|

市場調查報告書

商品編碼

1521756

藝術品物流:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Fine Art Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

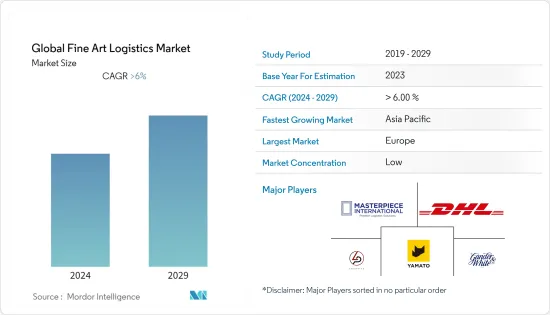

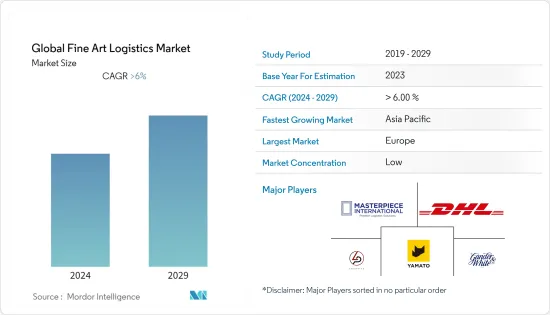

預計全球藝術品物流市場在預測期內複合年成長率將超過 6%

主要亮點

- 藝術品物流是指對繪畫、雕塑、古董、工藝品等貴重、易碎藝術品的專業化運輸、搬運、儲存和安裝。這些公司提供高階物流服務,將貨物和藝術品安全可靠地從一個地點運送到另一個地點。

- 我們使用特殊的包裝材料、氣候控制車輛和安全的儲存設施來保護藝術品在運輸和儲存過程中免受損壞或盜竊。利用展覽、博物館設施和其他公共藝術展示的美術物流。

- *提高藝術品運輸和儲存效率和安全性的需求正在推動藝術品物流行業引入新技術。 RFID標籤、GPS追蹤和網路庫存管理系統使運輸商能夠及時了解藝術品的位置和狀況。

- 這可以降低遺失、損壞或被盜的風險,並確保您的藝術品按時交付。技術可以實現更準確的記錄和文檔,這對於保險目的以及遵守法律要求和法規也很重要。將技術融入藝術品物流對於保持藝術品的完整性和價值,同時確保運輸和儲存過程順利安全至關重要。

- 運輸可能複雜且困難,因為藝術品必須仔細包裝和運輸以避免損壞。 2022年8月,Crozier Fine Arts Ltd收購了藝術品倉儲和物流公司IFA Logistics,以擴大其在亞洲國家的業務。 Crozier Fine Arts Ltd 在倫敦、香港和紐約的擴張有助於運輸作品。因此,運輸服務的採用是藝術品市場參與者擴大的驅動力,創造了物流需求。

藝術品物流市場趨勢

越來越多的收藏家支持藝術品物流市場的成長

- 為了確保藝術品的安全運輸和儲存,藝術品的價值不斷上升,增加了對專業物流服務的需求。藝術收藏家願意為這項服務付費。隨著收藏家和畫廊在世界各地買賣藝術品,對能夠管理將藝術品從一個國家運輸到另一個國家的複雜性的物流服務的需求不斷成長。藝術收藏家經常參與這個過程,因為他們可能必須將他們的收藏轉移到新的環境或展覽。將於 2023 年 2 月舉行的印度藝術博覽會總監表示,藝術的範圍和多樣性反映出印度和南亞當代和現代藝術物流市場不斷成長。

- 私人收藏家通常希望他們的藝術品在氣候控制的環境中運輸時得到最小心的處理。為了滿足這些收藏家的需求,專門從事藝術品的物流公司成立了。 2022年11月,已故微軟聯合創始人保羅艾倫的私人藝術收藏競標在紐約舉行,多件作品價值超過15億美元。

- 根據《紐約時報》報道,這是有史以來最昂貴的競標,許多作品每件售價都超過1億美元。喬治修拉的《Les Poseuses,Ensemble Petite Version》以 1.49 億美元成交,創下競標最高價。因此,私人收藏家對收藏日益成長的興趣以及優質運輸和交付服務的採用推動了美術物流市場的成長。

亞太地區未來將佔據最大市場佔有率

- 在亞太地區,藝術品物流市場的成長和展覽市場的成熟正在推動藝術品物流公司的整合和標準化,以滿足對可靠和專業的藝術品運輸服務日益成長的需求。隨著藝術品收購和轉售興趣的增加,亞太藝術品市場持續成長,對藝術品高效運輸、儲存和處理的需求也隨之增加。

- 為了滿足這項需求,美術物流公司針對珍貴藝術品運輸和保護的特殊要求,提供專業的運輸和倉儲服務。為了支持印度美術物流市場的顯著成長,2023 年印度藝術博覽會將有 85 家參展和 71 家畫廊參加。該博覽會擁有大量參展、畫廊和機構,展示了來自印度和南亞的各種當代、現代和數位藝術。來自印度和國外著名畫廊的參與進一步強調了美術物流市場的區域影響力和重要性。

- 隨著該地區線上畫廊的興起和電子商務的發展,對藝術品物流服務的需求預計將會增加。亞太地區正在大力投資建造新的博物館和畫廊,以期為該地區的企業創造新的機會。因此,預計未來幾年亞太地區將在藝術品物流領域佔據重要的市場佔有率。

藝術品物流行業概況

藝術品物流市場的主要參與者正在考慮與當地企業建立策略夥伴關係、收購和聯盟,作為擴大全球企業發展的主要策略。我們也投資技術和基礎設施,以增強物流能力並提供更好的客戶服務。這些企業致力於提供自訂解決方案,以滿足客戶的特定需求,包括針對精緻和大型藝術品的專業包裝和處理服務。為了滿足全球對藝術品物流服務日益成長的需求,市場主要企業專注於提供優質的產品和服務。市場的主要企業包括 Yamato Transport、DHL、Gander & White、Masterpiece International 和 DB Schenker。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 市場技術進步

- 政府法規和市場舉措

- 運輸費用注意事項

- 價值鏈/供應鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 藝術收藏品的增加推動了對安全儲存設施的需求

- 專業知識是更好處理和市場成長的關鍵

- 市場限制因素

- 運輸成本上升

- 易碎物品難以安全包裝和運輸

- 市場機會

- 加大藝術品產業物流服務投入

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 按類型

- 運輸

- 包裝

- 貯存

- 按用途

- 藝術品經銷商和畫廊

- 競標行

- 美術館/博物館

- 藝術博覽會

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 西班牙

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 馬來西亞

- 泰國

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 埃及

- 其他中東和非洲

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 北美洲

第7章 競爭格局

- 市場集中度

- 公司簡介

- Yamato Transport

- Gander & White

- Sinotrans

- Helu-Trans

- Hasenkamp

- Agility Logistics

- Masterpiece International

- US Art

- DHL

- DB Schenker

- Andre Chenue

- LP ART

- 其他公司

第8章市場的未來

第9章 附錄

The Global Fine Art Logistics Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- Fine arts logistics refer to the specialized transportation, handling, storage, and installation of precious and fragile art objects, such as paintings, sculptures, antique pieces, and artifacts. These companies provide high-end logistics services for the safe and secure transportation of goods and artwork from one place to another.

- They use specialized packaging materials, climate-controlled vehicles, and safe storage facilities to protect works of art from damage or theft during transportation and storage. Coordination of art utilizes fine art logistics for exhibitions, museum installations, and other public displays of art.

- * The need for improved efficiency and security of art transport and storage is a driving force behind the adoption of new technologies in the fine art logistics industry. In order to provide better visibility and control of the entire logistics process, RFID tags, GPS tracking, or internet inventory management systems allow transport operators to keep track of art objects' location and condition in a timely manner.

- This helps reduce the risk of loss, damage, or theft and ensures that artwork is delivered in good time. The use of technology allows for more accurate record-keeping and documentation, which is important for insurance purposes and for complying with legal requirements and regulations. In order to preserve the integrity and value of art objects while guaranteeing a smooth and secure transport and storage process, it is essential that technology be integrated into fine art logistics.

- * Due to the need to pack and deliver the art carefully to avoid damage, transportation can be complex and difficult. In August 2022, Crozier Fine Arts Ltd acquired art storage and logistics company IFA Logistics to expand in Asian countries. In London, Hong Kong, and New York, the expansion of Crozier Fine Arts Ltd has helped transport its works. The adoption of transport services is, therefore, driven by the expansion of players in the fine art market, giving rise to a demand for logistics.

Fine Art Logistics Market Trends

A Growing Number of Collectors are Supporting the Growth of the Art Logistics Market

- In order to ensure the safe transport and storage of art, demand for specialized logistical services has increased due to an increase in its value. The art collectors are prepared to pay for this service. There is a growing demand for logistics services that can manage the complex transport of art from one country to another as collectors and galleries buy and sell artwork all over the world. This process is often attended by art collectors, as they may have to move their collections into new environments or exhibitions. According to the Director of the Indian Art Fair, in February 2023, the scope and diversity of art reflect the expansion of the contemporary and modern art logistics market in India and South Asia.

- During transport in a climate-controlled environment, private collectors often expect their art to be handled with the utmost care. This demand for high-quality service has led to the development of specialized fine art logistics companies that can meet the needs of these collectors. In November 2022, the auction of the private art collection of Paul Allen, the late Microsoft co-founder, in New York displayed various items priced at more than USD 1.5 billion.

- It was the most expensive auction in history, according to the New York Times, as many individual pieces sold for more than USD 100 million each. Georges Seurat's "Les Poseuses, Ensemble Petite Version" sold for USD 149 million and was the most expensive item in that sale. Therefore, the growth of the fine art logistics market is being driven by increasing interest in private collectors' collections as well as their adoption of good shipping and delivery services.

Asia-Pacific Holds the Largest Market Share in the Coming Years

- In Asia-Pacific, the growth of the art logistics market and the maturity of the exhibition market have led to the consolidation and standardization of art logistics companies, allowing them to meet the growing demand for reliable and professional art transport services. The need for efficient transport, storage, and handling of art is becoming increasingly important as the Asia-Pacific art market continues to grow in parallel with an increasing interest in acquiring and reselling art.

- In order to meet this need, art logistics companies provide specialized transport and safekeeping services in response to the specific requirements of carrying and protecting valuable works. In support of the significant growth in the Indian fine art logistics market, the exhibition was held with 85 exhibitors and 71 galleries at the India Art Fair 2023. A wide range of contemporary, modern, and digital art from India and South Asia is presented at the fair, which is attended by a number of exhibitors, galleries, and institutions. The regional reach and importance of the fine art logistics market are further underlined by the participation of prominent Indian and international galleries.

- The demand for fine art logistics services is expected to increase with the increasing number of online galleries and growing e-commerce in the area. Significant investments in the building of new museums and art galleries are being made in Asia-Pacific, with a view to creating new opportunities for enterprises there. Thus, Asia-Pacific is expected to hold a significant market share in the area of fine art logistics over the coming years.

Fine Art Logistics Industry Overview

Strategic partnerships, acquisitions, and collaborations with local players are the main strategies pursued by key operators in the fine art logistics market to expand their global reach. They are also investing in technology and infrastructure to increase their capacity for logistics and provide better customer service. They are dedicated to providing their clients with custom solutions in order to meet their specific needs, such as specialized packaging and handling services for delicate or large works of art. In order to meet the increasing global demand for art logistics services, key players in the market are focusing on providing quality products and services. The key players in the market are Yamato Transport, DHL, Gander and White, Masterpiece International, and DB Schenker, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technology Advancements in the Market

- 4.3 Government Regulations and Initiatives in the Market

- 4.4 Spotlight on Transport Rates

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Impact on COVID-19 on the Market

5 Market Dynamics

- 5.1 Market Drivers

- 5.1.1 The Demand for Secure Storage Facilities is Driven by the Increase in Art Collection Value

- 5.1.2 Specialized Expertise is the Key to Better Handling and Market Growth

- 5.2 Market Restraints

- 5.2.1 High Cost of Transportation Costs

- 5.2.2 Securing the Packaging and Transport of Fragile Goods is Difficult

- 5.3 Market Opportunities

- 5.3.1 Increasing Investments in the Logistics Services in the Art Industry

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/ Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Transportation

- 6.1.2 Packing

- 6.1.3 Storage

- 6.2 By application

- 6.2.1 Art Dealers and Galleries

- 6.2.2 Auction Houses

- 6.2.3 Museums

- 6.2.4 Art Fairs

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 Spain

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia

- 6.3.3.5 Singapore

- 6.3.3.6 Malaysia

- 6.3.3.7 Thailand

- 6.3.3.8 Rest of Asia-Pacific

- 6.3.4 Middle East and Africa

- 6.3.4.1 Saudi Arabia

- 6.3.4.2 Qatar

- 6.3.4.3 United Arab Emirates

- 6.3.4.4 Egypt

- 6.3.4.5 Rest of Middle East and Africa

- 6.3.5 Latin Maerica

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.5.3 Rest of Latin America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Company Profiles

- 7.2.1 Yamato Transport

- 7.2.2 Gander & White

- 7.2.3 Sinotrans

- 7.2.4 Helu-Trans

- 7.2.5 Hasenkamp

- 7.2.6 Agility Logistics

- 7.2.7 Masterpiece International

- 7.2.8 U.S. Art

- 7.2.9 DHL

- 7.2.10 DB Schenker

- 7.2.11 Andre Chenue

- 7.2.12 LP ART

- 7.3 Other Companies