|

市場調查報告書

商品編碼

1439853

微型逆變器:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Micro Inverter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

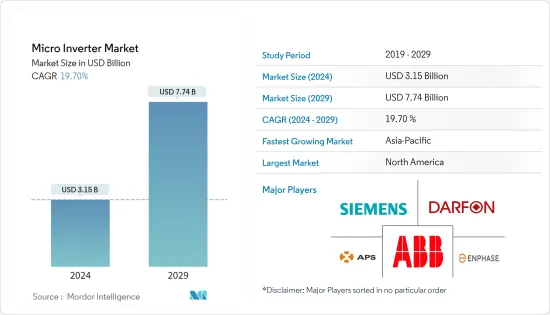

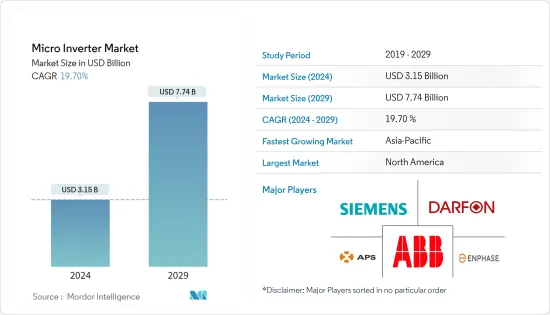

2024年微型逆變器市場規模預估為31.5億美元,預估至2029年將達77.4億美元,預測期內(2024-2029年)複合年成長率為19.70%。

實現模組級監控、易於安裝、增加設計靈活性、無需直流開關點以及比傳統逆變器更好的安全性等因素是推動微型逆變器市場增長的一些因素。

主要亮點

- 持續的研發活動和微型逆變器成本的顯著降低正在推動微型逆變器市場的發展。此外,由於其緊湊的尺寸和多功能性,市場也在顯著成長。此外,基於模組化、安全性和最大能源採集的消費者需求的不斷成長預計將在預測期內繼續以相當大的速度推動市場。

- 對微型逆變器的需求使得該公司能夠開發更多的電池儲存。 2022年4月,能源儲存提供商Yotta Energy(德克薩斯州)宣布獲得一份價值197萬美元的契約,在拉斯維加斯內利斯空軍基地安裝太陽能+儲能微電網。

- 微型逆變器有多種用途,並在世界各地廣泛採用。它們具有多種優勢,包括設計彈性以及透過最大功率點追蹤 (MPPT) 技術從太陽能電池板產生最大功率的能力。這些因素使微型逆變器市場在住宅和商業應用中比其他逆變器更具優勢。

- 對微型逆變器的需求使得該公司能夠開發更多的電池儲存。 2022年4月,德克薩斯州奧斯汀的Yotta Energy獲得了一份價值197萬美元的契約,在拉斯維加斯內利斯空軍基地安裝太陽能發電+儲存微電網。該公司相信電池也正朝著同一方向發展:模組級微儲存。該公司在裝有安定器的同一個太陽能模組貨架設備中部署了 52 磅、1 千瓦時的磷酸鋰鐵電池。

- 據政府間組織國際能源署稱,與石化燃料和核能發電相比,全球再生能源容量預計將比 2020 年增加 60% 以上,到 2026 年將超過 4,800(吉瓦)。據說這相當於相當於世界總發電量的總和。

微型逆變器市場趨勢

住宅行業推動市場成長

- 美國和加拿大等國家的住宅領域擴大採用太陽能,主要是由於節省電費的承諾、對替代電力源的需求以及減少氣候變遷風險的願望。因此,微型逆變器市場的成長機會增加。

- 在預測期內,推動微型逆變器市場的關鍵因素包括太陽能發電成本下降、政府對住宅太陽能發電的支持政策、FIT計劃和激勵措施以及各國政府設定的太陽能目標,從而促使屋頂光伏發電的佔有率太陽能發電預計將增加。

- 全球大多數微型逆變器企業都提供單相設備。此外,單相輸電最適合國內應用,也是微型逆變器的主要市場,因此全球需求量大。例如,在美國和歐洲,住宅部門依賴單相電力傳輸。

- 持續的技術改進,例如提高光伏組件的效率,將推動成本降低。這些高度模組化技術的工業化正在帶來令人印象深刻的好處,從規模經濟和競爭加劇到製造流程和供應鏈的改進,進一步加速了微型逆變器市場的成長。

亞太地區創下最高市場成長紀錄

- 在研究期間,亞太地區預計將成為微型逆變器成長最快的市場。中國、日本、印度和澳洲等多個國家正在努力透過先進的太陽能發電系統來擴大其太陽能發電裝置容量,以提高電力可靠性。

- 亞太地區已為住宅、商業和太陽能發電廠安裝了多個微型逆變器。日本和澳洲主要採用微型逆變器技術。此外,印度和日本住宅屋頂太陽能裝置的增加正在鼓勵製造商滿足該地區潛在客戶的需求。

- 在印度、中國和日本等國家,各自政府制定了法規、改革和舉措,以實現電力部門的現代化。

- 在印度,住宅光伏的安裝成本估計為每千瓦 1,000 美元,高於商業光伏(每千瓦 692 美元)。然而,印度的住宅安裝成本(每千瓦 1,638 美元)和商業安裝成本(每千瓦 1,379 美元)均低於全球平均水平。這些因素推動了該地區的市場成長。

- 印度也計劃在2021年對進口太陽能電池組件和逆變器徵收20%的關稅,取代目前的保障稅。此次課稅是印度電力部長在與產業代表的電話交談中提案的,確認印度總理打算對進口商品徵收20%的基本關稅(BCD)。

微型逆變器產業概況

微型逆變器市場高度分散,主要參與者包括Enphase Energy Inc.、Altenergy Power System Inc.、DARFON、ABB Ltd和Siemens AG。這些市場參與者正在使用新產品發布、擴張、合作和收購等策略來擴大他們在這個市場的足跡。

- 2022 年 4 月 - Yotta Energy 宣布收購 350 萬美元新資本,使 A 輪資金籌措總額達 1,650 萬美元。本輪資金籌措和獎項使 Yotta 的總資金超過 2550 萬美元。

- 2021 年 10 月 - 全球領先的微型逆變器太陽能和電池系統製造商 Enphase Energy, Inc. 宣佈為北美客戶推出採用 IQ8TM 太陽能微型逆變器的 Enphase 能源系統。 IQ8 是 Enphase 迄今為止最先進的微型逆變器。與競爭產品不同,IQ8 可以在停電期間利用陽光創建微電網,無需電池即可提供備用能源。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 隨著採用率的增加,再生能源來源的好處和意識不斷增強

- 提高成本效益並開發這些產品

- 市場限制因素

- 安裝和維護成本高

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間敵對的強度

- 評估 COVID-19感染疾病對微型逆變器市場的影響

第5章市場區隔

- 依類型

- 單相

- 三相

- 透過通訊技術

- 有線

- 無線的

- 依銷售管道

- 直接地

- 間接

- 依用途

- 住宅

- 商業的

- 太陽能發電廠

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- Enphase Energy Inc.

- Altenergy Power System Inc.

- DARFON

- ABB Ltd

- Siemens AG

- Zhejiang Envertech Corporation Limited

- Omnik New Energy

- Sunpower Corporation

- ReneSolaPower

- AEconversion GmbH &Co. KG

- SMA Solar Technology AG

- Sparq Systems

- Sensata Technologies Inc.

- EnluxSolar Co. Ltd

- Delta Energy Systems

- SolarEdge Technologies Inc.

第7章 投資分析

第8章市場機會及未來趨勢

The Micro Inverter Market size is estimated at USD 3.15 billion in 2024, and is expected to reach USD 7.74 billion by 2029, growing at a CAGR of 19.70% during the forecast period (2024-2029).

The factors like enabling module-level monitoring, easier installation, enhanced design flexibility, removing the need for DC switching points, and better safety than conventional inverters are some factors that are fueling the growth of the micro inverter market.

Key Highlights

- Constant R&D activities and significant reductions in the costs of microinverters drive the micro inverter market. Furthermore, the market also receives a considerable boost due to its compact size and versatility. Additionally, the increasing requirement of consumers, based on modularity, safety, and maximum energy harvest, will continue to drive the market at a considerable pace in the forecast period.

- The demand for micro inverters has enabled companies to develop increased battery storage. In April 2022, energy storage provider Yotta Energy, Austin, Texas, announced that it had been awarded a USD 1.97 million contract to install a solar + storage microgrid at Nellis Air Force Base in Las Vegas.

- Due to the varying use of micro inverters, they are widely adopted worldwide. They provide various benefits such as design flexibility and capabilities like producing the maximum power from solar panels through maximum power point tracking (MPPT) technology. These factors have helped the micro-inverter market gain an advantage over other inverters in residential and commercial applications.

- The demand for micro inverters has enabled companies to develop increased battery storage. In April 2022, Yotta Energy of Austin, Texas, was awarded a USD 1.97 million contract to install a solar + storage microgrid at Nellis Air Force Base in Las Vegas. The company believes batteries are headed in the same direction: module-level microstorage. The business is deploying a 52lb, 1kWh lithium-iron-phosphate battery on the same solar module racking gear, which holds the ballast.

- Worldwide renewable electricity capacity is predicted to expand by more than 60% from 2020 to over 4,800 (GW) by 2026, equaling the total global power capacity of fossil fuels and nuclear power combined, according to the International Energy Agency (an intergovernmental agency).

Micro Inverter Market Trends

Residential Segment to Drive the Market Growth

- The increasing adoption of solar photovoltaics in the residential sector in countries such as the United States and Canada is primarily driven by expected savings in electricity costs, the need for an alternative source of electricity, and the desire to mitigate climate change risk. Therefore, boosting the growth opportunities for the micro inverter market.

- During the forecast period, the share of the rooftop solar PV is expected to increase, on account of decreasing solar PV costs, supportive government policies for residential solar PV, FIT programs and incentives, and targets set by various governments for solar energy are some of the critical factors that are driving the micro inverter market.

- The majority of micro-inverter businesses throughout the world provide single-phase devices. Furthermore, considerable demand is observed globally because single-phase power transmission is best adapted for domestic applications, which is likewise among the primary marketplaces for micro-inverters. For example, the residential sector relies on single-phase power transmission in the United States and Europe.

- Continuous technological improvements, including higher solar PV module efficiencies, drive cost reductions. The industrialization of these highly modular technologies has yielded impressive benefits, from economies of scale and greater competition to improved manufacturing processes and supply chains, further accelerating the micro-inverter market growth.

Asia-Pacific to Register Highest Market Growth

- Asia-Pacific is expected to be the fastest-growing market for micro-inverters over the study period. Several countries, such as China, Japan, India, and Australia, are striving to boost their solar PV installation capacity through advanced solar PV systems that could, in turn, enhance electric stability.

- Asia-Pacific has several micro-inverter installations for residential, commercial, and PV power plant applications. Japan and Australia have been the major adopters of micro-inverter technology. Additionally, the growth in residential rooftop solar PV installations in India and Japan encourages manufacturers to cater to the needs of potential customers in this region.

- In countries such as India, China, and Japan, respective governments have laid regulations, reforms, and initiatives for modernizing the power sector.

- In India, the residential PV installation cost is estimated to be USD 1000 per KW, which is higher when compared to its commercial counterpart (USD 692 per KW). However, the Indian installation costs are cheaper than the global average for both residential (USD 1638 per KW) and commercial (USD 1379 per KW). These factors fuel the market growth in the region.

- India is also set to impose a 20% levy on imported solar module cells and inverters in 2021, replacing the current safeguard duty. The levy was proposed by the Indian power minister during a call with industry representatives, confirming that the Prime Minister of India intended to impose a Basic Custom Duty (BCD) of 20% on imports.

Micro Inverter Industry Overview

The micro-inverter market is highly fragmented, and the major players such as Enphase Energy Inc., Altenergy Power System Inc., DARFON, ABB Ltd, and Siemens AG, among others. These market players are using strategies such as new product launches, expansions, partnerships, acquisitions, and others to increase their footprints in this market.

- April 2022 - Yotta Energy announced obtaining USD 3.5 million in new capital, bringing its total Series A funding to USD 16.5 Million. Yotta's total funding is now over USD 25.5 million due to the current funding round and award.

- October 2021 - Enphase Energy, Inc., the world's premier microinverter-based solar and battery system manufacturer, unveiled the Enphase Energy System with IQ8TM solar microinverters for clients in North America. IQ8 is Enphase's most advanced microinverter to date. Unlike rival gadgets, IQ8 can build a microgrid using sunlight throughout a power outage, delivering backup energy without a battery.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in benefits and awareness about the renewable energy sources along with increased adoption

- 4.2.2 Cost-effectiveness and increased developments of these products

- 4.3 Market Restraints

- 4.3.1 High installation and maintenance costs

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of Covid-19 on the Micro Inverter Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Single Phase

- 5.1.2 Three Phase

- 5.2 By Communication Technology

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.3 By Sales Channel

- 5.3.1 Direct

- 5.3.2 Indirect

- 5.4 By Application

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 PV Power Plant

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Enphase Energy Inc.

- 6.1.2 Altenergy Power System Inc.

- 6.1.3 DARFON

- 6.1.4 ABB Ltd

- 6.1.5 Siemens AG

- 6.1.6 Zhejiang Envertech Corporation Limited

- 6.1.7 Omnik New Energy

- 6.1.8 Sunpower Corporation

- 6.1.9 ReneSolaPower

- 6.1.10 AEconversion GmbH & Co. KG

- 6.1.11 SMA Solar Technology AG

- 6.1.12 Sparq Systems

- 6.1.13 Sensata Technologies Inc.

- 6.1.14 EnluxSolar Co. Ltd

- 6.1.15 Delta Energy Systems

- 6.1.16 SolarEdge Technologies Inc.