|

市場調查報告書

商品編碼

1519930

全球廢棄物管理市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Global Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

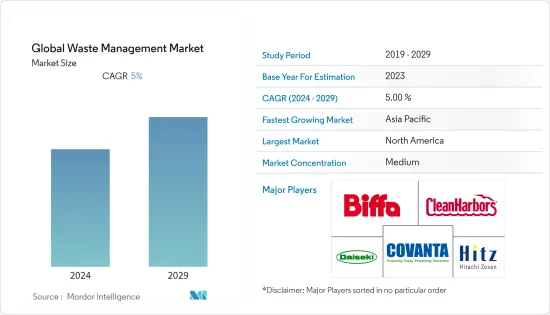

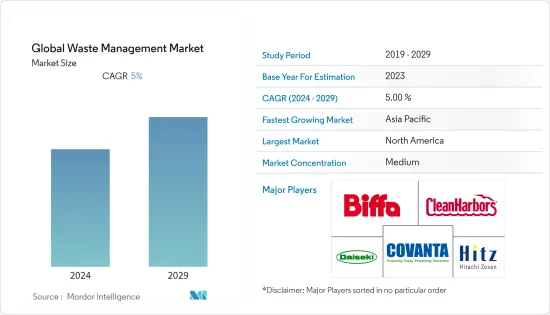

全球廢棄物管理市場規模預計在預測期內複合年成長率為 5%。

快速的經濟成長、都市化和人口成長增加了資源消費量,導致大量廢棄物排放到環境中。從全球觀點,目前的廢棄物和資源管理缺乏涵蓋產品設計、原料提取、生產、消費、回收和廢棄物管理整個連續流程的整體方法。缺乏有效廢棄物管理的土地以及對能源和資源回收的關注正在推動市場成長。另一方面,廢棄物管理的永續性低和對廢棄物管理的重視程度不高正在限制市場的成長。此外,可回收產品購買量的增加為市場成長提供了巨大的機會。全球廢棄物管理市場的成長是由政府擴大採取積極措施來減少非法傾倒所推動的。

COVID-19 對廢棄物管理產業的影響已從細分市場轉移。因為在封鎖期間,由於部分或完全關閉工業和辦公室,住宅比工業和商業中心產生了更多廢棄物。然而,隨著許多國家經濟復甦、生產重新啟動以及疫苗接種開始,廢棄物產生量將會增加,廢棄物回收業和廢棄物管理公司將被迫滿載運作。

廢棄物管理市場趨勢

注意建築/拆除廢棄物管理系統

目前,世界各地的建築和拆除廢棄物正在以健康的速度成長,其管理包括對建築物和其他基礎設施的建設、維修和拆除過程中產生的廢棄物進行監測、收集、運輸、回收和處置等各種活動。我們幫助最大限度地減少和再利用建設活動期間產生的廢棄物,包括混凝土、泥土、木材、玻璃、塑膠、紙板和金屬。與住宅廢棄物不同,建築和拆除廢棄物是惰性的、重的且不可生物分解性的。因此,監管機構要求商業設施對這些廢棄物進行分類、處理和過濾,然後才能回收或分解。建築和拆除活動的增加正在推動全球對建築和拆除廢棄物管理的需求。建築和拆除活動產生大量混凝土、木材、塑膠和金屬廢棄物。建築和拆除廢棄物管理的採用在世界各地越來越受歡迎,因為如果這些廢棄物處理不當,就會導致溫室氣體排放、環境退化和人類健康狀況不佳。

全球廢棄物增加

全球每年產生 20.1 億噸都市固態廢棄物,其中至少 33%(非常保守)沒有以環境安全的方式進行管理。全球整體,每人每天平均產生廢棄物量為0.74公斤,但範圍很廣,從0.11公斤到4.54公斤不等。儘管高所得國家僅佔世界人口的16%,但它們排放的廢棄物卻約佔全球的34%,即6.83億噸。

在許多國家,固態廢棄物管理業務是區域性責任,近 70% 的國家設立了負責廢棄物部門政策制定和法律規範的機構。大約三分之二的國家製定了有針對性的固態廢棄物管理法律法規,但執行情況差異很大。

到 2050 年,全球廢棄物預計將增加至 34 億噸,是同期人口成長量的兩倍多。整體而言,廢棄物產生量與收入水準之間存在正相關關係。在高所得國家,到 2050 年,人均每日廢棄物產生量預計將增加 19%,而在低收入和中等收入國家,預計將增加 40% 左右或更多。到 2050 年,低收入國家產生的廢棄物總量預計將增加兩倍以上。

廢棄物管理產業概述

全球廢棄物管理市場競爭激烈,許多公司專注於創新技術來回收和再利用世界各地各行業和家庭產生的廢棄物。一些新興企業也不斷湧現,遵循零廢棄物- 3R(減少、再利用、回收)概念,持續關注減少廢棄物。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察與市場動態

- 市場概況

- 深入了解有效廢棄物管理的技術進步與創新

- 產業吸引力-波特五力分析

- 價值鏈/供應鏈分析

- 洞察新興企業進入全球廢棄物管理產業的策略

- 特色市場趨勢

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 市場限制因素

- 市場機會

第6章市場細分(市場規模:金額/數量)

- 依廢棄物類型

- 工業廢棄物

- 城市固態廢棄物

- 電子廢棄物

- 塑膠廢棄物

- 醫療廢棄物/其他廢棄物

- 依廢棄方法分類

- 掩埋

- 焚化

- 回收

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東/非洲

- 拉丁美洲

- 北美洲

第7章 全球廢棄物管理產業投資分析

第8章 競爭格局

- 公司簡介

- Biffa Group

- Clean Harbors, Inc.

- Covanta Holding Corporation

- Veolia Environment SA

- Waste Connections

- Remondis AG & Co. Kg

- Suez Environment SA

- Daiseki Co. Ltd

- Waste Management Inc.

- Republic Services

- Averda

第9章 市場機會及未來趨勢

第10章附錄

第 11 章 附錄 免責聲明與出版商資訊

The Global Waste Management Market is expected to register a CAGR of 5% during the forecast period.

Rapidly growing economies, urbanization and the increasing population have led (materially intensive) to an increase in the resource consumption, and consequently the release of large amounts of waste into the environment. Observing from a global perspective, current waste and resource management lacks a holistic approach which covers the whole chain of product design, raw material extraction, production, consumption, recycling and waste management. A scarcity of land for the effective waste disposal and focus on the energy and resource recovery is driving the market growth. On the other hand, lower sustainability in waste management and low importance towards waste management are restricting market growth. In addition, the rise in the purchase of recyclable products is providing immense opportunities for market growth. The growth of the global waste management market is driven by an increase in the adoption of proactive government measures to reduce illegal dumping.

COVID-19 impacted the waste management industry from the focus of segment shift; as during lockdown, the residential segment generated more amount of waste as compared to industrial and commercial centres, as industries and offices were partially or completely shut. However, reviving economies and resuming production activities along with start of vaccination drives in numerous countries will increase the amount of waste generation and lead to re-initiation of waste recycle industry and waste management companies at their full-scale capacity.

Waste Management Market Trends

Spotlight on the Construction and Demolition waste management systems

At present, Construction and Demolition waste across worldwide is growing healthily whose management involves various activities such as - monitoring, collecting, transporting, recycling and disposing of the waste generated during construction, renovation or demolition of buildings or any other infrastructure. It assists in minimizing and re-using waste materials such as concrete, soil, wood, glass, plastic, cardboard and metal during construction activities. Unlike residential waste, construction and demolition waste materials are inert, heavy and non-biodegradable. Hence, regulatory authorities require commercial facilities for sorting, treating and filtering these materials before they can be re-used or decomposed. Increased construction and demolition activities are catalyzing the demand for the construction and demolition waste management worldwide. Construction and demolition activities produce large amounts of concrete, wood, plastic and metal waste. As improper disposal of these materials results in the emission of GHGs, environmental degradation, and deterioration of the overall health of people, the adoption of construction and demolition waste management practices has been gaining popularity all over the world.

Growth in Global Waste

There is a generation of 2.01 billion tons of municipal solid waste per year at the global level, with at least 33% of that-extremely conservatively-not managed in an environmentally safe manner. Worldwide, waste generated per person per day averages 0.74 kilograms but ranges widely, from 0.11 to 4.54 kilograms. Though they only account for 16 percent of the world's population, high-income countries generate about 34 percent, or 683 million tons, of the world's waste.

In many countries, solid waste management operations are a local responsibility, and nearly 70% of countries have established institutions with responsibility for policy development and regulatory oversight in the waste sector. About two-thirds of countries have created targeted legislation and regulations for solid waste management, though enforcement varies drastically.

Global waste is expected to grow to 3.40 billion tons by 2050, greater than double population growth over the same period. Overall, there is a positive correlation between waste generation and income level. Daily per capita waste generation in high-income countries is anticipated to increase by 19% by 2050, compared to low- and middle-income countries, where it is expected to increase by approximately 40% or more. The total quantity of waste generated in low-income countries is expected to increase by greater than three times by 2050.

Waste Management Industry Overview

The global waste management market is highly competitive with many players focused on the innovative technologies to recycle and reuse the waste generated across various industries and households across the globe. There are also several startups coming up in the industry that are continuously focusing on waste reduction following the Zero Waste - 3R (Reduce, Reuse and Recycle) philosophy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS and DYNAMICS

- 4.1 Market Overview

- 4.2 Insights into Technological Advancements and Innovation in Effective Waste Management

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Insights on Strategies of Rising Startups Venturing into the Global Waste Management Industry

- 4.6 Spotlight on Market Trends

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

- 5.3 Market Opportunities

6 MARKET SEGMENTATION (Market Size by Value and Volume)

- 6.1 By Waste type

- 6.1.1 Industrial waste

- 6.1.2 Municipal solid waste

- 6.1.3 E-waste

- 6.1.4 Plastic waste

- 6.1.5 Biomedical and Other Waste Types

- 6.2 By Disposal methods

- 6.2.1 Landfill

- 6.2.2 Incineration

- 6.2.3 Recycling

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Middle East & Africa

- 6.3.5 Latin America

- 6.3.1 North America

7 INVESTMENT ANALYSIS IN GLOBAL WASTE MANAGEMENT INDUSTRY

8 COMPETITIVE LANDSCAPE

- 8.1 Overview (Market Concentration and Major Players)

- 8.2 Company Profiles

- 8.2.1 Biffa Group

- 8.2.2 Clean Harbors, Inc.

- 8.2.3 Covanta Holding Corporation

- 8.2.4 Veolia Environment SA

- 8.2.5 Waste Connections

- 8.2.6 Remondis AG & Co. Kg

- 8.2.7 Suez Environment S.A.

- 8.2.8 Daiseki Co. Ltd

- 8.2.9 Waste Management Inc.

- 8.2.10 Republic Services

- 8.2.11 Averda*