|

市場調查報告書

商品編碼

1519929

虛擬感測器的全球市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Virtual Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

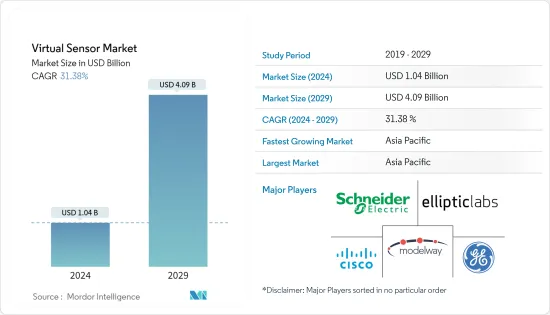

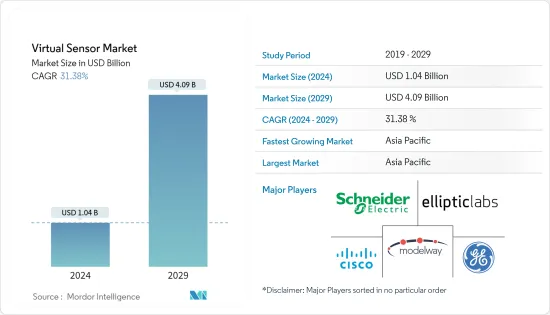

預計2024年全球虛擬感測器市場規模將達10.4億美元,2024-2029年預測期間複合年成長率為31.38%,2029年將達到40.9億美元。

虛擬感測器市場具有顯著擴大的潛力,並將成為許多與實體感測器相關的未來應用的關鍵組成部分。這些感測器的日益普及主要是因為它們為各個行業帶來了好處。

主要亮點

- 虛擬感測器也稱為軟感測器,是使用物理感測器的多個輸出讀數的數學模型開發的基於軟體的解決方案。透過引入這種虛擬感測器可以克服實體感測器的限制。單一虛擬感測器可以預測各種參數,例如速度、溫度、位置、壓力等。

- 其結果是物聯網、雲端、安全、分析、流程工業、石油和天然氣、運輸、汽車、消費性電子、醫療保健、國防和航太等產業的成本效益和應用。感測器和控制行業的進步將推動虛擬感測器市場的成長。

- 領先的製造商正在採用雲端基礎的虛擬感測解決方案作為他們的標準平台。在雲端平台上實施虛擬感測器有幾個優點,例如增強用戶和感測器雲端伺服器之間的資料連接。

- 此外,這些解決方案還有助於高效的交通監控、準確的天氣預報、改進的軍事行動和增強的醫療服務。該雲端平台還允許最終用戶降低總體擁有成本並擴展其資料儲存能力。

- 在製造業中,對具有成本效益的解決方案和提高業務效率的需求不斷成長,這推動了行業中最尖端科技的採用。為了保持競爭力並降低生產成本,各種規模的製造公司都不斷致力於發現和應用新策略。透過最佳化成本結構,您可以避免將大部分市場輸給盈利更高的競爭對手,或者在最壞的情況下,避免被淘汰。公司一直在尋找創造性的方法來減少開支而不犧牲生產力或效率。

- 此外,隨著數位轉型的興起,各組織對雲端運算的需求呈現爆炸性成長。與本地部署相比,雲端提供了廣泛的優勢,這推動了雲端服務的採用。自成立以來一直基於雲端的小型企業和新興企業的激增正在影響對雲端運算技能的需求。

虛擬感測器市場趨勢

交通運輸和汽車行業作為最終用戶的快速成長

- 數位雙胞胎技術在交通運輸行業中的日益普及預計將推動對虛擬感測器的需求。數位雙胞胎已成為交通領域的最新技術現象。將數位雙胞胎引入供應鏈正在提高本地和全球範圍內供應鏈網路的效率。資料使運輸公司能夠準確預測其營運。這項創新技術也產生了寶貴的見解,以增強企業策略。

- 虛擬感測器由於其多功能性而對汽車行業變得越來越重要。虛擬感測器在行業中的日益普及預計將在預測期內獲得市場的關注。在昂貴的感測器不斷膨脹的背景下,虛擬感測器的採用得到了廣泛的應用。

- 虛擬感測器涉及用車輛電控系統中嵌入的軟體替換實體感測器。其目的是無需物理組件即可獲取必要的資訊。許多車輛零件,包括輪胎、引擎和駕駛室,都配備了這些虛擬感測器。虛擬感測廣泛應用於汽車應用,例如乘客熱舒適度、輪胎壓力監測系統、動力傳動系統應用和彈簧品質狀況估計。

- 汽車產業嚴重依賴感測技術來實現安全、娛樂、交通管理、導航和引導等各種功能。隨著我們向自動駕駛汽車邁進,感測設備的使用預計將會擴大。雖然車輛中的實體感測器可能高成本且不可靠,但虛擬感測器正在成為汽車製造商的一種經濟高效的解決方案。這些虛擬感測器可作為實體感測器的輔助安全措施,在增強駕駛員輔助系統 (ADAS) 並最終實現自動駕駛功能方面發揮關鍵作用。

- 汽車產業對 ADAS 功能的需求不斷成長預計將推動該細分市場的成長。世界各國政府已採取各種措施來促進 ADAS 技術的採用,以確保車輛安全。此外,自動駕駛和自動駕駛汽車的成長趨勢也有助於擴大市場。例如,英特爾預測,到 2030 年,全球汽車銷售將超過 1.014 億輛,其中自動駕駛汽車約佔同年汽車註冊量的 12%。

- 此外,人工智慧(AI)已在包括汽車行業在內的各個行業中變得至關重要。該領域的一項關鍵創新是 ADAS(高級駕駛員輔助系統)的創建,旨在提高車輛安全性並在各種駕駛情況下為駕駛員提供協助。 ADAS 技術具有減少事故和促進道路安全的潛力,因此德國、中國和印度等國家擴大採用該技術。這些驅動 ASAD 技術的因素可能會在市場上創造重大機會。

亞太地區預計將經歷顯著成長

- 虛擬感測器對於促進智慧型裝置的操作和自動化非常重要。虛擬感測器透過增強互聯設備和物聯網系統的能力和功能,對於推動物聯網 (IoT) 需求至關重要。

- 在中國,人工智慧(AI)和物聯網(IoT)的持續技術進步和投資正在推動所研究市場的需求。 《中國製造2025》等政府措施重點關注物聯網等高科技產業的發展。政府的支持正在加速物聯網研究和創新,使其在多個經濟領域中得到採用。

- 組織可以在雲端基礎架構上部署虛擬感測器,無需專用的硬體或實體安裝,從而減少部署時間和營運成本。由於從本地到雲端基礎的持續遷移以及對特定於雲端的系統的需求不斷增加,日本的雲端採用率正在顯著成長。例如,2024 年1 月,亞馬遜網路服務宣布,到2027 年將在東京和大阪現有的雲端基礎設施上投資2.26 兆日圓(152.4 億美元),以滿足日本客戶對雲端服務日益成長的需求。根據 AWS 日本經濟影響研究 (EIS),這項投資預計將為日本 GDP 增加 5.57 兆日圓(376 億美元)。

- 汽車產業嚴重依賴感測技術來執行各種安全相關任務、交通管理、導航和指導。虛擬感測器進一步保護實體感測器,並在 ADAS(高級駕駛員輔助系統)以及最終自動駕駛汽車的開發中發揮關鍵作用。

- 印度汽車產業一直是經濟表現的可靠指標,因為它在經濟成長和技術進步中發揮關鍵作用。 ADAS(高級駕駛員輔助系統)透過預防或最大程度地減少潛在事故的影響來提高車輛安全性,在印度汽車市場中越來越重要。當今市場對 ADAS 等先進安全功能的需求至關重要。例如,2024 年 1 月,Mobileye Global Inc. 將為 Mahindra & Mahindra Ltd. 的下一代車輛提供先進的駕駛輔助技術,以擴大其在印度汽車行業的影響力。

- 虛擬感測器透過增強導航能力、飛機健康監測和自主系統來推動航太和國防領域的需求。此外,對航太和國防領域智慧工廠的投資透過實現品管、預測性維護和供應鏈整合,正在推動對虛擬感測器的需求。例如,2024年2月,GE航空航太公司宣布將投資1,500萬新元(1,100萬美元)將其位於新加坡的飛機引擎維修設施升級為創新型智慧工廠。

虛擬感測器產業概述

虛擬感測器產業既有大型國際公司,也有小型公司,導致市場高度分散。該領域的主要企業包括施耐德電氣 SE、Elliptic Labs ASA、Modelway SRL、思科系統公司和通用電氣公司。這些公司採取建立合作夥伴關係和收購等策略來擴大其產品範圍並在市場上獲得競爭優勢。

- 2024 年 3 月 - Elliptic Labs 宣佈在 Vivo 智慧型手機 V30 上搭載 AIAVirtual 接近感測器 INNER BEAUTY,目前已部署在超過 5 億台裝置上。

- 2024 年 1 月 - IntelliDynamics 宣布東歐天然氣生產商重新為其 Intellict 系統提供支援和維護。 IntelliDynamics 提供虛擬稱重和抗水合物估算。該系統即時傳達您生產的氣體、冷凝油和水的數量,並計算在生產線和中央處理中的多個點注入的甲醇/乙醇水合物抑製劑的量,以防止系統結冰。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- 關鍵績效指標

- 虛擬感測器使用案例分析

- 官方與客製化解決方案

- 價格分析

- 產業吸引力-波特五力分析

第4章市場動態

- 市場促進因素

- 物聯網和雲端平台的採用增加預計將推動市場發展

- 製造業對提高成本效益和業務效率的需求日益成長

- 市場挑戰

- 缺乏熟練的人力資源和技術知識

- 資料安全和隱私問題

第5章市場區隔

- 按安裝類型

- 雲

- 本地

- 按最終用戶產業

- 油和氣

- 製造業

- 交通/汽車

- 金屬/礦業

- 航太/國防

- 電子/消費性技術

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 世界排名分析

- 公司簡介

- Schneider Electric SE

- Elliptic Labs ASA

- Modelway SRL

- Cisco Systems Inc.

- General Electric Company

- Siemens AG

- Korber AG

- Intelli Dynamics(Biocomp Systems, Inc.)

- Andata Ltd

第 7 章 進入市場 (GTM) 策略

- 市場區隔與目標受眾

- 價值提案

- 分銷通路策略

- 競爭格局

- 回應市場問題

- 結論/建議

第8章市場展望

The Virtual Sensor Market size is estimated at USD 1.04 billion in 2024, and is expected to reach USD 4.09 billion by 2029, growing at a CAGR of 31.38% during the forecast period (2024-2029).

The virtual sensors market has the potential to expand significantly and become a key component in numerous future applications related to physical sensors. The growing adoption of these sensors is primarily driven by the benefits they offer to various industries.

Key Highlights

- Virtual sensors, also known as soft sensors, are software-based solutions developed using a mathematical model of multiple output readings from physical sensors. The limitations of physical sensors can be overcome by deploying these virtual sensors. A single virtual sensor can predict various parameters such as speed, temperature, position, and pressure.

- As a result, they offer cost benefits and find applications in industries such as IoT, Cloud, security, analytics, process industry, oil & Gas, transportation, automotive, consumer electronics, healthcare, and defense & aerospace. Advancements in the sensor and control industry will drive the growth of the virtual sensor market.

- Leading manufacturers are adopting a cloud-based virtual sensing solution as a standard platform. Implementing virtual sensors on a cloud platform offers several benefits, such as enhancing data connectivity between users and the sensor-cloud server.

- Moreover, these solutions facilitate efficient transportation monitoring, accurate weather forecasting, improved military activities, and enhanced healthcare services. The cloud platform also enables end-users to reduce overall ownership costs and expand data storage capabilities, consequently contributing to the growth of the virtual sensor market.

- The increasing demand for cost-efficient solutions and improved operational efficiency in the manufacturing sector fuels the adoption of cutting-edge technologies in the industry. To keep their competitive edge and reduce production costs, manufacturing companies of all sizes constantly focus on discovering and applying new tactics. If they optimize their cost structures, they can avoid losing a sizable portion of the market to competitors who can operate more profitably or, worse still, become obsolete. Businesses constantly seek creative ways to cut expenses without sacrificing productivity or efficiency.

- Furthermore, due to increased digital transformation, cloud computing demand has skyrocketed across organizations. The cloud offers extensive benefits over the on-premise deployment, which fuels the adoption of cloud services. The prevalence of new small-scale companies and startups based on the cloud from their inception influences the demand for cloud computing skills.

Virtual Sensors Market Trends

Transportation and Automotive Industry to be the Fastest Growing End User

- The increasing usage of digital twin technology in the transportation industry is expected to drive the demand for virtual sensors. Digital twins have emerged as the most recent technological phenomenon in the transportation sector. The implementation of digital twins in supply chains is enhancing the efficiency of supply chain networks on both local and global scales. By utilizing the data, transportation companies can accurately predict their operations. Significantly, this innovative technology also generates valuable insights to enhance corporate strategies.

- Virtual sensors are increasingly becoming crucial for the automotive industry due to their wide variety of applications. The growing adoption of virtual sensors in the industry will enable the market to gain traction over the forecast period. Amidst this costly sensory inflation, adopting virtual sensors has become prevalent.

- Virtual sensors entail replacing a physical sensor with software embedded in the vehicle's electronic control unit. The objective is to acquire essential information without needing a physical component. Numerous vehicle parts, including tires, engines, and cabins, are embedded with these virtual sensors. Virtual sensing is widely employed in automotive applications, such as passenger thermal comfort, tire pressure monitoring systems, powertrain applications, estimation of sprung mass state, and others.

- The automotive sector depends significantly on sensing technology for various functions such as safety, entertainment, traffic management, navigation, and guidance. With the advancement towards autonomous vehicles, sensing device usage is expected to grow. Despite the high cost and occasional unreliability of physical sensors in vehicles, virtual sensors are emerging as a cost-effective solution for car makers. These virtual sensors serve as a secondary safety measure to physical sensors and play a crucial role in enhancing driver assistance systems (ADAS) and ultimately achieving autonomous driving capabilities.

- The growing demand for ADAS features in the automotive industry is expected to drive the segment's growth. Several governments worldwide are implementing various measures to boost the adoption of ADAS technology to ensure vehicle safety. Furthermore, the increasing trend of autonomous or self-driving vehicles also plays a role in expanding the market. As an illustration, Intel predicts worldwide car sales will exceed 101.4 million units by 2030, with autonomous vehicles projected to make up approximately 12% of car registrations by the same year.

- Furthermore, Artificial Intelligence (AI) has become vital in various industries, including the automotive sector. A significant innovation in this field is the creation of advanced driver assistance systems (ADAS), which are designed to enhance vehicle safety and assist drivers in different driving situations. The adoption of ADAS technology is increasing in countries such as Germany, China, and India, as it has the potential to reduce accidents and promote road safety. Such factors in boosting ASAD technology may present significant opportunities for the market.

Asia Pacific Expected to Witness Significant Growth

- Virtual sensors are significant in facilitating the operation of smart devices and automation. Virtual sensors are crucial in driving demand for IoT (Internet of Things) by enhancing the capabilities and functionalities of connected devices and IoT systems.

- China's continuous technological progress and investments in Artificial Intelligence (AI) and IoT (Internet of Things) fuel the demand for the market studied. Government Initiatives like the "Made in China 2025" plan have placed a strong emphasis on advancing high-tech industries, such as IoT ((Internet of Things). This support from the government has accelerated the research and innovation in IoT, leading to its adoption in multiple sectors of the economy.

- Organizations can deploy virtual sensors on cloud infrastructure without needing dedicated hardware or physical installations, reducing the deployment time and operational costs. Cloud adoption in Japan is experiencing significant growth due to the continuous transition from on-premise to cloud-based systems and increasing demand for cloud-focused systems. For instance, in January 2024, Amazon Web Services announced its plans to invest JPY 2.26 trillion (USD 15.24 Billion) into its current cloud infrastructure in Tokyo and Osaka by 2027 to address the increasing customer demand for cloud services in Japan. According to the AWS Economic Impact Study (EIS) for Japan, this investment is projected to add JPY 5.57 trillion (USD 37.6 Billion) to Japan's GDP.

- The automotive sector depends hugely on sensing technology for various safety-related tasks, traffic management, navigation, and guidance. Virtual sensors offer an additional layer of protection to physical sensors and play a crucial role in advancing ADAS (Advanced driver assistance systems) and, ultimately, in creating autonomous vehicles.

- The automotive sector of India has always been a reliable gauge of economic performance, as it is a crucial player in both economic growth and technological progress. ADAS (Advanced driver assistance systems) enhances vehicle safety by preventing or minimizing the impact of potential accidents and is gaining importance in the Indian automotive market. The demand for advanced safety features like ADAS is vital in the current market. For instance, in January 2024, Mobileye Global Inc. plans to provide advanced driver assistance technology for upcoming Mahindra & Mahindra Ltd vehicles to expand its presence in India's automotive industry.

- Virtual sensors fuel demand in the aerospace and defense sector by enhancing navigation capabilities, aircraft health monitoring, and autonomous systems. Additionally, the investments in aerospace and defense smart factories drive demand for virtual sensors by enabling quality control, predictive maintenance, and supply chain integration. For instance, In February 2024, GE Aerospace declared that it would be investing SGD 15 million (USD 11 Million) to upgrade the aircraft engine repair facility in Singapore into an innovative Smart Factory aimed at modernizing engine repair practices and enhancing the advancements in technology.

Virtual Sensors Industry Overview

The virtual sensors industry is marked by a diverse mix of large international firms and smaller, medium-sized businesses, resulting in a highly fragmented market. Leading companies in this sector include Schneider Electric SE, Elliptic Labs ASA, Modelway SRL, Cisco Systems Inc., and General Electric Company. These companies are engaging in strategies like forming partnerships and pursuing acquisitions to expand their product ranges and secure a competitive edge in the market.

- March 2024 - Elliptic Labs announced that it is currently deployed in over 500 million devices and is shipping the AIAVirtual Proximity Sensor INNER BEAUTYon Vivo's V30 smartphone.

- January 2024 - IntelliDynamics announced that a gas producer in Eastern Europe has renewed its support and maintenance for its Intellect systems. IntelliDynamics will Provide virtual metering and hydrate inhibitor estimation. The system tells them in real-time how much gas, condensate, and water they are producing and calculates the amount of methanol/ethanol hydrate inhibitor to inject in multiple points in their production train and central processing to prevent their system from icing up.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Overview

- 3.1.1 Industry Attractiveness - Porter's Five Forces Analysis

- 3.1.1.1 Bargaining Power of Suppliers

- 3.1.1.2 Bargaining Power of Buyers

- 3.1.1.3 Threat of New Entrants

- 3.1.1.4 Threat of Substitute Products

- 3.1.1.5 Degree of Competition

- 3.1.2 Industry Value Chain Analysis

- 3.1.3 Key Performance Indicators

- 3.1.4 Analysis of Use Cases of Virtual Sensors

- 3.1.5 Official Vs Customized Solutions

- 3.1.6 Pricing Analysis

- 3.1.1 Industry Attractiveness - Porter's Five Forces Analysis

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Adoption of IoT and Cloud Platform Is Expected to Drive the Market

- 4.1.2 Growing Need For Enhanced Cost-effectiveness and Operational Efficiency in Manufacturing

- 4.2 Market Challenges

- 4.2.1 Lack of Skilled Manpower and Technical Knowledge

- 4.2.2 Data Security and Privacy Concerns

5 MARKET SEGMENTATION

- 5.1 By Deployment Type

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Manufacturing

- 5.2.3 Transportation and Automotive

- 5.2.4 Metal and Mining

- 5.2.5 Aerospace and Defense

- 5.2.6 Electronics and Consumer Technologies

- 5.2.7 Other End User Industries

- 5.3 By Geography***

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.3 Asia

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.6 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Global Rankings Analysis

- 6.2 Company Profiles*

- 6.2.1 Schneider Electric SE

- 6.2.2 Elliptic Labs ASA

- 6.2.3 Modelway SRL

- 6.2.4 Cisco Systems Inc.

- 6.2.5 General Electric Company

- 6.2.6 Siemens AG

- 6.2.7 Korber AG

- 6.2.8 Intelli Dynamics (Biocomp Systems, Inc.)

- 6.2.9 Andata Ltd

7 GO-TO-MARKET (GTM) STRATEGY

- 7.1 Market Segmentation and Target Audience

- 7.2 Value Proposition

- 7.3 Distribution Channel Strategies

- 7.4 Competitive Landscape

- 7.5 Addressing Market Challenges

- 7.6 Conclusion and Recommendations