|

市場調查報告書

商品編碼

1521755

安全物流:市場佔有率分析、產業趨勢、成長預測(2024-2029)Secure Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

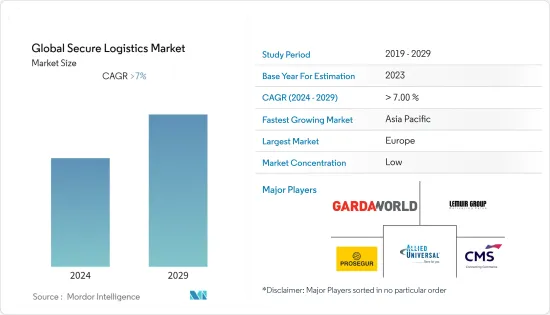

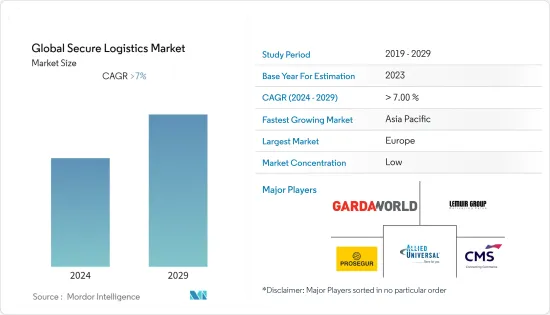

全球安全物流市場預計在預測期內複合年成長率將超過 7%

主要亮點

- 安全物流是指在儲存、運輸和裝卸過程中採取的安全措施,以最大程度地減少盜竊、損壞、遺失和未授權存取等運輸風險。企業和銀行日益關注的安全問題增加了對貨幣轉帳安全服務的需求。

- 安全物流市場的成長伴隨著分店和 ATM 服務外包需求的增加以及產品完整性要求的提高等因素。然而,預計阻礙市場成長的因素包括電子付款使用的增加以及與服務相關的高成本。透過專注於確保最後一英里的交付並將網路安全整合到安全運輸中,為安全物流領域的主要企業創造了市場機會。

- 包括銀行和金融機構在內的許多領域都使用安全的物流服務。印度儲備銀行 (RBI) 在銀行、非銀行金融公司 (NBFC) 和其他受監管的金融機構外包 IT 服務時將確保客戶資料的機密性並保護客戶的承諾和義務。

安全物流市場趨勢

預計亞太市場在預測期內將以最快的速度成長

- 對 ATM 機的需求不斷成長、金融機構的擴張以及貨物盜竊的增加正在推動這一領域的成長。隨著企業和機構越來越關注安全,對安全貨幣轉移和管理服務的需求不斷增加。新興市場銀行業的擴張預計也將受到富裕人口不斷成長和財富管理服務需求不斷成長的影響。

- 高淨值人士正在推動亞太地區安全和物流服務需求的成長。當個人累積大量財富時,他們會獲得理想的資產,例如奢侈品、藝術品、昂貴的珠寶飾品和收藏品。亞太地區日益成長的富裕人口需要專業的物流服務來確保這些寶貴資產的安全運輸和儲存。

- 2022年,在中國當地,約30.6萬名億萬富翁將居住在北京,約30.7萬名億萬富翁將居住在廣東省。據印度品牌資產基金會稱,到 2020 會計年度,將有超過 278,000 名印度人被視為高淨值人士 (HNWI)。高淨值人士持有至少100萬美元的金融資產。到 2025 年,這一數字預計將增加到 611,000 以上。

現金管理領域預計將在未來幾年佔據最大的市場佔有率

- 預計現金管理部門在預測期內將繼續主導市場佔有率。這一成長的原因是 ATM 在新興國家的普及率不斷提高。現金管理部門包括在途現金、現金處理和 ATM 服務。

- 在途現金是從銀行收集資金並交付到指定現金點,例如ATM,使用運鈔車來降低風險,減少盜竊機會並增加安全性。除了受地方、國家和當地法律約束的傳統現金在途服務外,服務提供者還提供自動提款機。司法部、內政部和警方負責監管該行業。

- 市場開拓專注於技術創新和開發高效產品,並結盟和合資企業以增加競爭。例如,德國郵政世界網旗下物流子公司 Danzas 與 Lemuir Group 於 2023 年 1 月在印度成立了新的合資企業。根據協議,新公司將為印度各地的企業提供全方位的一站式供應鏈解決方案,包括空運和海運、來自印度的分箱貨物拼運和清關。

- 2023年11月,全球保全服務、綜合風險管理和現金解決方案公司GardaWorld Security Corporation宣布,加拿大航空運輸安全局(「CATSA」)將與該公司簽署安全篩檢合約45 個機場(涵蓋所有機場的50% )提供包括旅客、機場工作人員、機組人員和行李在內的服務。

安全物流行業概況

全球安防市場供應鏈競爭激烈。持續的研發和價值鏈相關人員的努力是新技術不斷發展的結果。為了擴大其區域和全球影響力,主要企業正在實施各種業務成長策略。 Allied Universal、Brink's、Cargoguard、CMS Info Systems、PlanITROI、Garda World、Lemuir Group、Prosegur 是一些活躍在安全物流市場的公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 目前的市場狀況

- 市場技術進步

- 政府法規和市場舉措

- 運輸費用注意事項

- 價值鏈/供應鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 新興國家銀行和金融機構的成長

- 擴大行動付款的使用

- 市場限制因素

- 行動付款的使用增加

- 市場機會

- 技術進步數位化

- 增加基礎建設投資

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 按用途

- 現金管理

- 鑽石

- 珠寶飾品和貴金屬

- 製造業

- 其他

- 按類型

- 固定式

- 移動的

- 交通途徑

- 路

- 鐵路

- 航空

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 馬來西亞

- 泰國

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 埃及

- 其他中東/非洲

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 北美洲

第7章 競爭格局

- Market Concentration

- 公司簡介

- Lemuir Group

- CMS Info Systems

- CargoGuard

- Prosegur

- Allied Universal

- Securitas AB

- Secure Logistics LLC

- Brink's incorporated

- GardaWorld

- PlanITROI Inc.,*

- 其他公司

第8章市場的未來

第9章 附錄

The Global Secure Logistics Market is expected to register a CAGR of greater than 7% during the forecast period.

Key Highlights

- Secure logistics refers to safety measures for storage, transportation, and handling to minimize the risk of transport, including theft, damage, loss, or unauthorized access. The demand for currency movement security management services is growing due to the increasing safety concerns among enterprises and banks.

- The growth of the secure logistics market is supplemented by factors like increasing demand for outsourcing branch and ATM services, as well as increased product integrity requirements. However, the factors that are expected to hamper market growth include increased use of electronic payment and high costs associated with services. The market opportunities for key players in the secure logistics sector are created by focusing on securing last-mile delivery and integrating cyber security into safe transport.

- Safe logistics services, including banking and finance institutions, are used by a number of sectors. The Reserve Bank of India (RBI) created specific guidelines for banks, non-banking financial companies (NBFCs), and other regulatory financial institutions when outsourcing IT services to ensure the confidentiality of clients' data and protect any commitments and obligations made to the clients.

Secure Logistics Market Trends

During the Forecast Period, the Asia-Pacific Market is Expected to Grow at the Fastest Pace

- The increasing demand for ATMs, the expansion of financial institutions, and increased cargo thefts drive growth in this area. The demand for safe currency movement and management services is growing due to the increasing safety concerns of corporations and institutions. The expansion of the banking sector in developing markets is also expected to be influenced by a growing number of wealthy individuals and an increased demand for wealth management services.

- Wealthy individuals drive the growing demand for security logistics services in Asia-Pacific. Individuals acquire desirable assets such as luxury goods, art, expensive jewelry, and collectibles when accumulating considerable wealth. Specialized logistics services are needed to ensure the safe transport and storage of these valuable assets, given the growing number of high-net-worth individuals in Asia Pacific.

- In 2022, in mainland China, approximately 306,000 millionaires lived in Beijing, whereas around 307,000 millionaires lived in the Guangdong province. According to the India Brand Equity Foundation, in the financial year 2020, over 278 thousand Indians were considered to be high-net-worth individuals (HNWI). At least USD 1 million of financial assets are held by HNWIs. In 2025, this number is expected to increase to more than 611 thousand.

The Cash Management Segment is expected to Hold the Largest Share of the Market in the Coming Years

- During the forecast period, cash management is expected to remain a dominant segment. The growing penetration of ATMs in emerging economies is a reason for this growth. Cash-in-transit, cash processing, and ATM services are included in the cash management segment.

- Cash-in-transit involves collecting money from banks and delivering it to designated cash points like ATMs, utilizing armored trucks that reduce risks and enhance security by reducing opportunities for theft. In addition to traditional cash-in-transit services governed by regional, national, and local law, service providers offer automated teller machines. The Ministry of Justice, the Ministry of Interior, and the police are responsible for regulating this industry.

- Market players focus on developing innovation and efficient products and establishing alliances or joint ventures to increase their competitiveness. For example, Danzas, Deutsche Post World Net's logistics subsidiary, and the Lemuir Group set up a new joint venture company for India in January 2023. Under the agreement, this new company will offer easy access to a full range of one-stop supply chain solutions, including air and ocean freight, less than container load consolidation from India, and customs clearance for businesses throughout the country.

- In November 2023, GardaWorld Security Corporation, a global champion in security services, integrated risk management, and cash solutions, announced that the Canadian Air Transport Security Authority ("CATSA") signed a contract with the company for security screening services, including passengers, airport workers, aircrew, and baggage, in CATSA's largest administrative regions, Central and East, encompassing 45 airports or 50% of all CATSA airports.

Secure Logistics Industry Overview

There is high competition in the global supply chain of the security market. The ongoing R&D and the efforts of stakeholders in the value chain are a result of the constant development of new technology. To extend their regional and global presence, key players are implementing various business growth strategies. Allied Universal, Brink's, Cargoguard, CMS Info Systems, PlanITROI Inc., Garda World, Lemuir Group, and Prosegur are among the companies active in the security logistics market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technology Advancements in the Market

- 4.3 Government Regulations and Initiatives in the Market

- 4.4 Spotlight on Transport Rates

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Impact on COVID 19 on the Market

5 Market Dynamics

- 5.1 Market Drivers

- 5.1.1 The Growth of Banking and Financial Institutions in Emerging Economies

- 5.1.2 Mobile Payments are Being Increasingly Used

- 5.2 Market Restraints

- 5.2.1 Increasing Usage of Payments from Mobile

- 5.3 Market Opportunities

- 5.3.1 Technology Advancements and Digitalization

- 5.3.2 Increasing Investments in the Infrastructure

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/ Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Cash Management

- 6.1.2 Diamonds

- 6.1.3 Jewelry and Precious Metal

- 6.1.4 Manufacturing

- 6.1.5 Others

- 6.2 By Type

- 6.2.1 Static

- 6.2.2 Mobile

- 6.3 By Mode of Transport

- 6.3.1 Roadways

- 6.3.2 Railways

- 6.3.3 Airways

- 6.3.4 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.1.3 Mexico

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 France

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Italy

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 Singapore

- 6.4.3.6 Malaysia

- 6.4.3.7 Thailand

- 6.4.3.8 Rest of Asia-Pacific

- 6.4.4 Middle East and Africa

- 6.4.4.1 Saudi Arabia

- 6.4.4.2 Qatar

- 6.4.4.3 United Arab Emirates

- 6.4.4.4 Egypt

- 6.4.4.5 Rest of Middle East and Africa

- 6.4.5 Latin Maerica

- 6.4.5.1 Brazil

- 6.4.5.2 Argentina

- 6.4.5.3 Rest of Latin America

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Company Profiles

- 7.2.1 Lemuir Group

- 7.2.2 CMS Info Systems

- 7.2.3 CargoGuard

- 7.2.4 Prosegur

- 7.2.5 Allied Universal

- 7.2.6 Securitas AB

- 7.2.7 Secure Logistics LLC

- 7.2.8 Brink's incorporated

- 7.2.9 GardaWorld

- 7.2.10 PlanITROI Inc.,*

- 7.3 Other Companies