|

市場調查報告書

商品編碼

1692463

公車受電弓充電器:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Bus Pantograph Charger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

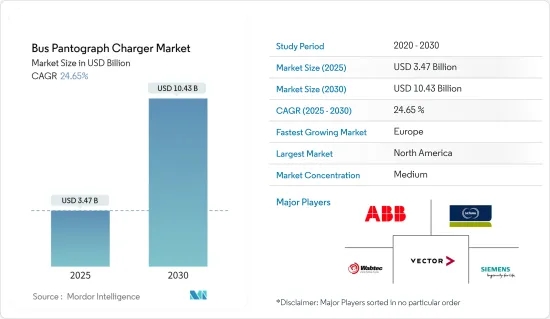

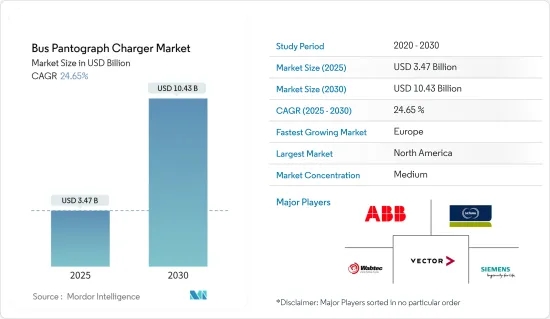

預計 2025 年公車受電弓充電器市場規模將達到 34.7 億美元,到 2030 年預計將達到 104.3 億美元,預測期內(2025-2030 年)的複合年成長率為 24.65%。

2020 年上半年,新冠疫情嚴重影響了公車受電弓充電器市場,封鎖和限制措施減少了交通運輸和其他相關產業的需求。此外,電動公車計劃的延遲和供應鏈中斷加劇了市場狀況。不過,大多數汽車製造商和電動車充電服務供應商已在有限產量和必要措施下重啟了受電弓充電器的生產。自 2020 年下半年以來,電動公車的銷售量大幅成長,預計在整個預測期內仍將持續成長。預計這將推動預測期內的市場成長。

從中期來看,由於世界主要國家擴大採用電動公車,不僅用於轉換,還用於接送學童,預計受電弓充電器的需求將會恢復。此外,預計在預測期內,政府投資的增加和對充電基礎設施發展的重視將推動市場需求。此外,各公司在充電站市場的新發展也有望推動成長。例如

主要亮點

- 2021年10月,澳洲領先的公車製造商Custom Denning選擇西門子提供其Sicharge UC管理解決方案和充電站。該技術目前正在測試中,將支援該製造商的下一代電動公車。它們的工作電壓高達 1,000 伏,功率範圍為 50 至 600 千瓦。

此外,主要企業的投資以及充電解決方案提供商和公車製造商之間日益成長的策略合作預計將為市場參與者提供新的機會。電池成本的下降推動了電動公車充電系統的使用激增。在預測期內,減少溫室氣體 (GHG)排放的力度不斷增加以及政府監管的加強可能會推動市場成長。

主要亮點

- 2022年6月,加拿大太平洋經濟發展署與不列顛哥倫比亞省交通和基礎設施部長合作,宣布了一項由聯邦政府共同資助的3.12億美元的投資計劃,以改善不列顛哥倫比亞省的公共交通服務。升級工程包括建造新的交通轉乘站和公車車隊進行電氣化改造。

由於北美地區主要國家擴大採用電動公車,預計預測期內北美將顯著成長。此外,由於政府、交通部門和其他社區和組織大力支持綠色汽車,預計中國和印度也將為亞太地區的成長做出貢獻。

主要亮點

- 2021 年 3 月,德里政府核准了提案,購買 300 輛新的低地板電動(AC)公車,以增加該市的公車隊數量。這些公車已被德里運輸公司接受。首批 118 輛公車預計於 2021 年 10 月抵達,另外 100 輛公車將於 11 月抵達。所有交付預計於 2022 年 1 月完成。

公車受電弓充電器的市場趨勢

越來越多的政府優先考慮環保公車

當今,柴油公車在世界各地被廣泛使用。此外,這些公車主要用於人口稠密的城市,這些城市的空氣品質由於其他污染物而已經很差。因此,世界各國政府正努力製定一系列旨在鼓勵環保交通的法規和支持政策。

在美國,美國環保署(EPA)和美國國家公路交通安全管理局(NHTSA)提案在2021年至2026年期間實施更安全、更經濟的節油汽車(SAFE)規則,該規則將為乘用車和商用車設定企業平均燃油經濟性和溫室氣體排放標準。根據零排放汽車 (ZEV) 計劃,OEM必須銷售一定數量的清潔、零排放汽車(電動、混合動力汽車和燃料電池商用車和乘用車)。中國的零排放汽車計畫的目標是到2030年道路上擁有1,200萬輛零排放汽車(包括公車)。

印度政府計劃在 2030 年實現 30% 的汽車銷量為電動車。作為該策略的一部分,政府宣布將在 2022 年前投資 14 億美元用於 FAME 計畫的第二階段。這一階段將重點放在透過補貼混合動力汽車輛電動公車來實現印度公共和共用交通的電氣化。這促使車隊營運商轉向使用電動公車。

此外,公共交通透過改善空氣品質和減少私家車多次出行的需要,促進了人口密集地區的城市永續性。由於這些優勢,世界各國政府都在積極推動永續、高效的公共巴士運輸服務,預計將為市場帶來正面的發展動能。例如,

- 2022年11月,倫敦公車業者Metroline宣布將購買39輛電動雙層巴士用於城際交通。這些巴士來自北愛爾蘭巴士製造商 Rightbeaus。這 39 輛公車將在倫敦布倫特區、伊靈區、哈羅區、巴尼特區以及倫敦北部剪切機的沃特福德運行 297 路和 142 號公車。該公車通過CCS的充電容量高達300kW,透過受電弓的充電容量高達420kW。

- 2022 年 3 月,一款尖端電動巴士概念車在義大利卡利亞裡亮相,巴士製造商 Lampini 已交付了訂單的七輛巴士中的第一輛。交付包括六輛配備受電弓的六公尺長電池電動公車。歐洲公車的這項新技術已被認可,並在中期內引起了極大的興趣。

北美可能是成長最快的市場

預計預測期內北美將在市場成長中發揮關鍵作用。此外,由於美國政府的多項舉措以及電動校車在全國範圍內的日益普及,美國很可能成為該地區成長的主要貢獻者之一。全部區域對電動公車的需求預計將受到政府、市政當局等越來越多採用電動公車的支持。例如

- 2021年6月,紐約電力局(NYPA)宣布完成一項價值3000萬美元的契約,將在全市各個車站安裝67個受電弓充電機,為該市的電動公車車隊充電。

- 2021 年 3 月,馬裡蘭州蒙哥馬利縣公立學校核准與 Highland Electric Transportation 簽訂合約。根據協議,Highland Electric Transportation 及其合作夥伴 Thomas Built Bus、Proterra 和 American Bus 將為蒙哥馬利縣公立學校區的所有五個公車站通電,並提供電動公車和充電基礎設施。

此外,隨著向電動車轉型的持續進行,加拿大政府也致力於在全國範圍內打造淨零排放運輸產業。例如

- 2021 年 3 月,基礎設施和社區部以及創新、科學和工業部宣布從 2021 年開始的五年內撥款 27.5 億加元(約合 20.2 億美元),用於改善公共交通系統和向綠能過渡,包括購買零排放公共交通和校車的資金。

北美地區如此強勁的成長勢頭正鼓勵電動公車基礎設施計劃中的幾家主要企業和企業採用受電弓,從而推動預測期內對公車受電弓充電器的需求。例如

- 2022年3月,ABB宣布將為聖路易斯的新型電動公車車隊提供服務,該市擁有美國最大的充電樁部署。 ABB 的順序充電系統由 20 個功率為 150kW 的插入式車庫充電器和三個額外的受電弓充電器組成。

因此,案例上述發展情況,預計北美在預測期內將比其他地區經歷最快的成長。

客車受電弓充電機產業概況

公車受電弓充電器市場的主要企業包括 ABB 有限公司、Wabtec 公司、Schunk Transit Systems GmBH 和比亞迪。公車受電弓充電器市場適度整合,由幾個全球和區域參與者主導。產品創新、合資企業、收購小型公司和產品發布是主要企業部署的關鍵策略。此外,世界各地的政府舉措也支持市場成長。例如,

- 2022 年 6 月,加拿大基礎設施銀行與達勒姆地區市政當局簽署了一份合作備忘錄,其中規定加拿大基礎設施銀行將投資高達 5,310 萬美元,以支持達勒姆地區交通局 (DRT) 的採購訂單。運輸車隊電氣化舉措是該地區在未來25年履行氣候變遷承諾的關鍵一步。

- 2021 年 12 月,柏林交通管理局 (BVG)審核核准再購買 90 輛電動公車。這些車輛長 12 米,配備單個電池,可在車庫充電,這將增加未來幾年將在全國範圍內使用的受電弓充電系統的需求。

上述電動公車的發展可能會進一步刺激對電動公車充電站的需求。除了這些策略之外,公車受電弓充電機還與主要公車製造商和充電站提供商簽署了供貨協議,以加強其市場地位。例如

- 2022 年 12 月,Solaris Bus & Coach Sp. z oo 簽署協議,向拉脫維亞營運商 Rgas Satiksme 供應 35 輛 Solaris Urbino 12 電動公車。這些公車將配備容量為 140 kWh 的 Solaris 高能量電池,透過插入式連接器和反向受電弓充電。該公車還將配備 eSConnect 系統,用於管理零排放公車車隊。該軟體由 Solaris 專家創建,不僅可以即時存取車輛數據,還可以識別可能發生的任何故障。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按充電類型

- 1級

- 2級

- 直流快速充電

- 依零件類型

- 硬體

- 軟體

- 按充電基礎設施類型

- 離機自上而下受電弓

- 機載自下而上的受電弓

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 韓國

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- ABB Ltd

- Schunk Transit Systems GmBH

- Wabtech Corporation

- Siemens Mobility

- Vector Informatik GmbH

- SETEC Power

- SCHUNK GmbH & Co. KG

- Valmont Industries, Inc.

- Comeca Group

第7章 市場機會與未來趨勢

The Bus Pantograph Charger Market size is estimated at USD 3.47 billion in 2025, and is expected to reach USD 10.43 billion by 2030, at a CAGR of 24.65% during the forecast period (2025-2030).

COVID-19 has severely affected the bus pantograph charger market for the first half of the year 2020, as lockdowns and restrictions resulted in reduced demand from transportation and other associated sectors. Furthermore, delays in electric bus projects and supply chain disruptions worsened the situation in the market. However, the majority of the automakers and EV charging providers resumed pantograph charger production with limited production and necessary measures. The sales of electric buses witnessed significant growth since the latter half of the year 2020 and are likely to continue during the forecast period. This is anticipated to drive the market in focus during the forecast period.

Over the medium term, the demand for pantograph chargers is expected to be picked up by the growing adoption of electric buses, not only for transit but also for school children's transportation across major countries in the world. Furthermore, growing government investments and their focus on improving charging infrastructure are expected to drive demand in the market during the forecast period. Moreover, a new development in the charging station market by the companies is also expected to support the growth. For instance,

Key Highlights

- In October 2021, Custom Denning, one of Australia's leading bus manufacturers, chose Siemens to provide its Sicharge UC management solution and charging stations. The technology, which is currently being tested, will aid the manufacturer's upcoming electric buses. It can operate at up to 1,000 volts and has a power range of 50 to 600 kW.

In addition, investments from the key players and growing strategic collaborations between charging solution providers and bus manufacturers are anticipated to offer new opportunities for players operating in the market. There is a surge in the utilization of electric bus charging systems owing to the decreasing cost of batteries. The growing efforts to reduce greenhouse gas (GHG) emissions, along with the rise in favorable government regulations, are likely to enhance the growth of the market over the forecast period. For instance,

Key Highlights

- In June 2022, the Pacific Economic Development Agency of Canada, in collaboration with British Columbia's Minister of Transportation and Infrastructure, announced a USD 31,2 million investment plan under their joint federal funding for improving public transportation services in British Columbia. The upgrade includes the construction of new transit interchanges as well as the electrification of the bus fleet.

North American region is expected to grow at a significant rate during the forecast period owing to the rising adoption of electric buses across major countries in the region. Furthermore, China and India are expected to contribute to growth in the Asia-Pacific region owing to strong encouragement from the governments, transit agencies, as well as other green vehicle-supporting communities and organizations.

Key Highlights

- In March 2021, the Delhi government approved a proposal to purchase 300 new low-floor electric (AC) buses to increase the city's bus fleet. These buses have been accepted by the Delhi Transport Corporation. The first batch of 118 buses was scheduled to arrive in October 2021, with another 100 following in November. The entire delivery was supposed to be finished by January 2022.

Pantograph Bus Charger Market Trends

Rising Emphasis of Government on Eco-Friendly Buses

Diesel buses are widely used today all over the world. Furthermore, these buses are mostly used in densely populated cities, where air quality has already been degraded by other pollutants. As a result, governments across the world are focusing on developing a variety of regulations and supportive policies aimed at encouraging environmentally friendly transportation.

The EPA and NHTSA in the United States proposed implementing the Safer Affordable Fuel-Efficient (SAFE) vehicles rule from 2021 to 2026. The rule may establish corporate average fuel economy and greenhouse gas emissions standards for passenger and commercial vehicles. OEMs are required to sell a certain number of clean and zero-emission vehicles (electric, hybrid, and fuel cell-powered commercial and passenger vehicles) under the Zero-emission Vehicles (ZEV) Program. The country's ZEV plan aims to put 12 million ZEVs (including buses) on the road by 2030.

The Indian government intends to electrify 30% of total vehicle sales by 2030. As part of this strategy, the government announced a USD 1.4 billion investment in phase two of the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) program through 2022. This phase focuses on electrifying public and shared transportation in India by subsidizing 7090 electric buses. This has prompted fleet operators to switch to electric buses.

Moreover, by improving air quality, public transportation contributes to the sustainability of a city in dense urban areas, reducing the need for multiple separate trips by private vehicle. Because of these advantages, governments around the world are actively promoting sustainable and efficient public bus transportation services, which are expected to create positive momentum in the market. For instance,

- In November 2022, Metroline, a potential London bus operator, announced the purchase of 39 electric double-decker buses for intercity transit. Wrightbius, a Northern Irish bus manufacturer, procured these buses. These 39 buses are expected to travel through the London boroughs of Brent, Ealing, Harrow, and Barnet, as well as Watford in Hertfordshire, north of London, on the 297 and 142 routes. The buses have charging capabilities of up to 300 kW via CCS or 420 kW via pantographs.

- In March 2022, a cutting-edge electric bus concept was unveiled in Cagliari, Italy, where bus manufacturer Rampini delivered the first of seven vehicles ordered. The delivery consists of six 6-meter battery-electric buses with pantographs. This new technology in European buses has been identified, and it has generated a lot of interest in the medium term.

North America Likely to Have Fastest Growth in the Market

North America is expected to play a key role in the growth of the market over the forecast period. Furthermore, the United States is likely to be one of the major contributors to growth in the region, owing to several government initiatives and the growing popularity of electric school buses across the country. The demand for electric buses across the North American region is anticipated to be supported by the growing adoption of governments, municipalities, etc. For instance,

- In June 2021, the New York Power Authority (NYPA) announced the completion of a USD 30 million agreement to install 67 pantograph chargers across various stations in the city to charge the city's electric bus fleet.

- In March 2021, the Montgomery County Public School system in Maryland approved a contract with Highland Electric Transportation to convert its school bus fleet to a fully electric fleet, beginning with converting 326 school buses through 2025. Based on the contract, Highland Electric Transportation and its partners, Thomas Built Buses, Proterra, and American Bus, will electrify all five bus depots belonging to the Montgomery County Public School district and supply electric buses and charging infrastructure.

Moreover, with the increasing transition to electric mobility, the Canadian government is also working to build a net-zero emissions transportation industry across the country. For instance,

- In March 2021, the Infrastructure and Communities Ministry and the Ministry of Innovation, Science, and Industry announced CAD 2.75 billion (~USD 2.02 billion) in funding over five years, beginning in 2021, to improve public transportation systems and transition them to cleaner electrical power, including funding for the purchase of zero-emission public transportation and school buses.

Such active growth in the North American region is encouraging several key players and the players in electric bus infrastructure projects to adopt pantographs, thus driving demand for bus pantograph chargers over the forecast period. For instance,

- In March 2022, ABB announced that it is offering its services to St. Louis's new electric bus fleet with the largest deployment of chargers in the United States. ABB's sequential charging system consists of 20 plug-in depot chargers with 150 kW of power and three additional pantograph chargers.

Therefore, based on the above-mentioned developments and instances, it is estimated that the North American region is likely to have the fastest growth compared to its counterparts over the forecast period.

Pantograph Bus Charger Industry Overview

Some of the leading electric bus charging infrastructure market players are ABB Ltd., Wabtec Corporation, Schunk Transit Systems GmBH, BYD, and others. The bus pantograph charger market is moderately consolidated and accounts for several global and regional players. Product innovation, joint ventures, acquisitions of smaller players, and product launches are the key strategies deployed by the major players. Moreover, initiatives taken by various governments across the world are also supporting the growth of the market. For instance,

- In June 2022, a Memorandum of Understanding was signed between the Canada Infrastructure Bank and the Regional Municipality of Durham, which concluded that CIB would invest up to USD 53.1 million to support Durham Region Transit's (DRT) purchase order, which included 100 battery-electric buses to be delivered to Durham by the end of 2027. The initiative to electrify transit vehicles is a critical step toward meeting the region's climate change commitments over the next 25 years.

- In December 2021, the Berliner Verkehrsbetriebe (BVG) supervisory board approved the purchase of 90 more electric buses. The vehicles are 12-meter-long battery monoplanes that will be charged in the depot, increasing demand for pantograph charging systems to be used across the country in the coming years.

The above-mentioned development in electric buses may further boost the requirement for charging stations for electric buses. Apart from these strategies, bus pantograph chargers are entering into supply agreements with key bus manufacturers and charging station providers to strengthen their position in the market. For instance,

- In December 2022, Solaris Bus & Coach Sp. z o.o. has agreed to supply 35 Solaris Urbino 12 electric buses to Latvian operator Rgas Satiksme. These buses are expected to have Solaris High Energy batteries with a capacity of 140 kWh that will be charged via a plug-in connector as well as an inverted pantograph. The buses will also include an eSConnect system for managing zero-emission bus fleets. This software, created by Solaris experts, provides real-time access to vehicle data as well as the identification of any faults as they occur.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD Million)

- 5.1 By Charging Type

- 5.1.1 Level 1

- 5.1.2 Level 2

- 5.1.3 Direct Current Fast Charging

- 5.2 By Pcomponent Type

- 5.2.1 Hardware

- 5.2.2 Software

- 5.3 By Charging Infrastructure Type

- 5.3.1 Off-board top-down pantograph

- 5.3.2 On-Board Bottom-Up Pantograph

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 South Korea

- 5.4.3.4 Japan

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Aegentina

- 5.4.4.3 Rest of the South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of the Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 ABB Ltd

- 6.2.2 Schunk Transit Systems GmBH

- 6.2.3 Wabtech Corporation

- 6.2.4 Siemens Mobility

- 6.2.5 Vector Informatik GmbH

- 6.2.6 SETEC Power

- 6.2.7 SCHUNK GmbH & Co. KG

- 6.2.8 Valmont Industries, Inc.

- 6.2.9 Comeca Group