|

市場調查報告書

商品編碼

1640574

計劃管理軟體 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Project Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

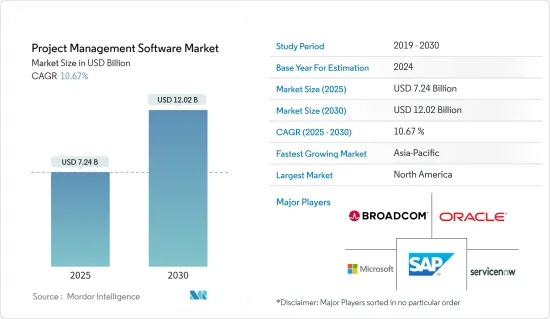

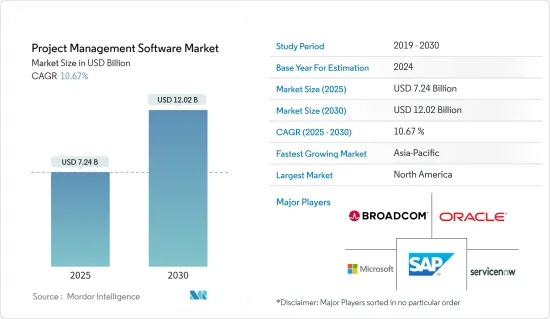

計劃管理軟體市場規模預計在 2025 年為 72.4 億美元,預計到 2030 年將達到 120.2 億美元,預測期內(2025-2030 年)的複合年成長率為 10.67%。

隨著當今企業規模和複雜性的成長,他們需要全面的解決方案來管理和協調整個組織的計劃合。這些解決方案可協助經營團隊調整計劃、工作量、預算和資源,密切注意計劃進展並報告成功交貨的情況。

關鍵亮點

- 由於幾乎每個產業的發展速度不斷加快、技術進步、數位轉型和顛覆,計劃管理軟體 (PMS) 已發展成為當今企業的策略職能。

- 預計推動計劃管理軟體 (PMS) 系統市場成長的因素包括提高軟體利用率來管理資源、最大限度地降低計劃風險和計劃成本、預算和改組規劃以及隨時隨地的即時性。這有助於存取儀表板。然而,預計在預測期內,提醒和截止日期等日益複雜的功能也將進一步推動市場成長。

- 軟體系統日益複雜化、最終用戶意識不斷增強以及連接和整合多個不同系統的能力等因素預計會推動需求,但高實施成本和構建這些系統的高成本預計也會推動需求。用戶公司投資計劃管理軟體系統,從而導致市場滲透緩慢。

- 隨著物聯網的出現和敏捷新產品開發方法的採用,計劃管理也逐漸成為新產品開發的一種手段,目前正與專案管理系統(PMS) 相結合,成為企業產品創建領域的熱門話題,UMT360、 GenSight 等公司都參與其中以及決策鏡頭。

- 在 COVID-19 疫情期間,計劃管理軟體提供了進口和貨運管理分析、靈活性鏈、地方政府策略以及未來對業務的影響的 360 度視圖。因此,預計對此類數位解決方案的依賴將大幅增加,即使在後疫情時代也不會消退。

- 這些軟體系統還幫助計劃經理評估疫情對其團隊造成的重大影響,並制定計劃以減輕負面影響,甚至透過遠端進行恢復。企業希望利用數位管道提供更好的規劃和調度、團隊協作、計劃預算等,最終補充和加強客戶關係。

計劃管理軟體 (PMS) 市場趨勢

石油和天然氣產業將經歷高成長

- 數位轉型和緊張的預算是由全球經濟狀況以及在快速變化時期為石油和天然氣行業提供成長平台的需求所驅動。對於石油天然氣和化學公司來說,即使是很小的延誤也可能造成數十萬美元的損失。

- 公司不斷利用計劃管理軟體的優勢來提高業務生產力、簡化溝通、改善計劃品質並降低整體計劃成本。

- 計劃的數量、規模和範圍不斷成長,需要可擴展性。依賴手動流程和分散的電子表格會使計劃面臨風險,並且需要時間來防止錯誤。準確的預測和有用的進度報告至關重要。準確的預測和有用的進度報告對於您的業務運作至關重要。

- 石油和燃氣公司正在使用計劃管理軟體來獲取即時、準確的計劃資料,使他們能夠花更多時間分析資料而不是輸入資料。工業公司正致力於調整資本支出決策並利用數位技術來實現更高的資本生產力。例如,2022 年 9 月,美國最大的私人合約天然氣壓縮機公司 Kodiak Gas Services LLC(Kodiak)選擇了 IFS Cloud(TM) 來支援其跨職能業務營運。這使得 Kodiak 能夠將三個主要記錄系統與多個功能領域和業務流程(包括銷售、供應鏈、採購、人力資本管理 (HCM) 和財務)整合到一個系統中。此外,IFS 白金合作夥伴 Astra Canyon 已實施該解決方案並將其部署到 Kodiak 的整個美國業務(16 個地點,1,157 名用戶)。

北美佔有最大市場佔有率

- 由於採用計劃管理軟體解決方案的企業數量不斷增加,北美預計將主導計劃管理軟體市場。企業對於高效追蹤和管理計劃的需求不斷成長,預計將刺激該地區採用 PMS。

- 預計在預測期內,採用 PMS 解決方案進行任務管理和靈活的工作規劃以成功執行任務將推動市場發展。此外,組織越來越注重改善員工之間的協作和提高團隊效率,這也推動了市場成長。

- 2022 年 1 月,TD SYNNEX Corporation 宣布與亞馬遜網路服務公司 (AWS) 達成新的策略合作協議 (SCA),涵蓋北美、拉丁美洲和加勒比地區。此次合作大大擴展了獨立軟體供應商(ISV)和雲端技術所提供的雲端解決方案,使合作夥伴能夠透過通路擴展提案以覆蓋更大的市場。

計劃管理軟體 (PMS) 產業概覽

計劃管理軟體市場競爭激烈。市場參與企業,大小不一,集中度適中。主要企業採取的關鍵策略是併購和產品創新,以在競爭中生存並擴大全球業務。

2022 年 7 月,Arcadis 與 IBI Group 達成協議,Arcadis 以每股 19.50 美元的全現金報價收購 IBI Group 全部已發行股。此次收購增強了我們在全球和本地提供最具創新性和影響力的計劃管理軟體的能力,所有這些都面向新的和創新的技術支援的解決方案。

2022 年 2 月,領先的建築管理軟體供應商 RedTeam Software LLC 宣布收購雲端基礎的建築管理解決方案 paskr Inc.。此次收購增強了該公司為各種規模的商業建築營業單位構建的整合軟體解決方案套件。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 最終用戶變得越來越成熟和有意識

- 能夠連接和整合多個不同的系統

- 市場限制

- 初期投資高

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場區隔

- 按部署

- 雲

- 本地

- 按最終用戶產業

- 石油和天然氣

- 資訊科技/通訊

- 醫療

- 政府

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- Broadcom Inc.(CA Technologies)

- Basecamp LLC

- AEC Software

- Workfront Inc.

- ServiceNow Inc.

- Unit4 NV

- Atlassian Corporation PLC

第7章投資分析

第8章 市場機會與未來趨勢

The Project Management Software Market size is estimated at USD 7.24 billion in 2025, and is expected to reach USD 12.02 billion by 2030, at a CAGR of 10.67% during the forecast period (2025-2030).

As today's corporations increase in size and complexity, an all-inclusive solution is needed to manage and coordinate an entire organization's portfolio of different projects. These solutions help the management to shuffle between plans, workload, budgets, and resources, carefully observe the project progress and report on delivery success.

Key Highlights

- Project management software (PMS) has evolved into a strategic function of today's business due to the accelerating pace, technological advancements, digital transformations, and disruptions happening across almost every industry.

- Some of the factors that are expected to enhance the growth of the project management software (PMS) systems market include the increasing use of software to manage resources, the rising demand for software that minimizes project risks and project costs, budget and shuffle plans, and help in accessing real-time dashboard anywhere and anytime. On the other hand, increasing sophistication and rising capabilities, such as reminders and setting due dates, are also anticipated to provide further impetus to the market's growth during the forecast period.

- While the factors such as increased sophistication of software systems, growing awareness among end users, and ability to connect and integrate multiple disparate systems are anticipated to drive the demand, the high installation costs of setting up these systems, coupled with high maintenance costs, are dissuading the enterprises in the end user from investing in project management software systems, thus leading to slow market penetration.

- Project management has also evolved into a means of new product development, owing to the emergence of the Internet of Things and the adoption of agile NPD, which has now merged with PMS and has led to the development of new firms like UMT360, GenSight, and Decision Lens in the field of enterprise product creation.

- During the COVID-19 pandemic, project management software provided a 360-degree view of import and fare control analysis, flexibility chain, provincial government strategy, and future impact on the business, among others. Hence, the reliance on such digital solutions has greatly increased and is anticipated to witness no retreat even in the post-pandemic era.

- These software systems also helped project managers evaluate the critical ways the pandemic affected their teams to mitigate the adverse effects and plans to recover, even remotely. Enterprises intend to harness digital channels that can provide proper planning and scheduling, team collaboration, and project budgeting, among others, ultimately leading to supplementing and further strengthening their relationships with their customers.

Project Management Software (PMS) Market Trends

Oil and Gas Segment to Witness High Growth

- Digital transformation and tight budgets are due to global economic conditions and the need to provide a growth platform that can cause an intense change in the oil and gas industry. The smallest delays can cost millions of dollars to an oil and gas or chemical company.

- Enterprises are continuously leveraging the benefits of project management software to increase business productivity, streamline communication, improve project quality, and minimize overall project costs.

- Projects are increasing in volume, size, and scope and need to be scalable. Relying on manual processes and decentralized spreadsheets exposes projects to risks and time to prevent errors. The need for accurate forecasts and useful progress reports is essential. Accurate forecasts and useful progress reports are crucial for business operations.

- Oil and gas organizations are utilizing project management software for real-time accurate project data to focus more time on data analysis over data entry. Industry players focus on adopting capital investment decisions and leveraging digital technologies to achieve higher capital productivity. For instance, in September 2022, Kodiak Gas Services LLC (Kodiak), the largest privately-owned contract compression company in the United States, selected IFS Cloud(TM) to enhance its cross-functional business operations, This allows Kodiak to consolidate its three main systems of record into one system with multiple functional areas and business processes, including sales, supply chain, procurement, human capital management (HCM), and finance. Furthermore, IFS Platinum Partner, Astra Canyon, implements the solution and rolls it out across Kodiak's entire US operations, encompassing 16 sites and 1,157 users.

North America Occupies the Largest Market Share

- The North American region is expected to dominate the project management software market due to the increasing number of enterprises adopting project management software solutions. The increasing demand among organizations to efficiently track and manage their projects is expected to act as a stimulator for adopting PMS in the region.

- The deployment of PMS solutions for task management for successfully executing tasks and flexible work planning is anticipated to drive the market during the forecast period. Additionally, organizations' increased focus on promoting collaborations among the workforce and boosting the team's efficiency drives the market growth.

- In January 2022, TD SYNNEX Corporation announced a new strategic collaboration agreement (SCA) with Amazon Web Services Inc. (AWS) that covers North America, Latin America, and the Caribbean regions. This partnership significantly expands cloud solutions for independent software vendors (ISV) and in cloud technology, enabling partners to expand their offerings to reach larger markets throughout the channel.

Project Management Software (PMS) Industry Overview

The project management software market is very competitive. The market is mildly concentrated because of many small and large players. The key strategies adopted by the major players are mergers and acquisitions and product innovations to stay ahead of the competition and to expand their global reach.

In July 2022, Arcadis and IBI Group agreed to a recommended all-cash offer of USD 19.50 per share for Arcadis to acquire all issued and outstanding shares of IBI Group. This acquisition amplifies the ability to deliver the most innovative and impactful project management software globally and locally, all aimed at new and innovative technology-enabled solutions.

In February 2022, RedTeam Software LLC, a leading construction management software provider, announced the acquisition of paskr Inc., a cloud-based construction management solution. This acquisition robusts a suite of integrated software solutions purpose-built for commercial construction entities of all sizes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Sophistication and Growing Awareness Among End Users

- 4.2.2 Ability to Connect and Integrate Multiple Disparate Systems

- 4.3 Market Restraints

- 4.3.1 High Initial Investment

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By End-user Vertical

- 5.2.1 Oil and Gas

- 5.2.2 IT and Telecom

- 5.2.3 Healthcare

- 5.2.4 Government

- 5.2.5 Other End-user Verticals

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Oracle Corporation

- 6.1.2 Microsoft Corporation

- 6.1.3 SAP SE

- 6.1.4 Broadcom Inc. (CA Technologies)

- 6.1.5 Basecamp LLC

- 6.1.6 AEC Software

- 6.1.7 Workfront Inc.

- 6.1.8 ServiceNow Inc.

- 6.1.9 Unit4 NV

- 6.1.10 Atlassian Corporation PLC