|

市場調查報告書

商品編碼

1521636

空氣煞車系統:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Air Brake System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

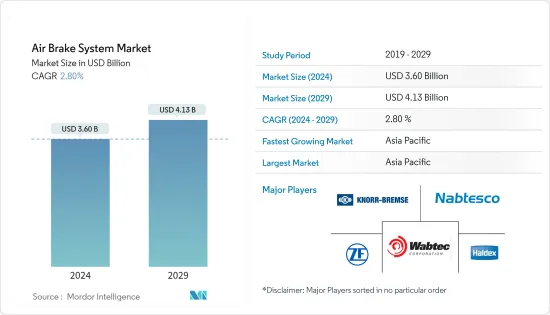

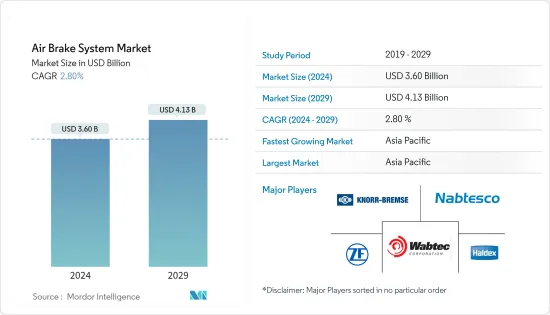

空氣煞車系統市場規模預計到 2024 年為 36 億美元,預計到 2029 年將達到 41.3 億美元,在預測期內(2024-2029 年)複合年成長率為 2.80%。

從中期來看,商用卡車和巴士的需求預計將在預測期內顯著推動市場成長,銷售和產量增加,特別是在物流和建築領域。

一些地區正在開發大型基礎設施計劃,包括高速公路、支線公路、港口和機場的建設,這對增強重型卡車的需求發揮關鍵作用。

由於電動車 (EV) 零件的特殊製造要求,電動車 (EV) 正在快速成長。對輕量、高性能組件的需求不斷增加,為市場創造了利潤豐厚的機會。

空氣煞車系統市場趨勢

客車佔主要市場佔有率

- 混合和電動客車使用兩種煞車系統:再生煞車和空氣煞車。再生煞車的工作原理是使用馬達作為發電機,透過執行「再生減速」來回收煞車過程中釋放的能量。在此過程中,動能轉化為電能並儲存在電池中以供以後使用。這個過程類似於自行車發電機的原理。

- 如果車輛配備再生煞車,則空氣煞車系統的使用頻率將低於僅依賴空氣煞車的柴油公車。需要記住的一件事是,再生煞車雖然有幫助,但不足以使車輛停止。因此,這項重要功能仍然需要空氣煞車。因此,未來幾年對空氣煞車系統的需求可能會大幅成長。

- 到2030年,電動公車的價格預計將與柴油引擎公車相當。與柴油公車相比,電動公車可降低81-83%的維護和營運成本,預計將增加對空氣煞車系統的需求。製造商越來越注重推出新的客車型號,預計在預測期內推出內裝和美觀度得到改善的客製化客車。許多政府和城市當局正在投資對其公車隊進行現代化改造,以改善大眾交通工具基礎設施、解決交通堵塞並減少空氣污染。

亞太地區正在經歷顯著成長

- 由於擁有先進研究設施的領先商用車製造商的存在,商用卡車和公共汽車的銷量不斷增加,亞太地區目前佔據了主要市場佔有率。

- 卡車在採礦、建築、基礎設施開發和能源工廠等許多行業中發揮著重要作用。為了確保電力行業材料的穩定供應並加速採礦活動,對高效碎片清除的需求日益成長。

- 目前,中國、印度和韓國是電動公車的三大市場。光是中國就佔全球電動公車總數的 98% 以上,擁有超過 50 萬輛持有。

- 全部區域汽車零件製造商的快速擴張正在推動市場發展。例如,2023 年 5 月,Kendrion NV 開設了佔地 28,000平方公尺的新工廠,是 Kendrion 集團中最大的工廠。

- 亞太地區商用車銷量的增加和電動商用車需求的增加預計將推動空氣煞車系統市場的成長。

空氣煞車系統產業概況

空氣煞車系統市場由幾家主要企業主導,包括克諾爾股份公司、西屋煞車公司、採埃孚股份公司和瀚德集團。由於製造業的快速擴張和主要企業的策略開拓,預計該市場在預測期內將顯著成長。

- 2023年12月,康士伯汽車的流量控制系統業務部門獲得了為期三年、價值3258萬美元的延期合約。該合約延期是由歐洲商用車OEM為 FCS Coupling 的壓縮空氣系統進行的。

- 2023 年 6 月,領先的煞車系統製造商克諾爾股份公司推出了最先進的電子機械列車煞車系統 (EM Brake),該系統使用壓縮空氣將煞車皮有效地固定到煞車盤。此先進系統旨在提供最佳煞車性能並確保火車乘客和貨物的安全。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 商用車銷售量增加

- 市場限制因素

- 維護成本高

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模-金額)

- 按煞車類型

- 鼓式空氣煞車器

- 方形煞車

- 按車型分類

- 剛體卡車

- 重型卡車

- 半拖車

- 公車

- 其他車型

- 按成分

- 壓縮機

- 州長

- 儲存槽

- 鬆弛調節器

- 其他組件

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- ZF Friedrichshafen AG

- Haldex Group

- Nabtesco Corporation

- Knorr-Bremse AG

- Wabtec Corporation

- TSE Brakes Inc.

- Fedral-Mogul Holding Corporation

- Meritor Inc.

- SORL Auto Parts Inc.

- Brakes India Limited

- Continenal AG

第7章 市場機會及未來趨勢

The Air Brake System Market size is estimated at USD 3.60 billion in 2024, and is expected to reach USD 4.13 billion by 2029, growing at a CAGR of 2.80% during the forecast period (2024-2029).

Over the medium term, the demand for commercial trucks and buses witnessed a rise in sales and production, particularly in the logistics and construction sectors, which is likely to drive the growth of the market significantly during the forecast period.

The development of major infrastructure projects in several regions, encompassing the construction of highways, feeder roads, ports, and airports, is playing a pivotal role in bolstering the demand for heavy-duty trucks, which is anticipated to enhance the demand for air brake systems in the coming years.

Electric vehicles (EVs) are growing rapidly due to the specific manufacturing requirements of EV components. The demand for lightweight and high-performance components has increased, creating a lucrative opportunity for the market.

Air Brake System Market Trends

Buses Hold Major Market Share

- Hybrid and electric buses employ two braking systems: regenerative braking and air braking. Regenerative braking works by utilizing the electric motor as a generator to capture the energy released during braking by performing 'regenerative deceleration.' In this process, kinetic energy is converted into electrical energy, which is stored in the battery for later use. This process is similar to the principle of a dynamo on a bicycle.

- When vehicles are fitted with regenerative braking, the air brake system is used less frequently than diesel buses that rely solely on air braking. It is important to note that while regenerative braking is helpful, it is not sufficient to stop a vehicle. Therefore, air braking remains necessary for this critical function. Thus, the demand for air brake systems is likely to witness significant growth in the coming years.

- By 2030, the prices of electric buses are expected to be on par with diesel-engine buses. Electric buses can reduce maintenance and operating costs by 81-83% compared to diesel-engine buses, which is expected to increase demand for air brake systems. Manufacturers are increasingly focused on launching new bus models and are expected to roll out customized buses with improved interiors and aesthetics over the forecast period. Many governments and city authorities are investing in the modernization of their bus fleets to improve public transportation infrastructure, address traffic congestion, and reduce air pollution.

Asia-Pacific Witnessing Major Growth

- Asia-Pacific currently holds a major market share due to an increase in the sale of commercial trucks and buses, driven by the presence of major commercial vehicle manufacturers with advanced research facilities.

- Trucks play a vital role in many industries, such as mining, construction, infrastructure development, and energy plants. There is a growing need for a consistent supply of materials to the power industries and efficient debris removal to speed up mining activities.

- China, India, and South Korea are currently the top three markets for electric buses. China alone has more than 98% of all-electric buses globally, with a fleet of over 500,000 units.

- The rapid expansion of automotive component manufacturers across the region is driving the market. For instance, in May 2023, Kendrion NV opened a new facility spanning 28,000 square meters - the largest one in the Kendrion Group.

- The increase in the sale of commercial vehicles in Asia-Pacific and the rise in demand for electric commercial vehicles is expected to boost the growth of the air brake systems market.

Air Brake System Industry Overview

The air brake system market is dominated by several key players, such as Knorr-Bremse AG, Wabtec Corporation, ZF Friedrichshafen AG, Haldex Group, and others. The market is expected to witness significant growth during the forecast period due to the rapid expansion of manufacturing industries and growing strategic development among key players worldwide.

- In December 2023, Kongsberg Automotive's Flow Control Systems business unit secured a three-year contract extension worth over USD 32.58 million. The extension was granted by a European commercial vehicle OEM for FCS Couplings' compressed air systems.

- In June 2023, Knorr-Bremse AG, a leading manufacturer of braking systems, introduced a cutting-edge electromechanical train braking system (EM brake) that utilizes compressed air to apply the brake pads to the brake discs effectively. This advanced system is designed to deliver optimal braking performance and ensure the safety of passengers and freight on trains.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Sale of Commercial Vehicles

- 4.2 Market Restraints

- 4.2.1 High Maintenance Cost

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Brake Type

- 5.1.1 Drum Air Brake

- 5.1.2 Disc Air Brake

- 5.2 By Vehicle Type

- 5.2.1 Rigid Body Trucks

- 5.2.2 Heavy-Duty Trucks

- 5.2.3 Semi-Trailer Tractors

- 5.2.4 Buses

- 5.2.5 Other Vehicle Types

- 5.3 By Component

- 5.3.1 Compressor

- 5.3.2 Governor

- 5.3.3 Storage Tank

- 5.3.4 Slack Adjuster

- 5.3.5 Other Components

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 ZF Friedrichshafen AG

- 6.2.2 Haldex Group

- 6.2.3 Nabtesco Corporation

- 6.2.4 Knorr-Bremse AG

- 6.2.5 Wabtec Corporation

- 6.2.6 TSE Brakes Inc.

- 6.2.7 Fedral-Mogul Holding Corporation

- 6.2.8 Meritor Inc.

- 6.2.9 SORL Auto Parts Inc.

- 6.2.10 Brakes India Limited

- 6.2.11 Continenal AG