|

市場調查報告書

商品編碼

1521710

B2B宅配、快捷郵件與小包裹(CEP):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)B2B Courier Express Parcel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

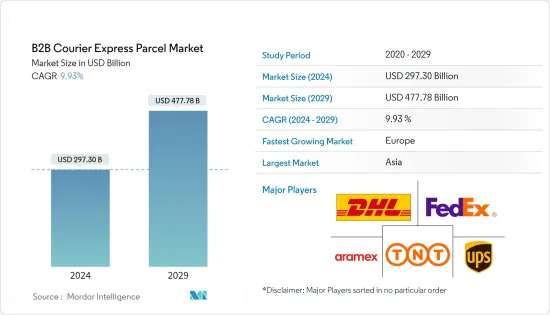

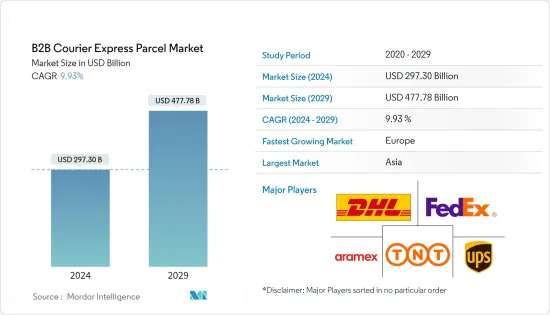

B2B宅配、快捷郵件和小包裹(CEP)市場規模預計2024年為2973億美元,預計2029年將達到4777.8億美元,複合年成長率為9.93%。

特定行業或專業市場在 B2B 電子商務中變得越來越受歡迎。這些入口網站提供特定類別的更廣泛的產品以及特定的附加價值服務(B 到 E)。

公司擴大利用巨量資料來提供個人化的客戶體驗。移動商店變得越來越受歡迎。雲端平台正在取代不適合這種規模的傳統平台。

B2B電子商務公司也正在整合系統和平台,與客戶建立全通路關係。缺乏優質的客戶資料(買家減少,專業服務減少)正在減緩個人化工作。

不斷擴大的產業規模和其他挑戰(例如訂單規模增大、價格波動、產品數量增加和交貨時間縮短)對現有供應鏈造成壓力。

B2B 電子商務由阿里巴巴、樂天、Unite Mercateo Global Sources、沃爾瑪印度和亞馬遜商業等公司主導。亞馬遜已將 B2B 業務從 AmazonSupply 更名。 2015年,亞馬遜更名為Amazon Business,短短一年內銷售額就突破10億美元。 2022年,亞馬遜的GMV(商品總價值)達到350億美元。

B2B宅配/快捷郵件/小包裹(CEP) 市場趨勢

擴大國內B2B CEP細分市場

大多數地區國內市場的成長速度快於國際市場,但一些地區的差距正在顯著縮小。

北美和歐洲國內市場與國際市場的差距正在縮小。這主要是由於歐洲市場相互關聯且國際貿易壁壘較低。事實證明,國內市場有能力抓住電子商務帶來的機會。

隨著消費者偏好的不斷變化,消費者要求更加個人化的電子商務和物流體驗,以滿足他們的需求並為他們提供自始至終的最佳舒適感。為了滿足這種不斷成長的需求,物流平台正在採用人工智慧、物聯網和巨量資料等技術來洞察消費者的偏好並調整他們的體驗。

電子商務公司正在擴大在歐洲的網路,以更好地服務客戶。例如,西班牙零售商 DIA 已將送貨服務擴展到西班牙海岸線的每個城鎮,從赫羅納到韋爾瓦,獲得了超過 500 萬新客戶。

由於醫療用品需求增加、醫療保健成本上升以及對更快、更有效率的送貨服務的需求等多種因素,預計未來幾年該地區的醫療保健產品宅配服務將會成長。

此外,從 2023 年起,全球零售額預計將成長至疫情前的水平,並推動市場成長。因此,國內 CEP 領域預計將擴大。

北美市場佔據主導地位

預計北美地區的銷售額將高於其他地區。該地區強勁的經濟意味著對高科技設備的大量投資。在B2B電子商務方面,美國處於領先地位。北美 B2B 產業的成長主要是由雲端處理、人工智慧、巨量資料和分析、行動/社交媒體、網路安全和物聯網等新興技術的使用所推動的。

在北美,線上 B2B 市場的出現比 B2C 和 C2C 零售電子商務要晚得多。零售通路早期採用者建立的生態系統影響了線上業務的擴散,並為 B2B 電子商務平台創造了廣闊的前景。零售電子商務平台的成長持續推動線上 B2B 線上市場空間的演變。

新的零售或批發通路合作夥伴正在將業務轉移到線上。美國人口普查局報告稱,2022年第一季電子商務銷售額佔總銷售額的14.8%,較2021年第一季成長6.8%。零售電子商務的日益普及反映了客戶的偏好,推動了生態系統的發展,並將新的電子商務平台和參與者推向市場。它還為 B2B 及其用戶創造了新的市場空間。

B2B宅配、快捷郵件與小包裹(CEP)小包裹產業概況

B2B CEP 市場高度多樣化且充滿活力。該行業的幾家主要企業為企業提供廣泛的服務。 DHL 是 B2B CEP 市場的主要參與者之一。

DHL 業務遍及全球,提供全面的服務,包括快遞、貨運代理和供應鏈解決方案。該公司擁有強大而先進的技術,使其能夠為世界各地的企業提供高效、可靠的服務。

德國郵政 DHL 集團旗下的空運和海運專家 DHL Global Forwarding 已成功為其客戶格蘭富實施永續物流解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 政府法規和舉措

- B2B CEP 產業的技術趨勢與自動化

- 電商產業洞察(國內、國際電商)

- B2B CEP 產業新興企業和創業投資的見解

- 宅配概覽

- B2B CEP業務儲存功能及附加價值服務說明

- 逆向物流與當日達市場洞察

- 節日期間(聖誕節、光棍節、黑色星期五等)運輸的見解

- COVID-19 對 B2B CEP 市場的影響

第5章市場動態

- 促進因素

- 電子商務熱潮

- 當日和隔日送達

- 抑制因素

- 監管挑戰

- 基礎設施限制

- 商機

- 最後一公里配送解決方案

- 國際擴張

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈/供應鏈分析

第6章 市場細分

- 交貨目的地

- 國內的

- 國外

- 最終用戶

- 服務(BFSI(銀行、金融服務、保險))

- 批發/零售(電子商務)

- 製造業、建設業、公共產業

- 一級產業(農業和其他自然資源)

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 拉丁美洲/中東/非洲

- 巴西

- 南非

- GCC

- 其他地區

- 北美洲

第7章 競爭格局

- 公司簡介

- DHL

- FedEx

- UPS

- TNT Express

- Aramex

- SF Express

- GLS

- Hermes

- Post Nord

- Royal Mail*

- 其他公司

第8章市場的未來

第9章 附錄

The B2B Courier Express Parcel Market size is estimated at USD 297.30 billion in 2024, and is expected to reach USD 477.78 billion by 2029, growing at a CAGR of 9.93% during the forecast period (2024-2029).

Vertical or specialized marketplaces are becoming increasingly popular in B2B e-commerce. These portals provide a wider variety of products in a specific category along with specific value-added services (business-to-everyone).

Companies are increasingly leveraging big data to provide a personalized customer experience. Mobile shops are becoming increasingly popular. Cloud platforms are taking over from legacy platforms that are not designed to handle such scale.

B2B e-commerce companies are also integrating their systems and platforms to create omnichannel relationships with their clients. The lack of high-quality customer data (fewer buyers and less specialized services) is slowing down personalization efforts.

The industry's larger scale and other challenges (such as larger order sizes, variable pricing, more products, and shorter delivery times) are putting pressure on existing supply chains.

B2B e-commerce is dominated by companies such as Alibaba, Rakuten, Unite Mercateo Global Sources, Walmart India, and Amazon Business. Amazon rebranded its B2B operations from AmazonSupply. In 2015, Amazon changed its name to Amazon Business, and in just one year, it achieved sales of more than USD 1 billion. In 2022, Amazon registered a GMV (gross merchandise value) of USD 35 billion.

B2B Courier Express Parcel Market Trends

Expanding Domestic B2B CEP Segment

Domestic markets have been growing more quickly than international markets in most regions, but the gap is narrowing significantly in some regions.

The gap between the domestic and international markets is smaller in North America and Europe. In Europe, this is primarily due to the interconnectedness of the market and the lower barriers to international trade. Domestic markets have proved capable of seizing on the opportunities that e-commerce brings.

Consumer preferences constantly change, so they demand a more personalized e-commerce and logistics experience that pampers them and provides the most excellent ease from beginning to end. To meet this increased demand, logistics platforms employ technologies like AI, IoT, and Big Data to gain insights into consumer preferences and adapt their experiences.

E-commerce companies are expanding their networks in Europe to provide better services to customers. For instance, the Spanish retailer DIA is expanding its delivery services to all towns along the Spanish coastline, from Girona to Huelva, reaching more than 5 million new customers.

Courier services for healthcare products are expected to grow in the coming years in the region due to several factors, such as the increasing demand for medical supplies, rising healthcare spending, and the need for faster and more efficient delivery services.

Also, from 2023, it was expected that the total retail sales globally would grow at pre-pandemic levels and drive the growth of the market. As a result, the domestic CEP segment was expected to expand.

North America is Dominating the Market

North America's revenue is expected to be higher than other regions. The region's strong economy means that there is ample investment in high-tech equipment. When it comes to B2B e-commerce, the United States leads the way. The growth of the B2B sector in North America is largely due to the use of advanced technologies such as cloud computing, AI, big data & analytics, mobility / social media, cybersecurity, and IoT.

Online B2B marketplaces came into being much later than retail B2C or C2C e-commerce options in North America. The ecosystem created by these early adopters of retail channels influenced the popularity of online operations and gave rise to promising prospects for B2B e-commerce platforms. The growth of retail e-commerce platforms continues to drive the evolution of B2B online marketspaces online.

New retail or wholesale channel partners are moving their operations online. The US Census Bureau reported that e-commerce sales made up 14.8% of total sales in Q1 2022, which was a 6.8 % increase from Q1 2021. The increasing popularity of retail e-commerce shows customer preference, which drives the evolution of the ecosystem and brings new e-commerce platforms and players into the market. It also creates a new market space for B2B and its users.

B2B Courier Express Parcel Industry Overview

The B2B CEP market is quite diverse and dynamic. In this industry, several key players provide a wide range of services to businesses. One of the prominent players in the B2B CEP market is DHL.

With a strong global presence, DHL is offering a comprehensive suite of services, such as express delivery, freight transportation, and supply chain solutions. The company has robust and advanced technology that enables it to provide efficient and reliable services to businesses worldwide.

DHL Global Forwarding, the air and ocean freight specialist of Deutsche Post DHL Group, successfully implemented sustainable logistics solutions for its customer Grundfos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends and Automation in the B2B CEP Industry

- 4.4 Insights into the E-commerce Industry (Domestic and International E-commerce)

- 4.5 Insights into Startups and Venture Capital Funding in the B2B CEP Industry

- 4.6 Brief on Courier Rates

- 4.7 Elaboration on Storage Functions and Value-added Services in the B2B CEP Business

- 4.8 Insights into Reverse Logistics and Same-day Delivery Market

- 4.9 Insights into Deliveries During Festive Season (Christmas, Singles' Day, Black Friday, etc.)

- 4.10 Impact of COVID-19 on the B2B CEP Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 E-commerce Boom

- 5.1.2 Same-day and Next-day Delivery

- 5.2 Restraints

- 5.2.1 Regulatory Challenges

- 5.2.2 Infrastructure Limitations

- 5.3 Opportunities

- 5.3.1 Last Mile Delivery Solutions

- 5.3.2 International Expansion

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/ Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

- 5.5 Value Chain/Supply Chain Analysis

6 MARKET SEGMENTATION

- 6.1 Destination

- 6.1.1 Domestic

- 6.1.2 International

- 6.2 End User

- 6.2.1 Services (BFSI (Banking, Financial Services and Insurance))

- 6.2.2 Wholesale and Retail Trade (E-commerce)

- 6.2.3 Manufacturing, Construction, and Utilities

- 6.2.4 Primary Industries (Agriculture and Other Natural Resources)

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 United Kingdom

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 India

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 LAMEA

- 6.3.4.1 Brazil

- 6.3.4.2 South Africa

- 6.3.4.3 GCC

- 6.3.4.4 Rest of LAMEA

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 DHL

- 7.2.2 FedEx

- 7.2.3 UPS

- 7.2.4 TNT Express

- 7.2.5 Aramex

- 7.2.6 SF Express

- 7.2.7 GLS

- 7.2.8 Hermes

- 7.2.9 Post Nord

- 7.2.10 Royal Mail*

- 7.3 Other Companies