|

市場調查報告書

商品編碼

1521754

紡織品回收:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Textile Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

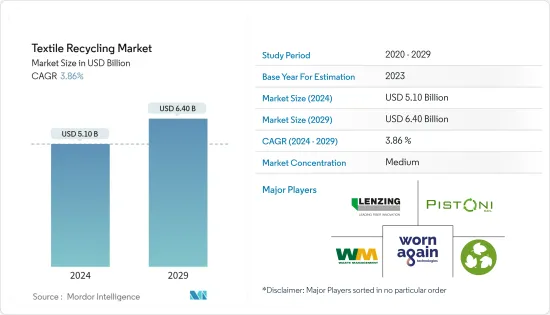

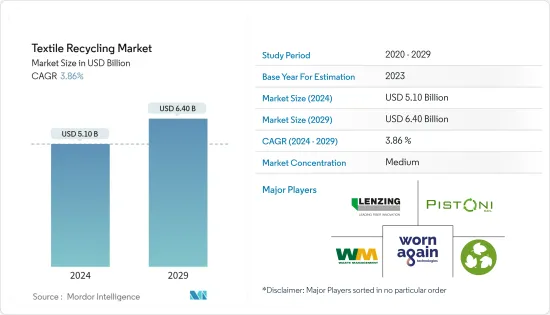

紡織品回收市場規模預計到 2024 年為 51 億美元,預計到 2029 年將達到 64 億美元,在預測期內(2024-2029 年)複合年成長率為 3.86%。

根據產業報告稱,紡織產品是歐洲消費量中第四大環境和氣候變遷壓力來源。管理廢舊紡織品和紡織廢棄物是歐洲面臨的重大挑戰。由於歐洲的再利用和回收能力有限,歐盟境內收集的大部分廢舊紡織品都被交易並出口到未來不確定的非洲和亞洲。

美國國際貿易委員會(USITC)2023年10月報告稱,2021年全球服飾業佔全球溫室氣體排放的1.8%。下游材料(纖維和紡織品)的生產約佔該行業總碳排放的 90%。該產業預計將大幅超過《巴黎協定》1.5°C 路徑設定的 2030 年碳排放目標。

政府政策對於推動紡織廢棄物管理產業的努力和創新非常重要。它們反映了全球和國家促進紡織廢棄物管理領域的運作和創新的迫切需求。例如,2021年3月,英國政府啟動了一項全面的廢棄物預防計劃,以減少紡織廢棄物對環境和社會的影響,並且在其他領域也啟動了回收、監管、合規、永續性和付加舉措。

紡織品回收市場趨勢

歐洲將審查以減少廢棄物為重點的努力

2023年7月,歐盟委員會發布了廢棄物框架指令修訂策略,強調了紡織品生產商責任的新規則和減少食品廢棄物的新目標。歐洲環境署表示,該提案可能會使有效減少食品和紡織業的生產過剩和廢棄物變得困難。

歐洲面臨氣候變遷和自然資源劣化的威脅。為了因應這些挑戰,歐洲綠色新政旨在將歐盟轉變為資源節約型和有競爭力的經濟體,並在 2050 年實現溫室氣體淨零排放。

歐盟委員會表示,自 COVID-19 大流行以來,歐洲綠色新政一直是其生命線。下一代歐盟復甦計畫和歐盟七年預算的 1.8 兆歐元(1.93 兆美元)投資中的三分之一用於資助歐洲綠色新政。

科技徹底改變紡織廢棄物處理

低價值廢棄物可以透過回收技術轉化為新的高價值紡織產品。政治壓力和氣候危機凸顯了開發新回收技術以將紡織廢棄物用作基礎材料的創新需求。為了確保循環策略的有效性,我們必須獲得高品質的可回收材料。

蘇爾壽有限公司為此製程提供核心設備、技術和專業知識,以及 Worn Again Technologies 的專有溶劑技術。為了提高效率和效益,紡織品回收商也正在採用新技術和新製程。例如,蘇爾壽和 H&M 創立了 Worn Again Technologies,該公司致力於開發獨特的紡織品回收工藝,將紡織品轉化為消費後的原始材料。

2023年3月,韓國化學技術研究所開發出紡織廢棄物封閉式回收技術。 KRICT 研究小組採用了一種廉價、無害、生物分解性的材料,透過化學方法從廢纖維混合物中識別出聚酯。

紡織品回收產業概述

紡織品回收市場的競爭格局是經驗豐富的公司、新公司和致力於永續解決方案的組織的混合體。廢棄物管理、回收和紡織品領域的知名公司已指定專門負責紡織品回收的單獨部門或子公司。此外,一些時尚品牌和零售商正在將可再生紡織品納入其產品中,將永續性納入其經營模式。公共當局和機構透過法規、獎勵和資助計劃影響競爭格局,以促進永續實踐和紡織品回收。紡織品回收市場的世界領導者包括 Wornagain Technologies、Lenzing Group 和 Birla Cellulose。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 科技趨勢

- 產業價值鏈分析

- 政府法規和舉措

第5章市場動態

- 促進因素

- 環保意識不斷增強

- 監理機關措施與政策

- 抑制因素

- 回收過程的複雜性

- 基礎設施和意識有限

- 機會

- 回收過程中的技術進步

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 按材質

- 棉布

- 聚酯和聚酯纖維

- 羊毛

- 尼龍和尼龍纖維

- 其他

- 按原料分

- 服裝廢棄物

- 家庭衣物廢棄物

- 汽車廢棄物

- 其他

- 按流程

- 機器

- 化學

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 印尼

- 孟加拉

- 其他亞太地區

- 中東/非洲

- 南美洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Worn Again Technologies

- Lenzing Group

- Birla Cellulose

- Pistoni SRL

- Waste Management Inc.

- The Woolmark Company

- American Textile Recycling

- Boer Group Recycling Solutions

- I:Collect

- Infinited Fiber Company*

- 其他公司

第8章 市場機會及未來趨勢

第9章 附錄

The Textile Recycling Market size is estimated at USD 5.10 billion in 2024, and is expected to reach USD 6.40 billion by 2029, growing at a CAGR of 3.86% during the forecast period (2024-2029).

According to industry reports, textiles are the fourth highest source of environmental and climatic change pressure in terms of European consumption. The management of used textiles, as well as textile waste, is a major challenge for Europe. Due to the limited capacity for reuse and recycling in Europe, many used textiles collected within the EU are traded and exported to Africa and Asia, where their future is uncertain.

The US International Trade Commission (USITC) reported in October 2023 that the global apparel sector accounted for 1.8 % of global GHG emissions in 2021. The production of downstream materials (textile fibers and fabrics) accounted for about 90 % of the total sector's carbon emissions. The industry is expected to significantly exceed its carbon emissions target for 2030, which is set in the 1.5°C pathway by the Paris Agreement.

Government policies are important in driving efforts and innovation in the textile waste management industry. They are a reflection of global and national obligations that drive operationalization and technological innovation in the area of textile waste management. For example, in March 2021, the UK government launched a comprehensive Waste Prevention Program to reduce the environmental and social impact of textile waste, as well as in other sectors focused on key areas such as recycling, regulation, compliance, sustainability, value addition, innovation, and entrepreneurship.

Textile Recycling Market Trends

Europe is Set to Revamp Initiatives Focused on Reducing Waste

In July 2023, the European Commission issued its strategies to revise the Waste Framework Directive, stressing new rules on the responsibility of textile producers and new targets for reducing food waste. According to the European Environmental Agency, the proposal could face difficulties effectively reducing overproduction and waste in the food and textiles sectors.

Europe faces a threat from climate change and the degradation of natural resources. To meet such challenges, the European Green Deal is set to change the EU into a resource-efficient and competitive economy, ensuring no net greenhouse gas emissions by 2050.

The European Commission says the European Green Deal has been its lifeline since the COVID-19 pandemic. One-third of the EUR 1.8 trillion (USD 1.93 trillion) investment in the Next Generation EU Recovery Plan and the EU's seven-year budget is financing the European Green Deal.

Technology is Revolutionizing the Textile Waste Management

Low-value waste can be transformed into new high-value textiles by recycling technologies. The need for innovation to exploit new recycling technologies enabling textile waste to be used as a basic material is underlined by political pressures and the climate crisis. To ensure any circular strategy's effectiveness, quality materials that can be recycled must be obtained.

Sulzer Ltd, together with Worn Again Technologies' unique solvent technology, provides equipment, technology, and expertise to form the heart of the process. New technologies and processes are also being adopted by textile recyclers to enhance efficiency and effectiveness. For example, Sulzer and H&M established Worn Again Technologies, which is working on a unique textile recycling process that turns textiles into virgin raw materials at their end of use.

A technology for the closed-loop recycling of textile waste was developed in March 2023 by Korea's Korean Research Institute on Chemical Technology. The KRICT research team has adopted an inexpensive and nontoxic biodegradable material to chemically discriminate polyester from a mixture of waste fabrics.

Textile Recycling Industry Overview

The competitive landscape in the textile recycling market consists of a mix of experienced enterprises, new companies, and organizations working on solutions that can be sustainably implemented. Separate divisions or subsidiaries dedicated to textile recycling are designated by well-established companies in the area of waste management, recycling, and textiles. Some fashion brands and retailers also integrate sustainability into their business models by including renewable textiles in their products. Public authorities and agencies affect the competitive landscape through regulation, incentives, and funding schemes to promote sustainable practices and textile recycling. Global leaders in the textile recycling market are Worn Again Technologies, Lenzing Group, and Birla Cellulose.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Government Regulations and Initiatives

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Growing Environmental Awareness

- 5.1.2 Regulatory Initiatives and Policies

- 5.2 Restraints

- 5.2.1 Complexity in Recycling Processes

- 5.2.2 Limited Infrastructure and Awareness

- 5.3 Opportunities

- 5.3.1 Technological Advancements in Recycling Processes

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Cotton

- 6.1.2 Polyester and Polyester Fiber

- 6.1.3 Wool

- 6.1.4 Nylon and Nylon Fiber

- 6.1.5 Others

- 6.2 By Source

- 6.2.1 Apparel Waste

- 6.2.2 Home Furnishing Waste

- 6.2.3 Automotive Waste

- 6.2.4 Others

- 6.3 By Process

- 6.3.1 Mechanical

- 6.3.2 Chemical

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Russia

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Indonesia

- 6.4.3.4 Bangladesh

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Middle East and Africa

- 6.4.5 South America

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Worn Again Technologies

- 7.2.2 Lenzing Group

- 7.2.3 Birla Cellulose

- 7.2.4 Pistoni SRL

- 7.2.5 Waste Management Inc.

- 7.2.6 The Woolmark Company

- 7.2.7 American Textile Recycling

- 7.2.8 Boer Group Recycling Solutions

- 7.2.9 I: Collect

- 7.2.10 Infinited Fiber Company*

- 7.3 Other Companies