|

市場調查報告書

商品編碼

1521417

機場除雪車輛和設備:市場佔有率分析、行業趨勢和成長預測(2024-2029)Airport Snow Removal Vehicle And Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

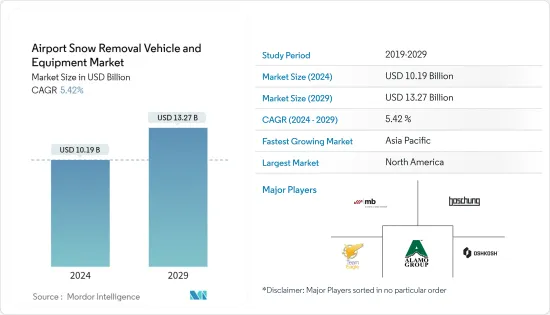

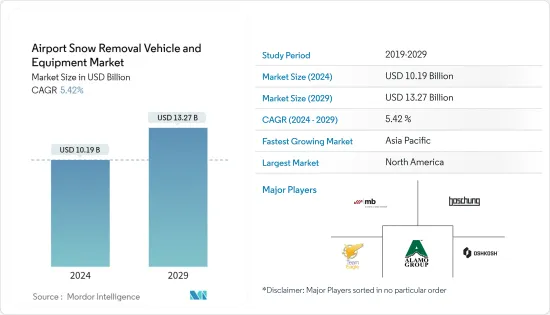

機場除雪車輛和設備市場規模預計到2024年為101.9億美元,預計到2029年將達到132.7億美元,在預測期內(2024-2029年)複合年成長率為5.42%。

主要亮點

- 該市場主要是由世界各地機場對可靠、有效的除雪解決方案日益成長的需求所推動的。空中交通量的增加以及隨之而來的航班數量的增加增加了對先進除雪車輛的需求,以管理各種天氣條件下的機場營運。

- 此外,航空當局對跑道維護和營運效率提出的嚴格安全要求正在推動市場成長。機場除雪設備價格昂貴,維護成本高是市場擴大的主要限制因素之一。航空公司營運中斷和飛機腐蝕也可能限制市場。

- GPS 系統、溫度感測器和自動除雪系統中改進材料使用等先進技術的整合也有助於市場擴張。隨著除雪作業性能和精確度的提高,機場正在努力最大程度地減少惡劣天氣造成的干擾。

機場除雪車市場趨勢

國內機場在預測期內維持市場主導地位

- 國內機場部門主要解決處理國內航班的機場的除雪需求。預計該領域將在印度和巴西等新興經濟體中強勁成長,這些國家機場基礎設施的擴大和航空需求的增加導致對改進的除雪設備的需求。與國際機場相比,國內機場的總數較多。

- 人們越來越需要自主或遠端控制的除雪設備,以提高操作員的安全性並提高工作效率。 2022 年 9 月,斯圖加特機場開始部署自動除雪車。 AirfieldPilot 是一款吹雪機,無需駕駛人即可清除跑道、滑行道和停機坪上的冰雪。 Aebi Schmidt Group (ASG) 和 Flughafen GmbH 在斯圖加特機場部署了自動除雪車輛和設備。

- 一些最具創新性的除雪技術包括Boschung的冰警報系統(可預測未來跑道狀況)以及Yeti Move的自動掃雪機(已交付斯德哥爾摩和奧斯陸機場)。 2022-23 年間,奧斯陸機場將共有 12 台機器自行運作。國內航空業的大幅擴張以及對技術先進的除雪設備的需求不斷增加,以清除滑行道上的冰,以確保飛機順利起飛和降落,是推動市場成長的主要因素。

北美在預測期內佔據市場佔有率主導地位

- 航空公司將在2022年開通超過650條新航線,其中至少有一個北美機場,而在2021年,航空公司將開通超過1,200條新航線,其中包括北美(包括加拿大和美國)的機場,其中約890條是新增國內航線。因此,隨著航空公司尋求增強連通性以吸引不斷成長的航空旅客數量,機場基礎設施可能會發揮關鍵作用。

- 航空旅行的快速成長增加了對新機場和航站樓的需求,以支持航空公司的機隊擴張計劃。 2022 年 7 月,美國聯邦航空管理局宣布計劃管理 10 億美元資金,作為美國現任政府通過的基礎設施法案的一部分。 2022 年 11 月,28 個州的 85 個機場準備根據 FAA 的機場改善計畫維持安全平穩的機場營運。 2022 會計年度,美國運輸部聯邦航空管理局撥款超過 7,620 萬美元,用於建造和維修掃雪機、除冰設備以及存放這些設備的建築物。該計劃資助各種計劃,包括新建或改進機場設施、跑道和滑行道維修以及照明和標誌等機場設施的改進。

- 同樣,2022 年 3 月,加拿大政府為聖約翰國際機場的一個關鍵基礎設施計劃提供了 2,200 萬美元的新資金。北美機場對航空基礎設施的需求,以應對不斷增加的航空客運量,預計將支撐市場。

機場除雪機產業概述

該市場是一個半本土市場,有以下主要企業: MB Companies、Boschung Holding AG、Alamo Group Inc.、Team Eagle Ltd. 和Oshkosh Corporation 等主要參與者正在建立策略夥伴關係和合作,以擴大其產品組合和市場佔有率。驅動力。

本公司大力投入研發,開發尖端、高效率、環保的除雪解決方案。機場掃雪機市場的特點是主要參與者的整合,迫使中小型參與者專注於細分市場或聯合起來,以在這個競爭激烈的行業中獲得競爭優勢。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 產品

- 鼓風機

- 除冰設備

- 裝載機

- 旋轉掃帚和散佈

- 散佈

- 目的

- 國外

- 國內的

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- MB Companies Inc.

- Oshkosh Corporation

- Alamo Group Inc.

- Kiitokori Oy

- Team Eagle Ltd.

- Boschung Holding AG

- Aebi Schmidt Holding AG

- Kodiak America

第7章 市場機會及未來趨勢

The Airport Snow Removal Vehicle And Equipment Market size is estimated at USD 10.19 billion in 2024, and is expected to reach USD 13.27 billion by 2029, growing at a CAGR of 5.42% during the forecast period (2024-2029).

Key Highlights

- The growing demand for dependable and effective snow removal solutions in airports around the world mainly drives the market. The growth in air traffic and the resulting increase in flight frequency have increased the need for sophisticated snow removal vehicles to manage airport operations in different weather conditions.

- Furthermore, stringent safety requirements imposed by aviation authorities concerning runway maintenance and operational effectiveness are driving the growth of the market. The airport snow removal equipment is expensive with a high maintenance cost is one of the main limitations of the expanding market. The disruption of the airline operations and the corrosion of the airframes may also limit the market.

- The integration of sophisticated technologies such as GPS systems, temperature sensors, and enhanced material usage in automatic snow removal systems also contribute to the expansion of the market. With improved performance and accuracy in snow removal operations, airports strive to minimize disruption caused by bad weather.

Airport Snow Removal Vehicles Market Trends

Domestic Airports to Continue Market Dominance During the Forecast Period

- The domestic airport segment caters to snow removal needs at airports that primarily handle domestic flights within a country. The segment is expected to witness significant growth in emerging economies such as India and Brazil, where the expansion of airport infrastructure and increasing air travel demand are driving the need for improved snow removal equipment. The total number of domestic airports is more when compared to international airports.

- There is an increasing need for autonomous or remote-controlled snow removal equipment that improves operator safety and enhances operational efficiency. In September 2022, the airport of Stuttgart started the deployment of autonomous snow-clearing vehicles. The AirfieldPilot is a sweeping blower and can be used to clear the snow and ice from the runways, the taxiways, and the aprons without the need for a driver. Aebi Schmidt Group (ASG) and Flughafen GmbH deployed autonomous snow-clearing vehicles and equipment at the airport Stuttgart.

- Some of the most innovative snow clearance technologies are Boschung's ice early warning system, which forecasts the future of runway conditions, and Yeti Move's autonomous snowploughs, which have been delivered to the airports in Stockholm and Oslo. All 12 units in Oslo Airport have been operating on their own since 2022-23. The considerable expansion in the domestic aviation industry and the rising need for technologically advanced snow removal equipment to remove ice from taxiways to ensure smooth arrival and departure of aircraft are major factors driving the market growth.

North America to Dominate Market Share During the Forecast Period

- The airlines launched over 650 new routes involving at least one North American airport in 2022, and in 2021, over 1,200 new routes were launched by airlines, including airports in North America (comprising Canada and the US), of which about 890 were new US domestic routes. Thus, as airlines aim to increase connectivity to capture the growing air passenger traffic, airport infrastructure may play a vital role.

- With the rapid growth in air travel, there is a significant need for new airports and terminals to support the fleet expansion plans of airlines. In July 2022, the Federal Aviation Administration announced its plans to administer USD 1 billion in funds as part of the Infrastructure Law passed by the current US government. Under the FAA's Airport Improvement Programme, in November 2022, 85 airports in 28 states were better prepared to keep airport operations running safely and smoothly. The US Department of Transportation's Federal Aviation Administration has awarded more than USD 76.2 million in FY2022 for snowplows, de-icing equipment, and new or upgraded buildings to store this equipment. The program pays for a variety of projects, including the construction of new and improved airport facilities, repairs to runways and taxiways, and maintenance of airfield elements such as lighting or signage.

- Similarly, in March 2022, the Canadian government provided USD 22 million in a new funding round for a critical infrastructure project at St. John's International Airport. The presence of demand for aviation infrastructure in North American airports to handle the increasing air passenger traffic is expected to aid the market.

Airport Snow Removal Vehicles Industry Overview

The market is semi-consolidated in nature with a presence of major players such as M-B Companies, Boschung Holding AG, Alamo Group Inc., Team Eagle Ltd., and Oshkosh Corporation. Key players are engaging in strategic partnerships and collaborations to expand their product portfolios and market presence. Technological innovation remains a key driver for gaining a competitive advantage.

Companies are investing heavily in R&D to develop cutting-edge, efficient, and eco-friendly snow removal solutions. The airport snow removal vehicle market is characterized by the consolidation of key players, which forces smaller players to concentrate on niche segments or team up to gain a competitive edge in this highly competitive industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Blowers

- 5.1.2 De-Icers

- 5.1.3 Loaders

- 5.1.4 Rotary Brooms and Sprayer Trucks

- 5.1.5 Spreaders

- 5.2 Application

- 5.2.1 International

- 5.2.2 Domestic

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 M-B Companies Inc.

- 6.2.2 Oshkosh Corporation

- 6.2.3 Alamo Group Inc.

- 6.2.4 Kiitokori Oy

- 6.2.5 Team Eagle Ltd.

- 6.2.6 Boschung Holding AG

- 6.2.7 Aebi Schmidt Holding AG

- 6.2.8 Kodiak America