|

市場調查報告書

商品編碼

1519901

全球高速鋼市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)High Speed Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

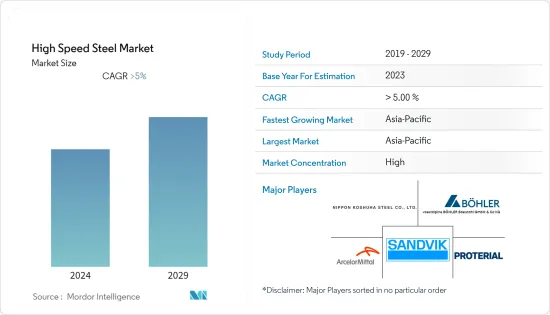

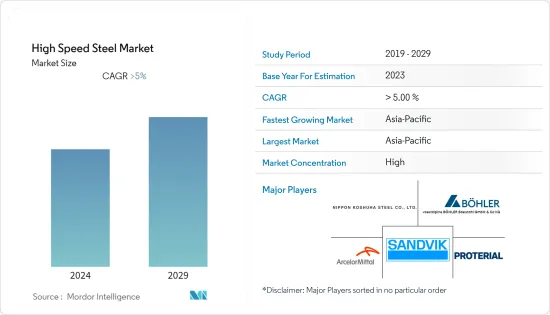

預計2024年全球高速鋼市場規模將達到31.3億美元,並在2024-2029年預測期內以超過4%的複合年成長率成長,到2029年將達到31.4億美元。

COVID-19 大流行對全球高速鋼(HSS)市場產生了重大影響,導致供應鏈中斷和需求下降。但2021年以來,隨著經濟重新開放、工業活動恢復,市場逐漸復甦。人們重新關注供應鏈的彈性。隨著汽車、航太等產業重拾動力,高速鋼需求預計將增加,市場可望進一步復甦。

主要亮點

- 市場成長的主要因素是工業應用的增加和航太業需求的增加。

- 在各種最終用途領域擴大使用硬質合金切削刀具可能會抑制市場成長。

- 未來幾年,由於技術的快速變化,高速鋼市場預計將成長。

- 預計亞太地區將在預測期內主導高速鋼市場。

高速鋼市場趨勢

汽車產業可望主導市場

- 高速鋼在汽車工業中有多種用途,包括使汽車更輕、更堅固,並且在某些地方能更好地吸收能量。

- 高速鋼具有多種性能,這些性能增加了汽車行業的需求,例如機械性能和範圍、厚度和寬度能力、熱軋和軋延可用性、塗層規格和化學成分規格。

- 在汽車工業中,鋼材的強度通常由其化學成分、熱歷史和微觀結構決定,而微觀結構則根據其在生產過程中所經歷的變形過程而變化。

- 高速鋼比普通鋼具有許多優勢,特別是在重量對燃料利用率影響很大的汽車產業。可焊性、疲勞性、靜態強度、陰極保護和抗氫脆性等機械性能對於汽車工業非常有用。

- 高速鋼用於結構應用,例如凸輪軸和曲軸鏈輪、連桿、同步器環、軸承蓋和油泵齒輪。這些應用中使用的不銹鋼還包括引擎閥座。 Fe-Cr-Mn-Si等鐵合金材料用於避震器零件、液壓系統過濾器、歧管法蘭、排氣轉換器出口法蘭、廢氣再循環系統等。

- 自大流行以來,汽車產業對傳統汽車和電動車的需求激增。

- 根據國際工業協會(OICA)統計,2022年全球汽車產量約8,501萬輛,較2021年的8,020萬輛成長5.99%。

- 在北美,根據OICA的數據,2022年汽車產量為14,798,146輛,比2021年的13,467,065輛成長9.88%。此外,在北美,2022 年電動車銷量為 1,108,000 輛,而 2021 年為 748,000 輛。

- 在歐洲,德國是主要的汽車製造商之一。德國汽車製造業是整個歐洲地區汽車生產的大股東。該國是主要汽車製造品牌的所在地,包括大眾、梅賽德斯-奔馳、奧迪、寶馬和保時捷。

- 根據國際汽車製造商組織(OICA)的數據,2022年該國汽車產量為3,677,820輛,比2021年的3,308,692輛成長11%。

- 總體而言,增加使用高速鋼來提高燃油效率和汽車輕量化將推動汽車產業的成長。

亞太地區預計將主導市場

- 預計亞太地區將成為未來幾年最大的高速鋼市場。在中國和印度等國家,由於汽車和航太等行業的成長,對高速鋼的需求正在迅速增加。

- 亞太地區的生產和銷售主要由中國、印度和日本等國家主導,這些國家擁有主要汽車製造商和大量生產基地。

- 根據中國工業協會預測,2022年汽車產量將達到2,700萬輛,比2021年成長3.4%,使中國成為全球最重要的汽車生產基地。

- 在中國,重點是擴大電動車的生產和銷售。該國的目標是到2025年每年生產700萬輛電動車。目標是到2025年中國新車產量的20%是電動車。

- 印度成為該地區第二大汽車製造商。印度汽車工業協會(SIAM)的數據顯示,2022-23會計年度,汽車數量較2021-2022會計年度增加約12.55%,達到創紀錄的25,931,867輛。

- 根據日本工業協會(JAMA)統計,2023會計年度日本國內汽車產量成長14.84%,達8,998,538輛。

- 這些變化可能會增加預測期內對高速鋼的需求。

高速鋼業概況

高速鋼市場因其性質而部分整合。市場上的主要企業包括 Sandvik AB、voestalpine BOHLER Edelstahl GmbH & Co. KG、NIPPON KOSHUHA STEEL、PROTERIAL Ltd、ArcelorMittal。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大在各種工業應用的應用

- 航太業的需求增加

- 其他司機

- 抑制因素

- 硬質合金切削刀具在各種最終用途領域的使用不斷增加

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:以金額為準)

- 類型

- 鎢高速鋼

- 鉬高速鋼

- 其他類型

- 產品類別

- 金屬切削工具

- 冷加工工具

- 其他產品類型

- 最終用戶產業

- 汽車產業

- 航太

- 塑膠

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)分析/排名分析

- 主要企業策略

- 公司簡介

- ArcelorMittal

- CRS Holdings LLC

- ERASTEEL

- Friedr. Lohmann GmbH

- NACHI-FUJIKOSHI CORP.

- NIPPON KOSHUHA STEEL CO. LTD

- PROTERIAL Ltd

- Sandvik AB

- thyssenkrupp AG

- VILLARES METALS SA

- voestalpine BOHLER Edelstahl GmbH & Co. KG

第7章 市場機會及未來趨勢

- 科技進步迅速

- 其他機會

The High Speed Steel Market size is estimated at USD 3.13 billion in 2024, and is expected to reach USD 3.14 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The COVID-19 pandemic significantly impacted the global high-speed steel (HSS) market, causing disruptions in supply chains and reducing demand. However, since 2021, the market has been gradually recovering as economies reopened and industrial activities resumed. There is a renewed focus on supply chain resilience. As industries like automotive and aerospace regain momentum, the demand for HSS is expected to increase, driving further recovery in the market.

Key Highlights

- The major factors driving the market's growth are the growing number of industrial uses and the increasing demand from the aerospace industry.

- The growing use of carbide-based cutting tools in different end-use sectors is likely to slow the market's growth.

- In the coming years, the high-speed steel market is expected to grow due to the rapid changes in technology.

- Asia-Pacific is expected to dominate the high-speed steel market over the forecast period.

High Speed Steel Market Trends

The Automotive Industry is Expected to Dominate the Market

- High-speed steel is used in many ways in the automotive industry to make vehicles lighter, stiffer, and better at absorbing energy in some places.

- High-speed steel has various properties that enhance its demand in the automotive industry, such as mechanical properties and ranges, thickness and width capabilities, hot- and cold-rolled availability, coating specifications, and chemical composition specifications.

- In the automotive industry, steel's strength is usually determined by its microstructure, which varies based on its chemical makeup, its history with heat, and the deformation processes it goes through during its production schedule.

- High-speed steel has a lot of advantages over regular steel, especially in the automotive industry, where weight is a significant factor in how well fuel is used. The mechanical properties, such as weldability, fatigue, static strength, cathodic protection, and resistance to hydrogen embrittlement, are useful to the auto industry.

- High-speed steel is used in structural applications such as camshaft and crankshaft sprockets, connecting rods, synchronizer rings, bearing caps, oil pump gears, etc. The stainless steel used in these applications includes engine valve seats. Ferrous-based alloys, such as Fe-Cr-Mn-Si materials, are used in shock absorber parts, filters for hydraulic systems, manifold flanges, exhaust converter outlet flanges, and exhaust gas recirculation systems.

- The automotive industry has been witnessing an upsurge in demand for both conventional and electric vehicles post-pandemic, primarily due to the increased traveling activities of people across the globe.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, around 85.01 million vehicles were produced worldwide, showcasing a growth rate of 5.99% compared to 80.20 million vehicles in 2021.

- In North America, according to the OICA, automotive production in 2022 accounted for 14,798,146 units, an increase of 9.88% compared to the show in 2021, which was reportedly 13,467,065 units. Additionally, in North America, the sales of electric vehicles in 2022 accounted for 1,108 thousand units, compared to 748 thousand unit sales in 2021.

- In Europe, Germany is among the key manufacturers of vehicles. The automobile manufacturing industry in Germany is a prominent shareholder of the overall automotive production in the European region. The country hosts major car-making brands, including Volkswagen, Mercedes-Benz, Audi, BMW, Porsche, etc.

- According to the Organization Internationale des Constructeurs d'Automobiles (OICA), in 2022, the country produced 3,677,820 vehicles, which increased by 11% compared to 3,308,692 cars in 2021.

- Overall, the increasing usage of high-speed steel for better fuel efficiency and lighter vehicles will boost the growth of the automotive industry.

Asia-Pacific is Expected to Dominate the Market

- During the next few years, the Asia-Pacific region is expected to be the largest market for high-speed steel. In countries like China and India, the growth of industries like automotive, aerospace, and others has caused the demand for high-speed steel to surge.

- The production and sales in the Asia-Pacific region are primarily dominated by countries like China, India, and Japan, which consist of large automotive manufacturers and a vast number of production bases within the countries.

- According to the China Association of Automobile Manufacturers (CAAM), China had the most significant automotive production base globally, with a total vehicle production of 27 million units in 2022, an increase of 3.4% compared to 2021.

- In China, the main focus is to increase production and sales of electric vehicles. The country has set a target to produce 7 million electric vehicles per year by 2025. By 2025, the goal is to have electric vehicles comprise 20% of total new vehicle production in China.

- India has become the second-largest automotive vehicle manufacturer in the region. According to the Society of Indian Automobile Manufacturers (SIAM), in FY 2022-23, the total number of automobile manufacturers in the country grew by about 12.55% compared to FY 2021-2022, recording 25,931,867 units.

- According to the Japan Automobile Manufacturers Association (JAMA), motor vehicle production in the country in 2023 grew by 14.84%, recording 8,998,538 units.

- During the forecast period, these changes are likely to increase the need for high-speed steel.

High Speed Steel Industry Overview

The high-speed steel market is partially consolidated in nature. Some of the major players in the market include Sandvik AB, voestalpine BOHLER Edelstahl GmbH & Co. KG, NIPPON KOSHUHA STEEL CO. LTD, PROTERIAL Ltd, and ArcelorMittal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage in Different Industrial Applications

- 4.1.2 Increasing Demand from Aerospace industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 The Rising Use of Carbide-based Cutting Tools Across Various End-use Sectors

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Tungsten High Speed Steel

- 5.1.2 Molybdenum High Speed Steel

- 5.1.3 Other Types (Cobalt High-Speed Steel, Chromium High-Speed Steel, and Vanadium High-Speed Steel)

- 5.2 Product Type

- 5.2.1 Metal Cutting Tools

- 5.2.2 Cold Working Tools

- 5.2.3 Other Product Types (Milling Tools, Drilling Tools, etc.)

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace

- 5.3.3 Plastics

- 5.3.4 Other End-user Industries (Mining, Manufacturing, Tool Making, etc)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 CRS Holdings LLC

- 6.4.3 ERASTEEL

- 6.4.4 Friedr. Lohmann GmbH

- 6.4.5 NACHI-FUJIKOSHI CORP.

- 6.4.6 NIPPON KOSHUHA STEEL CO. LTD

- 6.4.7 PROTERIAL Ltd

- 6.4.8 Sandvik AB

- 6.4.9 thyssenkrupp AG

- 6.4.10 VILLARES METALS SA

- 6.4.11 voestalpine BOHLER Edelstahl GmbH & Co. KG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Technological Improvement

- 7.2 Other Opportunities