|

市場調查報告書

商品編碼

1521428

5G 國防:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)5G In Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

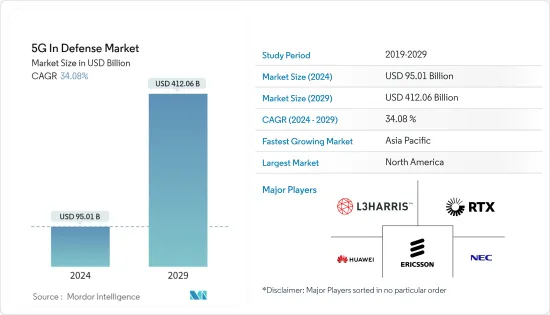

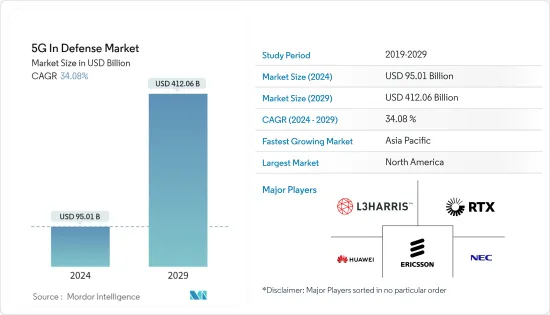

5G國防市場規模預計到2024年將達到950.1億美元,預計到2029年將達到4120.6億美元,在預測期內(2024-2029年)複合年成長率為34.08%。

主要亮點

- 對巨量資料的日益依賴預計將推動國防設備對 5G 網路的需求不斷成長。擴大使用即時資料進行決策,提出了重要的資料收集要求。憑藉更快、更徹底的通訊,5G 網路能夠更快地獲取大量資料。透過5G網路,這種新的無線網路將實現從無人機和無人偵察機到指揮中心的即時資料傳輸,從而增強情境察覺和戰術偵察能力。

- 國防計劃的需求可能會推動國防市場的互通性。可以透過 5G 網路執行針對獨特最終用戶的端對端切片。切片可以客製化,以提供自動駕駛汽車和卡車以及自動化處理技術等項目所需的系統性能。

- 然而,建造 5G 基礎設施的高昂成本可能會阻礙預測期內的市場成長。

5G國防市場趨勢

預測期內航空市場複合年成長率最高

- 由於無人機(UAV)和軍用飛機採購的增加,機載領域預計將以最高的複合年成長率成長。 5G 與機載在國防市場的整合有可能顯著增強能力並改變軍事空中作戰。

- 結合5G可以大大增強無人機和無人機的操作。高速資料傳輸可實現監視、偵察和戰鬥行動所需的即時視訊和感測器資料流。 2023年12月,《國防授權法案》(NDAA)宣布國防支出為8,860億美元。它也呼籲美國國防部向軍事基地部署5G開放RAN專用無線網路。

- 5G 的超低延遲還可以在每一毫秒都至關重要的環境中更好地遠端控制無人機。 5G可以確保飛機資產與地面或海軍部隊之間的無縫資料整合,創建統一的作戰圖景並提高聯合作戰的效率。 5G 將促進多架無人機之間的通訊,並實現無人機集群作戰。成群的此類無人機可以聯合執行監視、電子戰或攻擊行動等任務。

亞太地區將在預測期內經歷最高的成長

- 隨著中國、韓國、日本等國家在部署5G網路方面取得重大進展,亞太地區5G技術正經歷顯著成長,導致對5G技術解決方案的需求激增。中國在無線網路市場的競爭中正在超越美國,特別是在 5G 技術方面。這些國家和其他國家5G網路的廣泛建立正在推動5G測試市場的擴大。

- 例如,印度陸軍希望沿其邊境建設5G網路,以改善通訊,並擁有滿足作戰需求的高速資料網路。中國已經開始在實際控制線(LAC)沿線建造5G網路,以改善通訊。

- 印度陸軍正在努力利用5G來支援戰術性戰場區域的行動。在此背景下,陸軍通訊工程學院與印度理工學院馬德拉斯分校於2022年4月簽署了一份關於建立5G測試平台的合作備忘錄(MoU)。這些新興市場的開拓將確保亞太地區國防5G市場的快速成長。

國防領域5G產業概況

國防領域的 5G 市場是半固定的,每個市場參與者都透過有吸引力的產品和有競爭力的定價策略來爭取主導市場佔有率。國防 5G 市場的主要市場參與企業包括 Telefonaktiebolaget LM Ericsson、華為技術公司、NEC 公司、L3Harris Technologies, Inc. 和 RTX Corporation。這些在該市場營運的領先公司正在採取各種策略,例如併購、研發投資、聯盟、合作夥伴關係、區域擴張和新產品推出。

例如,2022 年 4 月,洛克希德馬丁公司和英特爾公司簽署了一份合作備忘錄,利用兩家公司在技術和通訊方面的專業知識來提供創新的 5G 解決方案。該合作備忘錄擴大了兩家公司之間的戰略關係,使它們能夠為美國國防部提供支援 5G 的硬體和軟體解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 透過通訊基礎設施

- 小型基地台

- 大型基地台

- 無線接取網路

- 透過核心網路技術

- 軟體定義網路 (SDN)

- 霧計算(FC)

- 行動邊緣運算(MEC)

- 網路功能虛擬(NFV)

- 按平台

- 土地

- 海軍

- 空中的

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 以色列

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Huawei Technologies Co., Ltd.

- L3Harris Technologies, Inc.

- NEC Corporation

- Nokia Networks(Nokia Corporation)

- Qualcomm Technologies, Inc.

- RTX Corporation

- Samsung Electronics Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- THALES

- Wind River Systems, Inc.

第7章市場機會與未來趨勢

The 5G In Defense Market size is estimated at USD 95.01 billion in 2024, and is expected to reach USD 412.06 billion by 2029, growing at a CAGR of 34.08% during the forecast period (2024-2029).

Key Highlights

- The growing dependence on big data is projected to drive the increased need for 5G networks of defense equipment. The increased use of real-time data for decisive decision-making has raised substantial data collections. With faster and more thorough communication, the 5G network will establish the capacity to take huge amounts of data more swiftly. Through its 5G network, this new wireless network would allow for real-time data transfer from unmanned aerial vehicles and surveillance drones to command centers, boosting situational awareness and tactical reconnaissance.

- Defense program demand will propel interoperability forward in the defense market. End-to-end slicing for unique end users can be carried out via 5G networks. Slices can be tailor-made to offer system performance needed by programs such as autonomous cars and trucks and automated process technology.

- However, the high costs involved in setting up 5G infrastructure might hinder the market growth during the forecast period.

5G In Defense Market Trends

Airborne Segment to Register the Highest CAGR During the Forecast Period

- The airborne segment is expected to grow with the highest CAGR owing to the rising procurement of unmanned aerial vehicles (UAVs) and military aircraft. 5G integration with airborne in the defense market has the potential to significantly enhance capabilities and transform military aerial operations.

- Incorporating 5G can greatly enhance UAV and drone operations. High-speed data transmission will allow real-time video and sensor data streaming, crucial for surveillance, reconnaissance, and combat operations. In December 2023, the National Defense Authorization Act (NDAA) announced that it would allocate USD 886 billion in defense spending. It also asked the US Defense Department to deploy 5G open RAN private wireless networks on military bases.

- The ultra-low latency of 5G can also support better remote control of UAVs in environments where every millisecond counts. 5G can ensure seamless data integration between airborne assets and ground or naval forces, creating a unified combat picture and improving joint operations' efficiency. 5G can facilitate communication between multiple drones, enabling swarm drone operations. Such drone swarms can collaboratively undertake tasks, be it for surveillance, electronic warfare, or even offensive operations.

Asia-Pacific to Witness the Highest Growth During the Forecast Period

- 5G technology in the Asia-Pacific region is experiencing significant growth due to countries such as China, South Korea, and Japan, which have advanced considerably in rolling out 5G networks, leading to a surge in demand for 5G technology solutions. China is outcompeting the US in the wireless network market, specifically with 5G technology. The widespread establishment of 5G networks in these and other countries in the area has propelled the expansion of the 5G testing market.

- For instance, the Indian Army wants to establish a 5G network along the border to improve communication and get a high-speed data network for operational requirements. China has already begun the operation of setting up a 5G network along the Line of Actual Control (LAC) for better communication.

- The Indian Army has been endeavoring to exploit 5G for supporting operations in the tactical battlefield area. In this context, in April 2022, a Memorandum of Understanding (MoU) for the establishment of a 5G testbed was signed between the Military College of Telecommunication Engineering and IIT Madras. Such developments will ensure speedy growth of the 5G defense market in Asia Pacific.

5G In Defense Industry Overview

The 5G in Defense Market is semi-consolidated, with the market players vying for a dominant market share through attractive offerings and competitive pricing strategies. Some of the key market participants in the 5G defense market include Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., NEC Corporation, L3Harris Technologies, Inc., and RTX Corporation. These major players operating in this market have adopted various strategies comprising M&A, investment in R&D, collaborations, partnerships, regional business expansion, and new product launches.

For instance, in April 2022, Lockheed Martin and Intel Corporation signed a memorandum of understanding to leverage their expertise in technology and communications to bring together innovative 5G-capable solutions. The memorandum of understanding (MoU) will expand the strategic relationship between the two companies to align 5G-enabled hardware and software solutions for the US Department of Defense.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Communication Infrastructure

- 5.1.1 Small Cell

- 5.1.2 Macro Cell

- 5.1.3 Radio Access Network

- 5.2 By Core Network Technology

- 5.2.1 Software-Defined Networking (SDN)

- 5.2.2 Fog Computing (FC)

- 5.2.3 Mobile Edge Computing (MEC)

- 5.2.4 Network Functions virtualization (NFV)

- 5.3 By Platform

- 5.3.1 Land

- 5.3.2 Naval

- 5.3.3 Airborne

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Rest of Latin America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Israel

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Huawei Technologies Co., Ltd.

- 6.2.2 L3Harris Technologies, Inc.

- 6.2.3 NEC Corporation

- 6.2.4 Nokia Networks (Nokia Corporation)

- 6.2.5 Qualcomm Technologies, Inc.

- 6.2.6 RTX Corporation

- 6.2.7 Samsung Electronics Co., Ltd.

- 6.2.8 Telefonaktiebolaget LM Ericsson

- 6.2.9 THALES

- 6.2.10 Wind River Systems, Inc.