|

市場調查報告書

商品編碼

1519925

全球工業雷射器市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Industrial Lasers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

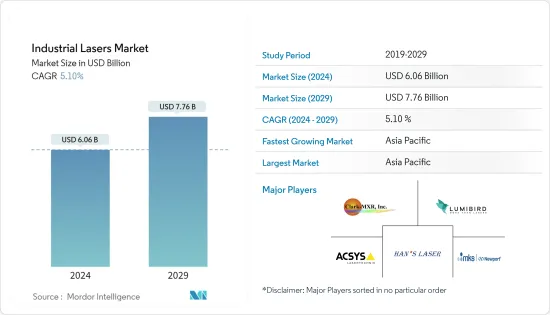

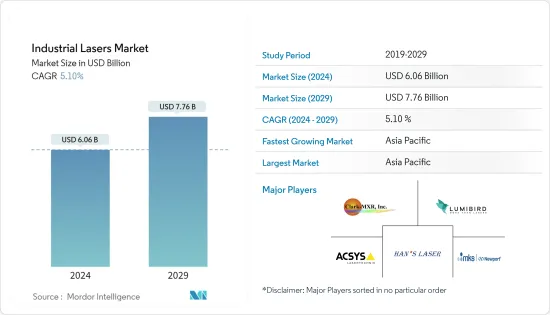

預計2024年全球工業雷射器市場規模將達60.6億美元,2024年至2029年複合年成長率為5.10%,2029年將達77.6億美元。

主要亮點

- 由於醫療和牙科應用、太空探索和工業應用對雷射的需求不斷成長等多種因素,預計工業雷射器市場在預測期內將出現強勁成長。材料加工是雷射在工業上的一個突出應用。光纖雷射器,其次是直接二極體雷射,主要用於材料加工。

- 工業雷射用於各種生物醫學設備,用於醫學影像、雷射手術和動態治療應用。二極體雷射常用於多種軟組織口腔外科手術,包括顎骨切除、孔源性纖維瘤、肌瘤切除、臉部色素沉著治療及血管病變治療。二極體雷射將能量轉移到細胞的能力可用於諸如加溫、焊接、凝固、蛋白質變性、乾燥、汽化和碳化等任務。

- 隨著供應商定期嘗試為航太和國防工業推出新的解決方案,市場正在見證各種創新和合作夥伴關係。例如,2022年3月,Ultisense發布了LRF 6042,這是一款配備先進光纖雷射技術的25公里測距模組。 LRF 6042 是 Altisense 高性能光纖雷射測距儀產品組合的最新成員,它以 Vectronix 的軍用測距儀開發經驗為基礎。緊湊型 LRF 6042 在 2.3 m x 2.3 m 目標上的測量距離可達 8 km,射程性能可達 25 km。與需要在脈衝之間充電和冷卻的其他系統相比,LRF 6042 可以不間斷地連續測量。可實現高達 10Hz 的重複頻率。這非常適合長期追蹤(例如人或車輛)。

- 在製造過程中採用雷射解決方案的公司必須遵守各種政府安全法規。此外,該設備比其前輩相對昂貴,使其在工業領域的採用成為一個挑戰。

- 此外,通貨膨脹對製造業有重大影響,導致製造成本上升。這是由於多種因素造成的,包括原料價格飆升、運輸成本增加、人事費用以及人手不足。結果,製造商可能被迫提高價格以維持盈利,最終減少對其產品的需求。通貨膨脹也會導致合約約束、勞動力轉移和製造商的投入問題。通膨上升可能會限制所研究市場的成長。

工業雷射器市場趨勢

家電實現大幅成長

- 在消費性電子產業,雷射打標有助於產品識別和開關、插頭、連接器、電容器外殼和包裝等組件的識別。電子元件中使用的電子連接器和阻燃塑膠可以使用紫外線雷射進行雷射打標,以實現可追溯性。 300W及以上的雷射用於硬焊、鈑金焊接和消費性電子零件製造的鈑金切割應用。

- 消費性電子產品中使用的現代晶片是使用微影製程製造的,這是一種使用模板和雷射重複列印複雜晶片電路的高科技技術。

- 然而,5G 網路的擴展以及具有先進技術和功能的新產品的推出正在刺激智慧型手機、平板電腦和數位單眼相機的普及。智慧型手機市場的主要供應商不斷推出具有新功能和改進相機品質的智慧型手機,創造了對工業雷射的需求。

- 據愛立信稱,到 2028 年,西歐智慧型手機用戶數量可能達到 4.59 億。截至 2022 年,西歐智慧型手機用戶數約為 4.4 億。

- 混合實境耳機市場的不斷成長正在推動市場研究。例如,2023 年 6 月,蘋果發布了 Vision Pro,這是一款配備 3D 相機的混合實境耳機,可協助用戶拍攝 3D 太空照片和影片。

亞太地區預計將出現顯著成長

- 亞太地區是世界上最大的製造業經濟體的所在地,包括中國、日本、韓國和台灣。汽車、電子、航太和醫療設備等領域製造業的持續擴張創造了對工業雷射的巨大需求,以支援各種加工、切割、焊接和打標應用。

- 亞太地區是大族雷射技術產業集團等重要市場參與者的所在地。該地區以其在汽車和醫療行業的能力而聞名,預計將推動該地區的市場成長。此外,由於亞太地區預計將擁有最高的市場成長率,因此多家公司正在投資推動成長和開拓。

- 印度等新興國家擴大製造地和實現自力更生的努力將進一步支持市場成長。製造業已成為印度高成長產業之一。印度製造計劃使印度成為世界地圖上的製造中心,並使印度經濟獲得全球認可。 IBEF 預計,到 2030 年,印度將出口價值 1 兆美元的商品,預計將成為世界主要製造中心。

- 該地區的汽車工業正在走向電氣化和小型化,要求更高的剛性、設計靈活性和生產力。具有高光吸收效率的藍色雷射在汽車馬達和電池的銅加工領域需求量很大。高生產率的加工需要具有高功率和高光束品質的雷射光源。

工業雷射產業概況

工業雷射器市場是半靜態的。市場上的主要供應商正在探索超快雷射的新應用,因為他們的地理範圍不斷擴大並與更多的生態系統參與者合作。參與者包括 ACSYS Lasertechnik Inc.、大族雷射技術產業集團、Clark-MXR Inc.、Newport Corporation (MKS Instruments Inc.) 和 Lumibird SA。

- 2024 年 1 月 - ACSYS Lasertechnik GmbH (Kornwestheim) 在今年的「世界貨幣博覽會」(2024 年 2 月 1-4 日)上宣布了各種創新成果。在2號館D4展位上,雷射技術領域高精度標準零件和特種機械供應商該公司展示了其在造幣行業靈活且節約資源的塗層去除、雕刻和拋光的創新解決方案。

- 2023 年 11 月 - IPG Photonics Corporation 和電弧焊接產品製造商 Miller Electric Mfg. LLC 宣佈建立策略合作夥伴關係,旨在進一步推動手持式焊接應用的雷射解決方案。兩家公司在開發解決客戶挑戰的特定解決方案方面擁有獨特的專業知識,它們共同提供無與倫比的優勢,同時易於學習和操作,我們將進一步改進我們的產品並將其推向市場。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 比傳統替代方案提高了精度和準確度

- 零件小型化

- 市場限制因素

- 遵守與雷射使用相關的法規

第6章 市場細分

- 按類型

- 光纖雷射

- 固體雷射

- 二氧化碳雷射

- 其他類型

- 按用途

- 切割

- 焊接

- 標記

- 鑽孔

- 添加劑製造

- 其他用途

- 按最終用戶產業

- 航太/國防

- 車

- 衛生保健

- 家用電器

- 半導體

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- ACSYS Lasertechnik Inc.

- Han's Laser Technology Industry Group Co. Ltd

- Clark-MXR Inc.

- Newport Corporation(MKS Instruments Inc.)

- Lumibird SA

- Coherent Inc.

- IPG Photonics

- Trumpf Group

- Lumentum Holdings Inc.

- Jenoptik AG

第8章投資分析

第9章 市場機會及未來趨勢

The Industrial Lasers Market size is estimated at USD 6.06 billion in 2024, and is expected to reach USD 7.76 billion by 2029, growing at a CAGR of 5.10% during the forecast period (2024-2029).

Key Highlights

- The industrial lasers market is anticipated to witness robust growth during the forecast period owing to several factors, like rising demand for these lasers in medical and dental applications, space exploration, and industrial applications. Material processing is a prominent application for lasers in industries. Optical fiber lasers, followed by direct diode lasers, are majorly used for material processing.

- Industrial lasers are used in various biomedical instruments for medical imaging, laser surgery, and photodynamic therapy applications. They are commonly used in multiple soft tissue oral surgery, such as frenectomy, epulis fissuratum, fibroma removal, facial pigmentation treatment, and vascular lesion treatment. The diode laser's ability to transmit energy to cells can be used for tasks like warming, welding, coagulation, protein denaturation, drying, vaporization, and carbonization.

- The market is witnessing various innovations and partnerships as vendors are looking to launch new solutions regularly for the aerospace and defense industry. For instance, in March 2022, Ultisense launched the LRF 6042, a 25 km rangefinder module with advanced fiber laser technology. The LRF 6042 is the newest addition to the Ultisense portfolio of high-performance fiber laser rangefinders and builds on Vectronix's experience in developing military rangefinders. The compact LRF 6042 measures up to 8 km on 2.3 m X 2.3 m targets and boasts a maximum range performance of up to 25 km. Compared to other systems that have to charge and cool between pulses, the LRF 6042 measures continuously without interruption. It can achieve repetition rates of up to 10 Hz. This is ideal for tracking (e.g., people, vehicles) over an extended period.

- Enterprises adopting laser solutions as part of their manufacturing process are subject to various government safety regulations. In addition, the equipment is comparatively costlier than their conventional counterparts, thus challenging their adoption in the industrial space.

- Moreover, inflation significantly impacts manufacturing, leading to higher manufacturing costs. This can be due to various factors, such as higher prices for raw materials, increased shipping costs, and labor costs and shortages. As a result, manufacturers may be forced to raise their prices to maintain profitability, ultimately decreasing product demand. In addition, inflation can also lead to contract constraints, shifts in labor, and input issues for manufacturers. The rising inflation could restrain the growth of the market studied.

Industrial Lasers Market Trends

Consumer Electronics to Witness Major Growth

- In the consumer electronics industry, laser marking aids product recognition and identification of components like switches, plugs, connectors, capacitor housings, and packaging. Electronic connectors and flame-retardant plastics used for electronic components can be laser-marketed for traceability using UV lasers. Lasers above 300W are used in brazing, thin metal welding, and sheet metal cutting applications for manufacturing consumer electronic components.

- Modern chips used in consumer electronics are manufactured using photolithography, a hi-tech use of stencils and lasers, to print complex chip circuits in a repeatable way.

- However, the growing 5G network and the introduction of new products with advanced technologies and features fuel the adoption of smartphones, tablets, and DSLR cameras. Leading vendors in the smartphone market are continuously announcing new features and smartphones with better camera quality, which creates demand for industrial lasers.

- According to Ericsson, the number of smartphone subscriptions in Western Europe may reach 459 million by 2028. There were approximately 440 million smartphone subscriptions in Western Europe as of 2022.

- The expanding market for mixed reality headsets is aiding the market studied. For instance, in June 2023, Apple introduced Vision Pro, a mixed-reality headset with a 3D camera to help users capture spatial photos and videos in 3D.

Asia-Pacific Expected to Witness Major Growth

- Asia-Pacific is home to some of the world's largest manufacturing economies, including China, Japan, South Korea, and Taiwan. The ongoing expansion of manufacturing industries in sectors such as automotive, electronics, aerospace, and medical devices creates a significant demand for industrial lasers to support various machining, cutting, welding, and marking applications.

- The Asia-Pacific region houses some important players in the market, such as Han's Laser Technology Industry Group. The region is known for its capabilities in the automotive and medical industries, which are expected to drive the region's market growth. Also, various players have invested in driving their growth and development, as the Asia-Pacific region is expected to witness the highest growth rate in the market.

- Initiatives by emerging countries like India to expand their manufacturing footprint and become self-reliant further propel the market growth. Manufacturing emerged as one of India's high-growth sectors. The 'Make in India' program places India on the global map as a manufacturing hub and globally recognizes the Indian economy. According to IBEF, India can export goods worth USD 1 trillion by 2030 and is on the road to becoming a significant global manufacturing hub.

- The automotive industry in the region is moving toward electrification and miniaturization while requiring high rigidity, design flexibility, and productivity. Blue lasers with high optical absorption efficiency are in high demand in the field of copper fabrication for automotive motors and batteries. The highly productive processing requires a laser beam source with high output power and high beam quality.

Industrial Lasers Industry Overview

The industrial lasers market is semi-consolidated as the significant vendors in the market are also expanding regionally and increasingly involved with ecosystem players, thus exploring new applications of ultrafast lasers. Some of the players include ACSYS Lasertechnik Inc., Han's Laser Technology Industry Group Co. Ltd, Clark-MXR Inc., Newport Corporation (MKS Instruments Inc.), and Lumibird SA.

- January 2024 - ACSYS Lasertechnik GmbH (Kornwestheim) presented various technological innovations at this year's "World Money Fair" from February 1-4, 2024. At Stand D4, Hall 2, the supplier of high-precision standards and special machines in the field of laser technology, presented innovative solutions for flexible, resource-saving de-coating, engraving, and polishing in the Mint industry, among other things.

- November 2023 - IPG Photonics Corporation and Miller Electric Mfg. LLC, a manufacturer of arc welding products, announced a strategic partnership with a goal to promote laser solutions for handheld welding applications further. Both companies bring unique expertise to develop specific solutions to address customer challenges, and together, they will further advance and bring to market products that are easy to learn and operate while offering unmatched benefits.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Enhanced Precision and Accuracy over Conventional Alternatives

- 5.1.2 Miniaturization of Component Parts

- 5.2 Market Restraints

- 5.2.1 Regulation Compliance Associated with Laser Usage

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fiber Laser

- 6.1.2 Solid-state Laser

- 6.1.3 CO2 Laser

- 6.1.4 Other Types

- 6.2 By Application

- 6.2.1 Cutting

- 6.2.2 Welding

- 6.2.3 Marking

- 6.2.4 Drilling

- 6.2.5 Additive Manufacturing

- 6.2.6 Other Applications

- 6.3 By End-user Industry

- 6.3.1 Aerospace and Defense

- 6.3.2 Automotive

- 6.3.3 Healthcare

- 6.3.4 Consumer Electronics

- 6.3.5 Semiconductors

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 ACSYS Lasertechnik Inc.

- 7.1.2 Han's Laser Technology Industry Group Co. Ltd

- 7.1.3 Clark-MXR Inc.

- 7.1.4 Newport Corporation (MKS Instruments Inc.)

- 7.1.5 Lumibird SA

- 7.1.6 Coherent Inc.

- 7.1.7 IPG Photonics

- 7.1.8 Trumpf Group

- 7.1.9 Lumentum Holdings Inc.

- 7.1.10 Jenoptik AG