|

市場調查報告書

商品編碼

1521316

地下物件測繪:市場佔有率分析、產業趨勢、成長預測(2024-2029)Underground Utility Mapping - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

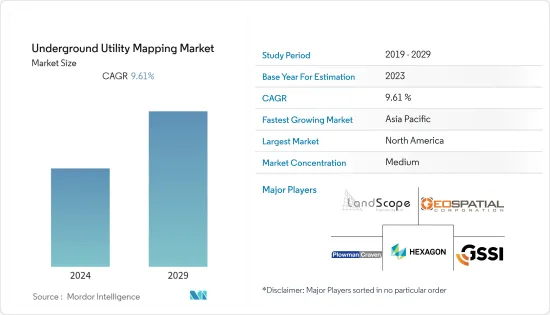

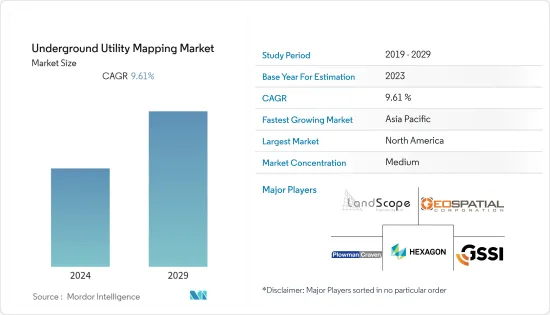

地下測繪市場規模預計到 2024 年將達到 13.2 億美元,預計到 2029 年將達到 20.9 億美元,在預測期內(2024-2029 年)複合年成長率將超過 9.61%。

地下物體(例如管道和地下電力線)的測繪確定了物體的位置。地下物體測繪在土木工程中至關重要,因為它可以節省由於物體碰撞而導致的昂貴維修的時間和金錢。借助準確的埋葬地圖,計劃規劃人員可以準確規劃所需工作的成本。然而,繪製隱藏埋藏物體的位置圖本質上是一項艱鉅的任務,測量人員面臨記錄精度和繪圖挑戰。

主要亮點

- 在過去幾年中,地下工程 (SUE) 行業開發了繪製地下物體地圖的新方法。我們使用物理技術(例如電磁定位器和地下雷達)和非技術方法(例如歷史記錄)來收集足夠的地下基礎設施資訊。

- 近年來,隨著智慧型手機的普及,供應商抓住機會開發基於應用程式的地圖解決方案來協助工程師的工作。例如,地下測繪工具製造商雷迪公司發布了 Android 測繪應用程式,該應用程式與其 RF 標記定位器範圍以及電纜、管道和 RF 標記範圍相容。該應用程式使用藍牙連接來創建埋藏物體的即時地圖。

- 新技術與埋藏物測繪的結合透過提高探勘活動的準確性、效率和安全性,正在徹底改變地下測繪市場。這些進步使探勘團隊能夠克服與地下基礎設施相關的挑戰,最佳化探勘路線並最大限度地降低風險,最終推動市場成長和創新。

- 技術的進步促進了許多用戶可以使用的高級檢測應用程式的開發。這些應用程式包括軟體解決方案、行動應用程式和配備可偵測地下物體的感測器的手持裝置。

- 繪圖工具通常具有較高的前期投資要求以及較高的維護成本。這可能會阻止潛在客戶,尤其是小型組織或預算有限的組織採用地下埋葬測繪解決方案。

- COVID-19 大流行加速了數位技術的採用,包括地下埋葬測繪解決方案。組織已經認知到流程數位化和自動化對於提高效率、減少對體力勞動的依賴以及減少未來干擾的重要性。

地下測繪市場的趨勢

地下雷達有望成為最大的組件解決方案

- 地下雷達 (GPR) 是繪製埋地物體地圖的合適方法,可發射 MHz 和 GHz 範圍內的定向電磁波。探地雷達利用電磁訊號的反射來定位地下公共物體。

- 探地雷達技術精度高,可定位金屬和非金屬埋藏物體。埋地測量人員喜歡使用地下雷達進行埋地物體測繪,因為它可以提供快速資料擷取、低運作成本和高解析度影像。

- 探地雷達提供了一種非破壞性且有效的方法來評估水泥建築物,提供有關鋼筋位置、樓板厚度、空腔和管道的寶貴資訊。透過避免侵入性技術,探地雷達可確保準確的結果,同時最大限度地減少對正在進行的建設計劃的干擾。

- 無人機製造商正在開發具有探地雷達功能的無人機,用於探測地下公共埋藏物體,預計將在未來幾年擴大市場機會。

- 隨著天然氣管道的激增,對準確、高效的測繪和監測的需求日益增加。地下穿透技術對於定位管道並評估其狀況而不擾亂或破壞周圍環境至關重要。據GGON稱,截至2024年2月,中國運作的天然氣管道數量位居世界第一。中國天然氣管網由442條功能管道組成,其中規劃或已建造302條。全球運作中的天然氣管道總數超過1500條。

預計未來北美將佔據大部分市場佔有率

- 北美快速的都市化和人口成長給現有基礎設施系統帶來了越來越大的壓力,增加了對地下測繪服務的需求。都市區特別複雜且人口稠密,需要精確的測繪,以避免在建設活動期間損壞地下公用設施。

- 據國家地下資產登記諮詢小組稱,過去 20 年來,不確定的地下地點平均每年給美國經濟造成 500 億美元的損失,並造成 1,500 多人受傷和近 400 人死亡。由於地下測繪資訊缺失和不準確,這種不確定性是導致高速公路建設延誤的重要原因。埋藏物測繪的這種不確定性刺激了該地區基於先進技術的解決方案的成長。

- 許多北美城市和直轄市正在投資智慧城市計劃,利用科技改善基礎設施管理、增強公共服務並最佳化資源配置。地下測繪為基礎設施資產管理和規劃提供重要資料,對於智慧城市規劃和發展至關重要。

- 該地區正在大力開發共享施工期間捕獲的地下物體資料的方法。例如,芝加哥市啟動了試驗計畫,部署一個平台來收集資料並共用地鐵 3D 地圖。

- 該地區的參與者還專注於無機成長策略,以獲取重要的市場佔有率,從而促進該地區細分市場的成長。此外,該地區的許多公共工程部門現在都使用 GIS 來顯示公共公用設施的位置。

地下測繪產業概述

由於全球參與者和中小企業的存在,地下測繪市場處於半固體。市場上的主要企業包括 Hexagon AB、GSSI Geophysical Survey Systems Inc.、LandScope Engineering Ltd、Plowman Craven Limited 和 Geospatial Corporation。每個參與者都在採取聯盟和收購等策略來加強其產品陣容並獲得競爭優勢。

- 2023年7月,海克斯康礦業部門宣布收購加拿大HARD-LINE公司,該公司是礦場自動化、礦場生產最佳化和遠端控制技術領域的全球領導者。 HARD-LINE 專注於遠端控制解決方案和網路基礎設施,使重型機械能夠從安全位於地面或地下的控制站進行遠端操作,無論距離如何。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 新技術與埋藏物測繪結合,改善探勘活動

- 提高檢測應用程式的可用性並提高行銷支出回報

- 市場挑戰

- 測繪工具維護成本高

第6章 COVID-19 對地下物測繪市場的影響

第7章 市場區隔

- 依組件類型

- 解決方案

- 地下雷達

- 電磁定位器

- 其他解決方案

- 按服務

- 解決方案

- 按最終用戶產業

- 公共

- 油和氣

- 建築/施工

- 通訊業

- 電

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第8章 競爭格局

- 公司簡介

- Hexagon AB

- GSSI Geophysical Survey Systems Inc.

- Landscope Engineering Ltd

- Plowman Craven Limited

- Geospatial Corporation

- Vivax-Metrotech Corp.

- Maverick Inspection Ltd

- Red Laser Scanning

- Technics Group

- multiVIEW Locates Inc.

第9章投資分析

第10章市場的未來

The Underground Utility Mapping Market size is estimated at USD 1.32 billion in 2024, and is expected to reach USD 2.09 billion by 2029, growing at a CAGR of greater than 9.61% during the forecast period (2024-2029).

Underground utility mappings like pipework or underground electric wires determine the utility location. Underground utility mapping is essential to civil engineering because it saves time and money on costly repairs caused by striking utilities. Project planners can accurately plan costs for work to be done with the help of an accurate utility map. However, surveyors face record accuracy and mapping challenges, as mapping the location of hidden utility objects is an inherently difficult task.

Key Highlights

- Over the last few years, the subsurface utility engineering (SUE) industry has developed novel approaches to mapping underground utility infrastructure. Geophysical technologies such as electromagnetic locators and ground-penetrating radars are used with non-technical methods such as historical records to gather sufficient subsurface infrastructure information.

- With the proliferation of smartphones in recent years, vendors are seizing the opportunity to create app-based mapping solutions to aid engineers in their work. For example, Radiodetection, a manufacturer of underground utility mapping tools, released an Android mapping app compatible with the RF marker locator range and the cable, pipe, or RF marker range. The app uses Bluetooth connectivity to create a real-time map of buried utilities.

- The combination of emerging technologies with utility maps is revolutionizing the underground utility mapping market by improving the accuracy, efficiency, and safety of exploration activities. These advancements enable exploration teams to overcome challenges associated with underground infrastructure, optimize exploration routes, and minimize risks, ultimately driving growth and innovation in the market.

- Technological advancements have led to the development of sophisticated detection applications that are more accessible to many users. These applications may include software solutions, mobile apps, and handheld devices equipped with sensors capable of detecting underground utilities.

- High maintenance costs often accompany high upfront investment requirements for mapping tools. This can deter potential customers, especially smaller organizations or those with limited budgets, from adopting underground utility mapping solutions.

- The COVID-19 pandemic accelerated the adoption of digital technologies, including underground utility mapping solutions. Organizations recognized the importance of digitizing and automating processes to improve efficiency, reduce reliance on manual labor, and mitigate future disruption.

Underground Utility Mapping Market Trends

Ground Penetrating Radar is Expected to be the Largest Component Type Solution

- Ground-penetrating radar (GPR) is the preferred method for utility mapping, emitting directional electromagnetic waves in the MHz and GHz range. GPR uses the electromagnetic signal's return to determine the location of underground utility infrastructure.

- GPR technology is highly accurate and can locate both metallic and nonmetallic utilities. Utility surveyors prefer ground-penetrating radar for utility mapping surveys because it provides quick data acquisition, lower operating costs, and high-resolution imagery.

- GPR offers a non-destructive and efficient method for assessing concrete structures, delivering valuable information on rebar locations, slab thickness, and voids or conduits. By avoiding invasive techniques, GPR minimizes disruption to ongoing construction projects while ensuring accurate results.

- Drone manufacturers are developing GPR-enabled drones for detecting underground utilities, which is expected to expand the market opportunities in the coming years.

- As the number of natural gas pipelines grows, the need for accurate and efficient mapping and monitoring increases. Ground penetration techniques are essential for locating, identifying, and assessing the pipeline's condition without causing disruption or damage to the surrounding environment. According to GGON, as of February 2024, China had the highest number of operational gas pipelines globally. The Chinese gas network comprised 442 functional pipelines, with 302 proposed or already under construction. The total number of operational gas pipelines globally is above 1,500.

North America is Expected to Hold a Significant Portion of the Market Share in the Future

- The rapid urbanization and population growth in North America are increasing the pressure on existing infrastructure systems, leading to higher demand for underground utility mapping services. Urban areas are particularly complex and densely populated, requiring precise mapping to avoid damage to underground utilities during construction activities.

- According to the National Underground Asset Registry Advisory Group, the uncertainty of locating underground utilities costs the US economy an average of USD 50 billion (USD 50,000 million) per year, with over 1,500 injuries and nearly 400 deaths recorded over the last 20 years. Due to missing or inaccurate information about underground utility mapping, this uncertainty is a significant cause of highway construction delays. These mapping utility uncertainties fuel the growth of advanced technology-based solutions in the region.

- Many cities and municipalities in North America are investing in smart city initiatives to leverage technology to improve infrastructure management, enhance public services, and optimize resource allocation. Underground utility mapping is crucial in smart city planning and development by providing essential data for infrastructural asset management and planning.

- Significant efforts are being made in the region to develop methods of sharing data about underground utilities captured during construction. For instance, the City of Chicago launched a pilot program to deploy a platform for collecting data and sharing a 3D map of the subway.

- The region's players are also focusing on inorganic growth strategies to capture significant market shares, boosting the growth of the regional segment. Moreover, many public works departments in the region currently use GIS to display the location of underground utilities.

Underground Utility Mapping Industry Overview

The underground utility mapping market is semi-consolidated due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Hexagon AB, GSSI Geophysical Survey Systems Inc., LandScope Engineering Ltd, Plowman Craven Limited, and Geospatial Corporation. The players are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain a competitive advantage.

- July 2023: Hexagon's Mining division announced the acquisition of Canadian company HARD-LINE, one of the global leaders in mine automation, mine production optimization, and remote-control technology. HARD-LINE specializes in remote control solutions and network infrastructure, allowing for the tele-remote operation of hefty machinery from the control station in a safe area on the surface or underground, regardless of distance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emerging Technologies Combined With Utility Maps to Improve the Exploration Activities

- 5.1.2 Increasing Availability of Detecting Applications and Increased Return on Marketing Spending

- 5.2 Market Challenges

- 5.2.1 Significantly High Maintenance Costs of Mapping Tools

6 IMPACT OF COVID-19 ON THE UNDERGROUND UTILITY MAPPING MARKET

7 MARKET SEGMENTATION

- 7.1 By Component Type

- 7.1.1 Solutions

- 7.1.1.1 Ground Penetrating Radar

- 7.1.1.2 Electromagnetic Locators

- 7.1.1.3 Other Solutions

- 7.1.2 Services

- 7.1.1 Solutions

- 7.2 By End-user Industry

- 7.2.1 Public Safety

- 7.2.2 Oil and Gas

- 7.2.3 Building and Construction

- 7.2.4 Telecommunication

- 7.2.5 Electricity

- 7.2.6 Other End-user Industries

- 7.3 By Geography***

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles*

- 8.1.1 Hexagon AB

- 8.1.2 GSSI Geophysical Survey Systems Inc.

- 8.1.3 Landscope Engineering Ltd

- 8.1.4 Plowman Craven Limited

- 8.1.5 Geospatial Corporation

- 8.1.6 Vivax-Metrotech Corp.

- 8.1.7 Maverick Inspection Ltd

- 8.1.8 Red Laser Scanning

- 8.1.9 Technics Group

- 8.1.10 multiVIEW Locates Inc.