這些因素正在推動該國市場的需求。

- 在德國,大約一半的土地用於農業。它是世界第三大農產品出口國。德國約三分之一的農業用地主要種植穀物,其中小麥是主要作物,其次是大麥和黑麥。這增加了對肥料的需求並擴大了腐植酸的市場,腐植酸是植物營養的豐富來源。

- 根據聯邦統計局的數據,德國農業國內生產總值(GDP)從2021年第三季的74.1億歐元增加到2021年第四季的76.4億歐元。

- 英國國家統計局的數據顯示,農業GDP從2021年第二季的31.46億英鎊增加至2021年第三季的31.57億英鎊,支撐了受調查市場的成長。

- 上述因素可能增加歐洲應用產業對腐植酸的需求。

腐植酸產業概況

全球腐植酸市場本質上是部分一體化的。市場主要企業包括(排名不分先後)Humic Growth Solutions Inc.、鄭州盛達胡米克生物科技有限公司、Humintech、Cifo Srl 和 Mineral Technologies Inc.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 促進因素

- 農業領域需求龐大

- 抑制因素

- 農民缺乏意識

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 定價概覽

第5章市場區隔

- 類型

- 粉末狀的

- 顆粒狀

- 液體

- 目的

- 有機肥

- 動物飼料

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章 競爭形勢

- 合併、收購、合資、合作和協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- Agbest Technology Co. Limited

- Arctech Inc.

- Black Earth Humic LP

- Cifo Srl

- Desarrollo Agricola y Minero, SA

- Humic Growth Solutions Inc.

- Humintech

- Jiloca Industrial Sa

- Saint Humic Acid

- The Anderson Inc.

- Xian Shan Yuan

- Zhengzhou Shengda Khumic Biotechnology Co., Ltd

- Mineral Technologies Inc.

- Grow More Inc.

第7章市場機會與未來趨勢

- 新興市場的人口和飲食變化

- 對有機肥料和生物刺激劑的需求不斷成長

The Humic Acid Market size is estimated at USD 0.79 billion in 2024, and is expected to reach USD 1.38 billion by 2029, growing at a CAGR of 11.61% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. However, the COVID-19 outbreak has led to the blooming of home gardening, along with growing food insecurity across various regions of the world. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the short term, the major driving factors of the market are its massive demand from the agriculture sector.

- However, a lack of awareness among farmers is likely to slow down the market.

- Nevertheless, changing demographics, food habits in emerging markets, and the growing need for organic fertilizers and bio-stimulants are expected to increase the demand for humic acid over the forecast period.

- Europe dominates the market across the world, with the most substantial consumption from countries like France, Germany, and United Kingdom.

Humic Acid Market Trends

Organic Fertilizer Segment to Dominate the Market

- Humic acid is widely used in fertilizers to improve nutrient uptake, water retention, microbial growth, and soil structure. It also helps in the reduction of toxins.

- Humic acid offers a wide range of physical, chemical, and biological benefits. Humic acid also improves the cation-exchange capacity (CEC) and the oxygen content. The improved average water holding capacity thereby improving the soil fertility and plant growth. The fertile soil may contain a maximum humic acid content of 3% and whereas in peat, the humic acid content varies falls in the range of 3 to 10%.

- The physical benefits offered by humic acid include enhancing the soil structure and preventing high water and nutrient loss in sunlight and sand soils. It helps in converting the sand soils into fertile soils by decomposition.

- The chemical benefits include the neutralization of acid and alkaline salts and regulating pH value. The use of humic acid improves the absorption of both organic and mineral substances and retains water-soluble inorganic fertilizers.

- According to the OECD-FAO Agricultural Outlook 2021-2030, Asia-Pacific is the largest producer of agricultural and fisheries commodities. The region is expected to account for 53% of the global agriculture and fish output by 2030. The total value of production is projected to expand by 20% by 2030 in comparison to the 2018-20 base level.

- According to the US Census Bureau, the current population of the United States is expected to increase by 0.7-0.9%, driven by a high level of immigration. With the increasing per capita income and growing population level, the demand for food crops and cash crops is also estimated to increase. For instance, as per the FAO, food demand in the United States is expected to increase by 50-90% by 2050.

- Therefore, all the aforementioned factors are likely to drive humic acid consumption from organic fertilizer segment over the forecast period.

Europe to Dominate the Market

- Europe was found to be the major market for the consumption of humic acid, owing to increasing consumption from countries such as France, Germany, and United Kingdom.

- France is home to the largest agricultural sector in Europe. It is among the top producers in the world agriculture market and produces sugar beets, wine, milk, beef and veal, cereals, and oilseeds. However, the country experienced severe droughts, and according to France's main agricultural trade union, FNSEA, 14,000 farms out of 440,000 filed compensation claims following the extreme heat and lack of rain that ravaged France during the spring and summer. This had a significant impact on the demand for fertilizers, thereby affecting the humic acid market.

- According to the Organization for Economic Co-operation and Development, in France, the total agricultural land around accounted for 9,647 thousand hectares in 2020-21 and is expected to rise in the coming years, considering the increasing demand for food in the country. According to the INSEE (France), GDP from agriculture in France increased to EUR 8,076 million in the fourth quarter of 2021 from EUR 8,033 million in the third quarter of 2021. Such factors favor the demand for the studied market in the country.

- In Germany, about half of the land is used for agriculture. It is the third largest exporter of agricultural goods in the world. Grain is majorly cultivated on about one-third of the agricultural land of Germany, where wheat is the leading crop, followed by barley and rye. This is increasing the demand for fertilizers, thereby boosting the market for humic acid, as it is a rich source of plant nutrients.

- According to the Federal Statistical Office, the Gross domestic product (GDP) from agriculture in Germany increased to EUR 7.64 billion in the fourth quarter of 2021 from EUR 7.41 billion in the third quarter of 2021.

- In the United Kingdom, the Office for National Statistics, GDP from agriculture increased to GBP 3,157 million in the Q3 of 2021 from GBP 3,146 million in the Q2 of 2021, thereby supporting the growth of the studied market.

- The above-mentioned factors are likely to ascend the demand for humic acid across the application industries in Europe.

Humic Acid Industry Overview

The global humic market is partially consolidated in nature. Some of the key players in the market (not in any particular order) include Humic Growth Solutions Inc., Zhengzhou Shengda Khumic Biotechnology Co. Ltd, Humintech, Cifo Srl, and Mineral Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Drivers

- 4.1.1 Huge Demand from the Agriculture Sector

- 4.2 Restraints

- 4.2.1 Lack of Awareness Among Farmers

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Overview

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Powdered

- 5.1.2 Granular

- 5.1.3 Liquid

- 5.2 Application

- 5.2.1 Organic Fertilizer

- 5.2.2 Animal Feed

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Agbest Technology Co. Limited

- 6.4.2 Arctech Inc.

- 6.4.3 Black Earth Humic LP

- 6.4.4 Cifo Srl

- 6.4.5 Desarrollo Agricola y Minero, S.A.

- 6.4.6 Humic Growth Solutions Inc.

- 6.4.7 Humintech

- 6.4.8 Jiloca Industrial Sa

- 6.4.9 Saint Humic Acid

- 6.4.10 The Anderson Inc.

- 6.4.11 Xian Shan Yuan

- 6.4.12 Zhengzhou Shengda Khumic Biotechnology Co., Ltd

- 6.4.13 Mineral Technologies Inc.

- 6.4.14 Grow More Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Changing Demographics and Food Habits in the Emerging Markets

- 7.2 Growing Need for Organic Fertilizers and Bio-stimulants