|

市場調查報告書

商品編碼

1686526

移動式製圖系統:市場佔有率分析、產業趨勢與成長預測(2025-2030)Mobile Mapping Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

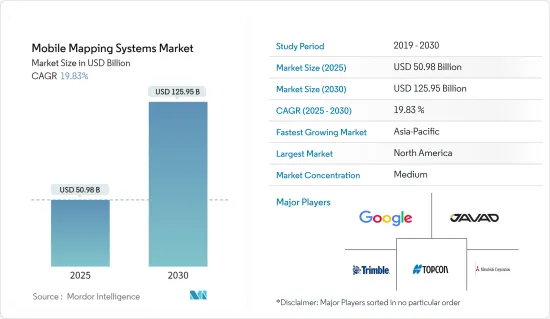

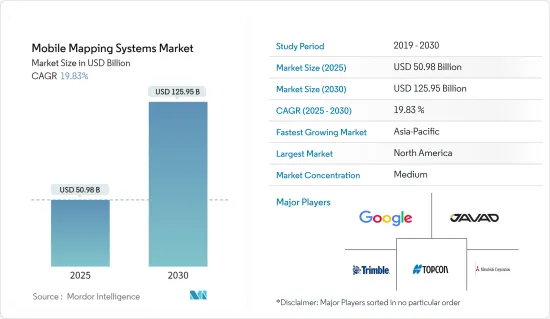

移動式製圖系統市場規模預計在 2025 年為 509.8 億美元,預計到 2030 年將達到 1259.5 億美元,預測期內(2025-2030 年)的複合年成長率為 19.83%。

衛星測繪技術的快速普及及其與智慧型手機和物聯網 (IoT) 連接設備的無縫整合正在推動市場成長。

隨著全球都市化進程加快以及政府措施的推動,智慧城市迅速擴張。智慧城市只有有了3D地圖才能實現。透過對 3D 城市建模、自主導航、交通、災害管理、道路資產數位化和減少污染的支持,智慧城市行動地圖技術旨在透過最佳化資源和維持永續性來提高生活品質。智慧型手機和網際網路的使用在管理和存取資料方面發揮關鍵作用。

此外,行動導航用於環境監測地理資訊系統(GIS)在環境監測的應用也越來越多。環境研究人員正在採用移動式製圖GIS 工具來幫助預測和監測風暴和颶風。美國太空總署資助的生態系統監測和自然資源管理研究計劃正在推動移動式製圖領域的收益成長。

移動式製圖系統有多種應用,包括開發用於行人導航的室內地圖、用於自動駕駛汽車的高清地圖、資產和基礎設施管理、航空測量、管道測量、水文測量、疏浚以及海洋定位和挖掘作業。

按需部署系統的出現標誌著移動式製圖市場的曲折點,它以較低的前期成本(按月/以季度為基礎向用戶收費)提供了高靈活性和準確性。本公司提供基於訂閱的模式來應對永久用戶許可的需求。

新冠疫情導致 IT 產業快速重組,企業紛紛轉向遠距辦公。疫情期間,移動式製圖市場顯著成長。一些公司和機構已經使用移動式製圖資料進行視覺化和地理空間分析,以限制疾病的傳播。儀表板用於顯示地理空間資料。其中一些儀表板和應用程式幾乎即時接收資料變更。

移動式製圖系統的市場趨勢

影像服務區隔市場佔據主導地位

- 衛星影像和 GIS 系統使安全和執法機構能夠識別犯罪熱點和其他趨勢和模式。準確檢測犯罪的空間集中度並及時繪製犯罪地點地圖,使執法機構能夠精確定位犯罪在空間和時間上的集中度,為減少犯罪工作提供關鍵資訊。

- 此類圖像可以與其他資料(例如人口普查資料或商店、銀行和學校的位置)疊加,有助於簡化和加快此應用程式中的分析。這使安全管理人員能夠了解犯罪的根本原因並制定策略。這些策略包括增加緊急情況下的警察部署和調度。

- 然而,人們對能夠提供彩色和全色影像處理服務的先進遙感探測技術的需求日益成長,同時也能夠透過資料融合、增強、地理配準、鑲嵌以及色彩和灰階平衡來銳化影像。

- 此外,目前的市場發展針對的是水體監測。例如,非法捕魚和販運的挑戰使得人們需要發現海洋中的異常現象。 《自然生態與演化》的研究人員表示,在西太平洋和中太平洋等一些地區,非法捕撈可能占到漁業總量的30%。

- 聯合國糧食及農業組織 (FAO) 的統計數據強調了未報告和無管制 (IUU) 捕撈的全球影響。據估計,全球每年非法、不通報和不管制漁獲量的捕撈量達2,600萬噸,價值100億至230億美元。 DigitalGlobe 和 Planet 合作開展了計劃。該夥伴關係旨在偵查漁業產品的非法轉運。

亞太地區發展迅速

- 預計預測期內亞太市場將大幅擴張。政府在衛星圖像方面的舉措不斷增加以及產品的推出,吸引了國內外公司的投資,推動了該地區市場的成長。

- 2022 年 3 月,澳洲獨立無人機測繪公司 Emesent 宣布發布其最新的 Hovermap ST 自主無人機 LiDAR 測繪和測量有效載荷。 Emesent 的 LiDAR 有效載荷使用一種稱為同時定位和地圖繪製 (SLAM) 的技術,該技術允許無人機同時建立地圖並在該地圖內確定方向。

- 亞太國家GDP的快速成長帶動了公共運輸網路等基礎設施現代化項目和創新城市計劃,增加了對移動式製圖技術的需求。

- 中國銀川市是該地區最先進的智慧城市之一,幾乎所有基礎設施都連接到一個系統。例如,銀川智慧城市採用的方達平台結合3D地圖,在最新地圖上識別節點和燈具位置,並整合多種其他應用程式。此外,該地區的市場公司正在提出創新的解決方案。

- 例如,2022 年 6 月,Grab Holdings Limited 宣布推出 GrabMaps。新的企業解決方案使該公司能夠挖掘東南亞每年 10 億美元的地圖和定位服務市場潛力。 GrabMaps 最初是為內部使用而推出的,以滿足對更多超當地語系化解決方案的需求,從而增強 Grab 的業務。

- 行動裝置製造業的快速發展大大降低了掃描器、相機和其他組件的成本,使得小型企業和個人能夠更經濟地使用定位服務。

移動式製圖系統產業概況

隨著移動式製圖產業主要參與者的不斷增加,預計預測期內公司之間的競爭將會加劇。現有企業包括Google公司、Javad GNSS 公司、三菱公司、Trimble 和 Topcon 公司。大公司投入大量資源進行研發,以捍衛其市場地位並推動創新。進入障礙高、企業集中度高、市場滲透率高是影響市場競爭的重要特徵。整體而言,競爭對手之間的敵意仍然較高,這主要是由於所研究市場中參與者的強大影響力所致。

2022 年 9 月,營運北美最大的公私稱重站繞行網路的連網卡車服務供應商 Drivewyze 與交通分析和連網汽車服務供應商 INRIX 以及賓州收費公路委員會合作,宣布推出即時車載交通警報。賓州與俄亥俄州、新澤西州和北卡羅來納州一道,在全州範圍內提供交通延誤、堵塞和事故的音頻和影像警報。

2022 年 5 月,Hexagon 子公司徠卡測量系統宣布推出 Leica Pegasus TRK,這是一款現實捕捉移動式製圖系統,融合了人工智慧、自主工作流程和遠距移動式製圖,適用於資產管理、道路建設、關鍵基礎設施、石油和天然氣以及電力行業等應用。該系統非常適合為自動駕駛汽車創建高清底圖。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 與任何車輛整合

- 市場限制

- 系統採購和部署高成本

第6章市場區隔

- 按應用

- 影像服務

- 航空移動測繪

- 緊急應變計劃

- 網路使用

- 設施管理

- 衛星

- 按最終用戶產業

- 政府

- 石油和天然氣

- 礦業

- 軍隊

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Google LLC(Alphabet Inc.)

- Leica Geosystems AG(Hexagon Geosystems)

- Trimble Inc.

- Topcon Corporation

- NovAtel Inc.

- Javad GNSS Inc.

- Teledyne Optech

- Mitsubishi Corporation

- Imajing SAS

- TomTom International BV

- Cyclomedia Technology BV

- INRIX Inc.

第8章投資分析

第9章:未來機會

The Mobile Mapping Systems Market size is estimated at USD 50.98 billion in 2025, and is expected to reach USD 125.95 billion by 2030, at a CAGR of 19.83% during the forecast period (2025-2030).

The rapid acceptance of satellite mapping technology and its seamless integration into smartphones and Internet of Things (IoT)-connected devices are driving the market's growth.

Smart cities rapidly expanded due to increased urbanization and supported government initiatives worldwide. A smart city can only exist with a 3D map. With the support of 3D city modeling, autonomous navigation, traffic, disaster management, digitizing roadway property, and pollution reduction, mobile mapping technology for smart cities aims to improve quality of life by optimizing resources and maintaining sustainability. Smartphone and internet usage played critical roles in data management and access.

Further, mobile navigation geographic information system (GIS) for environmental monitoring is increasingly used in monitoring the environment. Environmental researchers are employing mobile mapping GIS tools to help with storm and hurricane forecasting and monitoring. The NASA-funded research project on ecological monitoring and natural resource management drives revenue growth in the mobile mapping sector.

Mobile mapping systems are used for various applications, including developing indoor maps for pedestrian navigation, high-definition (HD) maps for autonomous vehicles, asset and infrastructure management, ariel surveys, pipeline surveys, hydrographic surveys, dredging, and offshore positioning/drilling operations.

The emergence of on-demand deployment systems is an inflection point in the mobile mapping market, as high levels of flexibility and accuracy at low initial costs are offered (users are charged on a monthly/quarterly basis). Companies offer subscription-based models to counter the need for perpetual user licenses.

The COVID-19 pandemic resulted in a rapid restructuring of the IT industry, with firms shifting to remote labor. During the pandemic, the mobile mapping market grew considerably. Several businesses and agencies used mobile mapping data for visualization and geospatial analytics to restrict the spread of the disease. Dashboards were used to display geospatial data. Some of these dashboards and applications received data changes in near-real time.

Mobile Mapping Systems Market Trends

Imaging Services Segment to Dominate the Market

- Satellite imagery and GIS systems enable security and law enforcement agencies to identify hot spots and other trends and patterns for crime mapping. Accurate detection of spatial concentrations of crime and timely mapping of crime locations help law enforcement identify the concentration of crimes in space and time, thus providing important information for crime reduction efforts.

- Such imagery helps provide efficiency and speed of analysis in this application, allowing analysts to overlay other datasets, such as census demographics and locations of stores, banks, and schools. This helps security department administrators understand the underlying causes of crime and devise strategies. These strategies include allocating police officers and dispatching them to emergencies.

- However, there is an increase in demand for advanced remote sensing techniques, which can provide color and panchromatic image processing services along with the ability to sharpen the image with data fusion, enhancements, georeferencing, mosaicing, and color and grayscale balancing.

- Furthermore, current developments in the market studied aim to monitor water bodies. For instance, the challenge of illegal fishing and trafficking led to the need to find anomalies in the oceans. According to Nature Ecology & Evolution researchers, illegal fishing may constitute up to 30% of the total fisheries in some regions, such as the western and central Pacific oceans.

- The Food and Agriculture Organization of the United Nations (FAO) statistics highlight the global impact of unreported and unregulated (IUU) fishing. Global IUU fishing is estimated to represent up to 26 million metric tons of fish caught annually (equivalent to USD 10 billion-USD 23 billion). DigitalGlobe and Planet collaborated on one such project to identify illicit activities. The partnership aims to spot illegal transshipments of fisheries.

Asia Pacific to Register Fastest Growth

- The market in Asia-Pacific is expected to expand at a significant rate during the forecast period. Increasing government initiatives for satellite imaging are attracting investment from foreign and domestic players, along with product launches, which are driving the market's growth in the region.

- In March 2022, Emesent, an Australia-based independent drone mapping business, announced the release of its latest Hovermap ST autonomous drone LiDAR mapping and surveying payload. Emesent's LiDAR payloads use a technology known as simultaneous localization and mapping (SLAM), in which a drone produces a map while simultaneously localizing itself inside that map.

- The fast GDP expansion in Asia-Pacific countries led to infrastructure modernization programs such as mass public transit networks and innovative city projects, increasing demand for mobile mapping technologies.

- Yinchuan, China, is one of the region's most advanced smart cities, with practically all infrastructure linked into a single system. For instance, the Fonda platform used in Yinchuan smart city combines a 3D map to locate the nodes and lamps in the latest map and integrates various other applications. Moreover, market players in the region are launching innovative solutions.

- For instance, in June 2022, Grab Holdings Limited announced the introduction of GrabMaps. This new enterprise solution enables the firm to capitalize annually on the USD 1.0 billion market potential for mapping and location-based services in Southeast Asia. GrabMaps was first established for internal usage to answer Grab's demand for a more hyperlocal solution to power its operations.

- Rapid mobile device manufacturing has significantly decreased the cost of scanners, cameras, and other components, making location-based services more affordable for SMEs and private individuals.

Mobile Mapping Systems Industry Overview

The growing presence of big players in the mobile mapping industry is expected to intensify competitive rivalry during the forecast period. Incumbents, such as Google Inc., Javad GNSS Inc., Mitsubishi Corporation, Trimble, and Topcon Corporation. Large companies are expending significant resources on R&D operations to protect their position and drive innovation in the market. High barriers to exit, growing levels of firm concentration, and market penetration are some of the significant characteristics influencing the competition in the market. Overall, the intensity of competitive rivalry remains moderately high, mainly driven by the strong presence of players involved in the market studied.

In September 2022, Drivewyze, the connected truck services provider and operator of North America's largest public-private weigh station bypass network, announced real-time, in-cab traffic alerts in collaboration with INRIX, a transportation analytics and connected vehicle services provider, and the Pennsylvania Turnpike Commission. Pennsylvania joins Ohio, New Jersey, and North Carolina in providing in-state alerts that offer audio and visual indicators of upcoming traffic delays, congestion, and incidents.

In May 2022, Leica Geosystems, part of Hexagon, announced the introduction of the reality capture mobile mapping system Leica Pegasus TRK, introducing artificial intelligence, autonomous workflows, and long-range mobile mapping for applications in asset management, road construction, critical infrastructure, oil, gas, and electricity industries. The system is ideal for creating high-definition base maps for autonomous vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Integration with All Kinds of Vehicles

- 5.2 Market Restraints

- 5.2.1 High Cost of System Acquisition and Deployment

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Imaging Services

- 6.1.2 Aerial Mobile Mapping

- 6.1.3 Emergency Response Planning

- 6.1.4 Internet Applications

- 6.1.5 Facility Management

- 6.1.6 Satellite

- 6.2 By End-user Verticals

- 6.2.1 Government

- 6.2.2 Oil and Gas

- 6.2.3 Mining

- 6.2.4 Military

- 6.2.5 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Google LLC (Alphabet Inc.)

- 7.1.2 Leica Geosystems AG (Hexagon Geosystems)

- 7.1.3 Trimble Inc.

- 7.1.4 Topcon Corporation

- 7.1.5 NovAtel Inc.

- 7.1.6 Javad GNSS Inc.

- 7.1.7 Teledyne Optech

- 7.1.8 Mitsubishi Corporation

- 7.1.9 Imajing SAS

- 7.1.10 TomTom International BV

- 7.1.11 Cyclomedia Technology BV

- 7.1.12 INRIX Inc.