|

市場調查報告書

商品編碼

1685736

汽車連接器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Automotive Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

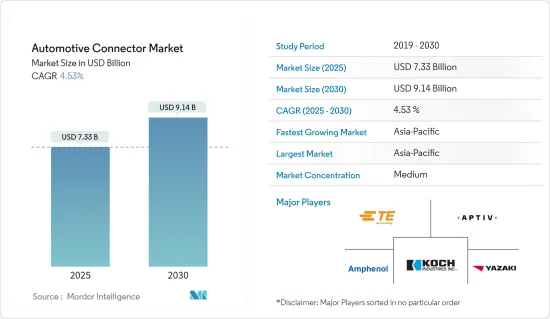

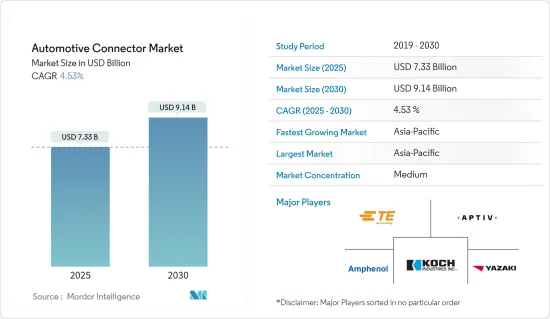

汽車連接器市場規模預計在 2025 年為 73.3 億美元,預計到 2030 年將達到 91.4 億美元,預測期內(2025-2030 年)的複合年成長率為 4.53%。

新冠肺炎疫情為市場帶來了負面影響,一些汽車和零件製造廠暫時關閉,導致汽車銷量略有下降。不過,隨著一些國家逐步解除封鎖,汽車需求也略有增加。因此,隨著需求的增加,主要企業也正在擴大生產設施以提高產量。

從長遠來看,預計市場將主要受技術進步和系統創新的推動。導航和資訊娛樂系統越來越受歡迎,並成為全球大多數汽車的標準配備。為了連接這些系統,需要一個用於電控系統的汽車連接器。

消費者對安全的擔憂日益增加,加上政府機構採取的安全相關舉措,推動了各種車輛系統對可靠連接器的需求。例如,汽車使用的安全帶、安全氣囊和煞車等安全系統需要由固定器和安全約束系統連接器組成的連接系統。因此,汽車安全系統需求的不斷成長直接影響汽車連接器的需求,從而推動市場成長。

預計預測期內亞太地區將佔據市場的大部分佔有率。強勁的汽車行業、電動和混合動力汽車的興起以及政府舉措預計將在預測期內支撐全部區域的需求。然而,由於市場對汽車連接器的需求不斷增加,主要企業也在該地區進行投資。

例如,2021年9月,李爾公司(Lear)宣布與台灣汽車連接器產品製造商胡連聯合股份有限公司簽署合資最終協議。此舉將立即擴展李爾公司的垂直整合能力,使其能夠為全球汽車製造商提供的現有和未來的車輛架構設計和製造一系列連接系統產品。

汽車連接器市場趨勢

資訊娛樂系統的進步

啟用車輛的先進安全功能和對電動車(EV)的需求不斷增加是推動市場成長的主要因素。此外,汽車感測器和資訊娛樂系統的日益複雜化正在推動全球對汽車線束和連接器的需求。塑膠光纖 (POF) 擴大取代汽車中的銅纜,以改善資料傳輸、提高設計靈活性並減輕車輛整體重量。 POF 需要汽車連接器才能正常運作。

除此之外,由於技術採用而導致的空調和 HVAC 系統的演變預計將對預測期內連接器的成長產生積極影響。市場的主要企業正在進行收購,以製造連接器並滿足汽車的功能。

例如,2021年2月,JAE電子開發了MX79A汽車資訊娛樂連接器,用於車載導航系統、ADAS(高級駕駛輔助系統)、倒車相機和車上娛樂系統。此外,2021年6月,座椅和電子電氣系統領域的全球汽車技術領導者李爾公司與總部位於德國洛芬根的科技公司IMS Connector Systems GmbH簽署了共同開發契約,後者專門從事汽車應用的高速乙太網路解決方案。

此外,記憶體和資料儲存連接器正在先進的汽車系統中用於支援自動駕駛汽車中的 Wi-Fi 網路。再加上混合動力汽車的日益普及,推動了市場的成長。此外,自我調整頭燈、巡航控制、停車輔助、出發警報系統以及自動駕駛汽車中機器學習的融入等產品創新預計將在未來幾年推動市場發展。

預計歐洲將在預測期內佔據更大的市場佔有率

歐洲在實施車輛安全功能方面處於領先地位,其次是美洲和亞太地區。該地區對汽車電氣化的需求不斷成長,以及政府旨在發展該國汽車工業的支持措施,預計將為預測期內汽車連接器的成長提供積極的前景。

此外,為了滿足日益成長的消費者需求,製造商,尤其是電動車產業的製造商,正專注於開發創新解決方案。隨著人們對車輛安全功能的認知不斷提高,連接器製造商預計將專注於開發滿足需求的功能。

例如,2021 年 9 月,TE Connectivity (TE) 收購了 ERNI Group AG (ERNI)。收購 ERNI 補充了 TE 廣泛的連接產品系列,特別是用於工廠自動化、汽車、醫療和其他工業應用的高速和細間距連接器。此外,2021 年 1 月,浩亭技術集團擴展了其 IX Industrial® 微型資料連接器產品線,增加了用於資訊娛樂系統、乘客資訊系統和其他產品型號的新型電纜組件。此解決方案非常適合火車和公車資訊娛樂和乘客資訊系統。這款連接器比鐵路應用中常用的同類圓形連接器小得多,而且輕得多。

由於汽車行業的進步,預計預測期內連接器在歐洲市場將顯著成長。

汽車連接器產業概況

汽車連接器市場是一個適度整合的市場,主要參與者如 TE Connectivity Ltd、Yazaki Corporation、JST Mfg、Amphenol Corporation、Aptiv PLC 和 Sumitomo Wiring Systems Ltd 佔據著相當大的市場佔有率。這些公司專注於在全球擴展其連接器業務,以抓住汽車先進電子和安全系統日益成長的趨勢。

例如,2021年4月,TactoTek和Amphenol ICC宣布將合作開發與TactoTek IMSE技術相容的汽車級套模連接器。 Amphenol ICC 將把 TactoTek 的 IMSE 等變革性技術與 Amphenol ICC 的汽車級 MicroSpace 連接器平台和 Duflex 壓接技術相結合,為客戶提供新技術產品。

此外,京瓷於2021年3月推出了車內0.4mm間距8152系列電子連接器。符合高速傳輸標準MIPI D-PHY(2.5Gbps)、PCI Express Gen2(5Gbps)、Gen3(8Gbps)。該框架採用屏蔽設計,堅固耐用,可降低 EMI,適合要求嚴格的汽車應用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 應用

- 動力傳動系統

- 舒適、便利、娛樂

- 安全與保障

- 車身線路和電力分配

- 導航和儀表

- 車輛類型

- 搭乘用車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 世界其他地區

- 巴西

- 阿根廷

- 南非

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- TE Connectivity Ltd

- Yazaki Corporation

- JST Mfg Co. Ltd

- Molex Incorporated(Koch Industries Inc.)

- Amphenol Corporation

- Luxshare Precision Industry Co. Ltd

- Aptiv PLC

- Hirose Electric Co. Ltd

- Samtec

- Lumberg Holding

- Sumitomo Wiring Systems Ltd

第7章 市場機會與未來趨勢

The Automotive Connector Market size is estimated at USD 7.33 billion in 2025, and is expected to reach USD 9.14 billion by 2030, at a CAGR of 4.53% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market, as there was a slight decline in vehicle sales due to several vehicles and component manufacturing facilities shutting down temporarily. However, with the gradual removal of lockdowns in several countries, the demand for vehicles has slightly increased. Therefore with the increase in demand, key players are also increasing their manufacturing facilities to increase production.

Over the long term, the market is expected to be primarily driven by technological advancements and innovations in systems. Rising adoption of navigation and infotainment systems, among others, have become standard features in most cars across the world. To connect these systems, central electronic control unit automotive connectors are required.

The increase in safety concerns among consumers, coupled with safety-related initiatives from government agencies, has elevated the requirement for a reliable connector in various vehicle systems. For instance, safety systems like seatbelts, airbags, and brakes used in vehicles require a connection system comprising a retainer and safety restraint system connector. Thus, the increasing demand for automotive safety systems has a direct influence on the demand for automotive connectors, in turn driving the growth of the market.

Asia-Pacific is expected to hold a dominant share of the market during the forecast period. The strong automotive industry and rising electric and hybrid vehicles, coupled with government initiatives, are anticipated to support demand across the region during the forecast period. However, key players are also investing in the region due to the increase in the demand for automotive connectors in the market.

For instance, in September 2021, Lear Corporation (Lear) announced the signing of a definitive agreement for a joint venture with Hu Lane Associate Inc., a Taiwanese manufacturer of automotive connector products. It will immediately broaden Lear's vertical integration capabilities by engineering and manufacturing a portfolio of connection systems products for current and future vehicle architectures offered by global automakers.

Automotive Connector Market Trends

Increasing Advancement in Infotainment ystem

The increasing incorporation of advanced security features in automobiles, as well as the rising demand for electric vehicles (EVs), is the primary factor driving the market growth. Furthermore, the increasing sophistication of automotive sensors and infotainment systems has increased the global demand for automotive wiring harnesses and connectors. Plastic optical fiber (POF) is replacing copper cables in automobiles to improve data transmission and design flexibility while also reducing overall vehicle weight. POF requires automotive connectors to function properly.

In addition to this, the evolution of air conditioning systems and HVAC systems, owing to technological proliferation, is expected to favorably impact connectors' growth during the forecast period. Major players in the market are manufacturing the connectors and entering acquisitions to meet the features in the vehicles.

For instance, in February 2021, JAE Electronics developed MX79A Automotive Infotainment Connectors for use in automotive navigation systems, advanced driver assistance systems, backup cameras, and in-vehicle entertainment. Additionally, in June 2021, Lear Corporation, a global automotive technology leader in seating and e-systems, signed a joint development agreement with IMS Connector Systems GmbH, a technology company based in Loffingen, Germany, specializing in high-speed Ethernet solutions for automotive applications.

Furthermore, memory and data storage connectors are used in advanced automotive systems to support Wi-Fi networks in automated vehicles. This, combined with the increasing adoption of hybrid vehicles, is fueling market growth. Furthermore, product innovations such as adaptive front lighting, cruise control, park assistance, and departure warning systems, as well as the incorporation of machine learning in self-driving vehicles, are expected to propel the market in the coming years.

Europe is Expected to Capture a Larger Market Share During the Forecast Period

Europe leads the way in implementing vehicle safety features, with the Americas and Asia-Pacific following in its footsteps. Growing demand for vehicle electrification in the region, as well as supportive government measures aimed at the development of the country's automotive industry, are expected to create a positive outlook for the growth of automotive connectors during the forecast period.

Furthermore, active developments to meet growing consumer demand, particularly from manufacturers in the electric vehicle industry, are focusing on developing innovative solutions. With increased awareness of vehicle safety and security features, connector manufacturers are anticipated to focus on developing features to meet the demand.

For instance, in September 2021, TE Connectivity (TE) acquired ERNI Group AG (ERNI). The acquisition of ERNI complements TE's broad connectivity product portfolio, particularly in high-speed and fine-pitch connectors for factory automation, automotive, medical, and other industrial applications. Additionally, in January 2021, HARTING Technology Group expanded its IX Industrial(R) line of miniature data connector products with new cable assemblies intended for infotainment and passenger information systems and other product variants. This solution is ideal for infotainment and passenger information systems in trains and buses. The connector is significantly smaller and lighter than the comparable circular connectors commonly used in railway applications.

As a result of the advancement of the automotive industry, connectors are expected to grow significantly in the European market during the forecast period.

Automotive Connector Industry Overview

The automotive connector market is a moderately consolidated market due to the major players, like TE Connectivity Ltd, Yazaki Corporation, J.S.T. Mfg Co. Ltd, Amphenol Corporation, Aptiv PLC, and Sumitomo Wiring Systems Ltd, capturing significant shares in the market. These companies are focusing on expanding their connector business globally to capture the growing trend of advanced electronics and safety systems in vehicles.

For instance, in April 2021, TactoTek and Amphenol ICC announced that they were collaborating to develop automotive-grade in-mold connectors for TactoTek IMSE technology. Amphenol ICC will bring new technology products to customers with transformational technologies like TactoTek's IMSE combined with Amphenol ICC's automotive-grade MicroSpace connector platform and Duflex crimp technology.

Additionally, in March 2021, KYOCERA launched 0.4mm-Pitch 8152 series electronic connectors for automotive applications. It conforms to high-speed transmission standard MIPI D-PHY (2.5 Gbps), PCI Express Gen2 (5Gbps), and Gen3 (8Gbps). The frame is shielded for a robust design and EMI reduction suitable for demanding automotive applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Million)

- 5.1 Application

- 5.1.1 Powertrain

- 5.1.2 Comfort, Convenience, and Entertainment

- 5.1.3 Safety and Security

- 5.1.4 Body Wiring and Power Distribution

- 5.1.5 Navigation and Instrumentation

- 5.2 Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 South Africa

- 5.3.4.4 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 TE Connectivity Ltd

- 6.2.2 Yazaki Corporation

- 6.2.3 J.S.T. Mfg Co. Ltd

- 6.2.4 Molex Incorporated (Koch Industries Inc. )

- 6.2.5 Amphenol Corporation

- 6.2.6 Luxshare Precision Industry Co. Ltd

- 6.2.7 Aptiv PLC

- 6.2.8 Hirose Electric Co. Ltd

- 6.2.9 Samtec

- 6.2.10 Lumberg Holding

- 6.2.11 Sumitomo Wiring Systems Ltd