|

市場調查報告書

商品編碼

1521761

保全服務:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Security Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

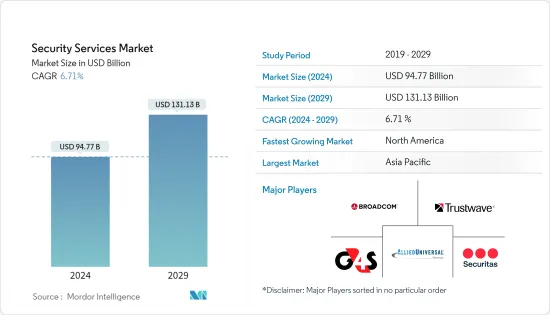

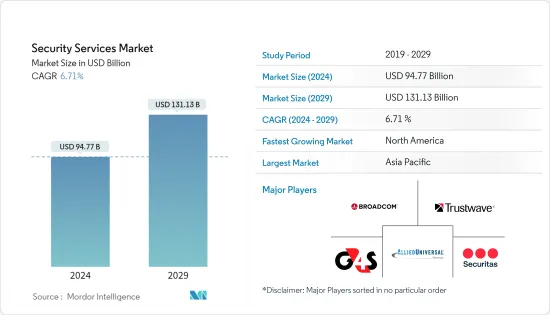

保全服務市場規模預計到 2024 年為 947.7 億美元,預計到 2029 年將達到 1311.3 億美元,在預測期內(2024-2029 年)複合年成長率為 6.71%。

主要亮點

- 實體領域和數位領域之間的關係變得越來越複雜,需要開發更複雜的安全系統,特別是在新興經濟體。隨著這些系統透過智慧型設備和物聯網與巨量資料和人工智慧(AI)等技術整合,對保全服務的需求正在迅速增加。虛擬職場環境的出現和對設施使用不斷變化的需求正在催生新的保全服務和解決方案。此外,電子商務的成長進一步增加了物流中心和類似結構對技術支援的安全解決方案的需求。

- 越來越多的人向城市遷移,都市化和工業化速度不斷加快。世界城市人口平均每週增加 150 萬人,如此高的人口密度可能會引起人們對犯罪的擔憂。隨著技術監控設備的使用增加,大多數新興國家的保全服務市場預計將迅速擴大。工業化的不斷發展和全球工業生產的成長需要對生產設施、辦公室和其他職場環境進行投資,而每個環境都有自己的安全要求。

- 隨著世界人口可支配所得的增加,保全服務的需求也隨之增加。例如,大眾交通工具和公共物流設施等基礎設施投資增加了安全需求,因為這些資產需要受到保護。全球經濟成長和新建築的持續投資都促進了保全服務市場的開拓。例如,智慧城市計畫計畫於2023年7月啟動,將在全國100個城市投資數十億美元,以滿足印度快速成長的城市人口的需求。

- 網路威脅的性質不斷變化,因此保全服務必須不斷適應。隨著新的攻擊媒介的出現,保全服務不足可能會使您的組織面臨風險並阻礙您開拓市場的能力。例如,2023 年資料外洩次數最多的三個產業是醫療保健、金融服務和製造業。

- COVID-19 大流行對全球保全服務市場產生了負面影響。例如,音樂會場館、會議和體育賽事等重要公共活動已關閉,減少了對保全服務的需求。然而,在保全服務 -19 之後,將需要在封鎖期間為零售和醫療保健等基本功能提供保全服務,以及接觸者追蹤和人群監控等安全服務,以促進社會恢復正常需求。

保全服務市場趨勢

雲端部署佔據主要市場佔有率

- 部署在雲端的託管保全服務具有高度適應性和擴充性。此外,服務提供者可以存取、追蹤和遠端解決雲端中的任何問題。持續監控使您能夠快速有效地解決任何問題。機器學習 (ML)、人工智慧 (AI)、巨量資料分析、威脅情報和進階自動化平台的日益普及也推動了向雲端管理保全服務的轉變。一些市場參與企業正在透過創新和協作努力推出綜合服務,以滿足行業不斷變化的需求。

- 由於大流行,遠端工作迅速擴展,增加了對雲端基礎的協作工具和存取解決方案的依賴。確保這些環境的安全需要專業的保全服務,包括安全存取和全面保護。因此,企業擴大選擇將自動化安全措施與手動流程結合的混合架構,以降低與雲端安全相關的成本和複雜性。

- 隨著進行數位轉型的公司開始對其本地IT基礎設施進行現代化改造並將部分業務遷移到雲端這一困難但必要的過程,IT 決策者通常會考慮法規遵循、面臨安全性和降低風險的挑戰。這些公司的問題因缺乏合格的 IT 人才以及無法跟上最新的工具、技術和實踐而變得更加複雜。隨著網路和資料安全風險的上升,MSSP 可以幫助不堪重負的企業管理雲端配置、降低風險並確保合規性。

- 由於複雜、大規模的架構而需要自訂安全雲端部署或對不同系統有特定實施要求的組織可以從此類服務中受益匪淺。依賴動態資源分配的組織通常需要改善自動化來有效監控動態環境。這些複雜的自動化要求可以透過 AT&T、Verizon、IBM 和 SecureWorks 等提供者提供的服務來滿足。

- 2023 年 10 月,CyberArk 宣布推出新功能,基於該公司基於風險的智慧權限控制,確保所有用戶安全存取雲端服務和現代基礎設施。這種新的安全控制可以安全地存取雲端環境的每一層,同時不會中斷或改變開發人員和其他使用者存取雲端服務的方式。

亞太地區實現顯著成長

- 近年來,亞太地區的網路威脅和攻擊有所增加。人們擴大使用網際網路,商業變得更加數位化,並且存在地緣政治緊張局勢。這些因素增加了對可靠的網路安全保全服務的需求,以防止網路攻擊和破壞。

- MeitY提供的資料顯示,2023年印度將報告超過150萬起網路攻擊,較往年大幅增加。印度是全年網路安全事件數量最多的五個國家之一。此外,印度目前的網路使用者數量位居世界第三。

- 保全服務。可用的。在傳統產業中,數位轉型和IT技術的進步正在增加對網際網路中心服務的需求,進一步推動市場的成長。

- 人工智慧、5G、物聯網、虛擬實境技術的快速興起以及這些技術的商業化正在增加對資料處理和資訊交流的需求。這些因素可能會加速該地區資料中心的建設,從而導致產業快速擴張。隨著印度對組織資訊的安全性、機密性和可用性的威脅不斷增加,基於業務風險方法的資訊安全標準模型已經被採用、實施、操作、監控,並且需要審查、維護和改進強調。

- 亞太地區越來越多的公司將數位轉型作為首要任務。隨著越來越多的公司採取正式策略來加速推進,市場對數位轉型的需求正在顯著增加。中國、印度、日本和韓國等多個國家正在醫療保健、金融服務、政府和製造業等多個領域經歷快速數位轉型。這種轉變需要利用雲端運算、物聯網和數位平台,並需要提供先進的保全服務來保護數位資產。

保全服務服務業概況

保全服務市場競爭激烈。市場分散,有大大小小的參與者。所有主要公司都擁有較大的市場佔有率,並致力於擴大消費群。市場的主要參與者包括 Broadcom、Trustwave Holdings Inc.、G4S Limited、Securitas Inc.、Allied Universal、Unity Resource Group、Constellis、DSS Securitech Pvt.Ltd. 和 Fortra LLC。為了在預測期內獲得競爭優勢,公司正在透過建立多個合作夥伴關係、聯盟、收購以及投資新產品推出來擴大市場佔有率。

2023 年 4 月 安全與設施服務供應商 Allied Universal 與 Allied Universal 子公司 MSA Security 合作收購 Elite Tactical Security Solutions。收購精英 Tactical 將使 Allied Universal 能夠提供安全和行政保護服務,以及爆炸物和槍支探測犬團隊。此次收購後,Allied Universal 的解決方案組合將負責管理拉斯維加斯的安全和高階主管保護服務。 Elite Tactical 的犬類服務將整合到 MSA Security 的計劃中。

2023 年 3 月 - Fortra 的 Terranova Security 與 Elevate Security 合作,為市場帶來最佳的安全意識和威脅監控。對於希望保護敏感資訊、增強資訊安全以及降低網路攻擊和資料外洩的人為風險的組織來說,此元素至關重要。 80%的網路釣魚事件是由4%的用戶引起的,92%的惡意軟體事件是由3%的用戶引起的。 Elevate Security 為安全團隊提供可見性和分析能力,以主動識別和回應組織中最脆弱的用戶,並在安全事件發生之前降低用戶風險。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 數位化顛覆和不斷成長的合規要求

- 更多採用多重雲端或混合雲端策略

- 政府關注網路安全

- 市場挑戰

- 缺乏保全服務意識

- 組織的保全服務預算有限

- 複雜性和整合挑戰

第6章 市場細分

- 按服務類型

- 託管保全服務

- 專業保全服務

- 諮詢服務

- 威脅情報和保全服務

- 依實施類型

- 本地

- 雲

- 按最終用戶產業

- 資訊科技和基礎設施

- 政府機關

- 產業

- 衛生保健

- 運輸/物流

- 銀行

- 其他最終用戶產業

- 按地區*

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 印度

- 中國

- 日本

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Broadcom

- Trustwave Holdings Inc

- G4S Limited

- Allied Universal

- Securitas Inc

- Unity Resource Group

- Constellis

- DSS Securitech Pvt. Ltd

- Fortra LLC

- IBM Corporation

- VS4 Security Services

- Fujitsu

- Verizon

- Wipro

第8章投資分析

第9章市場的未來

The Security Services Market size is estimated at USD 94.77 billion in 2024, and is expected to reach USD 131.13 billion by 2029, growing at a CAGR of 6.71% during the forecast period (2024-2029).

Key Highlights

- The relationship between the physical and digital realms is becoming increasingly complex, necessitating the development of more sophisticated security systems, particularly in more developed economies. The need for security services is rapidly growing as these systems integrate with technologies such as big data and artificial intelligence (AI) through smart devices and the IoT. The emergence of virtual working environments and the ever-evolving demands for facility utilization are leading to new security services and solutions. Additionally, the growth of e-commerce has further increased the demand for technology-enabled security solutions in distribution centers and similar structures.

- The rate of urbanization and industrialization is accelerating as more and more people relocate to cities. The world's urban population is increasing by an average of 1.5 million individuals each week, and this high population density could raise concerns about criminal activity. It is anticipated that the security services market will experience a rapid expansion in the majority of developed countries as the utilization of technological monitoring equipment increases. The ongoing industrialization and growth of global industrial production necessitates the investment of production facilities, offices, and other work environments, each with its security requirements.

- As the global population increases its disposable income, the requirement for security services is likely to grow. For instance, infrastructure investments in public transport and public logistics facilities require the protection of these properties, thus necessitating an increase in the demand for security. Economic growth and ongoing global investment in new construction are both contributing to the development of the security services market. For instance, in July 2023, the Smart Cities Mission seeks to address India's rapidly expanding urban population by investing billions in 100 cities nationwide.

- The ever-changing nature of cyber threats necessitates that security services must be constantly adapted. As new attack vectors emerge, organizations can be put at risk if security services are inadequate, thus impeding market development. For instance, in 2023, the three industries that experienced the highest number of data breaches were the healthcare, financial services, and manufacturing sectors.

- The COVID-19 pandemic had a detrimental effect on the global security services market. For instance, the closure of significant public events, such as concert venues, conferences, and sports competitions, reduced the need for security services. However, post-COVID-19, there is an increase in the demand for security services for essential functions, such as retail and healthcare during lockdown, as well as for security and technology-enabled security services, such as contact tracing and crowd surveillance, to facilitate the return of societies to normalcy.

Security Services Market Trends

Cloud Deployment to Hold Significant Market Share

- Managed security services deployed in the cloud are highly adaptable and scalable. Additionally, the service provider can access, track, and even remotely resolve any problems within the cloud. Continuous monitoring ensures the prompt and effective resolution of any issues. The rising adoption of machine learning (ML), artificial intelligence (AI), big data analytics, threat intelligence, and advanced automation platforms further supports the transition to cloud-managed security services. Several market participants are introducing comprehensive services through innovative and collaborative initiatives to meet the changing needs of the industry.

- The rapid expansion of remote work due to the pandemic has necessitated a greater reliance on cloud-based collaborative tools and access solutions. Specialized security services are necessary to guarantee the safety of these environments, including secure access and comprehensive protection. As a result, enterprises will increasingly opt for hybrid architectures that combine automated security measures with manual processes to reduce the costs and intricacies associated with cloud security.

- IT decision-makers typically face regulatory compliance, security, and risk reduction challenges as companies amid digital transformation embark on the difficult yet necessary process of modernizing their on-premise IT infrastructure and transitioning some of their operations into the cloud. The lack of qualified IT personnel and the inability to remain up-to-date with the latest tools, technologies, and practices exacerbate these corporate worries. At a time when network and data security risks are on the rise, MSSPs can assist overwhelmed enterprises in managing cloud configuration, reducing risk, and ensuring regulatory compliance.

- Organizations that require a custom security cloud deployment due to a complex or expansive architecture or have specific implementation requirements with disparate systems can benefit significantly from such services. Organizations that rely on dynamic resource allocation typically require improved automation to monitor their dynamic environments efficiently. These complex automation requirements can be met through the services provided by providers such as AT&T, Verizon, IBM, and SecureWorks.

- In October 2023, CyberArk announced new capabilities for securing access to cloud services and modern infrastructure for all users based on the company's risk-based intelligent privilege controls. The new security controls enable secure access to every layer of cloud environments while causing no disruption or change to how developers and other users access cloud services.

Asia-Pacific to Witness Significant Growth

- Cyber threats and attacks have increased in Asia-Pacific over the last few years. People increasingly use the internet, businesses are digitalizing, and geopolitical tension exists. These factors have heightened the need for reliable cybersecurity services to safeguard against cyberattacks and breaches.

- In India, according to data provided by MeitY, more than 1.5 million cyberattacks were reported in 2023, which was a considerable rise from previous years. India was one of the five countries with the highest number of cybersecurity incidents in the year. Additionally, India is currently ranked third worldwide in terms of internet user numbers.

- Organizations in the region are increasingly turning to managed security services due to the growing threats to cybersecurity, such as IT ransomware attacks, distributed denial-of-service (DDoS) attacks, data extraction, and the increased visibility of major cyberattacks in the media. Traditional industries are increasingly embracing digital transformation and improving their IT technologies, increasing the demand for Internet center services, further contributing to the market's growth.

- The rapid emergence of artificial intelligence, 5G, the Internet of Things, and virtual reality technologies, as well as the commercialization of these technologies, has increased the need for data processing and the exchange of information. These factors may lead to accelerating data center construction in the region, potentially resulting in a rapid expansion of the industry. The threats to the security, confidentiality, and availability of organization information are on the rise in India, thus emphasizing the need for a standardized model of information security based on the business risk approach to be implemented, implemented, operated, monitored, reviewed, maintained, and improved for the overall security of customers.

- Asia-Pacific has seen an increase in the adoption of digital transformation as a top priority. As more businesses adopt formal strategies to facilitate their efforts, the market demand for digital transformation has increased significantly. Several countries, such as China, India, Japan, and South Korea, are experiencing rapid digital transformation in various sectors, including healthcare, financial services, administration, and manufacturing. This transformation necessitates the utilization of cloud computing and the Internet of Things (IoT), as well as digital platforms, which requires the provision of sophisticated security services to protect digital assets.

Security Services Industry Overview

The security services market is very competitive. The market is fragmented due to the presence of various small and large players. All the major players account for a significant market share and focus on expanding the consumer base. Some of the significant players in the market are Broadcom, Trustwave Holdings Inc., G4S Limited, Securitas Inc., Allied Universal, Unity Resource Group, Constellis, DSS Securitech Pvt. Ltd, and Fortra LLC. Companies are increasing their market share by forming multiple partnerships, collaborations, and acquisitions and investing in introducing new products to earn a competitive edge during the forecast period.

April 2023: Allied Universal, a security and facility services provider, partnered with MSA Security, a subsidiary of Allied Universal, to acquire Elite Tactical Security Solutions, a strategic extension of their services to the Las Vegas area. The acquisition of Elite Tactical will enable Allied Universal to provide security and executive protection services and explosives and firearms detection canine teams. As a result of this acquisition, Allied Universal's portfolio of solutions will be responsible for managing security guard and executive protection services in Las Vegas. Elite Tactical's canine services will be integrated into MSA Security's program.

March 2023 - Fortra's Terranova Security partnered with Elevate Security to bring the best security awareness and threat monitoring to the marketplace. This factor is essential for organizations looking to protect sensitive information, enhance information security, and mitigate the human risk of cyber-attacks and data breaches. 4% of users account for 80% of all phishing incidents and 3% for 92% of all malware incidents. Elevate security proactively identifies and responds to an organization's most vulnerable users and provides security teams with visibility and analytics to mitigate user risk before enabling a security incident.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Digital Disruption and Increased Compliance Demands

- 5.1.2 Increasing Adoption of Multi-Cloud or Hybrid Cloud Strategies

- 5.1.3 Governments Focus on CyberSecurity

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness of Security Services

- 5.2.2 Limited Budget Constraints by Organizations for Security Services

- 5.2.3 Complexity and Integration Challenges

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Managed Security Services

- 6.1.2 Professional Security Services

- 6.1.3 Consulting Services

- 6.1.4 Threat Intelligence Security Services

- 6.2 By Mode of Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-user Industry

- 6.3.1 IT and Infrastructure

- 6.3.2 Government

- 6.3.3 Industrial

- 6.3.4 Healthcare

- 6.3.5 Transportation and Logistics

- 6.3.6 Banking

- 6.3.7 Other End-user Industries

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Broadcom

- 7.1.2 Trustwave Holdings Inc

- 7.1.3 G4S Limited

- 7.1.4 Allied Universal

- 7.1.5 Securitas Inc

- 7.1.6 Unity Resource Group

- 7.1.7 Constellis

- 7.1.8 DSS Securitech Pvt. Ltd

- 7.1.9 Fortra LLC

- 7.1.10 IBM Corporation

- 7.1.11 VS4 Security Services

- 7.1.12 Fujitsu

- 7.1.13 Verizon

- 7.1.14 Wipro