|

市場調查報告書

商品編碼

1440189

四輪車和三輪車:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Quadricycle and Tricycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

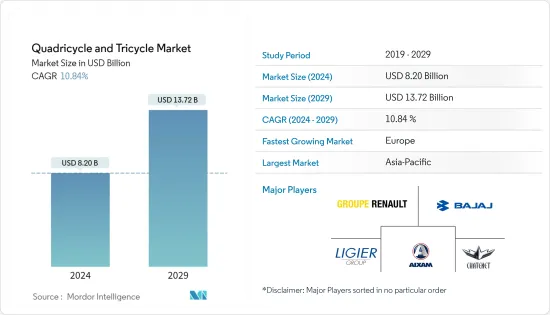

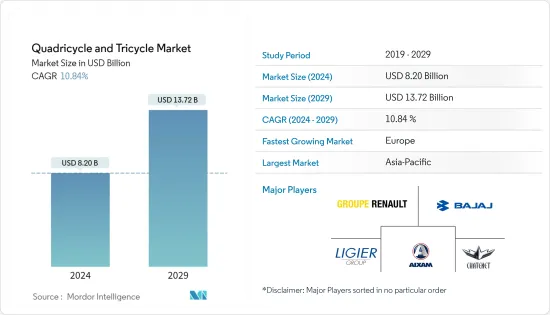

四輪車和三輪車市場規模預計到 2024 年為 82 億美元,預計到 2029 年將達到 137.2 億美元,預測期內(2024-2029 年)年複合成長率為 10.84%。

COVID-19感染疾病導致經濟放緩,迫使製造設施關閉,限制了四輪車和三輪車市場的擴張。 COVID-19感染疾病對市場產生了重大影響,由於銷售疲軟,多家OEM推遲了新產品的推出。此外,許多公司正在削減研發費用,預計將阻礙三輪車和四輪車的技術進步並減緩市場成長。

從長遠來看,快速的都市化、電動和不斷增強的環保意識預計將推動四輪車和三輪車的需求。四輪車價格便宜,佔用的道路空間較少,排放的污染物也較少,使其成為印度、菲律賓、哥倫比亞、印尼、中國和日本等交通堵塞嚴重問題的國家的理想選擇。

此外,已開發國家和新興國家的物流和移動食品擴大使用三輪車,推動了三輪車產業的成長。該行業的成長增加了企業對三輪車的需求,推動了三輪車產業的產品和技術改進。例如,Gordon Murray Design 及其聯盟合作夥伴Delta 馬達和 itMoves 推出了 MOTIV,這是一款獨特且用途廣泛的自動四輪車。

亞太地區已經擁有三輪車/三輪車的主要市場,因此預計在預測期內將佔據市場的主要佔有率。近年來,各大汽車製造商也在該地區推出了電動三輪車。此外,由於一些參與者正在大力投資開發最新產品以搶佔市場佔有率,預計歐洲和北美也將快速成長。

四輪車和三輪車市場趨勢

由於四輪車的普及,市場需求預計將增加

近年來,四輪車和三輪車越來越受歡迎。這是由於公眾和政府的接受度不斷提高,以及越來越多的應用程式可以將它們作為普通汽車的替代品。由於四輪車體積小,可以在城市交通中輕鬆管理並佔用更少的空間,可能有助於解決世界停車問題。

近年來,一些國家已核准四輪車作為新的車輛類別。例如,

該四輪車已被印度政府認證為新型道路車輛。搭乘用四輪車的最大重量為 475 公斤,在發射前經過了必要的碰撞測試,為乘員制定了安全標準。除了傳統的汽油動力四輪車外,政府還核准了電動和混合四輪車。

一家新的Start-Ups正在透過引入基於新技術的小型車輛進行城市內旅行,從而徹底改變個人移動領域。例如,Micro Mobility Systems推出了Microlino 2.0電動微型車和Microletta電動三輪車。根據報道,Microlino 2.0 的最高時速為 90 公里/小時,續航里程為 200 公里。預計於 2021 年開始出貨。

2021 年 1 月,雷諾推出了Mobilize 品牌,推出了 Twizy 風格的 EZ-1。這款四輪車長 2.3 米,由 50% 的回收材料製成,配有全玻璃門以提高可視性,並且可以選擇更換電池以延長其使用壽命。該公司還聲稱,EZ-1 95% 的零件在車輛使用壽命結束時都可以回收。

預計歐洲在預測期內將經歷最快的成長

在歐洲這個新興市場,被稱為「Sub-A」車型的四輪車被廣泛採用,佔據了重型輕型車和小客車之間的空間。 「sub-A」一詞是指A類汽車,這是小客車中最小的部分。這些發展與公眾和政府的接受度不斷提高以及四輪車可以有效地代替傳統車輛的各種應用相一致。

由於尺寸緊湊,四輪車很容易在城市交通中操縱,而且佔地面積小,可以解決世界各地的停車問題。幾家領先公司正在大力投資開發最新產品,以在該地區獲得更高的市場佔有率。例如,

2021年1月,福斯旗下西雅特宣布,先前宣布的電動四輪車Minimo的生產計畫於2022年開始全面運作。

2020年2月,雪鐵龍推出了Ami,從技術上來說,它被歸類為「輕型四輪車」。此外,您不需要駕駛執照即可操作它。雪鐵龍計劃出售該汽車,但也希望將其出租,類似於電動Scooter和其他微型移動解決方案。汽車可以按月和按分鐘出租。四輪車可以線上上購買並直接運送到客戶家中。

2020 年 12 月,德國 IAV 開發了一款自動駕駛電動三輪車,用於「最後一英里」送貨,由乘客追逐包裹。計劃的第二階段是開發內部轉向和煞車系統,以取代購買的系統,從而顯著減輕輪圈的總重量並改善操控性。

大流行之後,隨著人們尋求在不依賴大眾交通工具或更昂貴的汽油車輛的情況下保持獨立,電動三輪車和四輪車的使用增加。在預測期內,由於這些車輛的環保特性和所需投資成本較低,預計該地區對這些車輛的需求將會很高。

四輪車和三輪車行業概況

四輪車和三輪車市場適度整合,主要佔有率由全球參與者佔據,區域參與者也積極參與。 Aixam-Mega、Casalini SRL、雷諾是該市場的一些全球參與者。隨著各國政府認知到需要這些小型電動車來支持電動,市場正在呈現積極的發展。製造商正在推出新型號以跟上競爭對手的步伐。

2021 年 12 月,馬恆達電氣宣布計劃在未來三年內推出至少四款新車,其中包括一款新型四輪車類別。該公司專注於開發用於客運和貨運的電動三輪車和四輪車,以增加續航里程和負載容量。

2021年10月,雪鐵龍在歐洲推出電動四輪車「Ami Cargo」。雪鐵龍Ami是電動商用車Mini Ami的商用版本,重量不到425公斤。它由 5.5 kWh 鋰離子電池組提供動力,為 8 BHP馬達提供動力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 按動力來源類型

- 電

- 汽油

- 太陽的

- 按使用類型

- 個人

- 商業的

- 按車型

- 四輪車

- 三線

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 南非

- 阿拉伯聯合大公國

- 其他國家

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Automobiles CHATENET

- Ligier Group

- Aixam-Mega

- Bajaj Auto Ltd

- Estrima SRL

- Bellier Automobiles

- Worksman Cycles

- Daimus

- Light Foot Cycle

- Electronio Wheels

- Mahindra and Mahindra

- Groupe Renault

第7章市場機會與未來趨勢

The Quadricycle and Tricycle Market size is estimated at USD 8.20 billion in 2024, and is expected to reach USD 13.72 billion by 2029, growing at a CAGR of 10.84% during the forecast period (2024-2029).

The COVID-19 pandemic brought economies to a standstill and forced the closure of manufacturing facilities, thus, limiting the expansion of the quadricycle and tricycle markets. The COVID-19 pandemic significantly impacted the market, with several OEMs postponing the introduction of new products due to low sales. Many firms also reduced their R&D spending, which is projected to hamper the technical progress of tricycles and quadricycles, thus slowing market growth.

Over the long term, demand for quadricycles and tricycles is expected to be fueled by rapid urbanization, electrification, and increasing environmental consciousness. Quadricycles are less expensive, take up less road space, and emit fewer pollutants, making them ideal for nations where traffic congestion is a big concern, such as India, the Philippines, Colombia, Indonesia, China, and Japan.

Further, the growing use of tricycles in logistics and mobile food outlets in both established and emerging countries has boosted the tricycle industry's growth. This segment's growth is boosting demand for tricycles at the corporate level and driving product and technological improvements in the tricycle sector. For example, Gordon Murray Design and its consortium partners Delta Motorsport and itMoves unveiled 'MOTIV,' a unique and extremely versatile autonomous quadricycle vehicle.

The Asia-Pacific region is expected to hold a significant share in the market over the forecast period as the region already has major markets for tricycle/trikes. Over the last few years, major automakers have also been introducing electric tricycles across the region. Furthermore, Europe and North America are also likely to witness fast growth as several players are investing heavily in developing the latest products to gain market share.

Quadricycle and Tricycle Market Trends

Growing Adoption of Quadricycles Expected to Enhance Demand in the Market

The popularity of quadricycles and tricycles has risen in recent years due to increased acceptance from the public and governments, as well as an increase in the applications where they may be profitably utilized instead of regular vehicles. Quadricycles can be readily managed in urban traffic due to their small size, and they may help solve parking problems globally by taking up lesser space.

Several countries have approved quadricycles as a new vehicle category in recent years. For instance,

Quadricycles were certified as a new type of vehicle permitted to run on roads by the Indian government. A passenger quadricycle will have a maximum weight of 475 kg and be subjected to a required crash test before being released, which will define passenger safety criteria. The government has approved electric and hybrid quadricycles in addition to ones that operate on conventional gasoline.

New startups are revolutionizing the personal mobility space by introducing new technology-based small vehicles for intracity movement. For instance, Micro Mobility Systems launched the Microlino 2.0 electric microcar and Microletta electric trike. The Microlino 2.0 has a top speed of 90 km/h, and a 200 km reported range. It was to begin shipping in 2021.

In January 2021, Renault launched its Mobilize brand with Twizy-style EZ-1. The quadricycle is 2.3 meters long and made of 50% recycled materials, with full glass doors to boost visibility and the option to extend its life by swapping batteries. The company also claims that 95% of the EZ-1's parts can be recycled at the end of the vehicle's life.

Europe Expected to Witness Fastest Growth During the Forecast Period

As an emerging market, Europe has been widely adopting quadricycles known as 'sub-A' models, which occupy the space between heavy mini-cars and passenger cars. The term 'sub-A' refers to the A-category cars, which are the smallest passenger car segment. These developments are in line with the increasing acceptance from the public and governments and an increase in the various applications where quadricycles can be used profitably instead of traditional vehicles.

Due to their compact size, quadricycles can be easily maneuvered in urban traffic and address the problem of parking globally as they take up lesser space. Several major players are investing heavily in developing the latest products to gain a higher market share in the region. For instance,

In January 2021, SEAT, a subsidiary of Volkswagen, announced that the production of its preannounced electric quadricycle Minimo was expected to be in full operation from 2022.

In February 2020, Citroen introduced Ami, technically classed as a 'light quadricycle.' It also doesn't require a driving license to operate. Citroen will sell the car, but it also hopes to rent them out like electric scooters and other micro-mobility solutions. The cars will be available to rent on both a monthly and minute-by-minute basis. The quadricycle can be brought online and will be delivered directly to the customers' homes.

In December 2020, IAV in Germany developed an autonomous electric tricycle for 'last mile' deliveries, wherein the rider is followed by their cargo. The project's second phase is developing the steering and braking systems in-house to replace bought-in systems to significantly reduce the wheel's total weight and improve its handling.

The use of electric tricycles and quadricycles has risen post-pandemic as people seek to remain independent without relying on public transport or more expensive petrol-fuelled vehicles. During the forecast period, the region is likely to see high demand for these vehicles owing to their eco-friendly nature and the cheaper investments required.

Quadricycle and Tricycle Industry Overview

The quadricycle and tricycle market is moderately consolidated owing to the significant share occupied by global players and the active presence of regional players. Aixam-Mega, Casalini SRL, and Renault are some of the global players in the market. The market is witnessing positive developments as various governments accept the need for these small electric vehicles to support electrification. Manufacturers are launching new models to stay abreast of their competition.

In December 2021, Mahindra Electric announced plans to introduce at least four new vehicles over the next three years, including one in a new quadricycle category. The company is focusing on developing electric three-wheelers for passengers and freight with increased range and payload capacity, as well as an electric quadricycle.

In October 2021, Citroen launched its Ami Cargo electric quadricycle in Europe. The Citroen Ami is the commercial version of the mini Ami electric LCV weighing less than 425 kg. It is powered by a 5.5-kWh lithium-ion pack, which supplies energy to an electric motor of 8 BHP.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Power Source Type

- 5.1.1 Electric

- 5.1.2 Gasoline

- 5.1.3 Solar

- 5.2 By Application Type

- 5.2.1 Personal

- 5.2.2 Commercial

- 5.3 By Vehicle Type

- 5.3.1 Quadricycle

- 5.3.2 Tricycle

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 South Africa

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Automobiles CHATENET

- 6.2.2 Ligier Group

- 6.2.3 Aixam-Mega

- 6.2.4 Bajaj Auto Ltd

- 6.2.5 Estrima SRL

- 6.2.6 Bellier Automobiles

- 6.2.7 Worksman Cycles

- 6.2.8 Daimus

- 6.2.9 Light Foot Cycle

- 6.2.10 Electronio Wheels

- 6.2.11 Mahindra and Mahindra

- 6.2.12 Groupe Renault