|

市場調查報告書

商品編碼

1685877

下一代先進電池-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Next Generation Advanced Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

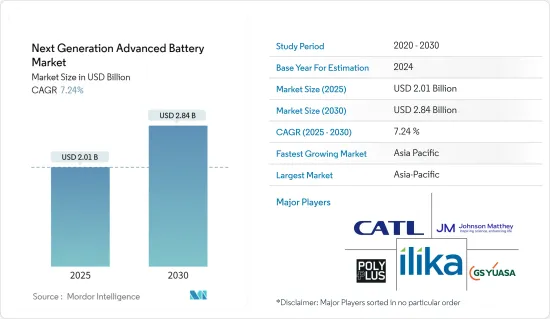

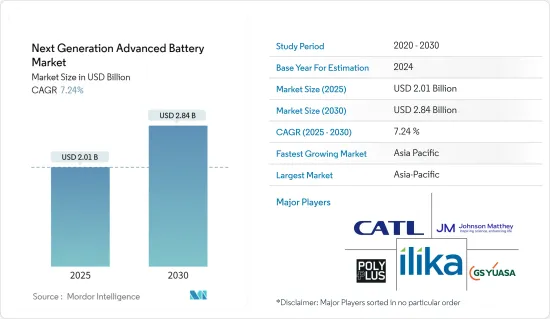

下一代先進電池市場規模預計在 2025 年為 20.1 億美元,預計到 2030 年將達到 28.4 億美元,預測期內(2025-2030 年)的複合年成長率為 7.24%。

2020 年,市場受到了新冠疫情的負面影響。目前市場已恢復至疫情前的水準。

主要亮點

- 從長遠來看,電動車需求的成長和普及預計將推動市場成長。

- 然而,預計高昂的製造和研發成本將在預測期內阻礙下一代先進電池的成長。

- 然而,預計下一代先進電池製造設施的發展將在預測期內為下一代先進電池市場提供有利的成長機會。

- 亞太地區佔據市場主導地位,並可能在預測期內實現最高的複合年成長率。這一成長歸因於印度、中國和日本等地區國家投資的增加以及家用電器和電動汽車的普及。

下一代先進電池市場的趨勢

預計運輸領域將主導市場

- 交通運輸系統的電氣化越來越受歡迎,各種政府指令加速了電動車的普及,這直接推動了交通運輸領域下一代先進電池的成長。

- 2021年,各大汽車製造商表示,通用汽車將在2035年前停止銷售汽油和柴油汽車,而奧迪股份公司則計劃在2033年前停止生產這類汽車。汽車製造商正在爭取將其電動車電氣化,並正在投資先進的電池,以使電動車更有效率、更盈利。

- 本田於2022年4月宣布,將在未來十年投資398.4億美元用於電氣化和軟體技術,以加速其全球業務的發展。該公司還將在北美建造一條固態電池示範生產線,投資約3.4265億美元。該投資公司計劃與通用汽車合作,到 2024 年推出兩款中大型電動車 (EV)。

- 根據國際能源總署(IEA)預測,全球電動車保有量將從2015年的125萬輛增加到2020年的1,020萬輛左右。 2020年,純電動車將佔電動車的大多數,約685萬輛,而插電式混合動力車將佔電動車的大多數,約335萬輛。

- 此外,與傳統的鋰離子電池相比,鋁空氣電池的優點在於,它以鋁為燃料,空氣透過電解與金屬反應,產生電能。續航里程與汽油車相當,能量密度高於鋰離子電池。然而,政府的政策支持和汽車製造商的興趣不足以將其廣泛用於電動車的蓄電池。

- 2021年12月,德國汽車製造商梅賽德斯-賓士宣布將投資1億美元用於一系列電動車。該公司還打算在未來五年內將固態電池技術整合到有限數量的汽車中。賓士計劃向開發固態電池的電池公司 Factoral Energy 投資數千萬美元。

- 2022 年 4 月,日產汽車公司開始建造層壓固態電池原型生產設施,並計劃在 2028 年前將其推向市場。這是日產「2030 雄心」策略的一部分,該策略將使該公司投資 170 億美元用於四款新型電動車概念。

- 總體而言,汽車製造商正在大力投資固態電池和金屬空氣電池的開發,使汽車成為下一代先進電池市場的關鍵領域之一。

亞太地區佔市場主導地位

- 截至2021年,中國、印度和日本是亞太地區下一代先進電池技術的潛在市場。

- 截至2022年3月,中國電池能源儲存裝置容量達到3GW,較2019年的1.7GW成長76.5%。此外,中國政府預計到2030年將電池儲存容量提高到100GW。這一情況為該地區各類下一代先進電池開發商創造了巨大的機會。

- 根據中國儲能產業技術聯盟(CNESA)介紹,受電網配套服務(能源儲存的主要用途)相關政策的完善以及青海、廣東、江蘇、內蒙古、新疆等地區的政策發展推動,中國正迎來一波能源儲存建設發展熱潮。在預測期內,此類政府政策可能會刺激對先進電池技術的需求。

- 目前,中國正在進行下一代先進電池技術的各項開發計劃與投資。 2021年7月,寧德時代推出首款新一代鈉離子電池及其AB電池組解決方案。寧德時代將電動車市場轉向鈉離子電池的舉措也得到了中央政府的推動,工業和資訊化部宣布將制定此類電池的標準。

- 除了中國方案外,2022年1月,日本國家材料科學研究所(NIMS)和Softbank Corporation公司開發了一種鋰空氣電池,其能量密度超過500Wh/kg,大大高於目前的鋰離子電池。研究團隊證實,該電池可以在室溫下充電和放電。研究團隊研發的電池展現出最高的能量密度和循環壽命性能。這項成果標誌著鋰空氣電池向實用化邁出了重要一步。

- 鋰空氣電池具有成為終極二次電池的潛力,其重量輕、容量大,理論能量密度是現有鋰離子電池的數倍。這些潛在優勢可用於各種技術,包括無人機、電動車和家庭儲能系統。

- 此外,「印度製造」是印度的一項高度優先的舉措,並且已經為生產電動車提供了獎勵。汽車電池和電網儲存是印度製造業的重點。二輪車、三輪車、汽車和小型巴士的電動車市場對價格的敏感度高於對性能的敏感度。即使下一代先進電池比性能參數略高的類似鋰離子電池具有價格優勢,但它們在印度的市場機會可能比在其他地方更好。規模經濟生產的先進電池在印度具有巨大的市場潛力。

- 2022 年 3 月,印度核准了四家公司根據 PLI 計劃製造先進化學電池 (ACC) 蓄電池的激勵措施的競標。這四家公司——Reliance New Energy Solar Limited、Ola Electric Mobility Private Limited、現代環球汽車有限公司和 Rajesh Exports Limited——獲得了 1,810 億印度盧比計劃的獎勵,以促進印度國內電池的生產。根據該計劃,選定的ACC電池製造商預計將在兩年內建立生產設施。預計這種政府支持的優惠待遇將有助於創造有利於下一代先進電池市場未來發展的環境。

- 因此,預計上述因素將在預測期內推動亞太地區下一代先進電池市場的發展。

下一代先進電池產業概況

從本質上來說,下一代先進電池市場處於適度整合狀態。市場的主要企業(不分先後順序)包括 Sion Power Corporation、Contemporary Amperex Technology、PolyPlus Battery Co. Ltd.、GS Yuasa Corporation 和 Saft Groupe SA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2027 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 技術領域

- 固體電解質電池

- 鎂離子電池

- 新一代液流電池

- 金屬空氣電池

- 鋰硫電池

- 其他技術

- 最終用戶

- 家電

- 運輸

- 工業的

- 能源儲存

- 其他最終用戶

- 地區

- 北美洲

- 亞太地區

- 歐洲

- 南美洲

- 中東和非洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Pathion Holding Inc.

- GS Yuasa Corporation

- Johnson Matthey PLC

- PolyPlus Battery Co. Inc.

- Ilika PLC

- Sion Power Corporation

- LG Chem Ltd

- Saft Groupe SA

- Contemporary Amperex Technology Co. Ltd

第7章 市場機會與未來趨勢

The Next Generation Advanced Battery Market size is estimated at USD 2.01 billion in 2025, and is expected to reach USD 2.84 billion by 2030, at a CAGR of 7.24% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the growing demand and increasing adoption of electric vehicles are expected to drive the growth of the market studied.

- On the other hand, high manufacturing and R&D costs are expected to hamper the growth of Next-Generation advanced batteries during the forecast period.

- Nevertheless, the development of manufacturing facilities for next-generation advanced batteries is likely to create lucrative growth opportunities for the Next-Generation advanced battery market in the forecast period.

- Asia-Pacific region dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with adoption of consumer electronics and electric vechiles in the countries of this region including India, China and Japan.

Next Generation Advanced Battery Market Trends

Transportation Segment Expected to Dominate the Market

- The electrification of the transportation system is gaining popularity, and various government mandates have accelerated the adoption of electric vehicles, which directly aids the growth of next-generation advanced batteries in the transportation sector.

- In 2021, automobile giants announced that General Motors will stop selling petrol and diesel models by 2035, and Audi AG plans to stop producing such vehicles by 2033. The carmakers are rushing to electrify their electric cars, which has led the company to invest in advanced batteries for more efficient and profitable electric vehicles.

- In April 2022, Honda Motors announced that it would invest USD 39.84 billion in electrification and software technologies to accelerate its business globally for the next ten years. It will also build a demonstration production line for all-solid-state batteries in North America, allocating approximately USD 342.65 million. The investment company plans to launch two mid-to-large-scale electric vehicles (EV) models by 2024 with a partnership with General Motors.

- According to the International Energy Agency (IEA), the global electric vehicle stock increased from 1.25 million in 2015 to about 10.2 million in 2020. In 2020, battery-electric vehicles accounted for most of the electric vehicles at about 6.85 million, and plug-in hybrid electric vehicles were about 3.35 million.

- Furthermore, aluminium-air batteries have an advantage over the conventional lithium-ion battery as the aluminium acts as a fuel where air reacts with the metal via an electrolyte to produce power. It has a travel range similar to gasoline-powered cars and a higher energy density than the lithium-ion battery. However, it lacks government policy support and attention from automakers to make it a popular battery energy storage system for electric vehicles.

- In December 2021, Mercedes Benz, a German car manufacturer, announced to invest of USD 100 million in a wide range of electric cars. The company also intends to integrate solid-state battery technology into a limited number of vehicles within the next five years. Mercedes Benz plans to invest tens of millions into Factorial Energy, a battery company to develop solid-state batteries.

- In April 2022, Nissan Motor Company planned to bring laminated solid-state batteries to the market by 2028, with the beginning of a prototype production facility. It is a part of Nissan's Ambition 2030 strategy, plus an investment of USD 17 billion for the four new electric vehicle concepts.

- Overall, automobile manufacturers are investing heavily in developing solid-state batteries and metal-air batteries, making automobiles one of the major sectors of the next-generation advanced battery market.

Asia-Pacific to Dominate the Market

- As of 2021, China, India, and Japan were the potential markets for the next generation advanced battery technology in the Asia-Pacific region.

- As of March 2022, China's battery energy storage capacity reached 3 GW, representing an increase of 76.5% compared to 1.7 GW in 2019. Furthermore, the Chinese Government is expected to increase its battery storage capacity to 100 GW by 2030. Such scenarios are creating vast opportunities for various next-generation advanced battery developers in the region.

- According to the China Energy Storage Alliance (CNESA), the refinement of policy related to grid ancillary services - energy storage's primary application - as well as policy developments in regions including Qinghai, Guangdong, Jiangsu, inner Mongolia, and Xinjiang, have created a wave of energy storage construction and development in China. Such government policies will likely boost the demand for advanced battery technologies during the forecast period.

- At present, various development projects and investments in the next generation advanced battery technologies are happening in China. In July 2021, CATL unveiled the first next-generation sodium-ion battery and its AB battery pack solutions. Also, CATL's quest to shift the electric vehicle market toward a sodium-ion cell received a boost from the central government after the Ministry of Industry and Information Technology announced the creation of standards for such battery types.

- In addition to the scenario in China, in January 2022, Japan's National Institute for Material Science (NIMS) and the Softbank Corp. developed a lithium-air battery with an energy density of over 500Wh/kg-significantly higher than currently lithium-ion batteries. The research team confirmed that this battery could be charged and discharged at room temperature. The battery developed by the team shows the highest energy densities and best cycle life performances. These results signify a major step toward the practical use of lithium-air batteries.

- The lithium-air batteries are expected to have the potential to be the ultimate rechargeable batteries: they are lightweight and high capacity, with theoretical energy densities several times that of currently available lithium-ion batteries. Because of these potential advantages, they may use various technologies, such as drones, electric vehicles, and household electricity storage systems.

- Further, "Make in India" is a high-priority movement for India and has already provided incentives to produce electric cars. Batteries for cars and grid storage are high on the agenda for manufacturing in India. The EV market for two-wheelers, three-wheelers, cars, and minibusses is more price-sensitive than performance sensitive. If the next generation advanced batteries have a price advantage over a comparable lithium-ion battery whose performance parameters are marginally higher, it would still find a better market opportunity in India than elsewhere. The advanced batteries made with economies of scale have huge market potential in India.

- In March 2022, India approved bids for four companies to avail incentives under the PLI Scheme for the Advanced Chemistry Cell (ACC) Battery Storage Manufacturing. Reliance New Energy Solar Limited, Ola Electric Mobility Private Limited, Hyundai Global Motors Company Limited, and Rajesh Exports Limited received incentives under India's INR 181 billion program to boost local battery cell production. Under the scheme, selected ACC battery storage manufacturers were expected to set up a production facility within two years. Such government-supportive incentives are expected to create an environment for the future development of the next generation advanced battery market.

- Therefore, the above-mentioned factors are expected to drive the next-generation advanced battery market in the Asia-Pacific region during the forecast period.

Next Generation Advanced Battery Industry Overview

The next-generation advanced battery market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include Sion Power Corporation, Contemporary Amperex Technology Co. Ltd, PolyPlus Battery Co. Inc., GS Yuasa Corporation, and Saft Groupe SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solid Electrolyte Battery

- 5.1.2 Magnesium Ion Battery

- 5.1.3 Next-generation Flow Battery

- 5.1.4 Metal-Air Battery

- 5.1.5 Lithium-Sulfur Battery

- 5.1.6 Other Technologies

- 5.2 End User

- 5.2.1 Consumer Electronics

- 5.2.2 Transportation

- 5.2.3 Industrial

- 5.2.4 Energy Storage

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Pathion Holding Inc.

- 6.3.2 GS Yuasa Corporation

- 6.3.3 Johnson Matthey PLC

- 6.3.4 PolyPlus Battery Co. Inc.

- 6.3.5 Ilika PLC

- 6.3.6 Sion Power Corporation

- 6.3.7 LG Chem Ltd

- 6.3.8 Saft Groupe SA

- 6.3.9 Contemporary Amperex Technology Co. Ltd