|

市場調查報告書

商品編碼

1521337

亞硝酸鹽:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Nitrite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

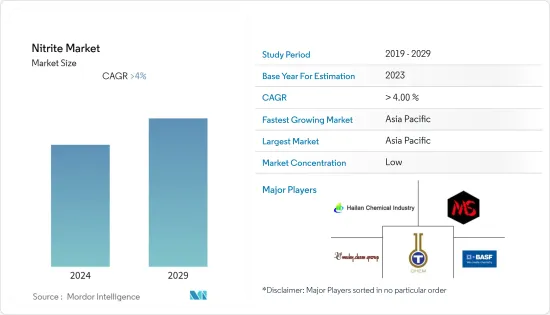

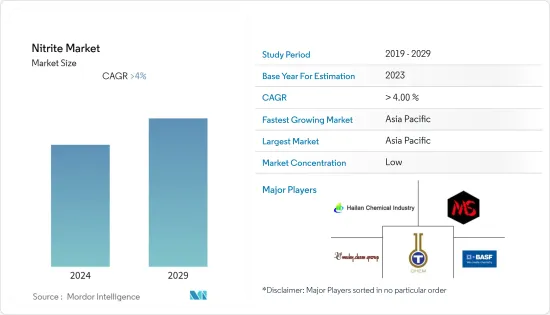

亞硝酸鹽市場規模預計到2024年為221萬噸,預計到2029年將達到270萬噸,在預測期內(2024-2029年)複合年成長率超過4%。

主要亮點

- 儘管COVID-19大流行對亞硝酸鹽市場產生了影響,但其整體影響並不像最初預期的那麼大。由於潛在的需求因素和不斷變化的消費趨勢,預計市場將在長期內復甦並繼續成長。

- 亞硝酸鹽和相關化合物(例如亞硝酸鈣)在農業中擴大用於植物生長調節和作為營養源,已成為亞硝酸鹽市場的關鍵催化劑。

- 亞硝酸鹽市場受到環境污染、溫室氣體排放、潛在致癌性、高鐵血紅蛋白血症等健康問題以及對空氣品質和呼吸系統健康的影響等挑戰的阻礙,這些挑戰主要受到嚴格的環境法規的影響。

- 對更安全的亞硝酸鹽替代品研發的投資正在推動亞硝酸鹽市場向前發展,為食品工業、公共衛生和亞硝酸鹽的持續成長創造重大機會。

- 由於印度和中國農業投資的增加,預計亞太地區將主導全球市場。

亞硝酸鹽市場趨勢

農業領域主導市場

- 亞硝酸鈣、亞硝酸鉀和亞硝酸鈉的植物生長調節和營養益處透過提高作物產量、抗逆性和改善品質來推動亞硝酸鹽市場。

- 過去幾十年來,農業產量和產量不斷增加,全球化肥料和農藥消耗量也隨之增加。在許多開發中國家都觀察到了這種發展。

- 根據聯合國糧食及農業組織(FAO)預測,2022年全球化肥料消費量將達2億噸,比2021年的1.09億噸增加87%。這種激增有可能刺激亞硝酸鹽市場的成長。此外,全球約有80%的人口依賴進口食品。

- 根據美國地質調查局的數據,美國是世界上最大的氨生產國和消費國之一。 2022年,美國合成氨產量將達1,300萬噸,比上年的1,270萬噸小幅增加2%。該生產將由 16 家公司在全國 35 家工廠進行,預計將在預測期內推動亞硝酸鹽市場的發展。

- 根據環境、食品及農村事務部統計,2022年英國農業利用面積(英國)為1,680萬公頃,佔全國總面積的69%。

- 此外,在過去十年中,歐盟(EU)一直是英國在硝酸銨方面的重要貿易夥伴。據英國國家統計局稱,2022 年從歐盟進口的硝酸銨將達到約 1.1565 億英鎊(1.4305 億美元),高於 2021 年的 6508 萬英鎊(8050 萬美元)。與前一年同期比較成長76%。這一趨勢有可能刺激亞硝酸鹽市場。

- 德國大約一半的土地面積用於農業。它是世界第三大農產品出口國,也是亞硝酸鹽市場的領導者。德國農業用地面積最大的州是下薩克森州、巴伐利亞州、北萊茵-威斯特法倫州、巴登-符騰堡州和梅克倫堡-前波莫瑞州。

- 日本經濟產業省公佈,2022年日本化學工業用硝酸銨重度油炸藥產量約19.75噸,較2021年的19.48噸略有增加。這意味著日本的產量在過去五年來首次出現成長,顯示出現復甦。此外,預計在接下來的預測期內產量也會增加。

- 因此,預計上述因素將在預測期內增加亞硝酸鹽市場的需求。

亞太地區主導市場

- 亞太地區在全球市場中佔據主導地位,其中消費量最高的國家是中國和印度等。

- 亞硝酸鹽用作多種基本藥物的合成中間體,包括血管擴張劑和治療氰中毒的藥物。

- 印度作為全球最大的學名藥生產國,在全球製藥業中佔有重要地位。印度製藥業預計將達到1,000億美元,醫療設備市場預計到2025年將成長250億美元。根據印度品牌股權基金會統計,2022年印度藥品出口額為246.2億美元。

- 中國作為全球第二大醫藥市場,由於中產階級的不斷壯大和人口老化,正快速崛起。 2022年該國藥品銷售額激增至1,750億美元,較2021年的1,344億美元大幅成長,與前一年同期比較成長30%。該製藥業的強勁成長預計將有助於亞硝酸鹽市場的擴大。

- 亞硝酸鹽,例如亞硝酸鈣,可以增加鋼筋混凝土的耐腐蝕,特別是在沿海地區。亞硝酸鹽可以保護橋樑和建築物等結構中的鋼材,延長其使用壽命並減少維護。此外,亞硝酸鈉還可作為快速固化的施工促進劑。

- 根據中國國家統計局預測,2022年中國建築業產值將突破31兆元人民幣(4.61兆美元),與前一年同期比較成長10%,達到29.31兆元人民幣(4.36兆美元)。與 10 年前相比成長了近 100%,並且與前一年同期比較成長,預計這將在預測期內推動亞硝酸鹽市場的發展。

- 亞硝酸鹽有助於礦石加工過程中的礦物分離,是採礦炸藥的重要成分。據印度工業和內貿部稱,印度採礦業預計到 2022 年將成長 12% 左右,這有望提振亞硝酸鹽市場。

- 農業是印度約58%人口的主要生計來源。根據印度品牌股權基金會 (IBEF) 的數據,2022 財政年度農業(連同漁業和林業)的總付加價值約為 4,724.7 億美元。

- 預測期內,農業、製藥、建築和其他行業的亞硝酸鹽消費量預計將增加。由於上述所有因素,預計該地區的亞硝酸鹽市場在預測期內將會成長。

亞硝酸鹽產業概況

亞硝酸鹽市場分散。主要參與者包括BASF股份公司、山東海蘭化工、Deepak Nitrite Limited、Anmol Chemicals Group、Finoric LLC 等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 農業領域需求不斷增加

- 化學合成、建築、冶金和製藥等工業應用的需求增加

- 肉類保存的需求不斷增加

- 抑制因素

- 亞硝酸鹽的負面影響

- 在某些應用中天然或有機替代品的威脅

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔:市場規模(基於數量)

- 種類

- 亞硝酸鈣

- 亞硝酸鉀

- 亞硝酸鈉

- 其他類型(亞硝酸銨、亞硝酸鋇)

- 目的

- 農業

- 飲食

- 衛生保健

- 建造

- 製藥

- 冶金

- 其他應用(水處理、攝影、分析化學)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Anmol Chemicals Group

- BASF SE

- Deepak Nitrite Limited

- Finoric LLC

- Forbes Pharmaceutical

- Hualong Nitrite Limited

- Linyi Kemele Chemical Co. Ltd

- Linyi Luguang Chemical Co. Ltd

- MUBY CHEMICALS

- Shandong Hailan Chemical Industry Co. Ltd

- Surpass Chemical Company Inc.

- Thatcher Company

第7章市場機會與未來趨勢

第8章 更安全的亞硝酸鹽替代品的研發投資

第9章 其他機會

簡介目錄

Product Code: 71438

The Nitrite Market size is estimated at 2.21 Million tons in 2024, and is expected to reach 2.70 Million tons by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic impacted the nitrite market, but its overall effect was not as significant as initially anticipated. The market is expected to recover and continue growing in the long term, driven by underlying demand factors and evolving consumer trends.

- The increasing use of nitrites and related compounds, such as calcium nitrite, in agriculture for plant growth regulation and as a nutrient source is emerging as a significant catalyst for the nitrite market.

- The nitrite market is hindered by challenges such as environmental pollution, greenhouse gas emissions, potential carcinogens, health concerns like methemoglobinemia, and impacts on air quality and respiratory health, largely influenced by stringent environmental regulations.

- Investing in the research and development of safer nitrite alternatives is driving the nitrite market forward and providing substantial opportunities for the food industry, public health, and the sustainable growth of nitrate.

- Asia-Pacific is projected to dominate the global market due to growing agricultural investments in India and China.

Nitrite Market Trends

Agriculture Sector to Dominate the Market

- The plant growth regulation and nutrient benefits of calcium nitrite, potassium nitrite, and sodium nitrite are driving the nitrite market by offering enhanced crop yields, stress resilience, and improved quality.

- During the last decades, agricultural production and yields have increased along with global fertilizer and pesticide consumption. The development is observed in various developing countries and industrialized countries.

- As per the Food and Agriculture Organization (FAO) of the United Nations, global fertilizer consumption reached 200 million tonnes in 2022, marking an 87% increase from the 2021 consumption of 109 million tonnes. This surge holds the potential to stimulate growth in the nitrite market. Additionally, approximately 80% of the global population depends on imported food.

- According to the US Geological Survey, the United States ranks among the top global producers and consumers of ammonia. In 2022, ammonia production in the U.S. totaled 13 million metric tons, a slight 2% increase from the 12.7 million metric tons from the previous year. This production was carried out by 16 companies operating at 35 facilities across the country, and it is expected to drive the nitrite market during the forecast period.

- According to the UK Department for Environment, Food & Rural Affairs, the United Kingdom's total utilized agricultural area (UAA) stood at 16.8 million hectares in 2022, representing 69% of the nation's total area.

- Moreover, over the past decade, the European Union has been a significant trade partner for the United Kingdom in terms of ammonium nitrate. According to the Office for National Statistics (UK), EU imports of ammonium nitrate amounted to approximately GBP 115.65 million (USD 143.05 million) in 2022, up from GBP 65.08 million (USD 80.50 million) in 2021, marking a notable 76% increase from the previous year. This trend has the potential to stimulate the nitrite market.

- In Germany, about half of the land is used for agriculture. It is the third-largest exporter of agricultural goods in the world, driving the nitrite market. The states of Germany with the largest area used for agriculture include Lower Saxony, Bavaria, North Rhine-Westphalia, Baden-Wurttemberg, and Mecklenburg-Vorpommern.

- In 2022, Japan's production volume of ammonium nitrate fuel oil explosive in the chemical industry was approximately 19.75 tons, a slight increase from 19.48 tons in 2021, as reported by METI (Japan). This marked the first increase in production in Japan over the past five years, indicating recovery. Furthermore, projections suggest an anticipated rise in production volume during the upcoming forecast period.

- Thus, the abovementioned factors are expected to increase the demand in the nitrites market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the market across the world, with the largest consumption from countries such as China and India.

- Nitrites can be used as an intermediate in the synthesis of various essential medications, including vasodilators and certain pharmaceuticals for cyanide poisoning treatment.

- India holds a prominent position in the global pharmaceutical industry as the world's largest producer of generic drugs. The Indian pharmaceutical industry is projected to reach USD 100 billion, while the medical device market is anticipated to expand by USD 25 billion by 2025. In 2022, pharmaceutical exports from India amounted to USD 24.62 billion, according to the India Brand Equity Foundation.

- China, as the second-largest global market for pharmaceuticals, is experiencing rapid emergence, driven by a growing middle class and an aging population. The country's pharmaceutical sales surged to USD 175 billion in 2022, showing a substantial increase from the USD 134.4 billion recorded in 2021, marking a significant 30% rise from the previous year. This robust growth in the pharmaceutical sector is anticipated to contribute to the expansion of the nitrites market.

- Nitrites, like calcium nitrite, enhance corrosion resistance in reinforced concrete, especially in coastal areas. They protect steel in structures like bridges and buildings, extending their lifespan and reducing maintenance. Additionally, sodium nitrite acts as a construction accelerator for rapid setting.

- As per the National Bureau of Statistics of China, the construction industry in China generated an output of over CNY 31 trillion (USD 4.61 trillion) in 2022, representing an increase of 10% of CNY 29.31 trillion (USD 4.36 trillion) compared to the previous year. There is an increase of almost 100% from a decade ago with a steady growth y-o-y, and it is expected to boost the nitrite market during the forecast period.

- Nitrites aid in mineral separation during ore processing and are crucial components in mining explosives. With India's mining sector expanding by approximately 12% in FY2022, as per the Department for Promotion of Industry and Internal Trade (India), it's anticipated to boost the nitrite market.

- Agriculture is the major source of livelihood for approximately 58% of the population in India. According to the India Brand Equity Foundation (IBEF), the gross value added by agriculture (along with fishing and forestry) was around USD 472.47 billion in the financial year 2022.

- The consumption of nitrites across sectors like agriculture, pharmaceuticals, construction, and others is anticipated to rise in the region during the forecast period. Owing to all the factors mentioned above, the nitrite market is estimated to increase in the region during the forecast period.

Nitrite Industry Overview

The nitrite market is fragmented in nature. Some major players are BASF SE, Shandong Hailan Chemical Industry Co., Ltd, Deepak Nitrite Limited, Anmol Chemicals Group, and Finoric LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Agriculture Sector

- 4.1.2 Increasing Demand for Industrial Applications Like Chemical Synthesis, Construction, Metallurgy, and Pharmaceuticals

- 4.1.3 Increasing Need for Meat Preservation

- 4.2 Restraints

- 4.2.1 Negative Effects of Nitrite

- 4.2.2 Threat of Substitutes Like Natural or Organic in Few Applications

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Calcium Nitrite

- 5.1.2 Potassium Nitrite

- 5.1.3 Sodium Nitrite

- 5.1.4 Other Types (Ammonium Nitrite and Barium Nitrite)

- 5.2 Application

- 5.2.1 Agriculture

- 5.2.2 Food and Beverages

- 5.2.3 Healthcare

- 5.2.4 Construction

- 5.2.5 Pharmaceutical

- 5.2.6 Metallurgy

- 5.2.7 Other Applications (Water Treatment, Photography, and Analytical Chemistry)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anmol Chemicals Group

- 6.4.2 BASF SE

- 6.4.3 Deepak Nitrite Limited

- 6.4.4 Finoric LLC

- 6.4.5 Forbes Pharmaceutical

- 6.4.6 Hualong Nitrite Limited

- 6.4.7 Linyi Kemele Chemical Co. Ltd

- 6.4.8 Linyi Luguang Chemical Co. Ltd

- 6.4.9 MUBY CHEMICALS

- 6.4.10 Shandong Hailan Chemical Industry Co. Ltd

- 6.4.11 Surpass Chemical Company Inc.

- 6.4.12 Thatcher Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 Investing In R&D for Safer Nitrite Alternatives

9 Other Opportunities

02-2729-4219

+886-2-2729-4219