|

市場調查報告書

商品編碼

1521607

農業設備金融:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Agriculture Equipment Finance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

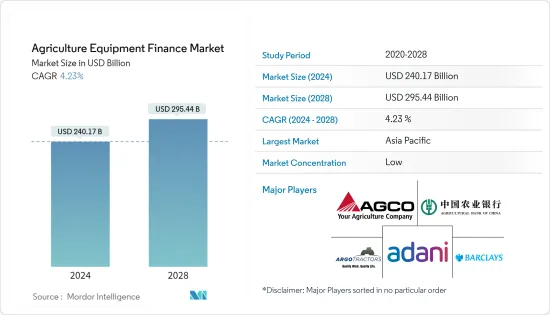

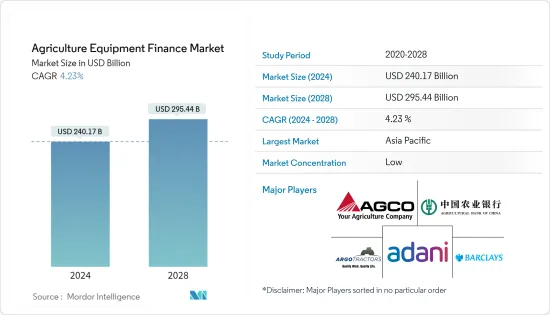

農業設備金融市場規模預計到 2024 年為 2,401.7 億美元,預計到 2028 年將達到 2,954.4 億美元,在預測期內(2024-2028 年)複合年成長率為 4.23%。

市場的主要驅動力是全球農業機械化趨勢。推動市場發展的另一個因素是透過線上金融平台進行簡單快速的資金籌措的需求不斷成長。在全球層面,市場也受到區塊鏈技術的出現的推動,區塊鏈技術保證了相關人員貸款的即時資訊透明度。促進市場成長的其他因素包括農業設備的低進口關稅。

線上金融平台也使農民、承包商和經銷商更容易獲得資金。這些平台允許用戶在註冊後幾分鐘內申請貸款,一旦貸款獲得核准,資金就會存入。快速且方便的融資預計將成為未來幾年全球農業設備融資市場成長的主要驅動力。

隨著農業設備租賃提供者數量的增加,願意投資一流、高品質設備的金融公司數量也在增加。這可能會推動未來幾年農業設備融資市場的成長。農業貸款減免等計劃旨在鼓勵農民購買農業設備。世界各國政府正在實施此類計劃,以幫助農民擺脫債務並鼓勵他們轉向機械化農業。

另類金融透過提供快速、輕鬆的信貸來幫助企業。多種替代融資管道提供大量中小型無抵押貸款,使中小企業更容易資金籌措。因此,未來幾年農業綜合企業的信貸需求預計將增加,從而推動農業和農業金融市場的成長。

農業裝備金融市場趨勢

農業曳引機需求不斷成長

由於農業機械化程度的不斷提高以及提高生產力和效率的需求,農用曳引機的市場規模不斷擴大。人口成長、都市化、糧食需求增加以及耕作方法技術創新等因素正穩步擴大農用曳引機市場規模。

都市化和人口向都市區遷移導致人事費用以驚人的速度上升。人事費用與生產成本直接相關。機械化降低了勞動工資。由於勞動力工資上漲和農業勞動力短缺,機械化率不斷提高。政府也透過提供補貼來支持農業機械化,以獲得更高的產量。技術進步也有助於提高機械化程度,提高農民對農業機械化好處的認知。

亞太地區農業機械銷售成長

亞太地區是最大的農業機械市場之一。由於人口眾多、對農業經濟的高度依賴以及可支配收入的增加,印度、日本和中國等亞太地區新興國家的政府正在尋找具有成本效益的方法來增加農業生產,我們專注於解決方案。

預計2023年,中國將主導亞太農業裝備市場。該國的高市場佔有率是由於農民數量多、種植面積大、勞動力短缺對先進農業設備的需求增加以及政府推動農業現代化和機械化的努力所致。 。

印度和中國佔亞太農機市場的60%。印度和中國對農業機械化的需求正在穩步成長。主要的市場促進因素是勞動力短缺、對農業效率的需求、訂單農業、政府獎勵和高勞動工資。此外,印度政府也提供補貼、低農業設備進口關稅和寬鬆的信貸便利,鼓勵農民實現農場機械化。

農產品金融業概況

農業裝備金融市場較為分散。農業設備金融市場的參與者致力於策略聯盟、合作夥伴關係、併購、區域擴張以及產品和服務推出。市場的主要企業包括阿達尼集團、愛科集團、中國農業銀行、Argo Tractors SA 和巴克萊銀行。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 支持農業領域女性的融資是塑造市場成長的關鍵趨勢。

- 政府努力提供低利率貸款

- 市場限制因素

- 銀行貸款利率上升是一項挑戰,將影響市場成長。

- 市場成長的最大障礙之一是不斷變化的排放法規。

- 市場機會

- 快速且方便的融資管道推動了全球農機融資市場的成長。

- 現代技術的使用增加以及對更高品質食品和農業生產的需求不斷成長

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 深入了解農業技術發展與進步

第5章市場區隔

- 按金融類型

- 租

- 貸款

- 信用額度

- 依產品

- 聯結機

- 收割機

- 牧場機械

- 其他

- 按地區

- 亞太地區

- 北美洲

- 歐洲

- 南美洲

- 中東/非洲

第6章 競爭狀況

- 供應商市場佔有率

- 併購

- 公司簡介

- Adani Group

- AGCO Corp.

- Agricultural Bank Ltd.of China

- Argo Tractors SpA

- Barclays PLC

- BlackRock Inc.

- BNP Paribas SA

- Citigroup Inc.

- Deere and Co.

- ICICI Bank Ltd.

- IDFC FIRST Bank Ltd.*

第7章市場機會與未來趨勢

The Agriculture Equipment Finance Market size is estimated at USD 240.17 billion in 2024, and is expected to reach USD 295.44 billion by 2028, growing at a CAGR of 4.23% during the forecast period (2024-2028).

The market is mainly driven by the growing trend of farm mechanization around the world. The market is also driven by the increasing demand for simplified and fast financing through online finance platforms. The market on a global level is also being driven by the emergence of blockchain technology, which ensures real-time information transparency of a loan to all parties involved. Other factors that are contributing to the market growth include low import duty on agricultural equipment.

In addition, online financial platforms have made it easier for farmers, contractors, and dealers to access capital. These platforms allow users to apply for credit within minutes of registering, and funds are credited as soon as the loan is approved. Quick and convenient access to loans is expected to be a major driver of growth in the global farm equipment financing market over the next few years.

As the number of providers of agricultural equipment rental grows, so too does the number of finance companies willing to invest in top-notch quality equipment. This will drive the growth of the agriculture equipment finance market over the next several years. Programs like farm loan waivers are designed to encourage farmers to purchase farm equipment. Governments around the world have implemented these programs to help farmers get out of debt and encourage them to switch to mechanized farming.

Alternative finance helps businesses by providing fast and easy credit. There are many small to medium-size unsecured loans available from various alternative finance sources, which make it easier for small to medium-sized businesses to get funding. As a result, the demand for credit in agriculture-related works is expected to increase in the coming years, thus driving the growth of the agriculture & agriculture finance market.

Agriculture Equipment Finance Market Trends

Rising Demand For Tractors In Agriculture Industry

The market size of the agricultural tractor market is constantly increasing due to the increasing mechanization of the agriculture industry and the need for increased productivity and efficiency. Factors such as population increase, urbanization, food demand increase, and technological innovation in farming practices have contributed to the steady growth of the market size of agricultural tractors.

Labor costs have been rising at an alarming rate due to urbanization and the migration of people into urban areas. Labor costs are directly related to production costs. Mechanization reduces labor wages. As labor wages are rising and there is a shortage of farm labor, the rate of mechanization is increasing. The government is also supporting the increase in farm mechanization to get high yields by offering subsidies. Technological advances are also contributing to the increase in mechanization and increasing awareness among farmers of the advantages of agricultural mechanization.

Rise In The Sales Of Agriculture Equipment In Asia-Pacific

Asia Pacific is one of the largest markets for agricultural machinery. With a large population and high dependency on the agricultural economy, rising disposable income, the governments of emerging countries in the APAC region like India, Japan and China are focusing on cost-effective solutions for high agricultural production.

China is expected to dominate the Asia-Pacific agricultural equipment market in 2023. The country's high market share is due to its large number of farmers, a large area under agricultural cultivation, growing demand for advanced agricultural equipment due to labor shortage, increasing government initiatives to modernize and mechanize the agriculture sector, and the presence of many agriculture equipment manufacturers.

India and China account for 60% of the farm machinery share in Asia-Pacific. Demand for farm mechanization has been steadily increasing in India and China. The main market drivers are labor shortage, the need to improve farm efficiency, contract farming, government incentives, and a high labor wage. In addition, the Indian government offers subsidies, low import taxes on agricultural equipment, and easy financing programs that encourage farmers to mechanize their farms.

Agriculture Equipment Finance Industry Overview

The agriculture equipment finance market is fragmented. Agricultural equipment finance market companies are implanting strategic alliances, partnerships, mergers and acquisitions, geographic expansion, and product/service launches. Key players in the market are Adani Group AGCO Corp Agricultural Bank of China Ltd and Argo Tractors S.A. Barclays PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Financing to support women in the agricultural sector is the primary trend shaping the growth of the market

- 4.2.2 Government initiatives to provide loans at a lower interest rate

- 4.3 Market Restraints

- 4.3.1 Costlier bank lending rates are a challenge that affects the growth of the market.

- 4.3.2 One of the biggest obstacles to market growth is the ever-evolving emission standards.

- 4.4 Market Opportunities

- 4.4.1 Quick and easy access to loans will drive the growth of the global agricultural equipment financing market

- 4.4.2 Increased usage of modern technologies and growing demand for high quality of food & agricultural production

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into technological developments and advancements in agricultural industry

5 MARKET SEGMENTATION

- 5.1 By Type of Finance

- 5.1.1 Lease

- 5.1.2 Loan

- 5.1.3 Line of Credit

- 5.2 By Product

- 5.2.1 Tractors

- 5.2.2 Harvesters

- 5.2.3 Haying Equipment

- 5.2.4 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Adani Group

- 6.3.2 AGCO Corp.

- 6.3.3 Agricultural Bank Ltd.of China

- 6.3.4 Argo Tractors SpA

- 6.3.5 Barclays PLC

- 6.3.6 BlackRock Inc.

- 6.3.7 BNP Paribas SA

- 6.3.8 Citigroup Inc.

- 6.3.9 Deere and Co.

- 6.3.10 ICICI Bank Ltd.

- 6.3.11 IDFC FIRST Bank Ltd.*