|

市場調查報告書

商品編碼

1521500

刺繡機:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Embroidery Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

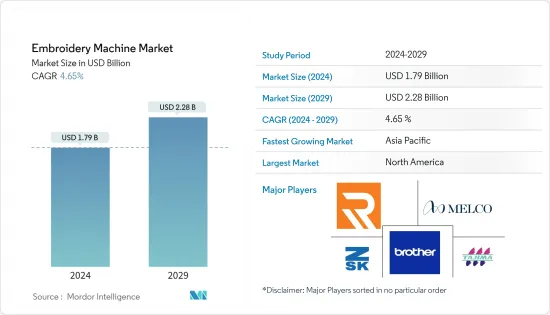

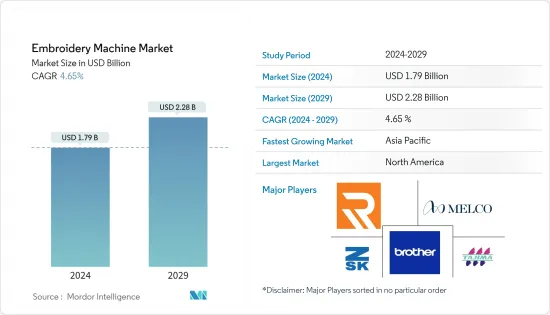

刺繡機市場規模預計到 2024 年為 17.9 億美元,預計到 2029 年將達到 22.8 億美元,在預測期內(2024-2029 年)複合年成長率為 4.65%。

近年來,繡花機市場成長顯著。客製化和刺繡的需求、技術進步以及紡織服裝業的成長等因素推動了這一成長。主要市場參與企業不斷創新以提高其機器的功能。

主要亮點

- 它提供快速的縫紉速度、高精度和易於使用的介面。該市場主要由中國、印度和日本等亞太國家主導。這些國家在刺繡機的生產和消費中發揮主要作用。亞太紡織業快速擴張,個人化刺繡及繡花產品潮流方興未艾。

- 除亞太地區外,北美和歐洲也在市場中發揮重要作用。客製化和獨特的紡織品越來越受歡迎,市場正在轉向自動化、電腦化機械,實現更有效率、更複雜的設計。

- 人工智慧和自動化等技術創新正在改變產業。這些創新透過提高效率、減少體力勞動並提供更大的設計靈活性,推動了刺繡機在各種最終用戶行業的採用。

繡花機市場趨勢

多頭繡花機的發展-頭數越多越好

多針繡花機的未來是光明的。另一方面,單針繡花機則有點乏善可陳。單針繡花機有著悠久的歷史。儘管如此,直到最近,小企業主才開始意識到使用單針繡花機經營業務的限制。

配備多個繡花機頭的繡花機可以同時縫製同一服裝或織物的不同部分。這意味著多個機頭可以同時在繡花機的同一部分上工作,與單針繡花機相比,大大提高了繡花機的效率和產量。

多頭繡花機特別適合需要生產大量繡花產品的紡織服裝業公司。換句話說,多頭繡花機是必須履行大訂單的製造商的完美選擇。

當一台繡花機上的多個機頭同時繡製同一件繡品時,完成一批繡花所需的時間會顯著減少。這對於在緊迫的期限內完成任務並需要最佳化生產計劃的公司來說尤其重要。

亞太地區占主導地位

亞太地區擁有全球最大的服裝市場,包括中國、印度和日本。中國是全球最大的服飾產品出口國。孟加拉和越南位列世界前五位服裝出口國。亞洲的幾個經濟體擁有大型 GTF(服飾、紡織品和鞋類)製造業。

服飾、紡織和製鞋業繼續在亞洲經濟中發揮重要作用,為該地區約6000萬人提供就業機會,並以間接就業的形式支持數百萬人就業。

東亞大部分地區的紡織業持續成長,其中中國、越南、印尼和柬埔寨的成長率最高。該地區是 Nike、Zara、C&A 和 H&M 等歐洲主要時尚公司的所在地。紡織產品在歐洲消費環境負擔中佔第四位。

東亞作為全球最大的服飾生產國,在全球紡織服裝供應鏈中發揮重要作用,2019年約佔全球紡織品出口的55%。

2022年,光是越南就向世界出口了價值376億美元的服裝、服飾和紡織品,其中出口額為58億美元。該產業持續快速成長,部分原因是隨著歐洲自由貿易聯盟和歐盟-越南自由貿易協定這兩項自由貿易協定的實施,東南亞地區的參與度不斷提高。由於歐洲經濟區自由貿易協定(歐盟-越南自由貿易協定),越南產品越來越依賴歐盟市場。然而,自COVID-19爆發以來,東亞服飾和紡織業受到歐盟(EU)和美國(美國)等主要市場需求減少的影響。此外,2020年印尼、馬來西亞、泰國和越南市場的紡織品出口也有所下降。

繡花機產業概況

繡花機市場細分,眾多參與企業紛紛進入市場。主要參與企業包括兄弟工業有限公司、伯尼納國際股份公司和田島工業有限公司。由於技術進步、消費者對客製化產品的偏好不斷增加以及全球紡織和服裝行業的成長,全球刺繡機市場正在不斷成長。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 目前的市場狀況

- 政府法規和舉措

- 科技趨勢

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 時尚和紡織業的成長推動市場

- 電腦繡花機需求增加

- 市場限制因素

- 營業成本高

- 市場機會

- 技術進步和自動化

- 波特五力分析

- 供應商的議價能力

- 消費者/買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 按類型

- 自由運動繡花機

- 康乃利指南刺繡機

- 飛梭繡花機

- 按最終用戶

- 住宅

- 商業的

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 法國

- 德國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東/非洲

- 南美洲

- 北美洲

第7章 競爭格局

第8章概述(市場集中度及主要企業)

第9章 公司簡介

- Brother Industries, Ltd.

- Bernina International AG

- Janome Sewing Machine Co., Ltd.

- Tajima Industries Ltd.

- ZSK Stickmaschinen GmbH

- Ricoma International Corporation

- Melco International

- PFAFF Industriesysteme und Maschinen GmbH

- Singer Sewing Company

- SWF Embroidery Machines*

第 10 章 *列表並不詳盡。

第11章市場展望 市場未來

第12章市場附錄

The Embroidery Machine Market size is estimated at USD 1.79 billion in 2024, and is expected to reach USD 2.28 billion by 2029, growing at a CAGR of 4.65% during the forecast period (2024-2029).

The market for embroidery machines has grown significantly in recent years. Factors such as customization and embroidery demand, technological advancement, and the growth of the textile and apparel industry have contributed to this growth. Key market players are constantly innovating to improve machine capabilities.

Key Highlights

- They offer faster stitching speed, better precision, and easy-to-use interfaces. The market is dominated by Asia-Pacific countries such as China, India, and Japan. These countries play a major role in the production and consumption of embroidery machines. The textile industry in Asia-Pacific is expanding rapidly, and the trend of personalized embroidery and embroidery products is on the rise.

- In addition to Asia-Pacific, North America and Europe are also playing an important role in the market. Customized and unique textiles are becoming increasingly popular, and the market has shifted towards computerized and automatic machines, allowing for more efficient and complex designs.

- Technological innovations, such as AI and automation, are changing the industry. These innovations improve efficiency, reduce manual labor, and provide more design flexibility, which is driving the adoption of Embroidery machines across different end-user industries.

Embroidery Machine Market Trends

Multi-head Embroidery Machines are growing - More heads are better than one

Multi-needle embroidery machines have a bright future ahead of them. Single-needle machine embroidery machines, on the other hand, are a bit less exciting. Single-needle sewing machines have been around for a long time. Still, it's only recently that small business owners have started to realize the limitations of using a single-needle machine to run a business.

Embroidery machines with multiple sewing heads can work on different areas of the same garment or fabric at the same time. This means that multiple heads can work on the same part of the embroidery machine at the same time, significantly increasing the efficiency and output of the machine compared to a single-head machine.

Multi-head machines are used by businesses, particularly in the textiles and apparel industry, that need to produce large amounts of embroidery products. This means that multi-head machines are the best choice for manufacturers that have to deal with high-volume orders.

When multiple heads are working on the same embroidery product at the same time on the same machine, the amount of time needed to complete one batch of embroidery decreases significantly. This is especially important for businesses that need to meet tight deadlines and optimize their production schedules.

Asia- Pacific is dominating the region

Asia-Pacific region is home to some of the world's largest apparel markets, such as China, India, and Japan. China is the world's largest exporter of apparel products. Bangladesh and Vietnam are among the top five apparel exporters in the world. Several Asian economies have significant GTF (garment, textiles, and footwear) manufacturing industries.

The garment, textiles, and footwear industries continue to play a vital role in Asian economies, providing employment for around 60 million people in the region and supporting millions more in the form of indirect employment.

The textile sector continues to grow in most of East Asia, with the highest growth rates observed in China, Vietnam, Indonesia, and Cambodia. This region is home to some of the biggest names in the European fashion industry, such as Nike and Zara, as well as C&A, H&M, and others. Textiles represent the fourth largest environmental impact due to European consumption.

As the world's largest garment producer, the East Asian region plays a significant role in the global textiles and apparel supply chain, accounting for around 55 percent of global textile exports in 2019.

Vietnam alone exported an estimated USD 37.6 billion worth of apparel, garments, and textile products to the world in 2022, of which USD 5.8 billion. The industry continues to grow rapidly, partly due to increased involvement in Southeast Asia due to the implementation of the two free trade agreements, the EFTA and the EU-Vietnam free trade agreement. As a result of the European Economic Area Free Trade Agreement (EU-Vietnam Free Trade Agreement), Vietnamese goods have become increasingly dependent on the EU market. However, since the outbreak of COVID-19, the garment and textile industries in East Asia have been affected by a decrease in demand in key markets such as the European Union (EU) and the United States (U.S.). In addition, textile exports from the Indonesian, Malaysian, Thai, and Vietnamese markets also decreased in 2020.

Embroidery Machine Industry Overview

The embroidery machine market is fragmented, with many players operating in the market. Some of the major players in the market are Brother Industries, Ltd, Bernina International AG, Tajima Industries Ltd, and many more. The global market for embroidery machines is on the rise due to technological advancements, growing consumer preferences for bespoke items, and the global growth of the textile and apparel industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Fashion and Textile Industry is driving the market

- 5.1.2 Rise in the demnad for Computerized Embroidery Machines

- 5.2 Market Restraints

- 5.2.1 High Operating Costs

- 5.3 Market Opportunities

- 5.3.1 Technological Advancements and Automation

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Free Motion Embroidery Machine

- 6.1.2 Cornely Hand Guided Embroidery Machine

- 6.1.3 Schiffli Embroidery Machine

- 6.2 By End -User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 USA

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 France

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Middle East and Africa

- 6.3.4.1 UAE

- 6.3.4.2 Saudi Arabia

- 6.3.4.3 Rest of Middle East and Africa

- 6.3.5 South America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

8 Overview (Market Concentration and Major Players)

9 Company Profiles

- 9.1 Brother Industries, Ltd.

- 9.2 Bernina International AG

- 9.3 Janome Sewing Machine Co., Ltd.

- 9.4 Tajima Industries Ltd.

- 9.5 ZSK Stickmaschinen GmbH

- 9.6 Ricoma International Corporation

- 9.7 Melco International

- 9.8 PFAFF Industriesysteme und Maschinen GmbH

- 9.9 Singer Sewing Company

- 9.10 SWF Embroidery Machines*