|

市場調查報告書

商品編碼

1519899

水溶性薄膜:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Water Soluble Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

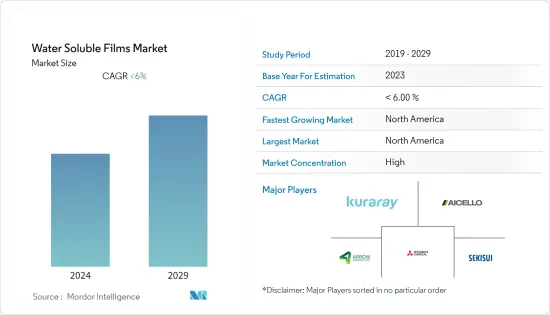

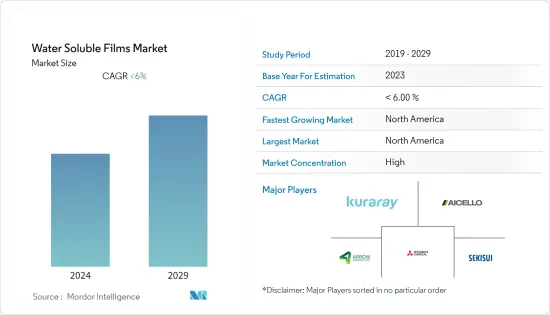

水溶性薄膜市場規模預計到2024年為4.3182億美元,預計到2029年將達到5.6544億美元,在預測期內(2024-2029年)複合年成長率將低於6%。

在 COVID-19 大流行期間,每個最終用戶群體都以不同的方式為市場做出了貢獻。由於對紡織品、複合成型等的依賴,水溶性薄膜市場受到了COVID-19的負面影響。另一方面,包裝、製藥和醫療保健行業正在為整體市場成長做出貢獻。

醫療保健領域對水溶性洗衣袋的需求不斷增加,以及對清潔劑和農藥包裝應用的需求迅速增加,預計將推動市場成長。

另一方面,與吸水性相關的限制,例如加工困難和品質不穩定,預計將阻礙市場成長。

加強遏制塑膠污染的法規預計將成為未來市場成長的機會。

北美市場佔有率最高,而亞太地區預計在預測期內成長率最高。

水溶性薄膜市場趨勢

包裝產業主導市場

- 包裝是水溶性薄膜的主要最終用戶行業,因為它們具有出色的密封性和深拉性,同時完全溶於冷水。水溶性薄膜可生物分解性、無毒、非抑制性。

- 水溶性薄膜可用於洗衣精、清潔劑洗滌劑、清潔產品、泳池用品、殺蟲劑、染料、化學肥料、水泥、食品添加劑、魚飼料、種子、髒服裝類、馬桶塊、粉末清潔劑和液體清潔劑。用於包裝,例如。

- 水溶性薄膜具有優異的空氣阻隔性,並提供有效的防油性能。這些薄膜可以長時間保存食品並有助於保持新鮮。此外,水溶性薄膜在烹飪過程中賦予肉品鮮美的風味。

- 水溶性薄膜在染料、水泥添加劑和酵素的包裝中的使用越來越多,以最大限度地減少污染並在產品製造過程中提供一致的劑量。水溶性薄膜的使用簡化了混合過程,並且可以更準確地測量添加劑。

- 此外,水溶性薄膜將乾飼料(例如碎煮物和顆粒)封裝在整個碼頭釣具中。這種水溶性薄膜袋因其強度、高熔化速率以及「舔」和「黏」角的能力而成為流行趨勢,以形成用於流延的動態水溶性薄膜小包裹。水溶性薄膜袋可用於包裝深海釣魚的餌料和魚鉤,防止淺水區的魚類干擾,並在深海釣魚時吸引大魚。

- 水溶性薄膜的另一個主要用途是液體清潔劑的包裝。此應用使用水溶性薄膜包裝來提供單位劑量的液體清潔劑產品。液體清潔劑成分的活性濃縮物被包裝在水溶性薄膜中。

- 推動這個市場的因素是包裝中擴大使用環保材料。環保包裝可回收、生物分解性、可重複使用、無毒且對環境影響較小。

- 2024年1月,Arrow Greentech Limited(AGTL)宣布已獲得印度專利局授予的專利,專利號為480889,名稱為「改良的水溶性薄膜及其製造方法」。這種改進的水溶性薄膜由於對環境安全而用於包裝行業。這種高品質的薄膜也可用於以較大體積的粉末或液體形式包裝各種活性成分,例如藥物和腐蝕性農藥。

- 因此,由於對客製化產品的需求不斷增加以及最大限度地減少化學品浪費以改善環境衛生,包裝中對水溶性薄膜的需求迅速成長。

北美市場佔據主導地位

- 美國是水溶性薄膜最大的市場,預計到2024年將佔約78%的市場。

- 水溶性薄膜的高耐溶劑性和氣體阻隔性能使其成為製藥業包裝應用的理想偏好產品。消費行為趨勢的變化和製造商便利性的增加正在加速國內產業的成長,並為水溶性薄膜市場帶來進一步的好處。

- 在美國水溶性薄膜市場營運的公司包括 Sekisui Specialty Chemicals America、 KURARAY CO. LTD.、Medanos Claros HK Limited 和 Aicello Corporation。

- 由於清潔劑包裝和製藥行業的需求不斷增加,加拿大水溶性薄膜市場在預測期內也可能顯著成長。消費者對易用性和便利性的需求激增,在水溶性清潔劑盒市場中發揮關鍵作用。

- 水溶性袋正在嚴重打擊加拿大的最終用戶領域,隨著加拿大尋求取代傳統塑膠,從而創造了對水溶性薄膜的需求。截至2020年10月,加拿大政府宣布了一項在2030年徹底消除一次性塑膠的綜合計畫。

- 根據加拿大健康資訊研究所的數據,2023年加拿大的醫療總支出約為3,440億美元,成長2.3%。 2023 年醫療總支出約佔加拿大國內生產總值(GDP) 的 12.1%。加拿大政府預計未來10年將在醫療保健上花費2,000億美元。鑑於水溶性洗衣袋在控制醫院髒服裝類和床單污染擴散方面發揮著至關重要的作用,這一發展推動了該國對水溶性薄膜的需求。

- 墨西哥的衣物洗護市場是由不斷擴大的酒店業推動的,這支持了酒店清潔劑的消費。 Ariel、ACE 和 Persil 等品牌是該國家庭和餐旅服務業使用的著名洗衣精盒。

- 受訪市場也預期紡織業前景光明。根據國際貿易管理局(ITA)的數據,2022年紡織品產量佔墨西哥製造業GDP的3%。該國是主要的紡織品生產國,每年出口價值約 70 億美元的紡織品。

- 這種趨勢可能會影響預測期內北美市場的成長。

水溶性薄膜產業概況

水溶性薄膜市場部分分散,主要企業在全球市場中佔據主要佔有率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 清潔劑和農藥包裝應用的需求

- 醫療保健領域對水溶性洗衣袋的需求增加

- 抑制因素

- 與吸水特性相關的限制

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 類型

- 冷水溶膜

- 熱水溶膜

- 溶解速度

- 即溶膜

- 中溶膜

- 難溶性薄膜

- 最終用戶產業

- 包裝

- 纖維

- 藥品/醫療保健

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 比荷盧經濟聯盟

- 奧地利

- 捷克共和國

- 波蘭

- 匈牙利

- 瑞士

- 北歐的

- 斯洛伐克

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 摩洛哥

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- AICELLO CORPORATION

- Arrow Greentech Ltd

- Cortec Corporation

- ECOMAVI SRL

- Ecopol SpA

- Green Cycles

- Guangdong Proudly New Material Technology Co. Ltd

- Foshan Polyva Materials Co. Ltd

- Kuraray Co. Ltd

- Mitsubishi Chemical Corporation

- Noble Industries

- Sekisui Chemical Co. Ltd

- Soltec Development

第7章 市場機會及未來趨勢

The Water Soluble Films Market size is estimated at USD 431.82 million in 2024, and is expected to reach USD 565.44 million by 2029, growing at a CAGR of less than 6% during the forecast period (2024-2029).

Different end-user sectors contributed to the market in different ways during the COVID-19 pandemic. Owing to its dependence on textiles, composite molding, and other factors, the water-soluble film market was negatively impacted in the wake of COVID-19. Meanwhile, the packaging, pharmaceutical, and healthcare sectors have contributed to the overall growth of the market.

The increasing demand for water-soluble laundry bags in the healthcare sector and the surging demand from detergent and agrochemical packaging applications are expected to drive market growth.

On the flip side, limitations associated with water absorption properties, such as difficult processibility and inconsistent quality, are expected to hinder the growth of the market.

Growing regulatory strictness to curb plastic pollution is expected to act as an opportunity for market growth in the future.

North America accounted for the highest market share, whereas Asia-Pacific is likely to register the highest growth rate in the market during the forecast period.

Water Soluble Films Market Trends

Packaging Industry to Dominate the Market

- Packaging is the major end-user industry for water-soluble films, as the film offers excellent sealing and deep drawing properties while being completely soluble even in cold water. They are considered biodegradable, non-toxic, and non-inhibitory.

- Water-soluble films are used for packing laundry detergents, dish-washing tablets, cleaning products, swimming pool products, agrochemicals, dyes, fertilizers, cement, food additives, fish bait, seeds, soiled clothes, toilet blocks, powder, liquid detergents, etc.

- Water-soluble films have good air barriers and offer effective resistance to oil. These films help preserve food for a longer time and keep the food fresh. Additionally, water-soluble films deliver savory flavors to meat products during cooking.

- The usage of water-soluble films in the packaging of dyes, cement additives, and enzymes is increasing to minimize pollution and provide a consistent dose during the product's manufacturing process. The mixing operations have become simple using water-soluble films, and the additive measures are more exact.

- Moreover, water-soluble films encapsulate the entire terminal tackle with dry feed such as crushed boilies and pellets. These water-soluble bags are trendy owing to their strength, high melt rate, and ability to 'lick' and stick' the corners to create aerodynamic water-soluble film parcels for casting. When water-soluble film bags are used to package baits and hooks for deep-water fishing, they prevent interference by fishes in shallow water areas and attract larger fishes for deep-water fishing.

- Another major application of water-soluble films is liquid detergent packaging. This application uses water-soluble film packaging to deliver unit dosages of liquid detergent products. Active concentrate of liquid detergent ingredients is packed in water-soluble films.

- The market is driven by the increased usage of environmentally friendly materials in packaging. Eco-friendly packaging is recyclable, biodegradable, reused, and non-toxic, with a low environmental impact.

- In January 2024, Arrow Greentech Limited (AGTL) announced that it received a grant for a patent titled 'Improved Water-Soluble Film and Method of Making the Same' under Patent No. 480889 from the Indian Patent Office. This improved water-soluble film is used in the packaging industry, as it is safe for the environment. Also, these quality films can be used for packaging different active ingredients, such as pharmaceuticals and aggressive agrochemicals, in powder and liquid formats of higher volumes.

- Thus, with the increasing demand for customized products and minimizing chemical wastage to improve environmental health, the demand for water-soluble films in packaging is growing at a rapid rate.

North America to Dominate the Market

- The United States is the largest market for water-soluble films and is expected to account for around 78% of the share in 2024.

- Water soluble films are an ideal preference for packaging applications in the pharmaceutical industry due to their high solvent resistance and gas barrier properties. The changing trends in consumer behavior and the manufacturer's easier convenience benefitted the industries to grow faster in the country, further benefitting the water-soluble films market.

- Some companies catering to the water-soluble films market in the United States are Sekisui Specialty Chemicals America, Kuraray Co. Ltd, Medanos Claros HK Limited, and Aicello Corporation.

- The Canadian water-soluble films market may also see a significant growth rate during the forecast period due to increasing demand from detergent packaging and pharmaceutical industries. The surge in consumer demand for user-friendliness and convenience plays a pivotal role in the market for water-soluble detergent pods.

- Water-soluble bags are also hitting the Canadian end-user sectors as the country fights to replace traditional plastics, thus creating a demand for water-soluble films. As of October 2020, the Canadian government issued an inclusive plan to completely phase out single-use plastics by 2030.

- According to the Canadian Institute for Health Information, Canada's total health expenditure was around USD 344 billion in 2023, an increase of 2.3%. The total health spending was around 12.1% of Canada's gross domestic product (GDP) in 2023. The Canadian government is expected to spend USD 200 billion on healthcare over the next ten years. So, given the crucial role of water-soluble laundry bags in controlling the spread of contamination from soiled clothes and bedsheets in hospitals, it is expected that this development may stir an escalation in the demand for water-soluble films in the country.

- Mexico holds a substantial laundry care market, with the expanding hospitality sector supporting the consumption of detergents in hotels. Brands like Ariel, ACE, and Persil are some of the prominent laundry detergent pods used in the country's homes and hospitality industry.

- The market studied is expected to find positive prospects in the textile industry. According to the International Trade Administration (ITA), textile production accounted for 3% of Mexico's manufacturing GDP in 2022. The country is a major textile producer with an annual export of textiles worth around USD 7 billion.

- Such trends are likely to impact the market's growth in North America over the forecast period.

Water Soluble Films Industry Overview

The water-soluble films market is partially fragmented, with top-level players accounting for a sizeable share of the global market. The major players (not in any particular order) include Kuraray Co. Ltd, Ecopol SpA, Mitsubishi Chemical Group Corporation, Sekisui Chemical Co. Ltd, and Aicello Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Demand From Detergent and Agrochemical Packaging Applications

- 4.1.2 Increasing Demand for Water-soluble Laundry Bags in the Healthcare Sector

- 4.2 Restraints

- 4.2.1 Limitations Associated With the Water Absorption Properties

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Cold Water-soluble Films

- 5.1.2 Hot Water-soluble Films

- 5.2 Dissolution Rate

- 5.2.1 Fast-soluble Films

- 5.2.2 Medium-soluble Films

- 5.2.3 Difficult-soluble Films

- 5.3 End-user Industry

- 5.3.1 Packaging

- 5.3.2 Textile

- 5.3.3 Pharmaceutical and Healthcare

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Benelux

- 5.4.3.6 Austria

- 5.4.3.7 Czech Republic

- 5.4.3.8 Poland

- 5.4.3.9 Hungary

- 5.4.3.10 Switzerland

- 5.4.3.11 Nordic

- 5.4.3.12 Slovakia

- 5.4.3.13 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Morocco

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AICELLO CORPORATION

- 6.4.2 Arrow Greentech Ltd

- 6.4.3 Cortec Corporation

- 6.4.4 ECOMAVI SRL

- 6.4.5 Ecopol SpA

- 6.4.6 Green Cycles

- 6.4.7 Guangdong Proudly New Material Technology Co. Ltd

- 6.4.8 Foshan Polyva Materials Co. Ltd

- 6.4.9 Kuraray Co. Ltd

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 Noble Industries

- 6.4.12 Sekisui Chemical Co. Ltd

- 6.4.13 Soltec Development

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Regulatory Strictness to Curb Plastic Pollution