|

市場調查報告書

商品編碼

1521725

電動車充電設備:全球市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Global Electric Vehicle Charging Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

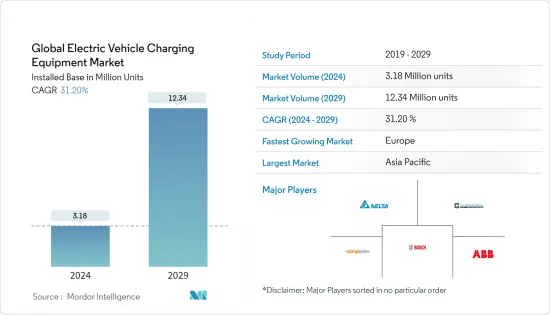

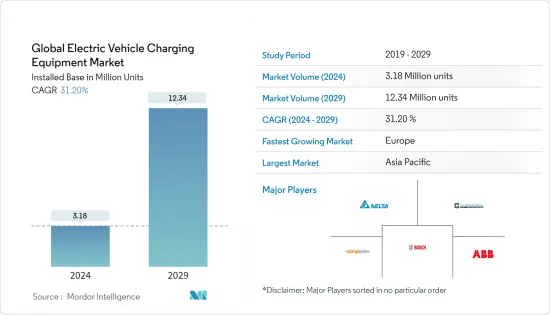

以安裝量計算,全球電動車充電設備市場規模預計將從2024年的318萬台擴大到2029年的1,234萬台,預測期間(2024-2029年)複合年成長率為31.20%。

主要亮點

- 從中期來看,電動車銷售的成長和公司投資安裝新充電站預計將在預測期內推動市場發展。

- 另一方面,負面環境影響預計將阻礙預測期內的市場成長。

- 預計更快、更有效率充電的開拓充電技術將在預測期內為市場創造重大機會。

- 預計歐洲市場在預測期內將出現顯著成長。

全球電動車充電設備市場趨勢

電動車銷量的成長預計將推動市場

- 電動車(EV)因其環境效益和技術進步而在世界各地越來越受歡迎。隨著電動車銷量的不斷增加,充電基礎設施的需求也隨之增加。為了適應道路上不斷增加的電動車數量,電動車充電設備的需求不斷增加。電動車充電站對於為電動車車主提供方便快速的充電選擇至關重要。

- 例如,根據國際能源總署 (IEA) 的數據,2022 年全球將售出約 730 萬輛純電動車,而 2021 年為 460 萬輛。

- 世界各國政府擴大推廣電動車的採用,作為減少溫室氣體排放和應對氣候變遷努力的一部分。為了支持這項轉變,各國政府正在提供各種獎勵來鼓勵使用電動車。這些獎勵包括稅額扣抵、回扣、津貼等財政獎勵,以及優先停車、公車專用道和充電基礎設施等非財政獎勵。

- 2024年2月,泰國政府決定為企業提供獎勵,將其商用重型卡車和巴士車隊持有至電池電動車,這將促進永續交通並排放碳排放,這是朝著減少碳排放量邁出的重要一步。對符合條件的公司稅額扣抵旨在加速電動車在該國交通部門的採用。

- 此外,作為促進永續交通和減少溫室氣體排放努力的一部分,電動車 (EV) 充電站在世界各地的中小型社區中越來越受歡迎。由於對電動車充電設備的需求不斷成長,這些充電站的部署正在增加。

- 因此,電動車銷量的成長預計將成為預測期內市場成長的驅動力。

歐洲預計將出現顯著成長

- 由於政府支持建立充電站、各公司開設充電中心以及在加油站強制使用 EB 充電器,電動車充電設備市場預計將成長。

- 歐洲各國政府正在遊說,爭取在公共場所、住宅和商業場所等多個地點安裝電動車充電站。這一趨勢導致對電動車充電設備的需求增加,以適應不斷增加的電動車數量。擴大歐洲的電動車充電基礎設施對於解決人們對里程焦慮和充電站使用問題的擔憂,對於鼓勵更多消費者轉換電動車至關重要。

- 2024 年 2 月,歐洲領先的電動車 (EV) 充電公司 Fastned 獲得在德國高速公路沿線安裝 34 個快速充電站的許可。該開發案是「Deutschlandnetz」競標的一部分,該招標是一項旨在加強德國電動車充電基礎設施的戰略舉措。 Fastned 在德國的擴張是實現其宏偉目標(到 2030 年在歐洲安裝 1000 個快速充電站)的重要一步。

- 在德國,越來越多的公司在全國推出電動車 (EV) 充電中心。這項策略性舉措旨在擴大電動車基礎設施,滿足德國對電動車充電設備不斷成長的需求。公司部署電動車充電中心不僅是為了加速電動車的採用,也是為了減少碳排放並推廣永續的交通解決方案。

- 例如,德國著名汽車製造商梅賽德斯-奔馳於2023年11月在德國曼海姆開設了首個專有充電中心。該舉措是該公司雄心勃勃的計劃的一部分,該計劃旨在未來 10 年內在全球擁有 2,000 多個充電站和 10,000 個快速充電點。

- 因此,由於上述電動車充電站安裝新興市場的開拓,預計歐洲市場在預測期內將顯著成長。

全球電動車充電設備產業概況

全球電動車充電設備市場已減半。市場的主要企業包括 ABB Ltd.、Robert Bosch GmbH、ChargePoint Inc.、ClipperCreek Inc. 和 Delta Electronics Inc.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029 年之前的市場規模與需求預測

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車銷量成長

- 投資安裝新充電站的公司

- 抑制因素

- 對環境的負面影響

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 按用途

- 家庭充電

- 工作場所充電

- 公共充電

- 按充電類型

- 交流充電(1 級和 2 級)

- 直流充電

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 奈及利亞

- 南非

- 其他中東和非洲

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- ABB Ltd

- Robert Bosch GmbH

- ChargePoint Inc.

- ClipperCreek Inc.

- Delta Electronics Inc.

- Powercharge

- Siemens AG

- Tesla Inc.

- Exicom Tele-Systems Ltd

- Ather Energy

- 市場排名分析

第7章 市場機會及未來趨勢

- 更有效充電設備的技術開發

簡介目錄

Product Code: 50002208

The Global Electric Vehicle Charging Equipment Market size in terms of installed base is expected to grow from 3.18 Million units in 2024 to 12.34 Million units by 2029, at a CAGR of 31.20% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, growth in electric vehicle sales and companies investing in commissioning new charging stations are expected to drive the market in the forecast period.

- On the other hand, the negative impact on the environment is expected to hamper the market's growth in the forecast period.

- The development of charging technology for faster and more efficient charging is expected to create a significant opportunity in the market during the forecast period.

- Europe is expected to witness significant growth in the market over the forecast period.

Global Electric Vehicle Charging Equipment Market Trends

Increase in Electric Vehicle Sales is Expected to Drive the market

- Electric vehicles (EVs) have been gaining popularity worldwide due to their environmental benefits and technological advancements. As the sales of electric vehicles continue to rise, the need for charging infrastructure becomes increasingly important. The demand for EV charging equipment is rising to support the growing number of electric vehicles on the roads. EV charging stations are essential for providing convenient and accessible charging options for EV owners.

- For instance, according to the International Energy Agency, in 2022, around 7,300,000 battery electric cars were sold globally, compared to sales amounting to 4,600,000 units in 2021.

- Governments worldwide are increasingly focusing on encouraging the adoption of electric vehicles as part of efforts to reduce greenhouse gas emissions and combat climate change. To support this transition, governments are providing various incentives to promote the use of electric vehicles. These incentives can include financial incentives such as tax credits, rebates, grants, and subsidies, as well as non-financial incentives like access to preferential parking, bus lanes, and charging infrastructure.

- In February 2024, the Thai government's decision to provide incentives for companies to transition their commercial fleets of large trucks and buses to battery electric vehicles was a significant step toward promoting sustainable transportation and reducing carbon emissions. The introduction of special tax deductions for eligible companies was aimed at encouraging the adoption of electric vehicles in the country's transportation sector.

- Further, electric vehicle (EV) charging stations are becoming increasingly prevalent in small and mid-sized communities worldwide as part of efforts to promote sustainable transportation and reduce greenhouse gas emissions. The deployment of these charging stations is on the rise, driven by a growing demand for EV charging equipment.

- Thus, growth in electric vehicle sales is expected to drive the market growth during the forecast period.

Europe is Expected to Witness Significant Growth

- The market for electric vehicle charging equipment is expected to witness growth due to the government's support in establishing charging sites, different companies opening their charging hub, and efforts to mandate EB chargers at gas stations.

- The European government has been working to grant permission for the installation of EV charging sites in various locations, including public spaces, residential areas, and commercial properties. This move has led to increased demand for EV charging equipment to support the growing number of electric vehicles on the road. The expansion of EV charging infrastructure in Europe is crucial for encouraging more consumers to switch to electric vehicles by addressing concerns about range anxiety and accessibility to charging stations.

- In February 2024, Fastned, a leading European electric vehicle (EV) charging company, was given the green light to set up 34 fast-charging sites along Germany's highways. This development is part of the "Deutschlandnetz" tender, a strategic initiative that aims to enhance the EV charging infrastructure in Germany. Fastned's expansion in Germany is a significant step toward achieving its ambitious target of establishing 1,000 fast charging stations across Europe by 2030.

- In Germany, companies are increasingly focusing on deploying their electric vehicle (EV) charging hubs across the country. This strategic move is aimed at expanding the infrastructure for electric vehicles and meeting the growing demand for EV charging equipment in Germany. Companies deploy EV charging hubs not only to facilitate the adoption of electric vehicles but also to reduce carbon emissions and promote sustainable transportation solutions.

- For instance, in November 2023, Mercedes-Benz, a renowned German automobile manufacturer, opened its first proprietary charging hub in Mannheim, Germany. This initiative is part of the company's ambitious plan to set up over 2,000 charging stations globally by the end of the decade, equipped with more than 10,000 fast-charging points.

- Thus, owing to the above developments in establishing EV charging stations, the market is expected to witness significant growth in Europe during the forecast period.

Global Electric Vehicle Charging Equipment Industry Overview

The global electric vehicle charging equipment market is semi-fragmented. Some of the major players in the market include ABB Ltd, Robert Bosch GmbH, ChargePoint Inc., ClipperCreek Inc., and Delta Electronics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growth in Electric Vehicle Sales

- 4.5.1.2 Companies Investing in Commissioning New Charging Stations

- 4.5.2 Restraints

- 4.5.2.1 The Negative Impact on the Environment

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Home charging

- 5.1.2 Workplace charging

- 5.1.3 Public charging

- 5.2 Charging Type

- 5.2.1 AC Charging (Level 1 and Level 2)

- 5.2.2 DC Charging

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Turkey

- 5.3.2.8 Russia

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Qatar

- 5.3.4.4 Egypt

- 5.3.4.5 Nigeria

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Columbia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Robert Bosch GmbH

- 6.3.3 ChargePoint Inc.

- 6.3.4 ClipperCreek Inc.

- 6.3.5 Delta Electronics Inc.

- 6.3.6 Powercharge

- 6.3.7 Siemens AG

- 6.3.8 Tesla Inc.

- 6.3.9 Exicom Tele-Systems Ltd

- 6.3.10 Ather Energy

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Development for more Effective Charging Equipment

02-2729-4219

+886-2-2729-4219