|

市場調查報告書

商品編碼

1521691

自主潛水器:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Autonomous Underwater Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

根據預測,自主潛水器的市場規模到2024年將達到21.3億美元,到2029年將達到54.5億美元,在市場估算和預測期間(2024-2029年)複合年成長率為20.62%。

該市場受到自主水下機器人(AUV)在多個領域的廣泛應用的推動,包括探勘和探勘、資源探勘、環境監測、國防和安全、基礎設施檢查和科學研究。

由於其穩定性、部署成本低、資料品質提高和卓越的導航演算法,AUV 的採用也在增加。這些好處使自主潛水器成為許多人的安全選擇。例如,AUV 被部署在石油和天然氣行業來繪製海底地圖。它也被軍方用於檢查和識別目的。這為許多國家的商業和安全服務。

潛水技術預計將為製造公司帶來有吸引力的商機。開拓具有卓越抗干擾能力的水下航行器的經濟有效的通訊技術預計將顯著推動市場成長。

然而,營運成本的增加和 AUV 營運績效的不確定性可能會阻礙市場成長。

自主潛水器市場趨勢

軍事和國防佔據很大的市場佔有率

自主水下航行器(AUV)由於能夠在水下環境中自主操作並收集有價值的資訊而被用於各種軍事和國防應用。這些車輛為軍隊和國防部隊提供了寶貴的水下作戰能力,包括監視、偵察、反水雷措施和特種作戰,從而增強了複雜和充滿挑戰的環境中的海上安全和情境察覺。

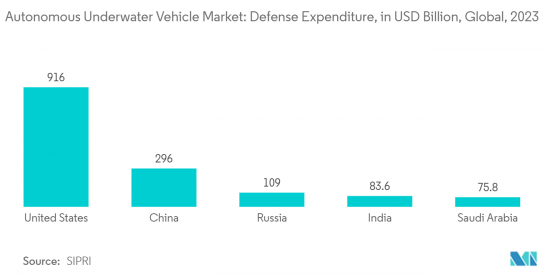

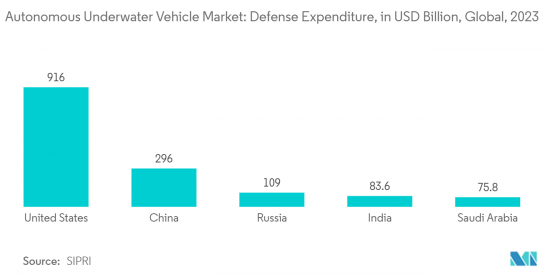

安全問題、對衝突地區的擔憂和威脅導致國防支出大幅增加。斯德哥爾摩國際和平研究所(SIPRI)2024年4月發布的全球軍費最新資料顯示,2022年全球軍費總額將實際成長6.8%,達到24,430億美元。各國正利用尖端技術來保護其邊界免受水下威脅。

根據國際商會國際海事局 (IMB) 年度海盜和武裝搶劫報告,2023 年報告了 120 起海盜和武裝搶劫船舶事件,而 2022 年為 115 起。此類威脅的增加引發了海上邊界以外的安全問題。因此,上述因素預計將推動市場成長。

北美地區將在預測期內經歷最高的成長

由於新興市場的存在、美國對 AUV 的需求不斷成長以及廣泛的研究和開發,預計北美自動駕駛汽車市場將在預測期內呈現最高成長。

2024 年 2 月,美國選擇 Anduril 及其 Dive 系列大型自主水下航行器 (AUV) 在競爭環境中進行分散式、遠距、持久性水下感測和有效載荷輸送原型。 Anduril 提供一系列支援人工智慧的 AUV,旨在執行各種國防和商業任務。

在印度-太平洋地區(特別是海上環境)緊張局勢不斷升級的情況下,美國國防部(DoD)正在大力投資自主系統的開發,以增強國家安全。例如,波音公司正在美國的資助下開發 Orca XLUUV。 2019年,該公司贏得了一份價值4300萬美元的契約,根據波音公司的Echo Voyager設計建造四艘AUV。這些計劃將於 2024 年完成。這些因素可能會刺激北美市場的成長。

自動潛水器產業概述

自動潛水器市場較為分散,參與者眾多,既有老牌企業,也有新興新興企業。主要公司包括康斯伯格集團 ASA、通用動力公司、洛克希德馬丁公司、波音公司和薩博公司。

這些參與者正在採取收購、聯盟、業務擴張以及產品和技術發布等策略性舉措,以維持其在該市場的地位並獲得競爭優勢。例如,2022 年 7 月,Kongsberg Gruppen ASA 獲得了幾份 HUGIN AUV 的重要合約。除了對海洋機器人不斷成長的需求外,該公司還宣稱其廣泛的產品組合使其能夠滿足新的應用需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 小尺寸

- 中等大小

- 大的

- 按用途

- 軍事/國防

- 油和氣

- 環保/監測

- 海洋學

- 考古/探勘

- 搜救行動

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 以色列

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- The Boeing Company

- Kongsberg Gruppen ASA

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- SAAB AB

- Teledyne Technologies Inc.

- Lockheed Martin Corporation

- General Dynamics Corporation

- BAE Systems plc

- Exail Technologies SA

第7章 市場機會及未來趨勢

The Autonomous Underwater Vehicle Market size is estimated at USD 2.13 billion in 2024, and is expected to reach USD 5.45 billion by 2029, growing at a CAGR of 20.62% during the forecast period (2024-2029).

The market is driven by the wide applications of autonomous underwater vehicles (AUVs) in multiple sectors, such as exploration and research, resource exploration, environment monitoring, defense and security, infrastructure inspection, and scientific research.

The adoption of AUVs has also increased due to their stability, low deployment cost, improved data quality, and excellent navigation algorithms. These benefits have made applying autonomous underwater vehicles a safe option for many. For instance, they are deployed in the oil and gas industry to create seafloor maps. The military also uses them for inspection and identification. This has aided commerce and security in many nations.

Underwater vehicle technology is expected to lead to attractive opportunities for manufacturing companies. Developing cost-effective communication technology for underwater vehicles with excellent disturbance tolerance will significantly fuel market growth.

However, increasing operational costs and uncertainty in the operational performance of AUVs are likely to hinder market growth.

Autonomous Underwater Vehicles Market Trends

Military & Defense will a Hold Significant Market Share

Autonomous underwater vehicles (AUVs) are utilized in various military and defense applications due to their ability to operate autonomously and gather valuable information in underwater environments. These vehicles provide military and defense forces with valuable capabilities for underwater operations, including surveillance, reconnaissance, mine countermeasures, and special operations, enhancing maritime security and situational awareness in complex and challenging environments.

Defense spending has significantly increased due to security issues, concerns over contested territories, and threats. According to new data on global military expenditure published by the Stockholm International Peace Research Institute (SIPRI) in April 2024, total global military spending increased by 6.8% in real terms in 2022, reaching USD 2,443 billion. Countries use cutting-edge technologies to protect their borders from underwater threats.

According to the ICC International Maritime Bureau (IMB) 's annual Piracy and Armed Robbery Report, 120 incidents of maritime piracy and armed robbery against ships were reported in 2023 compared to 115 in 2022. This increase in threats creates security issues across marine borders. Thus, the factors mentioned above are expected to drive market growth.

North America will Witness the Highest Growth During the Forecast Period

The autonomous vehicle market in North America is expected to showcase the highest growth during the forecast period, owing to the presence of leading manufacturers, rising demand for AUVs from the US Navy, and extensive research and development.

In February 2024, the US Navy selected Anduril and its Dive family of large autonomous underwater vehicles (AUVs) to prototype distributed, long-range, persistent underwater sensing and payload delivery in contested environments. Anduril provides a family of AI-enabled AUVs that are designed to perform a wide range of defense and commercial missions.

Amid rising tensions in the Indo-Pacific region, particularly in the maritime environment, the US Department of Defense (DoD) is heavily investing in the development of autonomous systems to strengthen national security. For instance, The Boeing Company is developing the Orca XLUUV with funding from the US Navy. In 2019, the company won a USD 43 million contract to build four of the AUVs based on the design of Boeing's Echo Voyager. They are planned to be finished in 2024. Such factors will stimulate the market growth in North America.

Autonomous Underwater Vehicles Industry Overview

The autonomous underwater vehicles market is fragmented, with several players and a mix of established companies and emerging startups. Some of the leading players include Kongsberg Gruppen ASA, General Dynamics Corporation, Lockheed Martin Corporation, The Boeing Company, and SAAB AB.

These players incorporate strategic initiatives such as acquisitions, partnerships, expansions, and product/technology launches to maintain their positions and gain a competitive advantage in this market. For instance, in July 2022, Kongsberg Gruppen ASA secured several significant contracts for HUGIN AUVs. The company declared that, in addition to the increasing demand for marine robots, its broader portfolio allows it to address new applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Small

- 5.1.2 Medium

- 5.1.3 Large

- 5.2 By Application

- 5.2.1 Military & Defense

- 5.2.2 Oil & Gas

- 5.2.3 Environment Protection & Monitoring

- 5.2.4 Oceanography

- 5.2.5 Archaeology & Exploration

- 5.2.6 Search & Salvage Operations

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Israel

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 The Boeing Company

- 6.2.2 Kongsberg Gruppen ASA

- 6.2.3 L3Harris Technologies Inc.

- 6.2.4 Lockheed Martin Corporation

- 6.2.5 SAAB AB

- 6.2.6 Teledyne Technologies Inc.

- 6.2.7 Lockheed Martin Corporation

- 6.2.8 General Dynamics Corporation

- 6.2.9 BAE Systems plc

- 6.2.10 Exail Technologies SA