|

市場調查報告書

商品編碼

1521315

熱處理鋼板:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Heat-treated Steel Plates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

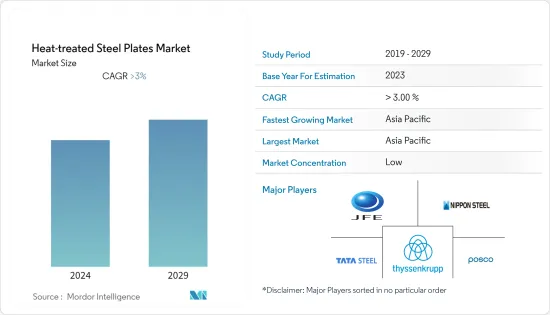

熱處理鋼板市場規模預計到2024年為73.3億美元,預計到2029年將達到90.2億美元,在預測期內(2024-2029年)複合年成長率將超過4%。

2020 年市場受到 COVID-19 的顯著影響。疫情迫使多個國家實施封鎖,全球幾乎所有產業的製造設施都關閉了一段時間。工業生產中斷影響了金屬生產,尤其是鋼鐵生產。此外,建設產業在此期間經歷了暫時的放緩。目前市場已經從疫情中恢復過來,並且正在以相當快的速度成長。 COVID-19 對 2020 年市場產生了負面影響。然而,市場預計將在2022年達到疫情前的水平,並繼續保持穩定成長。

主要亮點

- 重型機械生產應用的擴大和新興國家建設產業需求的增加正在推動市場成長。

- 原料價格的波動預計將阻礙熱處理鋼板市場的成長。

- 擴大在能源和電力領域的應用預計將是未來的機會。

- 由於工業化和建築業的快速成長,亞太地區預計將主導全球熱處理鋼板市場。

熱處理鋼板市場趨勢

擴大機器生產應用

- 熱處理鋼板用於提高鋼的機械和化學性能而不改變其原有性能。因此,它被用於各種最終用戶行業。

- 由於熱處理鋼板的特性,汽車和工業機械的需求不斷增加。在鋼種中,碳鋼佔有很大佔有率,用途廣泛。

- 熱處理鋼板用於生產機械設備,如齒輪齒、起重機電纜捲筒、輪圈、煞車鼓、機器蝸桿鋼、輪圈、鐵路車輪、曲軸、液壓離合器、電力傳輸線、鍋爐配件、等馬蘇。

- 印度工業和內貿促進部提案2022年對工業機械領域投資約250億印度盧比(約3.2億美元),與前一年同期比較%。

- 此外,我們還在中國進行了多項投資和擴張,以滿足專業機械不斷變化的需求。例如,中國礦山設備製造商奈普礦機於2022年10月宣布將在塞爾維亞設立全資子公司,並投資2,500萬美元在該國建造生產基地。

- 總體而言,工業機械應用的增加和發展中地區需求的下降預計將影響未來幾年對熱處理鋼板的需求。

亞太地區主導市場

- 亞太地區擁有高度發展的中國、日本和印度製造業,以及多年來持續投資發展的汽車、建築、能源和電力產業,預計將主導全球市場。

- 近年來,能源和電力產業的需求大幅成長。熱處理鋼板用於鍋爐、儲存槽、壓力容器和其他最常用於水力發電廠、核能發電廠和其他能源發電廠的結構部件。

- 亞太地區火力發電產業錄得成長,其中中國是該產業成長的主要推手。中國擁有的燃煤發電廠比世界上任何其他國家或地區都多。截至2022年7月,中國當地運作燃煤發電廠1,118座。這大約是排名第二的印度的四倍。中國煤炭發電量佔全球一半以上。

- 中國在「十四五」規劃(2021-2025年)中設定了約1,100GW的燃煤發電容量目標。因此,網路營運商國家電網和中國電力委員會的目標是在國內開發數百個新的燃煤發電廠。超過一半的燃煤發電廠正在虧損,許多電廠的運轉率低於50%。

- 此外,亞太地區的建設產業正在不斷成長。印度、日本和中國近年來經歷了不錯的成長。

- 在日本,國土交通省宣布,2022年將建造約859,500套住宅,與前一年同期比較增加0.4%。

- 國內重建計劃對市場成長做出了重大貢獻。例如,八重洲重建計劃包括辦公大樓、飯店、住宅、零售和教育設施,預計將於 2023 年完工。其他計劃包括芝浦鉻 (Shibaura Chrome) 重建項目和新橋大廈 (Shinbashi Building) 重建項目,其中包括辦公室、零售和住宅空間。

- 工業化的快速進步、機械設備的使用增加、新興市場的建築業以及發電廠數量的增加預計將在未來幾年推動亞太地區熱處理鋼板市場的發展。

熱處理鋼板產業概況

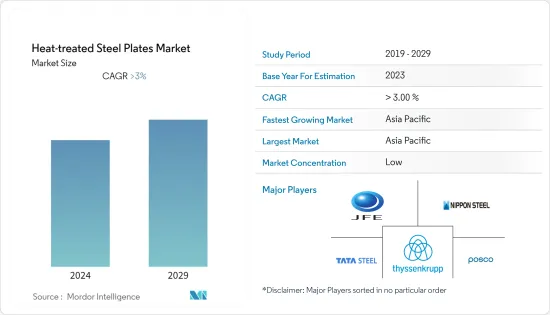

熱處理鋼市場分為幾個部分。研究市場的主要企業(排名不分先後)包括POSCO、新日鐵、塔塔鋼鐵有限公司、JFE Mineral & Alloy Company, Ltd.、蒂森克虜伯鋼鐵歐洲公司等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 增加機器生產中的使用

- 新興國家建築業需求不斷成長

- 其他司機

- 抑制因素

- 原物料價格波動

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 鋼種

- 碳鋼

- 不銹鋼

- 合金鋼

- 按熱處理類型

- 退火

- 回火

- 正火化

- 淬火

- 按行業分類

- 汽車/重型機械

- 建築/施工

- 造船/近海結構

- 能源/電力

- 其他(金屬加工、運輸等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ArcelorMittal

- Baosteel Group

- HYUNDAI STEEL

- JFE Mineral & Alloy Company,Ltd.

- NIPPON STEEL CORPORATION

- NUCOR

- Outokumpu

- POSCO

- TATA STEEL LIMITED

- thyssenKrupp Steel Europe

第7章 市場機會及未來趨勢

- 拓展能源電力領域的應用

- 其他機會

The Heat-treated Steel Plates Market size is estimated at USD 7.33 billion in 2024, and is expected to reach USD 9.02 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The market was significantly impacted by COVID-19 in 2020. Several countries were forced to go in lockdown owing to the pandemic scenario, which led to a shutdown of manufacturing facilities of almost every industry worldwide for a specified time. Disruption of industrial production impacted metals production, especially steel production. Furthermore, the building and construction industry experienced a temporary slowdown during the period. Currently, the market has recovered from the pandemic and is growing at a significant rate. COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

Key Highlights

- The increasing applications in the production of heavy machinery and growing demand from the construction industry in developing countries are driving the market growth.

- Fluctuating raw material prices is expected to hinder the market growth for heat-treated steel plates.

- Increasing application in the energy and power sector is expected to act as an opportunity in the future.

- Due to rapid industrialization and the growing construction sector, the Asia-Pacific region is expected to dominate the heat-treated steel plates market, globally.

Heat-Treated Steel Plates Market Trends

Growing Applications for Machinery Production

- Heat-treated steel plates are used to improve the mechanical and chemical properties of steel without changing any original characteristics. Hence, they are being used by various end-user industries.

- The demand from the automobile and industrial machinery has been growing because of heat-treated steel plate properties. Among all the types of steel, carbon steel has a major share and is used in different applications.

- Heat-treated steel plates are employed to produce machinery equipment, such as gear teeth profile, crane cable drum, gear wheel, brake drum, machines worm steel, flywheel, railway wheels, crankshaft, hydraulic clutches, electric transmission lines, boiler mountings, etc.

- The Department for Promotion of Industry and Internal Trade in India proposed investment value of nearly INR 25 billion (~ USD 320 million) in 2022 towards the industrial machinery sector, a significant increase of nearly 29% compared to previous year.

- Further, in China, several investment and expansion have been made to meet the developing need of speacialist machinery. For example, Naipu Mining Machinery, a Chinese manufacturer of mining equipment in October 2022, announced the investment of USD 25 million to set up a wholly owned subsidiary in Serbia and build a production base in the country.

- Overall, increasing applications for industrial machinery and a decrease in demand in developing regions are expected to impact the demand for heat-treated steel plates through the years to come.

Asia-Pacific to Dominate the Market

- Asia-Pacific region is expected to dominate the global market owing to the highly developed manufacturing sector in China, Japan, and India, coupled with the continuous investments done in the region to advance the automotive, construction, energy, and power sector through the years.

- The demand from the energy and power sector has been growing significantly in recent years. Heat-treated steel plates are being used for boilers, storage tanks, pressure vessels, and other structural parts most commonly used in hydropower stations, nuclear, and other energy generation plants.

- The Asia-Pacific thermal sector is registering growth, with China primarily driving the growth of the sector. China has the most coal-fired power plants of any country or territory in the world. On the Chinese Mainland as of July 2022, there were 1,118 operational coal power plants. This is approximately four times the number of such power plants in India, which came in second place. China accounts for more than half of worldwide coal electricity generation.

- China, under its 14th Five-Year Plan (2021-2025), has set the target for coal-power capacity to about 1,100 GW. Thus, the network operator, State Grid, and the China Electricity Council have been targeting to develop hundreds of new coal-fired power stations in the country. The country has been looking forward to developing power plants despite overcapacity in the sector, where more than half of the coal-power plants have been witnessing loss, and few plants have been running at less than 50% of their capacity.

- Moreover, the construction industry in Asia-Pacific has constantly been growing. India, Japan, and China have witnessed decent growth in recent years.

- In Japan, according to the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) Japan, in 2022, approximately 859.5 thousand housing developments were initiated in Japan, which represented an increase of 0.4% compared to the previous year.

- Redevelopment projects in the country have been one of the prominent contributors to the growth of the market. For instance, the Yaesu redevelopment project, which includes office, hotel, residential, retail, and educational facilities, is due to be completed by 2023. Other projects include the Shibaura chrome redevelopment and the new Shimbashi building redevelopment with office, retail, and residential spaces.

- With the rapid growth of industrialization, increasing usage of machinery equipment, and construction industries in developing countries, the rising power generation plants are expected to drive the market for heat-treated steel plates in Asia-Pacific through the years to come.

Heat-Treated Steel Plates Industry Overview

The heat-treated steel plates market is partly fragmented in nature. The major players in the studied market (not in any particular order) include POSCO, NIPPON STEEL CORPORATION, TATA STEEL LIMITED, JFE Mineral & Alloy Company,Ltd., and thyssenKrupp Steel Europe, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications in Machinery Production

- 4.1.2 Growing Demand from Construction Industry in Developing Countries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Steel Type

- 5.1.1 Carbon Steel

- 5.1.2 Stainless Steel

- 5.1.3 Alloy Steel

- 5.2 By Heat Treatment Type

- 5.2.1 Annealing

- 5.2.2 Tempering

- 5.2.3 Normalizing

- 5.2.4 Quenching

- 5.3 By End-user Industry

- 5.3.1 Automotive and Heavy Machinery

- 5.3.2 Building and Construction

- 5.3.3 Ship Building and Off-Shore Structures

- 5.3.4 Energy and Power

- 5.3.5 Others (Metalworking, Transportation, etc.)

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Baosteel Group

- 6.4.3 HYUNDAI STEEL

- 6.4.4 JFE Mineral & Alloy Company,Ltd.

- 6.4.5 NIPPON STEEL CORPORATION

- 6.4.6 NUCOR

- 6.4.7 Outokumpu

- 6.4.8 POSCO

- 6.4.9 TATA STEEL LIMITED

- 6.4.10 thyssenKrupp Steel Europe

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications in Energy and Power

- 7.2 Other Opportunities