|

市場調查報告書

商品編碼

1521686

太空低溫技術:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Space Cryogenics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

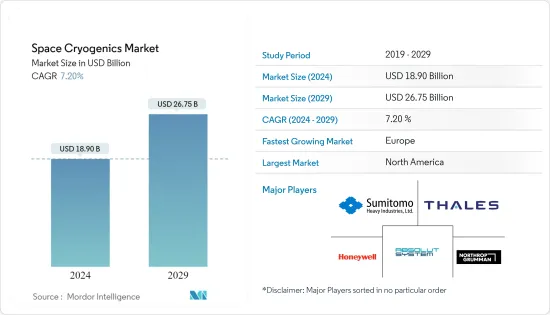

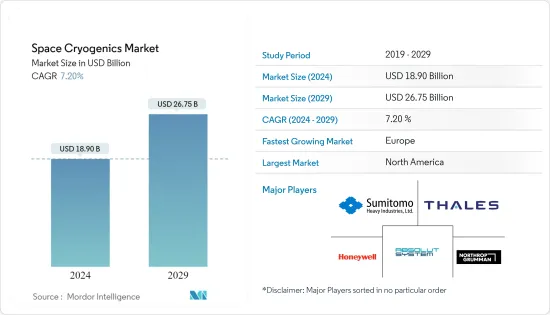

預計到 2024 年,太空低溫技術市場規模將達到 189 億美元,預計到 2029 年將達到 267.5 億美元,在預測期內(2024-2029 年)複合年成長率為 7.20%。

太空低溫技術市場的成長是由太空船上的操作日益簡化所推動的。隨著太空任務變得越來越複雜,對能夠長期提供可靠性能的低溫系統的需求不斷成長。

低溫技術的進步正在導致更強大、更有效率的低溫系統的發展,這些系統可以承受惡劣的太空環境。空間應用中感測器和冷電子設備等低溫設備的進步和開拓正在推動市場成長。

低溫感測器和冷電子設備是受益於材料科學進步的設備。開發、測試和部署低溫基礎設施需要大量的財務投資,包括儲存槽、隔熱材料、傳輸系統和冷卻機制。因此,低溫設備所需的高營運成本和資本支出是阻礙太空低溫市場成長的主要因素。

太空低溫市場的趨勢

在預測期內,空間科學任務部分將佔據最高的市場佔有率

由於在太空任務中擴大使用低溫技術,預計太空科學任務部分將在預測期內佔據最大的收益佔有率。在全球範圍內,航太機構在發射衛星、火箭等方面發揮領導作用。例如,2023年5月,印度太空研究組織(ISRO)使用具有低溫上部級的GSLV火箭成功發射了第二代導航衛星。 NVS-01 透過提供準確、即時的導航來補充該國的區域導航系統。

2022年11月,美國太空總署NASA在佛羅裡達州甘迺迪太空中心發射了Artemis-1任務。在升空過程中,核心級引擎在升空八分鐘後關閉並與火箭的其餘部分分離。此後,中低溫推進級(ICPS)被用來推進獵戶座太空船。獵戶座太空船的四塊太陽能板由美國太空總署部署。 Orion與ICPS分離並完成了「transluner注射」。目前它正在前往月球軌道的途中。預計此類發展將在可預見的幾年內引領該領域。

歐洲將在預測期內經歷最高的成長

在太空低溫技術市場中,由於正在進行和計劃中的太空舉措,預計歐洲在預測期內將呈現最高成長。例如,英國政府宣布2022年投資3,105萬美元,由英國主導打造太空望遠鏡,用於研究系外行星。透過這筆資金,該國預計將接收 Ariel 的有效載荷模組、低溫冷卻器和光學地面支援設備,同時繼續主導該任務的科學操作和資料處理。

2023年7月,法國議會核准了2024年至2030年的七年軍費開支計畫。該計劃包括 67 億美元的太空支出,比上一季成長 45%。 2023年9月,德國政府宣布了新的太空策略,制定了2030年太空旅行的目標和機會。

2023年10月,英國航太局和美國航太服務公司Axiom Space簽署了初步協議,旨在將英國太空人送入軌道為期兩週。英國的這項任務將得到歐洲太空總署的商業贊助和支持。因此,該地區太空產業活動的增加導致了對太空低溫技術的需求增加,預計這將推動市場收益成長。

空間低溫產業概況

太空低溫技術市場整合,龍頭企業市場佔有率最高。主要市場參與企業包括泰雷茲、諾斯羅普·格魯曼公司、Absolut System、住友重工有限公司和霍尼韋爾國際公司。

這些公司是低溫技術的領導者和低溫冷卻器的供應商。公司正在投資研發低溫系統,提供自動控制、遠端監控和維護功能,幫助簡化太空船操作並降低人為錯誤的風險。降低低溫系統的複雜性並提高其易用性使太空船操作員能夠專注於任務目標而不是複雜的系統管理。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按冷卻方式分

- 高溫冷卻器

- 低溫冷卻器

- 按用途

- 地球觀測

- 通訊應用

- 技術示範任務

- 低溫電子學應用

- 按溫度分類

- 120K以下

- 120 K

- 150K以上

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 俄羅斯

- 法國

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 以色列

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- THALES

- Absolut System

- Sumitomo Heavy Industries Ltd

- Air Liquide

- Oxford Instruments

- Parker Hannifin Corporation

- Honeywell International Inc.

- RICOR

- Creare

- Northrop Grumman Corporation

第7章 市場機會及未來趨勢

The Space Cryogenics Market size is estimated at USD 18.90 billion in 2024, and is expected to reach USD 26.75 billion by 2029, growing at a CAGR of 7.20% during the forecast period (2024-2029).

The space cryogenics market growth can be attributed to the increasing simplicity of operations in onboard spacecraft. With space missions becoming more complex, the demand for cryogenic systems that can deliver reliable performance over extended periods is growing.

Advancements in cryogenic technologies are leading to the development of more robust and efficient cryogenic systems to withstand harsh space conditions. Advancements and developments in cryogenic devices, such as sensors and cold electronics in space-based applications, are driving market growth.

Cryogenic sensors and cold electronics are devices that benefit from the development of materials science. Substantial financial investments are required for the development, testing, and deployment of cryogenic infrastructure, which includes storage tanks, insulation, transfer systems, and cooling mechanisms. Hence, high operating expenses and capital expenditures required for cryogenic setups are major factors hindering the growth of the space cryogenics market.

Space Cryogenics Market Trends

The Space Science Missions Segment will Account for the Highest Market Share During the Forecast Period

The space science missions segment is expected to account for the largest share of revenue over the forecast period, owing to the increasing use of cryogenics in space missions. Globally, space organizations have been taking the initiative to launch satellites, rockets, and others. For instance, in May 2023, a second-generation navigation satellite that utilizes a GSLV rocket with a cryogenic upper stage was successfully launched by the Indian Space Research Organization (ISRO). The NVS-01 will supplement the country's regional navigation system by delivering precise and real-time navigation.

In November 2022, the American space agency, NASA, launched the Artemis-1 mission at Florida's Kennedy Space Center. During the launch, the core stage engines shut down eight minutes after liftoff and separated from the rest of the rocket. After this, the Interim Cryogenic Propulsion Stage (ICPS) was used to propel the Orion spacecraft. The four solar panels of the Orion spacecraft were deployed by NASA. Orion decoupled from the ICPS and completed 'translunar injection.' It is now traveling toward the lunar orbit. Such developments are expected to lead the segment during the forecasted years.

Europe will Witness the Highest Growth During the Forecast Period

In the space cryogenics market, Europe is projected to witness the highest growth as a result of the ongoing and planned space initiatives during the forecast period. For instance, to ensure that the United Kingdom leads the creation of a space telescope to study exoplanets, in 2022, the UK government announced an investment of USD 31.05 million. With this funding, the country is envisioned to continue leading the mission's scientific operations and data processing while also receiving the payload module, cryogenic cooler, and optical ground support equipment for Ariel.

In July 2023, the French parliament approved a seven-year military spending program for 2024-2030 that includes USD 6.7 billion for space programs, which is a 45% increase from the previous period. In September 2023, the German government presented a new Space Strategy and laid its goals and opportunities for space travel until 2030.

In October 2023, the UK Space Agency and a US spaceflight services company, Axiom Space, signed an initial agreement as they bid to send British astronauts into orbit for two weeks. The mission with the UK would be commercially sponsored and supported by the European Space Agency. Hence, increasing activities in the space industry in this region are leading to a rise in demand for space cryogenics, which is expected to drive growth in market revenue.

Space Cryogenics Industry Overview

The space cryogenics market is consolidated, with leading players having the highest market share. Some of the key market players include THALES, Northrop Grumman Corporation, Absolut System, Sumitomo Heavy Industries Ltd, and Honeywell International Inc.

These companies are leaders in cryogenic technology and suppliers of cryogenic coolers. Companies are investing in the R&D of cryogenic systems that offer automated controls, remote monitoring, and maintenance capabilities to help streamline spacecraft operations and reduce the risk of human error. By reducing the complexity of cryogenic systems and enhancing their ease of use, spacecraft operators can focus on mission objectives rather than intricate system management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Cooling Type

- 5.1.1 High-Temperature Coolers

- 5.1.2 Low-Temperature Coolers

- 5.2 By Application

- 5.2.1 Earth Observation

- 5.2.2 Telecom Applications

- 5.2.3 Technology Demonstration Missions

- 5.2.4 Cryo-Electronics Applications

- 5.3 By Temperature

- 5.3.1 Less Than 120 K

- 5.3.2 120 K

- 5.3.3 More Than 150K

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Russia

- 5.4.2.4 France

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Israel

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 THALES

- 6.2.2 Absolut System

- 6.2.3 Sumitomo Heavy Industries Ltd

- 6.2.4 Air Liquide

- 6.2.5 Oxford Instruments

- 6.2.6 Parker Hannifin Corporation

- 6.2.7 Honeywell International Inc.

- 6.2.8 RICOR

- 6.2.9 Creare

- 6.2.10 Northrop Grumman Corporation