|

市場調查報告書

商品編碼

1643033

蜂巢式物聯網:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Cellular IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

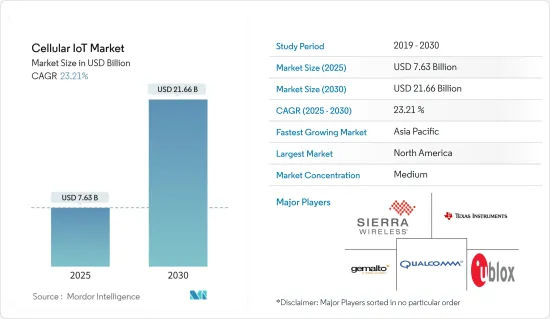

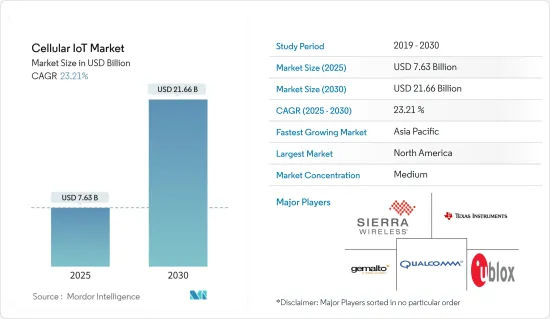

預計 2025 年蜂巢式物聯網市場規模為 76.3 億美元,到 2030 年將達到 216.6 億美元,預測期內(2025-2030 年)的複合年成長率為 23.21%。

主要亮點

- 預計推動全球蜂巢式物聯網成長的關鍵因素包括快速成長國家的存在、先進技術的採用不斷增加以及連接設備數量的增加。

- 製造業、汽車業、能源與公共產業等產業的數位化和自動化程度不斷提高,預計將推動全球蜂巢式物聯網市場的成長。此外,對更廣泛網路覆蓋的需求不斷成長、擴展行動寬頻以外業務的傾向不斷增加、以及全球企業之間容納大量連網設備的需求是預計推動蜂巢式物聯網市場成長的一些關鍵因素。

- 物聯網在汽車行業的日益普及、5G的商業化以及窄帶物聯網(NB-IoT)和機器的長期演進(LTE-M)的出現,是預計會使蜂巢式物聯網市場參與者受益的一些因素。

- 對端到端安全性的不斷成長的需求,包括強大的設備級存取和身份驗證以及加密的資料傳輸,正在推動全球蜂巢式物聯網市場的發展。蜂巢式物聯網解決方案提供了堅實的基礎設施,可協助企業最大限度地降低風險並最大限度地延長運作。

- 冠狀病毒的爆發及其影響減緩了蜂巢式物聯網的投資和部署,延長了許多地區蜂巢式物聯網市場的成長時間。但隨著全球醫療保健和供應鏈的嚴重中斷,政府、醫院、保險公司和物流供應商迅速做出反應,重新思考更互聯的世界如何更好地應對當前危機並幫助預防或減輕未來的危機。

- 世界各地的公司都轉向了WFH(在家工作)環境或在遠非正常的條件下業務。此外,視訊會議和串流視訊內容的爆炸性成長也給全球固定寬頻基礎設施帶來了壓力。

蜂巢式物聯網市場趨勢

汽車領域對 C-V2X蜂巢式物聯網的需求不斷成長,推動市場

由於對安全可靠的道路運輸的需求不斷增加、自動駕駛汽車的採用不斷增加以及物流和運輸公司對車輛遠端資訊處理的採用不斷增加,汽車領域的蜂巢式物聯網(C-V2X) 正在不斷發展。高速高密度交通中對可靠即時通訊的需求不斷成長,以及利用安全且成熟的 LTE 網路的全面覆蓋,正在推動對 C-V2X蜂巢式物聯網的需求。 5G技術的進步有望實現5G-V2X應用,提供更好的網路安全效能,並在擁擠的交通環境中處理大量訊息。推動蜂巢式物聯網領域發展的另一個因素是硬體組件的成本。

例如,去年Verizon 和日產完成了概念驗證計劃,展示了邊緣運算與 5G 和 C-V2X 的強大協同效應。 (蜂窩車聯網)。在本次實驗中,從路邊基礎設施和車載感測器收集的資料在 Verizon 網路邊緣進行了分析。經過處理後,資料會迅速傳輸到車輛,以便向駕駛員發出緊急通知。

亞太地區可望創下最高市場成長

亞太地區預計將成為蜂巢式物聯網快速成長的市場,因為中國和印度等國家擁有大量半導體經銷商。此外,該地區正經歷越來越多的科技公司湧入和對物聯網技術的投資不斷增加,預計將推動市場成長。

印度等亞洲國家的政府也對蜂巢式物聯網市場感興趣,並推出了許多智慧基礎設施計劃。印度、日本、中國、韓國、馬來西亞和新加坡政府正在推行國家蜂巢式物聯網戰略,預計將推動這些國家的蜂巢式物聯網市場的成長。

智慧電錶和電網的日益普及正在推動該地區能源產業的蜂巢式物聯網模組的擴張。此外,能源管理的擴展加上對綠色住宅日益成長的需求,正在推動整個建築自動化市場的需求,從而導致對蜂巢式物聯網部署的需求很高。

成本和效率是亞太地區企業物聯網的關鍵策略驅動力,而資料/網路安全和持續成本是主要挑戰。全球雲端和 IT 供應商正在成為亞太地區的主要物聯網供應商,從而刺激該地區的市場發展。

雖然資料/網路安全和持續開支是主要關注點,但成本和效率是亞太企業物聯網的關鍵策略促進因素。亞太地區企業物聯網方面的支出也相對較低。憑藉一流的技術和整合能力,這家國際雲端運算和 IT 供應商正迅速成為亞太地區的頂級物聯網供應商。

蜂巢式物聯網產業概覽

行動電話動物聯網(IoT)市場已呈現半固體,國內和國際市場均有少數大小參與者。由於科技巨頭數量較少,市場呈現半固定狀態。產品創新、併購是主要企業的主要市場策略。市場上最重要的發展是:

2023 年 2 月,美國行動晶片公司高通宣布推出 Qualcomm Aware,這是一款新的雲端平台,將高通晶片與硬體和軟體合作夥伴生態系統捆綁在一起。這個概念似乎是高通統籌的各種物聯網計劃的一站式商店。該公司表示:“Qualcomm Aware 旨在為各行各業的公司提供可擴展、經濟高效且資本高效的投資解決方案,以加快產品上市時間、簡化數位化轉型、降低風險,並為他們提供做出更明智的商業決策和應對跨行業挑戰所需的變革性見解。”

2022年11月,全球物聯網和汽車解決方案供應商移遠通訊宣布推出其新型AG18汽車模組,是下一代通訊車聯網(C-V2X)模組之一。透過PC5直接通訊,該模組使車輛能夠有效地相互通訊並與周圍環境進行通訊,確保提高安全性和交通效率。

此外,AG18 還支援透過統一的 5.9GHz智慧型運輸系統(ITS) 頻段進行車對車 (V2V)、車對基礎設施 (V2I) 和車對行人 (V2P)援助,而無需 (U)SIM、蜂窩合約或通訊協助。 AG18模組除了擁有卓越的C-V2X通訊能力外,還提供靈活的定位服務選項,包括L1+L5雙頻GNSS、高通航位推算(QDR3)、高精度PPE(RTK),讓全球汽車OEM和層級 1供應商能夠根據自身應用需求選擇適合的定位技術。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第 2 章執行摘要

第3章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 價值鏈分析

- COVID-19影響評估

- 市場促進因素

- 智慧城市對蜂巢式物聯網的需求不斷成長

- 國防安全保障監控領域對 5G蜂巢式物聯網的需求日益增加

- 市場挑戰

第 4 章 市場細分

- 按組件

- 硬體

- 軟體

- 按類型

- 2G

- 3G

- 4G

- 5G

- LTE-M

- NB-LTE-M

- NB-IoT

- 按最終用戶

- 零售

- 能源

- 衛生保健

- 製造業

- 消費性電子產品

- 汽車與運輸

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第5章 競爭格局

- 公司簡介

- CommSolid GmbH

- SEQUANS

- ZTE Corporation

- Telit

- MediaTek Inc.

- U-Blox

- Sierra Wireless

- Thales

- Texas Instruments Incorporated

- Qualcomm Technologies Inc.

第6章投資分析

第7章 市場機會與未來趨勢

The Cellular IoT Market size is estimated at USD 7.63 billion in 2025, and is expected to reach USD 21.66 billion by 2030, at a CAGR of 23.21% during the forecast period (2025-2030).

Key Highlights

- The presence of rapidly growing nations, rising adoption of advanced technologies, and an increasing number of connected devices are some of the major factors expected to fuel the global growth of cellular IoT.

- The rise in digitalization and automation across industries such as manufacturing, automotive, and energy & utilities are expected to drive the global cellular IoT market growth. Furthermore, increased demand for extended network coverage, increased inclination towards business expansion beyond mobile broadband, and the need to accommodate a large number of connected devices among businesses worldwide are some of the major factors expected to propel the growth of the cellular IoT market.

- The growing adoption of IoT in the automotive industry, the commercialization of 5G, and the emergence of Narrowband Internet of Things (NB-IoT) and Long Term Evolution for Machines (LTE-M) are some factors expected to benefit the cellular IoT market players.

- The growing demand for end-to-end security, such as device-level solid access and authentication, encrypted data transport, and so on, is driving the global cellular IoT market, as cellular IoT solutions provide a robust infrastructure that helps businesses minimize risk and maximize uptime.

- The coronavirus outbreak and its consequences slowed cellular IoT investment and deployment and extended timelines for cellular IoT market growth in many sectors. However, with major disruptions in global healthcare and supply chains, governments, hospitals, insurers, and logistics providers reacted quickly and rethought how a more connected world helped better address the current crisis and avert or mitigate future ones.

- Businesses around the world had either moved to WFH (work-from-home) environments or were operating under conditions that were far from normal. In addition, the world's fixed broadband infrastructure trembled due to a massive increase in video conferencing and video content streaming.

Cellular Internet of Things (IoT) Market Trends

Increasing demand of cellular Iot for C-V2X in automotive sector to Drive The Market

Cellular Vehicle-to-Everything (C-V2X) in the automotive sector is growing due to increased demand for safe and dependable road transportation, rising adoption of autonomous vehicles, and rising adoption of vehicle telematics by logistics and transportation companies. The increasing demand for highly reliable, real-time communication at high speeds and in high-density traffic and leveraging the comprehensive coverage of secure and well-established LTE networks are driving demand for C-V2X cellular IoT. The advancements in 5G technology would enable the applications of 5G-V2X, which is expected to offer better cybersecurity performance and handle many messages in congested traffic environments. Another factor driving the cellular IoT segment is the cost of hardware components.

For instance, in the previous year, Verizon and Nissan completed a proof-of-concept project demonstrating the powerful synergy of edge computing over 5G and C-V2X. (Cellular Vehicle-to-Everything). For the experiment, data collected from roadside infrastructure and onboard vehicle sensors were analyzed at the Verizon network's edge. Following processing, the data was quickly transmitted back to the vehicles for urgent driver notifications.

Asia-Pacific To Register Highest Market Growth

Asia-Pacific is anticipated to be the fastest-growing market of cellular IoT due to countries such as China and India having a large pool of semiconductor dealers. Furthermore, the growing influx of technology companies in the region and increased investment in IoT technology are expected to accelerate market growth.

Governments in Asian countries such as India are also interested in the cellular IOT market and are launching numerous smart infrastructure projects. Governments in India, Japan, China, Korea, Malaysia, and Singapore have promoted national cellular IoT strategies, which are expected to boost the growth of the cellular IoT market in these countries.

The growing use of smart meters and grids fuels the expansion of cellular IoT modules in the region's energy industry. Furthermore, the expansion of energy management, combined with rising demand for green homes, drives overall demand for the building automation market, resulting in high demand for cellular IoT deployment.

For APAC enterprises, key strategic IoT drivers are cost and efficiency, with data/network security and ongoing costs posing major challenges. Global cloud and IT vendors are emerging as leading IoT providers in APAC, adding fuel to the region's market.

While data/network security and ongoing expenditures are the primary concerns, cost and efficiency are the key strategic IoT drivers for APAC businesses. Spending on enterprise IoT is also relatively low in APAC. International cloud and IT vendors are quickly becoming the top IoT providers in APAC due to their best-in-class technology and integration capabilities.

Cellular Internet of Things (IoT) Industry Overview

The cellular internet of things (IoT) market is semi-consolidated due to a few large and small players in both domestic and international markets. Because of a few technological behemoths, the market appears to be semi-consolidated. Product innovation and mergers and acquisitions are key market strategies the major players employ. The following are some of the market's most significant developments:

In February 2023, Qualcomm, a US mobile chip company, launched a new platform Qualcomm Aware, a cloud-friendly bundle that includes Qualcomm silicon and an ecosystem of hardware and software partners. The concept appears to be a one-stop shop for all types of IoT projects overseen by Qualcomm. Furthermore, "Qualcomm Aware is designed to provide organizations across industries with a scalable, cost-effective, capital-efficient investment solution that accelerates time to market, simplifies digital transformation, and delivers transformative insights needed to reduce risk, make more informed business decisions, and navigate cross-industry challenges."

In November 2022, Quectel Wireless Solutions, a global IoT and automotive solutions provider, announced the release of its new AG18 automotive module, one of the next generation of cellular vehicle-to-everything (C-V2X) modules. With PC5 direct communications, the module allows vehicles to communicate with one another and with their surroundings effectively, ensuring improved safety and traffic efficiency.

Furthermore, the AG18 supports vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-pedestrian (V2P) communications on the unified 5.9GHz intelligent transportation system (ITS) band without the need for a (U)SIM, cellular subscription, or network assistance. In addition to superior C-V2X communication capabilities, the AG18 module includes flexible positioning service options such as L1+L5 dual frequency GNSS, Qualcomm Dead Reckoning (QDR3), and high-precision PPE (RTK), ensuring that global automotive OEMs and Tier 1 suppliers can leverage location technology appropriate to their application requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 MARKET DYNAMICS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Bargaining Power of Suppliers

- 3.2.2 Bargaining Power of Buyers/Consumers

- 3.2.3 Threat of New Entrants

- 3.2.4 Threat of Substitute Products

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Value Chain Analysis

- 3.4 Assessment of Impact of COVID-19

- 3.5 Market Drivers

- 3.5.1 Increasing Demand for Cellular IoT in Smart Cities

- 3.5.2 Increasing Demand of 5G Cellular IoT in Homeland Security with Surveillance

- 3.6 Market Challenges

4 MARKET SEGMENTATION

- 4.1 Component

- 4.1.1 Hardware

- 4.1.2 Software

- 4.2 Type

- 4.2.1 2G

- 4.2.2 3G

- 4.2.3 4G

- 4.2.4 5G

- 4.2.5 LTE-M

- 4.2.6 NB-LTE-M

- 4.2.7 NB-IoT

- 4.3 End-User

- 4.3.1 Retail

- 4.3.2 Energy

- 4.3.3 Healthcare

- 4.3.4 Manufacturing

- 4.3.5 Consumer Electronics

- 4.3.6 Automotive & Transportation

- 4.3.7 Other End-users

- 4.4 Geography

- 4.4.1 North America

- 4.4.2 Europe

- 4.4.3 Asia-Pacific

- 4.4.4 Rest of the World

5 COMPETITIVE LANDSCAPE

- 5.1 Company Profiles

- 5.1.1 CommSolid GmbH

- 5.1.2 SEQUANS

- 5.1.3 ZTE Corporation

- 5.1.4 Telit

- 5.1.5 MediaTek Inc.

- 5.1.6 U-Blox

- 5.1.7 Sierra Wireless

- 5.1.8 Thales

- 5.1.9 Texas Instruments Incorporated

- 5.1.10 Qualcomm Technologies Inc.