|

市場調查報告書

商品編碼

1521321

汽車聚合物複合材料:市場佔有率分析、產業趨勢、成長預測(2024-2029)Automotive Polymer Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

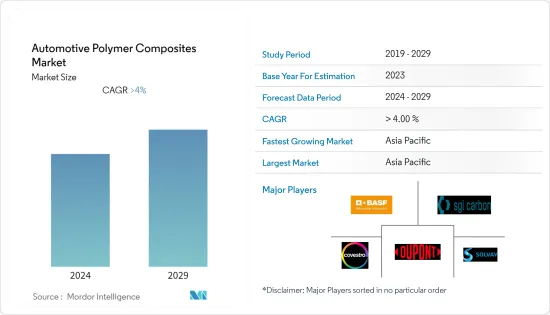

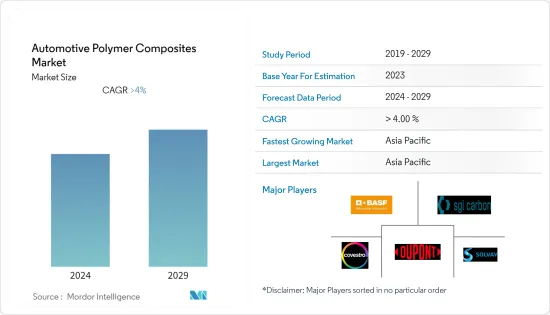

預計2024年汽車聚合物複合材料市場規模為151萬噸,預計2029年將達到199萬噸,預計在預測期內(2024-2029年)複合年成長率將超過5%。

COVID-19 大流行擾亂了供應鏈,導致生產放緩和停工以及景氣衰退,對汽車聚合物複合材料市場產生了重大影響。透過克服剩餘的挑戰並利用市場趨勢,汽車聚合物複合材料市場以其輕質和高性能材料徹底改變汽車產業,正走向光明的未來。

全球市場需要比鋼和鋁等傳統材料更輕的汽車聚合物複合材料,因為更輕的汽車意味著更好的燃油效率和更低的污染物排放。

另一方面,與鋼和鋁等傳統材料相比,聚合物複合材料的加工和製造往往涉及複雜且集中的技術,從而推高了成本並限制了汽車聚合物複合材料市場。

機器人、自動化和數位化方面的創新正在簡化聚合物複合材料的生產流程,降低成本和縮短前置作業時間,並為全球市場帶來令人興奮的可能性。

亞太地區在市場上佔據主導地位,中國、印度、日本和韓國等國家的消費量估計最高。

汽車高分子複合材料市場趨勢

輕型汽車領域聚合物的使用增加

- 汽車產業正在經歷重大變革時期,減重成為提高燃油效率和性能的關鍵驅動力。聚合物在這一轉變中發揮關鍵作用,擴大取代輕型車輛中的鋼和鋁等傳統材料。

- 幾十年來,汽車行業一直致力於減輕車輛重量,因為車輛重量對駕駛動力和燃油效率有直接影響。根據美國能源局(DOE) 的數據,車輛重量減輕 10% 可以提高燃油效率 6-8%。隨著世界各國政府實施更嚴格的排放法規併計劃在未來幾年制定更高的排放標準,輕量材料預計將變得越來越重要。

- 汽車上使用的複合聚合物主要以聚丙烯、聚氨酯、尼龍、聚氯乙烯、丙烯腈-丁二烯-苯乙烯(ABS)等為基礎。聚丙烯和聚氨酯僅佔調查市場的40%以上。

- 汽車製造商還使用預浸料(一種聚合物複合材料)來替代內部和外部部件中的金屬,從而減輕重量並提高性能和安全性。現代化和自動駕駛汽車的發展正在推動需求。

- 碳預浸料用途廣泛,可成型為各種密度、形狀和尺寸,使其成為航空和汽車行業中鋁和鋼的流行替代品。 BMW、法拉利和Lexus等主要汽車製造商正在積極設計採用完整碳纖維車身結構的新車。例如,將於2023年5月上市的第二代BMWM2將主要由碳纖維製成,包括車頂、內裝和整車零件。

- 賽車製造商正在減輕車輛重量,以提高燃油效率和速度。據美國能源局報告稱,汽車重量減輕10%,燃油效率可提高6-8%。這就是為什麼預浸料在汽車和運輸行業,尤其是賽車和高速車輛中如此受歡迎的原因。

- 根據國際汽車工業協會(OICA)預測,2022年全球汽車產業較2021年成長6%。全球已開發國家和新興國家的汽車產量均增加,包括中國、德國、韓國、英國和義大利。 2022年,汽車產量超過8,500萬輛。

- 根據OICA統計,2022年全球整體輕型商用車產量較2021年成長7%,達1,986萬輛。大部分產量來自美洲地區,該地區約佔全球輕型商用車產量的 60%。

- 此外,根據汽車工業商協會的數據,2022年英國商用車產量將增加39.3%(與2021年相比),達到101,600輛。 2022年國內市場產量40,409輛,與前一年同期比較14.0%,其中貨車、卡車、計程車、客車及客車下線101,600輛。汽車製造活動的增加可能會推動預測期內所研究市場的成長。

- 因此,塑膠在汽車中的比例預計將增加,從而提振汽車聚合物複合材料市場。

亞太地區預計將主導市場

- 由於中國、印度和韓國等國家的大量消費導致需求不斷增加,亞太地區佔據了主要市場佔有率,預計將在預測期內主導汽車聚合物複合材料市場。

- 根據OICA稱,2022年亞太地區汽車產量較2021年成長7%。中國、韓國、印度等新興國家2022年汽車產量激增。 2022 年,亞太地區汽車產量將超過 5,000 萬輛。

- 此外,由於儲蓄、低利率以及對個人出行的日益偏好,印度的乘用車銷售在 2022 年 1 月至 9 月期間保持強勁,說服客戶購買新車。受此影響,2022年前第三季印度新車註冊量成長約20.2%,達到280萬輛。 「Aatma Nirbhar Bharat」和「印度製造」計畫等政府改革也支持了該國的汽車工業。

- 印度、韓國和中國等亞太國家政府正努力鼓勵重型卡車車主購買新的重型卡車和其他商用車,並限制使用老舊、污染嚴重的商用車。該計劃預計將降低污染水平並加速重型卡車行業採用聚合物複合材料的進展。

- 此外,中國政府預計2025年電動車的普及率將達到20%。這反映在該國的電動車銷售趨勢上,2022年電動車銷量創下歷史新高。根據中國乘用車協會的數據,2022年中國電動車和插電式混合動力車銷量為567萬輛,幾乎是2021年銷量的兩倍。預計該國對汽車聚合物複合材料的需求將增加,預計此時銷售將持續。

- 上述因素和政府法規導致該地區對汽車聚合物複合材料的需求增加。

汽車用高分子複合材料產業概況

研究的市場是部分整合的。主要企業(排名不分先後)包括BASF股份公司、西格里集團、科思創股份公司、索爾維和杜邦。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 輕型汽車領域聚合物複合材料的使用增加

- 電動車產業高速成長

- 其他司機

- 抑制因素

- 火災風險和碰撞安全的安全問題

- 加工製造成本高

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場細分:市場規模(單位:成交量)

- 樹脂型

- 聚丙烯

- 聚氨酯

- 尼龍

- 聚氯乙烯

- ABS

- 聚乙烯

- 聚碳酸酯

- 其他樹脂類型(聚醚醚酮、聚酯等)

- 車輛類型

- 客車

- 輕型商用車

- 卡車/巴士

- 其他車型(跑車、特種車等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 摩洛哥

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Covestro AG

- DuPont

- Gurit Services AG

- Hexcel Corporation

- Johns Manville

- Kolon Industries

- Mitsubishi Chemical Corporatio

- Owens Corning

- Plasan Sasa Ltd

- Pyrophobic Systems Ltd

- SGL Carbon

- Solvay

- Teijin Carbon

- Toray Advanced Composites

- UFP Technologies Inc.

第7章 市場機會及未來趨勢

- 先進製造技術開發

- 專注永續性和循環經濟

The Automotive Polymer Composites Market size is estimated at 1.51 Million tons in 2024, and is expected to reach 1.99 Million tons by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic significantly impacted the automotive polymer composites market by disrupting the supply chain, causing production to slow down and shut down and an economic downturn. By overcoming the remaining challenges and capitalizing on the market trends, the automotive polymer composites market is poised for a positive future, revolutionizing the automotive industry with its lightweight, high-performance materials.

Lighter vehicles are more fuel-efficient and emit less pollution, which is driving demand for automotive polymer composites in the global market, which are lighter than traditional materials such as steel and aluminum.

On the flip side, compared to traditional materials like steel and aluminum, the processing and manufacturing of polymer composites often involve complex and labor-intensive techniques, driving up costs and is expected to act as a restraint for the automotive polymer composites market.

Innovations in robotics, automation, and digitalization are streamlining composite production processes, reducing costs and lead times, and creating exciting possibilities for the global market.

Asia-Pacific is estimated to dominate the market, with the most significant consumption coming from countries like China, India, Japan, and South Korea.

Automotive Polymer Composites Market Trends

Increasing Use of Polymers in the Light Vehicle Segment

- The automotive industry is undergoing a significant transformation, with lightweight emerging as a critical driver for fuel efficiency and performance improvements. In this shift, polymers are playing a starring role, increasingly replacing traditional materials like steel and aluminum in light vehicles.

- The automotive industry has been focusing on vehicle weight reduction for decades, as vehicle weight has a direct impact on driving dynamics and fuel efficiency. As per the US Department of Energy (DOE), reducing the weight of vehicles by 10% yields an increase of 6-8% in fuel economy. As governments around the world implement stringent emission regulations and plan to set even higher emissions standards in the coming years, the importance of lightweight materials is expected to increase.

- Major composite polymers used in automobiles are based on polypropylene, polyurethanes, nylon, polyvinyl chloride, acrylonitrile-butadiene-styrene (ABS), and others. Polypropylene and polyurethanes only account for more than 40% of the market studied.

- Automakers also use prepregs(a type of polymer composite) to replace metals in interior and exterior parts, reducing weight for better performance and safety. Modernization and autonomous vehicle development drive demand.

- Carbon prepregs are versatile and can be molded into various densities, shapes, and sizes, making them a popular substitute for aluminum and steel in the aviation and automotive industries. Major automakers like BMW, Ferrari, and Lexus are actively designing new models with complete carbon fiber body structures. For example, the second-generation BMW M2, launched in May 2023, is made mainly of carbon fiber, including the roof, interior, and vehicle components.

- Racing car manufacturers reduce curb weight to improve fuel efficiency and speed. According to a US Department of Energy report, a 10% reduction in vehicle weight can improve fuel economy by 6-8%. This makes prepregs highly sought-after in the automotive and transportation industries, especially for racing and high-speed vehicles.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the global automotive industry grew by 6% in 2022 compared to 2021. Automotive production increased in developed and developing countries worldwide, including China, Germany, South Korea, Canada, the United Kingdom, and Italy. Over 85 million motor vehicles were manufactured in 2022.

- According to OICA, light commercial vehicle production across the world increased in 2022 compared to 2021 by 7%, with 19.86 million units produced in 2022. The majority of the production comes from American regions, with about 60% of the total light commercial vehicles produced across the world.

- Moreover, according to the Society of Motor Manufacturers and Traders, British commercial vehicle production grew by 39.3% (as compared to 2021) to 101,600 units in 2022. The output for the domestic market in 2022 rose by 14.0 percent year-on-year to 40,409 units, with 101,600 vans, trucks, taxis, buses, and coaches leaving factory lines. The increased automotive manufacturing activities would aid the growth of the studied market during the forecast period.

- Hence, an increasing share of plastics in automobiles is expected to boost the automobile polymer composites market.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific region is expected to dominate the automotive polymer composites market throughout the forecast period, with its large market share driven by increasing demand from heavy consumption from countries like China, India, South Korea, and more.

- According to the OICA, motor vehicle production in the Asia-Pacific region grew by 7% in 2022 compared to 2021. Developed and developing countries in the area, such as China, South Korea, and India, experienced an upsurge in automotive production in 2022. Over 50 million motor vehicles were manufactured in the Asia-Pacific region in 2022.

- Furthermore, in the first nine months of 2022, Indian passenger car sales remained strong due to savings, lower interest rates, and an increasing preference for personal mobility, which convinced customers to buy new cars. As a result, new car registrations in India grew by around 20.2% in the first three quarters of 2022 to reach 2.8 million units. Also, government reforms such as "Aatma Nirbhar Bharat" and "Make in India" programs supported the country's automotive industry.

- Under the new scrappage policy, governments in Asia-Pacific countries, like India, South Korea, and China, seek to push heavy-duty truck owners to acquire new heavy-duty trucks and other commercial vehicles, discouraging the use of old, polluting ones. The program would reduce pollution levels and promote the advancements of the heavy trucks segment in adopting polymer composites.

- Moreover, the Chinese government estimates a 20% penetration rate of electric vehicle production by 2025. This is reflected in the country's electric vehicle sales trend, which went to a record-breaking high in 2022. As per the China Passenger Car Association, the country sold 5.67 million EVs and plug-ins in 2022, almost double the sales figures achieved in 2021. The market is anticipated to increase the demand for automotive polymer composites in the country, and sales are poised to continue at this moment.

- The factors above and supportive government regulations are contributing to the increased demand for automotive polymer composites in the region.

Automotive Polymer Composites Industry Overview

The market studied is partially consolidated in nature. The major players (not in any particular order) include BASF SE, SGL Group, Covestro AG., Solvay, and DuPont.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use of Composite Material in Light Vehicle Segment

- 4.1.2 High Growth of the Electric Vehicles Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Safety Concerns about Fire Risk and Crashworthiness

- 4.2.2 High Processing and Manufacturing Costs

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Volume)

- 5.1 Resin Type

- 5.1.1 Polypropylene

- 5.1.2 Polyurethanes

- 5.1.3 Nylon

- 5.1.4 Polyvinyl Chloride

- 5.1.5 ABS

- 5.1.6 Polyethylenes

- 5.1.7 Polycarbonate

- 5.1.8 Others Resins Type (Polyetheretherketone, Polyester, etc.)

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Trucks and Buses

- 5.2.4 Other Vehicle Types (Sports Cars, Specialty Vehicles, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 United Kingdom

- 5.3.3.2 France

- 5.3.3.3 Germany

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Morocco

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Covestro AG

- 6.4.3 DuPont

- 6.4.4 Gurit Services AG

- 6.4.5 Hexcel Corporation

- 6.4.6 Johns Manville

- 6.4.7 Kolon Industries

- 6.4.8 Mitsubishi Chemical Corporatio

- 6.4.9 Owens Corning

- 6.4.10 Plasan Sasa Ltd

- 6.4.11 Pyrophobic Systems Ltd

- 6.4.12 SGL Carbon

- 6.4.13 Solvay

- 6.4.14 Teijin Carbon

- 6.4.15 Toray Advanced Composites

- 6.4.16 UFP Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development in Advanced Manufacturing Technologies

- 7.2 Focus on Sustainability and Circular Economy