|

市場調查報告書

商品編碼

1685743

3D 地圖和 3D 建模:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)3D Mapping And 3D Modelling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

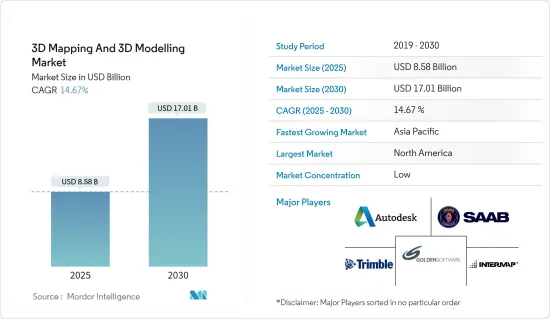

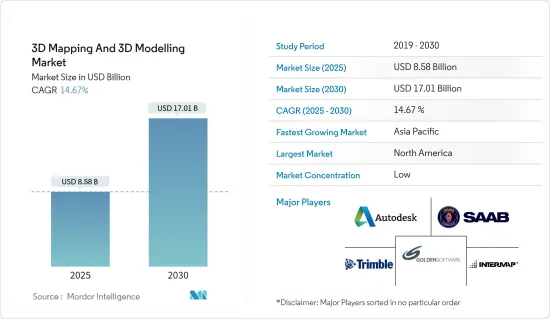

3D 地圖和 3D 建模市場規模預計在 2025 年為 85.8 億美元,預計到 2030 年將達到 170.1 億美元,預測期內(2025-2030 年)的複合年成長率為 14.67%。

主要亮點

- 3D 內容的日益普及正在推動 3D 地圖和 3D 建模產業的發展。 3D 內容是可以以三個維度測量的物理項目的開發:長度、高度和寬度。隨著對 3D 內容的需求不斷成長,對 3D 映射和建模的需求也不斷成長。 3D 映射和建模涉及使用專門的軟體來創建物品的3D表示。此外,在這個競爭激烈的市場中,3D 映射和建模的創新是創建 3D 環境的最簡單方法。 3D 地圖解決方案可讓您快速產生周圍環境的高品質 3D 地圖,並將其納入專業的視覺化過程中。

- 3D 映射和 3D 建模經常用於遊戲和視訊娛樂產業,以創建動作序列,讓觀眾感覺自己身處真實地點。近年來,由於手機遊戲和其他應用程式對 3D 動畫的需求不斷增加,以及視訊娛樂產業希望提供更好的觀看體驗,3D 映射和 3D 建模市場顯著成長。SONY、Xbox、微軟和騰訊等遊戲公司已經在使用 3D 技術開發 3D 遊戲,透過建立可以模仿使用者動作並提供更逼真體驗的虛擬世界。

- 預計 VR 技術的此類發展(尤其是在遊戲產業)將在整個預測期內對全球新一代 3D 顯示器市場產生重大影響。據遊戲開發者大會報道,遊戲世界正在迅速發展。 2023年的一項調查發現,全球36%的參與遊戲開發公司正積極為Meta Quest虛擬實境設備開發遊戲,這將為3D建模和製圖產業創造市場機會。

- 然而,資料盜版和與使用該技術相關的高成本是預測期內可能影響市場成長的一些因素。 3D 地圖和 3D 建模軟體的實施成本以及開發地圖和模型所需的高成本使得 3D 地圖和 3D 建模難以在許多最終用戶應用程式中廣泛採用,這可能會對預測期內的市場成長構成潛在挑戰。

3D 地圖和 3D 建模市場趨勢

娛樂和媒體產業對市場成長貢獻巨大

Epic Games、Ubisoft 和 Blizzard Entertainment 等遊戲製作公司都使用 3D 建模來創建和製作角色、環境和物件的動畫。例如,暴雪娛樂的遊戲《鬥陣特攻》使用 3D 建模來創建角色,每個角色都有獨特的能力和個性。

3D 建模技術在虛擬實境體驗中的應用創造了更身臨其境的環境。藝術家可以使用 3D 建模來創建虛擬世界、角色和物體,使用者可以在 VR 體驗中與之互動。例如,VR 遊戲《Beat Saber》使用 3D 建模創建霓虹色的方塊,玩家可以使用虛擬光劍將其切開。

虛擬實境在遊戲中的應用日益廣泛,正在推動全球對該市場的需求。 VR 遊戲機在美國、英國、中國和日本等主要經濟體越來越受歡迎。在預測期內,VR 遊戲的這些技術進步可能會在未來推動先進 3D 建模產業的全球成長。

娛樂產業動畫的成長推動了對 3D 映射的需求,為開發人員和遊戲玩家帶來了更身臨其境的體驗。紋理映射等技術可以創造具有視覺吸引力的環境,而投影映射則可以增強互動體驗,從而支持市場成長。

此外,疫情過後娛樂活動和展覽的增多,以及數位科技在活動管理中的融合,也支持了娛樂領域的市場發展。例如,2023 年 7 月,倫敦領先的活動場地 ExCeL London 委託了一個全新的超現實數位雙胞胎來幫助活動組織者決定活動的地點和流程,並與 OnePlan 合作使用該公司的 3D 場地地圖。

亞太地區可望成為成長最快的市場

預計亞太地區將佔據 3D 地圖和 3D 建模市場的大部分佔有率。這項市場擴張可歸因於醫療保健和生命科學、製造業、建築業以及媒體和娛樂產業對 3D 影像感測器、3D 建模、3D 視覺化和渲染軟體工具的需求不斷成長。

該地區的中小企業和政府機構出於行銷目的對其產品進行真實展示的需求日益成長,這可能會推動對 3D 地圖和 3D 建模產品的需求。雲端運算和物聯網的普及以及網路使用量的增加也是推動市場發展的因素。

媒體和娛樂業是該地區蓬勃發展的行業之一,得益於過去十年數位化和網路使用的不斷成長。預測期內,該地區博彩業的興起可能會帶來潛在的商機。

3D 地圖在建築和城市規劃中的應用正在推動市場需求以及亞太地區新興經濟體的基礎設施發展。例如,2023年11月,印度國家測繪機構印度測量局(SoI)與主要企業Genesys International宣佈建立戰略合作夥伴關係,在印度開展3D(3D)數位雙胞胎測繪項目,以創建印度重要城市和城鎮的數位雙胞胎。

中國、澳洲、新加坡、印度和日本是該地區網路生態系統發達的國家。該地區也正在採取一系列舉措,充分利用IT基礎設施,使商業用戶能夠採用更先進的技術。由於經濟因素推動了亞洲各地製造設施的發展和維護,預計該地區將迅速擴張。該地區的崛起也可歸因於其不斷擴張的經濟,許多企業採用 3D 地圖和建模來創新其產品。

3D 地圖和 3D 建模行業概覽

3D 地圖和 3D 建模市場高度分散,主要參與者包括 Autodesk Inc.、Saab AB、Golden Software LLC、Trimble Inc. 和 Intermap Technologies。市場參與者正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2024 年 2 月 - 作為其智慧 DCU 計畫的一部分,都柏林城市大學 (DCU) 與 Bentley Systems 合作,創建了一個與物聯網 (IoT)資料緊密相關的校園模型,利用 Bentley 的開放式 3D 和現實建模技術創建了一個沉浸式數位雙胞胎。

2023 年 11 月-Cadence 和 Autodesk 合作進行智慧產品設計。此次合作將把 Cadence Allegro X 和 OrCAD X 與 Autodesk Fusion 整合在一起,幫助設計和製造公司簡化對印刷基板(PCB) 的 3D 建模需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 相容 3D 的顯示設備的出現

- 3D 掃描器、3D 感測器和其他擷取設備的進步

- 市場限制

- 初期投資高

- COVID-19 產業影響評估

第6章 市場細分

- 按類型

- 3D 映射

- 3D 建模

- 按應用

- 投影映射

- 紋理映射

- 地圖和導航

- 其他用途

- 按行業

- 娛樂和媒體

- 車

- 衛生保健

- 建築和施工

- 防禦

- 運輸

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Autodesk Inc.

- Saab AB

- Golden Software LLC

- Trimble Inc.

- Intermap Technologies

- The Foundry Visionmongers Ltd

- Bentley Systems Inc.

- Topcon Positioning Systems Inc.

- Airbus Defense and Space

- Cybercity 3D Inc.

- ESRI Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The 3D Mapping And 3D Modelling Market size is estimated at USD 8.58 billion in 2025, and is expected to reach USD 17.01 billion by 2030, at a CAGR of 14.67% during the forecast period (2025-2030).

Key Highlights

- The growing availability of 3D content propels the 3D mapping and modeling industry. 3D content is the development of a physical item that can be measured in three different directions - typically the length, height, and breadth. As the need for 3D content grows, the demand for 3D mapping and modeling is also growing, which uses specialized software to produce a three-dimensional representation of an item. Additionally, in this competitive market, 3D mapping and modeling innovations are the easiest ways to create 3D environments. 3D mapping solutions quickly generate high-quality 3D maps of surroundings, ready to be integrated into professional visualization processes.

- 3D mapping and modeling are frequently used in the gaming and video entertainment industries to create action sequences that make viewers feel they are in the actual location. The market for 3D mapping and 3D modeling has grown significantly in recent years due to the rising demand for 3D animation in mobile gaming and other applications and the video entertainment industry's desire to deliver a better watching experience. Gaming firms such as Sony, Xbox, Microsoft, and Tencent already use 3D technology and develop 3D games by building a virtual world that can mimic the user's motion and give them a more realistic experience.

- These developments in VR technology, particularly in the gaming industry, are expected to substantially impact the global market for next-generation 3D displays throughout the projected period. According to the Game Developers Conference, the gaming world is fast evolving. In a 2023 study, 36% of participating game developers worldwide are actively developing games for the Meta Quest virtual reality gear, which would create a market growth opportunity for the 3D Modelling and mapping industry.

- However, data piracy and the high cost associated with the use of technology are some of the factors that may affect the growth of the market over the forecast period. The cost of implementing 3D mapping and modeling software and the high-cost workforce required for developing the maps and models make it challenging to broadly adopt them in many end-user applications, which could be a potential challenge for market growth during the forecast period.

3D Mapping & 3D Modelling Market Trends

Entertainment and Media Segment would Contribute Significantly to the Market Growth

Game-building companies, including Epic Games, Ubisoft, and Blizzard Entertainment, all use 3D modeling to create characters, environments, and objects that are then animated. For example, Blizzard Entertainment's game "Overwatch" uses 3D modelling to make its cast of characters, each with their unique abilities and personalities.

Applying 3D modelling technology in virtual reality experiences significantly creates immersive environments. Artists can use 3D modeling to create virtual worlds, characters, and objects that users can interact with in VR experiences. For example, the VR game "Beat Saber" uses 3D modeling to create neon-colored blocks that players slice with virtual lightsabers.

The growing use of virtual reality in gaming propels global demand for the market. VR gaming consoles are becoming increasingly popular in major economies such as the United States, the United Kingdom, China, and Japan. Over the projected period, these technological advancements in VR gaming will boost the growth of the advanced 3D modelling industry worldwide in the future.

The growth of animations in the entertainment industry fuels the demand for 3D mapping, enabling developers and gamers a more immersive experience. Techniques such as texture mapping create visually stunning environments, and projection mapping can increase interactive experiences, supporting the market's growth.

Additionally, the growth of events and exhibitions for entertainment purposes after the post-pandemic period and the emergence of digital technology integration in event management are supporting the development of the market in the entertainment segment. For instance, in July 2023, London's leading event venue, ExCeL London, commissioned a new hyper-realistic digital twin to aid event organizers in making decisions about the location and flow of their event, working in partnership with OnePlan for using its 3D venue mapping, showing the demand for the market during the forecast period.

Asia-Pacific is Expected to Be the Fastest-growing Market

Asia-Pacific is anticipated to have a substantial 3D mapping and modeling market share. Its expansion may be attributable to the rising demand for 3D imaging sensors, 3D modeling, and 3D visualization, rendering software tools in healthcare and life sciences, manufacturing, construction, and media and entertainment industries.

The growing demand for a realistic representation of the product for marketing purposes by small and medium-sized companies and government agencies in the region would stimulate demand for 3D mapping and modeling products. Rising cloud and IoT adoption and increased web usage are some of the reasons driving the market.

The media and entertainment business are one of the region's thriving industries, propelled by increased digitalization and internet usage over the last decade. The region's gaming industry's rise is likely to present potential opportunities during the forecast period.

The application of 3D mapping in construction and urban planning is driving the demand for the market in the Asia Pacific region in line with the infrastructural development in the emerging economies in the area. For instance, in November 2023, the national mapping agency Survey of India (SoI) and Genesys International, a leading Indian mapping company, on Wednesday announced a strategic tie-up for a three-dimensional (3D) digital twin-mapping program in India to create digital twins of significant cities and towns in India, which would support the market growth.

China, Australia, Singapore, India, and Japan are among the countries in the region with well-developed cyber ecosystems. The region is also launching various attempts to utilize IT infrastructure, allowing business users to adopt more advanced technology. The region is expected to expand rapidly due to economic considerations driving the development and maintenance of production facilities throughout Asia. The region's rise may also be ascribed to its expanding economy, where many firms are increasingly embracing 3D mapping and modeling to innovate their products.

3D Mapping And 3D Modelling Industry Overview

The 3D mapping and 3D modeling market is highly fragmented, with the presence of major players like Autodesk Inc., Saab AB, Golden Software LLC, Trimble Inc., and Intermap Technologies. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

February 2024 - Dublin City University (DCU) has partnered with Bentley Systems to create an advanced digital twin of its campus as part of its Smart DCU initiative by using Bentley's open 3D and reality modeling technology can make a campus model intricately linked with the Internet of Things (IoT) data, which results in an immersive digital twin, showing the market demand for the 3D modelling and Mapping during the forecast period.

November 2023 - Cadence and Autodesk Collaborate on Smart Product Design, and with this collaboration, the Cadence Allegro X and OrCAD X would be integrated with the Autodesk Fusion, enabling the design and manufacturing companies to ease their printed Circuit Board (PCB) 3D modelling needs, showing the increasing partnerships in the market supporting the growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advent of 3D-enabled Display Devices

- 5.1.2 Advancement of 3D Scanners, 3D Sensors, and Other Acquisition Devices

- 5.2 Market Restraints

- 5.2.1 High Initial Investments

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 3D Mapping

- 6.1.2 3D Modeling

- 6.2 By Application

- 6.2.1 Projection Mapping

- 6.2.2 Texture Mapping

- 6.2.3 Maps and Navigation

- 6.2.4 Other Applications

- 6.3 By End-user Vertical

- 6.3.1 Entertainment and Media

- 6.3.2 Automotive

- 6.3.3 Healthcare

- 6.3.4 Building and Construction

- 6.3.5 Defense

- 6.3.6 Transportation

- 6.3.7 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Autodesk Inc.

- 7.1.2 Saab AB

- 7.1.3 Golden Software LLC

- 7.1.4 Trimble Inc.

- 7.1.5 Intermap Technologies

- 7.1.6 The Foundry Visionmongers Ltd

- 7.1.7 Bentley Systems Inc.

- 7.1.8 Topcon Positioning Systems Inc.

- 7.1.9 Airbus Defense and Space

- 7.1.10 Cybercity 3D Inc.

- 7.1.11 ESRI Inc.