|

市場調查報告書

商品編碼

1445656

銣 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Rubidium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

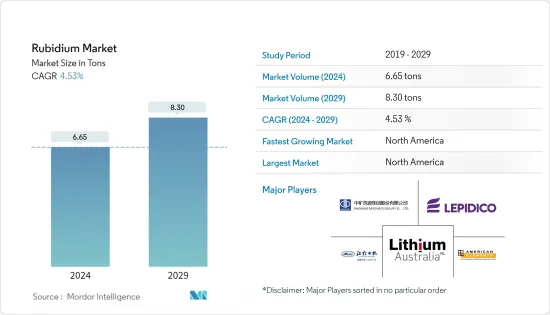

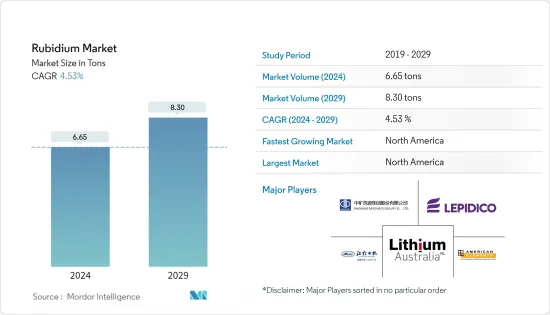

預計2024年銣市場規模為6.65噸,預計2029年將達到8.30噸,在預測期間(2024-2029年)CAGR為4.53%。

COVID-19 大流行對銣需求產生了負面影響。生物醫學研究部門因疫情而受到不利影響,減緩了生物製藥技術的新進展。銣市場從疫情中恢復並顯著成長。

主要亮點

- 短期內,推動所研究市場成長的主要因素是生物醫學研究應用的成長。

- 然而,除了運輸和儲存相關的安全困難之外,可用性和高成本是預計會對所研究的市場產生重大影響的兩個挑戰。

- 儘管如此,銣原子鐘的重要性日益增強,這對預測期內的銣市場來說是一個重大的成長機會。

- 由於該地區的大規模生產,預計北美將成為最大的銣市場。

銣市場趨勢

特種玻璃主導市場

- 特種玻璃構成了銣的主要市場,用於光纖電信系統和夜視設備。碳酸鹽(Rb2CO3)用作此類玻璃的添加劑,可降低電導率並提高穩定性和耐用性。

- 碳酸銣用於降低電導率,進而提高光纖電信網路的穩定性和耐用性。

- 根據歐洲資訊科技天文台(EITO)的資料,2022年電信服務收入約為 488 億歐元(519.9 億美元),而2021年為 484 億歐元(515.7 億美元)。

- 根據國際電信聯盟(ITU)的資料,到2021年,行動用戶數將超過 86 億,而2020年為 83 億。

- 銣碲光電發射表面用於光電電池,並涵蓋各種電子檢測和活化裝置。它對從中紫外線到可見光到近紅外線的廣譜輻射敏感。

- 碳酸銣也應用於玻璃鏡片和內置夜視裝置。銣用作真空管中的吸氣劑和光電元件。它用於製造特殊玻璃。

- 上述所有因素預計將推動特種玻璃的發展,增加預測期內對銣的需求。

北美地區佔比最大

- 就市場佔有率和收入而言,北美在銣市場中佔有重要佔有率。在預測期內,該地區的主導地位將繼續蓬勃發展。

- 銣主要從美國鹽湖鹵水中提取,以Cabot為龍頭。而且加拿大銣礦和銣鹽產量均居世界前五名。

- 加拿大馬尼托巴湖的伯尼湖礦區為美國和其他國家提供生產銣鹽的原料。該地區開採的礦石出口到多個國家。

- 美國是最早生產和使用銣的國家之一。在美國,銣主要用於高科技產業,其中80%用於高科技創造,20%用於電子裝置、特殊玻璃、催化劑等傳統領域。

- 然而,沒有關於消費、出口和進口的資料。根據近十年的產業資料,國內每年消費量約2000公斤。美國完全依賴進口銣材料,用於不同的應用,例如電子、醫療保健、特殊玻璃等。

- 就規模而言,美國電子市場是世界上最大的。此外,它是所研究市場的主要潛力區域之一。此外,由於先進技術的使用、研發中心數量的增加以及消費者需求的增加,預計在預測期內仍將是最大的市場。

- 由於電子產業創新、技術進步和研發活動的快速發展,對更新、更快的電子產品的需求很大。

- 根據消費者技術協會統計,美國消費性電子(CE)市場零售收入穩定擴張。2022年美國消費性電子零售額達5,050億美元。智慧型手機是消費性電子產品類中零售收入最高的商品,2022年將達到7,47億美元。視訊串流服務位居第二,其次是遊戲軟體和服務。

- 美國的醫療器材公司因其創新和高科技產品而在全球享有盛譽。醫療器材產業依賴美國擁有競爭優勢的多個領域,包括微電子、電信、儀器和生物技術。

- 因此,所有上述因素都可能增加預測期內銣市場的需求。

銣行業概況

銣市場得到整合,頂級公司在全球佔據了重要的市場佔有率。該市場的參與者包括 American Elements、Sinomine Resource Group、Jiangxi Special Motor、Lepidico Ltd、Lithium Australia NL 等。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 促進要素

- 不斷成長的生物醫學應用

- 在特種玻璃的應用

- 限制

- 銣的可用性和高成本

- 運輸和儲存相關的安全困難

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品和服務的威脅

- 競爭程度

第5章 市場細分

- 生產流程

- 鋰雲母

- 銫榴石

- 其他生產流程

- 應用領域

- 生物醫學研究

- 電子產品

- 特種玻璃

- 煙火

- 其他應用領域

- 地理

- 亞太

- 北美洲

- 歐洲

- 世界其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市佔率(%)**/排名分析

- 領先企業採取的策略

- 公司簡介

- American Elements

- Ganfeng Lithium

- International Lithium Corp.

- Lepidico

- Jiangxi Special Electric Motor

- Lithium Australia

- Merck Kgaa

- Sinomine Resource Group

- Thermo Fisher Scientific

第7章 市場機會與未來趨勢

- 銣原子鐘的重要性日益增強

The Rubidium Market size is estimated at 6.65 tons in 2024, and is expected to reach 8.30 tons by 2029, growing at a CAGR of 4.53% during the forecast period (2024-2029).

The COVID-19 pandemic negatively affected the rubidium demand. The biomedical research sector is adversely affected because of the pandemic, which slowed down new advancements in biopharmaceutical technology. The rubidium market recovered from the pandemic and is growing significantly.

Key Highlights

- Over the short term, the primary factor driving the growth of the market studied is its growth in biomedical research applications.

- However, apart from transportation and storage-related safety difficulties, availability and high cost are two challenges expected to impact the market studied significantly.

- Nevertheless, the growing significance of the rubidium atomic clocks is a significant growth opportunity for the rubidium market over the forecast period.

- North America is expected to be the largest rubidium market due to the large-scale production in the region.

Rubidium Market Trends

Specialty Glass to Dominate the Market

- Speciality glasses, which constitute the leading market for Rubidium, are used in fibre optics telecommunications systems and night-vision devices. The carbonate (Rb2CO3) is used as an additive to these types of glass, reducing electrical conductivity and improving stability and durability.

- Rubidium carbonate is used to reduce electrical conductivity, which improves stability and durability in fibre optic telecommunications networks.

- According to the European Information Technology Observatory (EITO), telecommunications services generated revenue of around EUR 48.8 billion (USD 51.99 billion) in 2022, compared to EUR 48.4 billion (USD 51.57 billion) in 2021.

- According to The International Telecommunication Union (ITU), mobile subscribers will have exceeded 8.6 billion by 2021, compared to 8.3 billion in 2020.

- A rubidium-tellurium photoemissive surface is used in photoelectric cells and incorporated into various electronic detection and activation devices. It is sensitive to a broad spectrum of radiation from the mid-ultraviolet through the visible into the near-infrared.

- Rubidium carbonate is also applied in glass lenses and built-in night vision devices. Rubidium is used as a getter in vacuum tubes and as a photocell component. It is used in making special glasses.

- All the factors above are expected to drive specialty glass, enhancing the demand for Rubidium during the forecast period.

North America Accounted for the Largest Share

- North America holds a significant share of the rubidium market in terms of market share and revenue. The region will continue to flourish in its dominance over the forecast period.

- Rubidium was mainly extracted from salt lake brine in the United States, with Cabot as the leading company. Moreover, Canadian rubidium ore and rubidium salt production are in the world's top five.

- The Bernie Lake mining area in Lake Manitoba, Canada, supplies the raw materials to produce rubidium salt in the United States and other countries. The ore mined in this area is exported to several countries.

- The United States was one of the first countries to produce and use rubidium. In the United States, rubidium is mainly employed in the high-tech industry, with 80% used in creating high-tech and 20% used in traditional fields, such as electronic devices, special glass, and catalysts.

- However, data on consumption, export, and import are not available. According to industry data from the last decade, domestic consumption is around 2,000 kg per year. The United States entirely relied on imported rubidium materials used in different applications, such as electronics, healthcare, specialty glasses, etc.

- The US electronics market is the largest in the world in terms of size. Moreover, it is one of the leading potential zones for the market studied. Furthermore, it is expected to remain the top market over the forecast period due to the usage of advanced technology, increased number of R&D centers, and rising consumer demand.

- There is a significant demand for newer and faster electronic products due to the rapid pace of innovation, technology advancement, and R&D activities in the electronics industry.

- According to the Consumer Technology Association, the retail revenue of the consumer electronics (CE) market in the United States expanded steadily. Consumer electronics retail sales in the United States reached USD 505 billion in 2022. Smartphones were the goods with the highest retail revenue in the consumer electronics category, with USD 74.7 billion in 2022. Video streaming services came in second, followed by gaming software and services.

- Medical device companies in the United States are highly regarded globally for their innovative and high-technology products. The medical device industry relies on several sectors where the United States holds a competitive advantage, including microelectronics, telecommunications, instrumentation, and biotechnology.

- Thus, all the above factors will likely increase the rubidium market demand during the forecast period.

Rubidium Industry Overview

The rubidium market is consolidated, with the top companies capturing a significant market share globally. Some of the players in the market include American Elements, Sinomine Resource Group Co. Ltd, Jiangxi Special Motor Co. Ltd, Lepidico Ltd, Lithium Australia NL, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Biomedical Applications

- 4.1.2 Applications in Specialty Glass

- 4.2 Restraints

- 4.2.1 Availability and High Cost of Rubidium

- 4.2.2 Transportation and Storage-Related Safety Difficulties

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Production Process

- 5.1.1 Lepidolite

- 5.1.2 Pollucite

- 5.1.3 Other Production Processes

- 5.2 Application Sector

- 5.2.1 Biomedical Research

- 5.2.2 Electronics

- 5.2.3 Specialty Glass

- 5.2.4 Pyrotechnics

- 5.2.5 Other Application Sectors

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Elements

- 6.4.2 Ganfeng Lithium

- 6.4.3 International Lithium Corp.

- 6.4.4 Lepidico

- 6.4.5 Jiangxi Special Electric Motor

- 6.4.6 Lithium Australia

- 6.4.7 Merck Kgaa

- 6.4.8 Sinomine Resource Group

- 6.4.9 Thermo Fisher Scientific

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Significance for the Rubidium Atomic Clocks