|

市場調查報告書

商品編碼

1519864

輕型車:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Lightweight Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

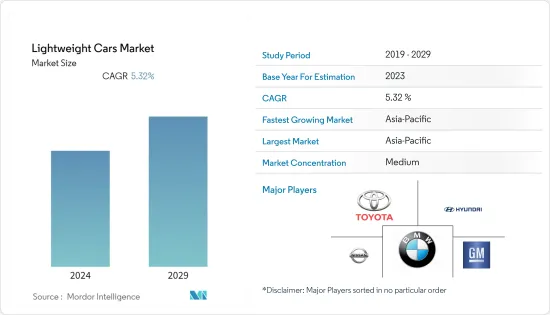

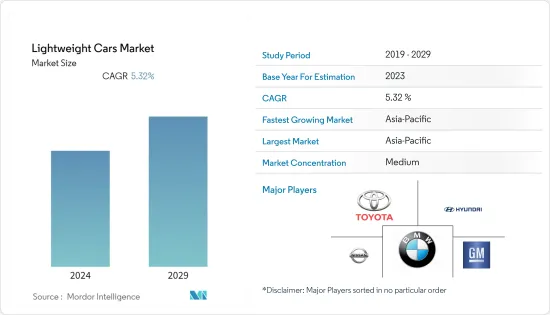

輕型車市場規模預計將從2024年的737.2億美元成長到2029年的979.5億美元,預測期間(2024-2029年)複合年成長率為5.32%。

輕型車市場是全球汽車產業重要且發展的部分。該市場重點關注採用可減輕總重量的材料和技術設計的車輛,從而提高燃油經濟性、性能和環境影響。

燃油效率和排放法規的提高是輕型車市場的主要驅動力。世界各國政府正在實施更嚴格的排放標準以應對氣候變化,鼓勵製造商生產更輕、更省油的汽車。這種監管環境與消費者所尋求的績效利益密切相關。

此外,更輕的車輛可提供改進的動態性能,例如更好的加速和操控性,從而吸引了重視高性能駕駛體驗的細分市場。此外,技術進步也扮演重要角色。材料科學和工程的進步使製造商能夠在不影響安全性或功能的情況下減輕車輛重量,從而滿足監管和消費者的需求。

北美、歐洲和亞太地區等地區因其獨特的監管、經濟狀況和消費趨勢而處於輕型車市場的前沿。例如,歐洲有嚴格的排放氣體法規,是輕型車技術的主要推動者。總的來說,這些區域市場正在為全球轉向更輕、更有效率的車輛做出貢獻。

輕型車市場趨勢

對輕型車的需求增加

輕型車市場發展迅速,主要得益於輕型車的需求不斷增加。該部門專注於透過先進材料和設計技術減輕車輛重量,以提高燃油效率、性能並減少對環境的影響。向輕量化汽車的轉變是為了響應永續性、技術進步和不斷變化的消費者偏好的全球趨勢。

此外,更嚴格的全球排放法規和燃油效率日益重要是輕型車市場的主要驅動力。隨著世界各國政府實施減少溫室氣體排放的政策,輕量化正成為關鍵策略。與重型車輛相比,輕型車輛消費量的燃料更少,排放的污染物也更少,這使得它們在環境法規嚴格的市場中更具吸引力。

新興市場的開拓和高強度鋼、鋁、鎂和碳纖維等材料的採用是輕型車市場的核心。此外,製造和設計方面的技術創新,例如電腦輔助工程和3D列印,使得輕質材料的使用更加精確和高效,進一步推動市場成長。

電動和混合動力汽車的興起也是輕型車市場的主要動力。輕量化對於這些車輛最大限度地提高續航里程和效率至關重要,因此輕量化設計成為電動車 (EV) 和混合技術的基本要素。這一趨勢正在推動對專為電動和混合動力汽車客製化的輕量材料和設計的投資和創新的增加。

這一趨勢導致了對專門針對電動和混合動力汽車的輕質材料和設計的投資和創新的增加。該市場預計將持續成長和創新,因為它在向更永續和更有效率的運輸解決方案的更廣泛轉變中發揮關鍵作用。

亞太地區主導市場

亞太地區經濟充滿活力,汽車產業快速發展,在全球輕型車市場中發揮著舉足輕重的作用。該地區的特點是在中國、日本、印度和韓國等國家的推動下,汽車產量和消費量較高。

輕型車領域專注於減輕品質以提高燃油效率和性能的車輛,受各種市場力量和技術創新的影響,該領域正在經歷顯著成長。

亞太地區經濟格局的特點是強勁成長,尤其是中國和印度等新興經濟體。這種成長導致購買力增強和中階不斷壯大,從而推動了對汽車(包括輕型汽車)的需求。該地區的經濟擴張不僅涉及汽車銷量的增加,還包括增加對汽車研發的投資,重點是輕質材料和技術。

亞太地區的公司也正在投資研發,以創造不損害車輛安全或性能的創新減重解決方案。這包括製造流程的進步以及將輕質部件整合到車輛設計中。

豐田、本田、現代、塔塔汽車等亞太地區主要汽車製造商正在大力投資輕型車市場。除了開發新車型外,這些公司還與材料供應商和技術公司合作,推動輕型車技術。

這些合作對於推動創新和降低與輕質材料和技術相關的成本至關重要。

輕型車產業概況

輕型車市場已整合,輕型車市場的主要企業包括豐田汽車公司、日產汽車公司、起亞汽車公司、現代汽車公司和福特馬達公司。

汽車製造商主要控制輕型車市場。我們也與主要複合材料製造公司建立了長期合作關係。由於需要永續性和低排放氣體來保護環境,許多OEM正在引入電動車作為模型。該行業正在尋求投資和開發具有最佳性能和續航里程組合的電動車。例如

- 2023年12月,豐田歐洲宣布計畫推出與比亞迪共同開發的新型電動運動跨界車。此次推出預計將在未來幾年內推出,是豐田到 2026 年在歐洲擴大電動和低排放氣體汽車產品組合的更廣泛策略的一部分。

- 這項舉措符合豐田對永續交通的承諾,也是其向歐洲市場推出各種環保汽車的重要一步。與比亞迪的合作凸顯了豐田利用合作夥伴關係來推進其輕型電動車技術和產品陣容的方法。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 技術創新和材料進步可能會推動需求

- 市場限制因素

- 輕量材料的高成本預計將限制市場成長潛力

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔:市場規模(單位:美元)

- 車型

- 客車

- 跑車

- 材料種類

- 玻璃纖維

- 碳纖維

- 高強度鋼

- 其他材料

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Toyota Motor Corporation

- Volkswagen

- Ford Motor Company

- Hyundai Motor Co.

- Nissan Motor Co. Ltd

- General Motors Company

- Honda Motor Co. Ltd

- Kia Motors Corporation

- Ferrari SpA

- Lamborghini SpA

第7章 市場機會及未來趨勢

The Lightweight Cars Market size in terms of Equal-5.32 is expected to grow from USD 73.72 billion in 2024 to USD 97.95 billion by 2029, at a CAGR of 5.32% during the forecast period (2024-2029).

The lightweight material market represents a significant and evolving segment of the global automotive industry. This market focuses on vehicles designed with materials and technologies that reduce overall weight, leading to improvements in fuel efficiency, performance and environmental impact.

The push for fuel efficiency and emission regulations is a primary driver of the lightweight car market. Governments worldwide are imposing stricter emission standards to combat climate change, incentivizing manufacturers to produce lighter, more fuel-efficient vehicles. This regulatory landscape is intricately connected to performance benefits sought by consumers.

Furthermore, lighter vehicles offer enhanced dynamics like better acceleration and handling, appealing to a segment of the market that values a high-performance driving experience. Additionally, Technological Advancements play a crucial role. Developments in material science and engineering have enabled manufacturers to reduce vehicle weight without compromising on safety or functionality, thus addressing both regulatory and consumer demands.

Regions like North America, Europe and Asia-Pacific are at the forefront of the lightweight car market each influenced by their specific regulatory, economic and consumer landscapes. Europe, for instance, with its stringent emission regulations has been a significant driver of lightweight vehicle technology. These regional markets collectively contribute to a global movement towards lighter more efficient vehicles.

Lightweight Cars Market Trends

Increasing Demand for Lightweight Passenger Cars

The lightweight vehicle market is rapidly evolving primarily driven by the increasing demand for lightweight passenger cars. This segment focuses on reducing vehicle weight through advanced materials and design techniques to enhance fuel efficiency, performance and reduce environmental impact.The shift towards lightweight vehicles is a response to global trends in sustainability, technological advancements and changing consumer preferences.

Furthremore, stricter global emission standards and the rising importance of fuel efficiency are significant drivers of the lightweight vehicle market. Governments worldwide are implementing policies to reduce greenhouse gas emissions leading to a focus on lightweighting as a key strategy.As lightweight vehicles consume less fuel and emit fewer pollutants compared to heavier counterparts making them increasingly attractive in markets with stringent environmental regulations.

The development and adoption of advanced materials such as high-strength steel, aluminum, magnesium and carbon fiber are central to the lightweight car market. These materials offer the necessary strength and durability while significantly reducing vehicle weight.Moreover, technological innovations in manufacturing and design, such as computer-aided engineering and 3D printing, have enabled more precise and efficient use of lightweight materials, further driving market growth.

Also, the rise of electric and hybrid vehicles has been a major catalyst for the lightweight vehicle market. In these vehicles, reducing weight is crucial for maximizing range and efficiency, making lightweight design an essential aspect of electric vehicle (EV) and hybrid technology.This trend has led to increased investment and innovation in lightweight materials and design specifically tailored for electric vehicle and hybrid vehicles.

The market is poised for continued growth and innovation playing a crucial role in the broader shift towards more sustainable and efficient transportation solutions.

Asia Pacific Region is Dominating the Market

The Asia-Pacific region with its dynamic economies and rapidly evolving automotive sector plays a pivotal role in the global lightweight car market. This region is characterized by its significant automotive production and consumption, driven by countries like China, Japan, India, and South Korea.

The lightweight car segment, focusing on vehicles designed with reduced mass for enhanced fuel efficiency and performance, is seeing substantial growth in this region, influenced by various market forces and technological innovations.

Asia-Pacific's economic landscape is marked by robust growth particularly in emerging economies such as China and India. This growth has led to increased purchasing power and a growing middle class which in turn fuels demand for automobiles, including lightweight vehicles.The region's economic expansion is not just limited to increased vehicle sales but also encompasses growing investments in automotive research and development, focusing on lightweight materials and technologies.

Moreover, the region is witnessing significant advancements in automotive technologies with a strong focus on developing lightweight materials such as high-strength steel, aluminum, magnesium and carbon fiber.Also, companies in Asia-Pacific are investing in research and development to create innovative lightweight solutions that do not compromise vehicle safety or performance. This includes advancements in manufacturing processes and the integration of lightweight components into vehicle design.

Major automotive players in the Asia-Pacific region such as Toyota, Honda, Hyundai, and Tata Motors are heavily invested in the lightweight car market. These companies are not only developing new models but also collaborating with material suppliers and technology firms to advance lightweight automotive technologies.

These collaborations are essential in driving innovation and reducing the costs associated with lightweight materials and technologies making them more accessible and viable for mass-market vehicles resulting in drive the growth of the market.

Lightweight Cars Industry Overview

Lightweight Cars Market is consolidated, some of the major players in the lightweight car market are Toyota Motor Corporation, Nissan Motor Co. Ltd, Kia Motors Corporation, Hyundai Motor Co., and Ford Motor Company.

Auto manufacturers majorly dominate the market for lightweight cars. They also have a long-standing partnership with major composite manufacturing companies. With the need for sustainability and lower emissions to protect the environment, many OEMs are releasing electric vehicles on their models. The industry is looking to invest in and develop electric vehicles with the best combination of performance and a long travel range. For instance,

- In December 2023, Toyota Europe has announced plans to roll out a new electric vehicle a Sport Crossover developed in collaboration with BYD. This launch, expected within the next few years is part of Toyota's broader strategy to expand its electric and low-emission vehicle portfolio in Europe by 2026.

- This initiative aligns with the company's commitment to sustainable transportation and marks a significant step in its efforts to introduce a diverse range of environmentally friendly vehicles to the European market. The collaboration with BYD underscores Toyota's approach to leveraging partnerships in advancing its light electric vehicle technology and offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Technological Innovations and Material Advancements is Likely to Fuel Demand

- 4.2 Market Restraints

- 4.2.1 High Cost of Lightweight Materials is Anticipated to Restrict the Market Growth Potential

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD)

- 5.1 Car Type

- 5.1.1 Passenger Cars

- 5.1.2 Sports Cars

- 5.2 Material Type

- 5.2.1 Glass Fiber

- 5.2.2 Carbon Fiber

- 5.2.3 High-strength Steel

- 5.2.4 Other Material Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Toyota Motor Corporation

- 6.2.2 Volkswagen

- 6.2.3 Ford Motor Company

- 6.2.4 Hyundai Motor Co.

- 6.2.5 Nissan Motor Co. Ltd

- 6.2.6 General Motors Company

- 6.2.7 Honda Motor Co. Ltd

- 6.2.8 Kia Motors Corporation

- 6.2.9 Ferrari SpA

- 6.2.10 Lamborghini SpA