|

市場調查報告書

商品編碼

1521748

軟性電池:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Flexible Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

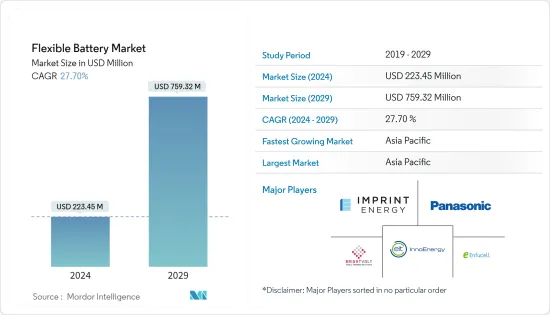

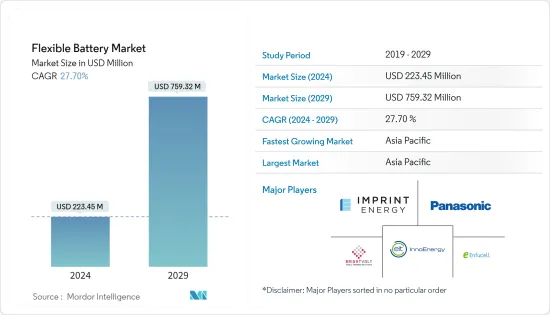

預計2024年軟性電池市場規模為2.2345億美元,預計2029年將達到7.5932億美元,在預測期內(2024-2029年)複合年成長率為27.70%。

主要亮點

- 從中期來看,醫療穿戴式裝置的快速普及加上物聯網(IoT)應用的滲透預計將增加對軟性電池市場的需求。

- 與軟性電池相關的高成本以及適用於各種應用的現有替代電池技術的可用性預計將阻礙預測期內的市場成長。

- 這些電池的特點,例如輕質和緊湊的設計,使其適合軍事應用,並有望為軟性電池市場提供重大機會。

- 亞太地區在市場上佔據主導地位,並且在預測期內也可能實現最高的複合年成長率。這一成長主要是由於人們越來越重視折疊式電子產品和穿戴式設備,特別是在中國、韓國和日本等經濟體。

軟性電池市場趨勢

以消費性電子為主的市場區隔

- 由於消費性電子產品對更小、更輕、更有效率電源的需求不斷成長,預計將主導軟性電池市場。隨著智慧型手機、穿戴式裝置和平板裝置等可攜式設備的激增,對緊湊、靈活的能源解決方案的需求正在迅速增加。

- 整個歐洲擁有成熟的家用電子電器產業,並獲得高科技連結環境的支持。隨著技術進步以及智慧辦公室和家庭變得越來越普遍,對家用電子電器產品的需求不斷增加。據 Startseite Bitkom V. 稱,到 2023 年,德國智慧型手機銷量將達到 2,140 萬部。

- 家用電子電器產品小型化的趨勢創造了對能夠適應不同外形規格和設計要求的電源的需求。軟性電池或薄膜電池由於其薄度、靈活性和可自訂的形式而非常適合這種需求,可以無縫整合到各種家用電子電器中。

- 例如,2023年8月,一群來自德國和英國大學的科學家宣布,他們已經完成了T-Nb2O5薄膜的開發。這項突破代表了消費性電子產品的重大進步,具有增強電池的潛力、計算和照明的進步。預測顯示電池能量密度和充電週期的改善,為消費性電子產業提供了廣闊的前景。

- 不斷變化的消費者偏好強調了對便利性、更長的設備使用壽命和更永續的能源解決方案的渴望。與傳統的笨重電池相比,軟性電池可提高能量密度並延長循環壽命,透過延長設備使用時間並減少對環境的影響來滿足消費者的需求。

- 這與消費者對環保和可回收能源來源的意識不斷增強產生了共鳴。消費性電子產品中新功能和特性的出現,例如物聯網功能、智慧型穿戴裝置和連網型設備,推動了對可透過靈活的電池高效供電的緊湊、持久電源的需求。

- 家用電子電器的市場主導地位也受到這些設備在全球日益普及的影響,尤其是在新興經濟體。這些地區不斷成長的消費群導致了對不僅價格實惠而且具有可靠耐用電源的設備的需求。

- 因此,鑑於上述幾點,家用電子電器市場預計將在預測期內佔據市場主導地位。

亞太地區成為成長最快的地區

- 由於各種因素擴大了其在該領域的主導地位,預計亞太地區軟性電池市場將顯著成長。關鍵促進因素之一是中國、日本、韓國和印度等國家家用電子電器產業的擴張。

- 亞太地區擁有龐大的消費群,他們更有可能採用最新的電子技術進步。在這些國家,對智慧型手機、穿戴式裝置、平板電腦和其他行動裝置的需求不斷增加,對高效能、緊湊和長壽命電源的需求也不斷增加。

- *亞太地區快速的工業化和技術進步為軟性電池技術相關研發活動的重大創新和投資鋪平了道路。

- 中國、日本和韓國等國家的政府和私人組織正在大力投資先進電池技術(包括軟性電池)的開發和商業化。這些投資正在推動國內軟性電池市場的成長,並增強區域製造能力,使亞太地區成為全球市場的領導者。

- 例如,2023年2月,日本政府宣布了總額為25.5億美元的電池戰略預算,用於新電池技術的研發。這個預算包括多種類型,包括固體鋰電池、軟性薄膜電池以及各種新興電池技術。這項措施可望加強日本在電池技術領域的地位。

- 亞太地區強大的製造能力,加上有利的法規環境和強大的供應鏈基礎設施,預計將支持該地區成為軟性電池製造的參與企業。具有成本效益的製造流程、不斷增加的技術進步投資以及對環保能源來源重視正在鞏固該地區在軟性電池市場的立足點。

- 例如,深圳格瑞普電池是中國領先的電池公司,生產超軟性軟性電池。這些電池的設計和製造是為了滿足新型穿戴式智慧電子產品的需求,這些電子產品需要高空間利用率,同時提供高能量密度。

- 主要鋰離子電池公司CATL展示了一種使用聚合物複合無機固體電解質的軟性電池。該電池還可以用剪刀扭轉或剪斷,不會造成任何安全隱患。不過,寧德時代並未透露進一步的技術參數,例如捻數,也沒有量產或短期交付樣本的計畫。所有這些都凸顯了該地區在開發先進電池技術(包括軟性和軟性電池)方面的重要性。

- 因此,鑑於上述幾點,預計亞太地區在預測期內將顯著成長。

軟性電池產業概況

軟性電池市場相對細分。該市場的主要企業包括Panasonic Corporation、Enfucell OY Ltd、Imprint Energy Inc.、BrightVolt Inc. 和 EIT InnoEnergy SE。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章執行概述

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:百萬美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 醫療穿戴裝置快速普及

- 物聯網 (IoT) 應用的擴展

- 抑制因素

- 適用於各種應用的替代電池技術的可用性

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 種類

- 薄膜電池

- 印刷電池

- 目的

- 家用電子電器

- 醫療設備

- 智慧包裝

- 智慧卡

- 其他

- 地區(2029 年之前的市場規模和需求預測)(僅按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 卡達

- 埃及

- 奈及利亞

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Panasonic Corporation

- Enfucell OY Ltd

- Imprint Energy Inc.

- BrightVolt Inc.

- EIT InnoEnergy SE

- ROCKET Poland Sp. z oo

- Molex

- Blue Spark Technologies

- Energy Diagnostics Limited

- Jenax Inc.

- Market Ranking/Share(%)Analysis

第7章 市場機會及未來趨勢

- 具有輕量化和緊湊設計的軟性電池為軍事應用提供了巨大的機會

簡介目錄

Product Code: 50002232

The Flexible Battery Market size is estimated at USD 223.45 million in 2024, and is expected to reach USD 759.32 million by 2029, growing at a CAGR of 27.70% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the rapid adoption of healthcare wearable devices, coupled with penetration of Internet of Things (IoT) applications, is expected to increase the demand for the flexible battery market.

- The high cost associated with flexible batteries and the availability of alternate battery technologies existing for various applications are expected to hinder market growth during the forecast period.

- Characteristics of these batteries, such as lightweight and compact designs, make them suitable for military applications, which is expected to create vast opportunities for the flexible battery market.

- Asia-Pacific dominates the market and is also likely to witness the highest CAGR during the forecast period. The growth is mainly due to the growing emphasis on foldable electronics and wearable devices, especially in economies such as China, South Korea, and Japan.

Flexible Battery Market Trends

Consumer Electronics Segment will Dominate the Market

- Consumer electronics are expected to dominate the flexible battery market due to the increasing demand for smaller, lighter, and more efficient power sources in this sector. The proliferation of portable devices, such as smartphones, wearables, and tablets, has led to a burgeoning need for compact and flexible energy solutions.

- Throughout Europe, there is a mature consumer electronics industry supported by a high-tech connectivity environment. As technology advances and smart offices and homes become more common, consumer electronics products are in demand. According to Startseite Bitkom e. V., smartphone sales volume in Germany was 21.4 million units sold thus far in 2023.

- The trend toward miniaturization in consumer electronics has created an imperative for power sources that can adapt to various form factors and design requirements. Flexible and thin film batteries, owing to their thinness, flexibility, and customizable shapes, align perfectly with this demand, enabling their seamless integration into a wide array of consumer electronic devices.

- For instance, in August 2023, a group of scientists from German and British universities announced that they completed the development of T-Nb2O5 thin films, facilitating the accelerated movement of Li-ion, a noteworthy stride forward. This breakthrough holds the potential for enhanced batteries and progress in computing and lighting, signifying a considerable advancement in consumer electronics. Forecasts suggest a boost in battery energy density and recharge cycles, offering substantial prospects in the consumer electronics sector.

- The evolving landscape of consumer preferences emphasizes convenience, longer device lifespans, and a desire for more sustainable energy solutions. The flexible batteries, with their potential for improved energy density and longer cycle life, meet these consumer demands by offering extended device usage and reduced environmental impact compared to traditional bulky batteries.

- This resonates with the growing consciousness of consumers towards environmentally friendly and recyclable energy sources. The advent of new functionalities and features in consumer electronics, such as IoT capabilities, smart wearables, and connected devices, fuels the need for compact and long-lasting power sources, which thin and flexible batteries can efficiently provide.

- The market's dominance by consumer electronics is also influenced by the expanding global penetration of these devices, especially in emerging economies. The increasing consumer base in these regions have led to a demand for devices that are not only affordable but also equipped with reliable and durable power sources.

- Therefore, as per the points mentioned above, the consumer electronics market segment is expected to dominate the market during the forecast period.

Asia-Pacific will be the Fastest-Growing Region

- Asia-Pacific is poised to witness remarkable growth in the flexible battery market due to various factors contributing to its expanding dominance in this sector. One of the primary driving forces is the expanding consumer electronics industry in countries like China, Japan, South Korea, and India.

- Asia-Pacific is home to a massive consumer base, with a strong inclination towards adopting the latest technological advancements in electronic devices. The escalating demand for smartphones, wearables, tablets, and other portable gadgets in these nations amplifies the need for efficient, smaller, and longer-lasting power sources, precisely the niche fulfilled by thin and flexible batteries.

- * The rapid industrialization and technological advancements in Asia-Pacific have paved the way for substantial innovations and investments in research and development activities related to flexible battery technologies.

- Governments and private entities in countries like China, Japan, and South Korea are investing significantly in the development and commercialization of advanced battery technologies, including thin and flexible batteries. Such investments fuel the growth of the domestic flexible battery market and strengthen the regional manufacturing capabilities, thereby positioning Asia-Pacific as a frontrunner in the global market.

- For instance, in February 2023, the Japanese government revealed a battery strategy budget totaling USD 2.55 billion designated for the research and development of new battery technologies. This budget encompasses diverse types, such as all-solid-state lithium batteries, thin and flexible film batteries, and a range of emerging battery technologies. This initiative is anticipated to bolster Japan's position in the realm of battery technology.

- Asia-Pacific strong manufacturing capabilities, coupled with a favorable regulatory environment and a robust supply chain infrastructure, are expected to support the region as a potential player in flexible battery production. The cost-effective manufacturing processes, increasing investments in technological advancements, and a growing emphasis on environmentally friendly energy sources reinforce the region's foothold in the flexible battery market.

- For example, Shenzhen Grepow Battery Co. Ltd, a leading battery company based in China, produces ultra-thin, flexible batteries. These batteries are designed and manufactured to meet the demand for novel wearable smart electronics that require high spatial utilization while offering high energy density.

- The lithium-ion battery giant CATL demonstrated a flexible battery using a polymer composite inorganic solid electrolyte. The battery can be twisted and even cut with scissors without causing safety problems. However, CATL does not disclose further technical parameters, such as the number of twists, and there are no plans for mass production or short-term delivery of samples. All these highlight the region's significance in the development of advanced battery technologies, including thin and flexible batteries.

- Therefore, as per the points mentioned above, Asia-Pacific is expected to witness significant growth during the forecast period.

Flexible Battery Industry Overview

The flexible battery market is relatively fragmented. Some of the key players in this market include Panasonic Corporation, Enfucell OY Ltd, Imprint Energy Inc., BrightVolt Inc., and EIT InnoEnergy SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rapid Adoption of Healthcare Wearable Devices

- 4.5.1.2 Growing Penetration of Internet of Things (IoT) Applications

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technologies Existing for Various Applications

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Thin-Film Batteries

- 5.1.2 Printed Batteries

- 5.2 Application

- 5.2.1 Consumer Electronics

- 5.2.2 Medical Devices

- 5.2.3 Smart Packaging

- 5.2.4 Smart Cards

- 5.2.5 Other Applications

- 5.3 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Turkey

- 5.3.2.8 Russia

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 UAE

- 5.3.4.3 South Africa

- 5.3.4.4 Qatar

- 5.3.4.5 Egypt

- 5.3.4.6 Nigeria

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Columbia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Enfucell OY Ltd

- 6.3.3 Imprint Energy Inc.

- 6.3.4 BrightVolt Inc.

- 6.3.5 EIT InnoEnergy SE

- 6.3.6 ROCKET Poland Sp. z o.o.

- 6.3.7 Molex

- 6.3.8 Blue Spark Technologies

- 6.3.9 Energy Diagnostics Limited

- 6.3.10 Jenax Inc.

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Lightweight and Compact Designs of Flexible Batteries Holds a Significant Opportunities for Military Applications

02-2729-4219

+886-2-2729-4219

![可拉伸和共形電子產品中可拉伸電池的全球市場:趨勢、機遇和競爭分析 [2023-2028]](/sample/img/cover/42/1272742.png)