|

市場調查報告書

商品編碼

1519898

混合動力解決方案的全球市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Hybrid Power Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

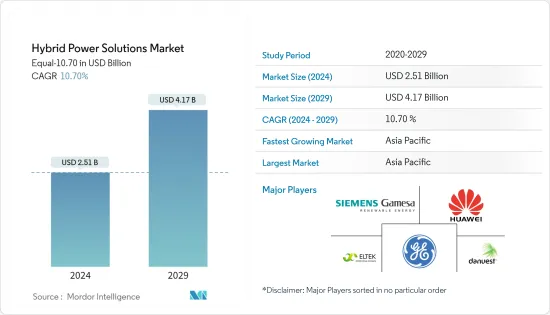

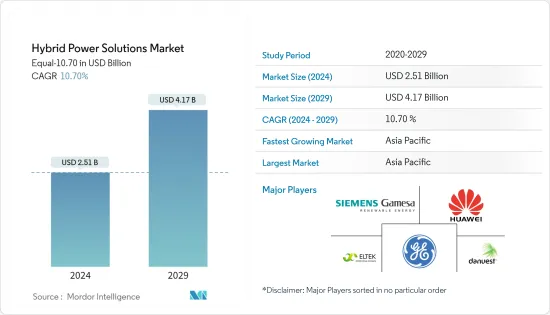

預計2024年全球混合動力解決方案市場規模將達25.1億美元,2024年至2029年複合年成長率為10.70%,2029年將達41.7億美元。

主要亮點

- 從中期來看,對碳排放和支持性政府政策的日益擔憂預計將推動預測期內的市場研究。

- 另一方面,高初始資本投資預計將阻礙預測期內的市場成長。

- 然而,世界各地正在進行的都市化活動預計將為混合動力解決方案市場創造巨大的機會。

- 由於能源需求的增加以及該地區基礎設施開發活動的活性化,預計亞太地區將成為市場的主導區域。

混合動力解決方案市場趨勢

太陽能發電機混合領域主導市場

- 由於戰略優勢和不斷發展的太陽能市場動態的融合,太陽能發電機混合市場預計將在混合動力解決方案市場佔據主導地位。造成這種主導地位的主要因素是對環境問題的高度關注和監管的需要。

- 太陽能發電機混合代表了可再生太陽能和輔助電源的融合,幫助產業應對日益成長的生態問題和嚴格的環境法規。積極配合此類永續實踐已成為尋求提高太陽能混合發電機市場競爭力和加強企業社會責任的公司的重要工具。

- 根據能源研究所《2023年世界能源統計回顧》,自2012年以來,太陽能發電量大幅增加。 2022年,全球太陽能發電總量將為1,322.6兆瓦瓦時,比2021年成長近25%,2012年至2022年年成長率約為29%,顯示出能源的顯著成長。

- 此外,太陽能發電機混合的多功能性為不同的工業和家庭部門注入了多方面的效用。它在偏遠地區和離網地區的適應性,以及電網整合和需求面管理的潛力,使其成為解決能源取得差異和電網穩定性問題的重要解決方案。

- 例如,2022年4月,阿特拉斯科普柯宣布推出一系列新的能源儲存系統,可與光電混合系統和柴油發電機結合。這些可以部署在沒有常規電網的偏遠地區。

- 因此,如上所述,在預測期內,太陽能發電機混合領域的需求預計將主導混合發電系統市場。

亞太地區主導市場

- 亞太地區在混合動力解決方案市場中的新興主導地位是多維市場動態和戰略要求的頂峰。植根於區域能源消費模式的策略要求證實了預期的優勢。亞太地區經濟體的快速都市化、工業擴張和電力需求的增加正在推動對永續和多樣化能源來源的需求。

- 混合動力解決方案最佳化能源效率和增強可再生資源的能力與該地區的能源安全目標和資源限制具有協同效應,凸顯了其重要性。

- 此外,監管支持和市場獎勵也鞏固了該地區的主導地位。政府倡導可再生能源整合和排放的舉措,加上有利的政策框架和財政獎勵,促進了混合動力解決方案的採用。

- 例如,印度有一個雄心勃勃的目標,即到 2030 年安裝近 500 吉瓦的可再生能源容量,其中大部分預計來自太陽能。在成本下降和政府支持措施的支持下,這正在推動該國太陽能產業的成長。

- 中國的目標是到2025年將非化石能源消費比重提高到20%,到2030年提高到25%。我們也計劃在2030年安裝超過1,200吉瓦的風能和太陽能發電設備。這些新興市場的開拓預計將推動混合動力解決方案市場的需求。

- 該地區強大的創新生態系統,加上廣泛的研發舉措,有望加速混合動力解決方案的進步。亞太地區正在成為尖端混合技術的熔爐,因為當地的創新創造了更高的系統效率、更高的可靠性和成本競爭。

- 因此,隨著電力需求持續成長,加上可再生能源整合和混合動力系統創新,亞太地區預計將成為整個預測期內最重要、成長最快的混合動力解決方案市場。

混合動力解決方案產業概覽

混合動力解決方案市場已減少一半。該市場的主要企業(排名不分先後)包括西門子歌美颯再生能源公司、通用電氣公司、華為投資控股公司、Eltek Ltd、Danvest BV等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 人們對環境問題的興趣日益濃厚

- 政府扶持政策

- 抑制因素

- 初始資本投資高

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 作品

- 太陽能加發電機

- 風力發電機

- 太陽能+風力+發電機

- 其他類型

- 最終用戶

- 商業/工業

- 住宅

- 公共產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 南非

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟和協議

- 主要企業策略

- 公司簡介

- Siemens Gamesa Renewable Energy SA

- General Electric Company

- Huawei Investment & Holding Co. Ltd

- Eltek Ltd

- Danvest BV

- Engie SA

- Silver Power Systems

- SMA Solar Technology AG

- Vergnet SA

第7章 市場機會及未來趨勢

- 都市化進程

簡介目錄

Product Code: 61057

The Hybrid Power Solutions Market size in terms of Equal-10.70 is expected to grow from USD 2.51 billion in 2024 to USD 4.17 billion by 2029, at a CAGR of 10.70% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the increasing concerns over carbon emissions and supportive government policies are expected to drive the market studied during the forecast period.

- On the other hand, high initial capital investments are expected to hinder the growth of the market studied during the forecast period.

- Nevertheless, the ongoing urbanization activities across the globe are expected to create huge opportunities for the hybrid power solutions market.

- The Asia-Pacific region is expected to be a dominant region for the market due to the increasing energy demand coupled with increasing infrastructure developmental activities in the region.

Hybrid Power Solutions Market Trends

Solar Generator Hybrid Segment to Dominate the Market

- The projected ascendancy of the solar generator hybrid segment within the hybrid power solutions market originates from the convergence of strategic advantages and evolving solar energy market dynamics. The primary factor driving the dominance is the height of environmental concerns and regulatory imperatives.

- Solar generator hybrids epitomize the amalgamation of renewable solar energy with auxiliary power sources, aiding the industry's response to mounting ecological concerns and stringent environmental regulations. This proactive alignment with sustainable practices augments the marketability of solar generator hybrids and positions them as pivotal instruments for corporations seeking to fortify their corporate social responsibility endeavors.

- According to the Energy Institute Statistical Review of World Energy 2023, the electricity generated from solar energy has constantly increased significantly since 2012. The total electricity generated through solar energy globally in 2022 was 1322.6 terawatt hours, an increase of almost 25% compared to 2021, while an annual growth rate between 2012 and 2022 was recorded at around 29%, signifying the significant growth of solar energy in recent years.

- Moreover, the versatility of solar generator hybrids instills in them a multifaceted utility across diverse industrial and domestic sectors. Their adaptability in remote and off-grid contexts, coupled with the potential for grid integration and demand-side management, positions them as a critical solution for addressing energy access disparities and grid stability concerns.

- For instance, in April 2022, Atlas Copco launched its new series of energy storage systems that can be coupled with solar energy hybrid system diesel generator power systems. These can be deployed in remote locations that do not have access to regular grid supply.

- Therefore, as discussed above, the demand for the solar generator hybrid segment is expected to dominate the hybrid power systems market during the forecast period.

Asia-Pacific to Dominate the Market

- The burgeoning dominance of the Asia-Pacific region in the hybrid power solution market emerges as a culmination of multifaceted market dynamics and strategic imperatives. Strategic imperatives routed in regional energy consumption patterns substantiate the anticipated dominance. Rapid urbanization, industrial expansion, and growing electricity demand within the Asia Pacific economies collectively amplify the need for sustainable and diversified energy sources.

- The capacity of hybrid power solutions to optimize energy efficiency and hardness renewable resources synergizes with the region's energy security goals and resource constraints, substantiating their paramount significance.

- Furthermore, regulatory support and market incentives fortify the region's leadership position. Government initiatives advocating for renewable energy integration and emissions reduction coupled with favorable policy frameworks and financial incentives catalyzed the adoption of hybrid power solutions.

- For instance, India has set up an ambitious target of installing nearly 500 GW of renewable capacity by 2030, a large share of which is expected to come from solar energy. This has propelled the growth of the country's solar sector, which falling costs and supportive government incentives have buoyed.

- China strives to increase the share of non-fossil energy consumption to 20% by 2025 and 25% by 2030. The country also aims to install more than 1200 GW of wind and solar power capacities by 2030. Such developments are anticipated to drive the demand for the hybrid power solutions market.

- The region's robust ecosystem for technological innovation, coupled with the proliferation of research and development initiatives, is poised to yield accelerated advancements in hybrid power solutions. As local innovation begets superior system efficiency, enhanced reliability, and cost competitiveness, the Asia-Pacific region emerges as a crucible for fostering cutting-edge hybrid technologies.

- Therefore, with ever-increasing power demand coupled with the integration of renewable energy and innovation in hybrid power systems, Asia-Pacific is expected to be the most significant and fastest-growing hybrid power solutions market throughout the forecast period.

Hybrid Power Solutions Industry Overview

The hybrid power solutions market is semi-fragmented. Some of the key players in this market (in no particular order) are Siemens Gamesa Renewable Energy SA, General Electric Company, Huawei Investment & Holding Co. Ltd, Eltek Ltd, and Danvest BV.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Environmental Concerns

- 4.5.1.2 Supportive Government Policies

- 4.5.2 Restraints

- 4.5.2.1 High Initial Capital Investment

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Configuration

- 5.1.1 Solar Plus Generator

- 5.1.2 Wind Plus Generator

- 5.1.3 Solar Plus Wind Plus Generator

- 5.1.4 Other Types

- 5.2 End-User

- 5.2.1 Commercial and Industrial

- 5.2.2 Residential

- 5.2.3 Utility

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Egypt

- 5.3.5.4 South Afrcia

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens Gamesa Renewable Energy SA

- 6.3.2 General Electric Company

- 6.3.3 Huawei Investment & Holding Co. Ltd

- 6.3.4 Eltek Ltd

- 6.3.5 Danvest BV

- 6.3.6 Engie SA

- 6.3.7 Silver Power Systems

- 6.3.8 SMA Solar Technology AG

- 6.3.9 Vergnet SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Urbanization Activities

02-2729-4219

+886-2-2729-4219