|

市場調查報告書

商品編碼

1521765

FIBC:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)FIBC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

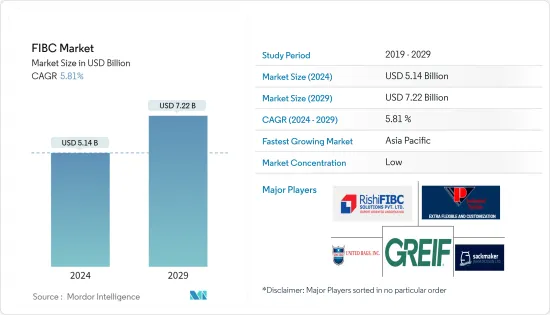

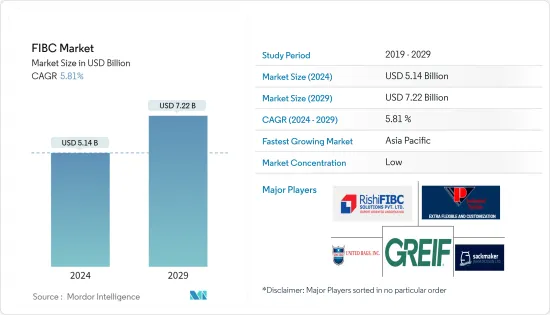

FIBC 市場規模預計到 2024 年為 51.4 億美元,預計到 2029 年將達到 72.2 億美元,在預測期內(2024-2029 年)複合年成長率為 5.81%。

主要亮點

- FIBC 是業界發展最快的包裝解決方案之一。貨櫃市場成長的關鍵原因之一是世界工業化的快速發展。化學工業和農業領域越來越依賴集裝袋來運輸各種產品,包括穀物、米、馬鈴薯、穀類和液體化學品。 FIBC 在炭黑、鋼材、合金、礦物、水泥和沙子等建築材料的儲存和運輸中也發揮著重要作用。

- 自動化和機器人技術對許多行業產生重大影響。自動化在 FIBC 製造中也逐漸成熟。高品質貨櫃的自動化生產和填充流程預計將在未來 FIBC 行銷中發揮重要作用。 2023 年 8 月,主要企業Spiroflow 宣布推出其新一代雙線散裝袋填充系統。自動釋放鉤和滾筒輸送機的組合簡化了填充過程。滿裝的散裝袋順利、自動地從灌裝機轉移到輸送機上。自動化還減少了手動工作。

- 隨著環境問題的日益嚴重,永續性現已成為企業和消費者的首要任務。 FIBC 製造商和分銷商正在響應對永續包裝解決方案不斷成長的需求。例如,2024 年 1 月,具成本效益貨櫃製造商和供應商 Vaal Bulk Bags 宣布將專注於創新包裝解決方案,並將永續性視為首要任務。透過關注環境的永續性,該公司的目標是減少散裝包裝對環境的影響,同時保持產品品質和功能。

- 聚乙烯 (PE) 和聚丙烯 (PPE) 是全球大多數貨櫃和內襯使用的兩種主要原料。然而,無論是在疫情期間還是疫情之後,原料的供應都是最令人擔憂的問題。因此,由於市場動盪(需求高、供給少),貨櫃產業出現價格上漲。近年來貨櫃價格大幅上漲,並已轉嫁給消費者。

- 此外,參與國際貿易的各個行業的成長也增加了對 FIBC 或軟質散裝袋的需求。根據聯合國貿易和發展會議(UNCTAD)2023年6月21日發布的最新《世界貿易最新動態》,全球商品貿易在2022年下半年下滑後,將在2023年初實現數量和金額的復甦。國際貿易的成長預計將加強對貨櫃在世界各地運輸貨物的需求。

貨櫃市場趨勢

化學和石化領域的需求增加

- 由於其高強度和耐化學性,集裝袋對於化學和石化原料的安全儲存和運輸至關重要。貨櫃(FIBC)用於包裝和運輸粉末、顆粒、易燃材料等危險物品。該行業的 FIBC 袋通常配備防靜電功能和內襯,以避免產品污染。

- FIBC 散裝袋由最高等級的聚丙烯樹脂製成,幾乎無法滲透所有化學物質、水、污染物、火災和爆炸。 FIBC 散裝袋可承載各種酸和鹼,包括硫酸、氫氧化鈉、氨水和漂白水。世界各地有多家公司提供強大容量的貨櫃。例如,Palmetto Industries 的 FIBC 大散裝袋可容納高達 4,000 磅的多種化學物質。

- 此外,全球化和改善的運輸網路正在促進化學品和石化產品的跨境貿易,推動市場發展。此外,企業正在利用跨境貿易機會擴大業務範圍、多元化收益來源並最佳化供應鏈。

- 根據美國工業理事會的數據,美國化學品製造業預計將在 2020 年從疫情導致的產量下降中恢復過來,2022 年複合年成長率為 4.3%。預計 2023 年成長率為 2.1%。化學品產量的成長預計在未來幾年將擴大,導致對化學品包裝的需求下降。

- 化學品包裝市場專注於專門設計用於儲存和運輸大量化學品的包裝解決方案的生產和分銷。這些包裝解決方案旨在滿足最高的安全和監管要求,確保化學品在整個生命週期中的完整性和穩定性。例如,聯合國 FIBC 袋專為危險材料的安全運輸而設計和測試,因為它們符合聯合國性能包裝標準。這些 FIBC 專為危險材料的安全運輸而設計和測試,以滿足聯合國性能包裝標準。

亞太地區預計將出現強勁成長

- 由於亞洲和其他全球市場的需求不斷增加,預計 FIBC 市場在未來幾年將達到高水準。在亞太地區,中國預計將佔據中間散裝包裝的最大市場佔有率。不斷成長的中國食品和飲料市場預計將在未來幾年對亞太地區中型散貨班輪市場的成長做出積極貢獻。

- 中國是世界上最大的經濟體之一,也是進出口總合最大的貿易國之一。該國被譽為世界工廠,在經歷了一段時期的急劇停滯後,製成品出口貿易開始再次復甦。隨著出口貿易的持續成長,預計市場對散裝袋和耐用中間軟質袋的需求強勁。

- 根據海關總署2023年12月報導公佈的官方資料,中國出口在2023年11月小幅復甦,結束了連續六個月的下滑,成為世界第二大經濟強國。 11月份出口較去年同月成長0.5%。此外,根據中國海關2024年1月發布的報告,中國的出口額在過去幾年中不斷成長,從2017年的22,633.5億美元增加到2023年的約33,800.2億美元,達到10億美元。因此,全國出口貿易的持續成長可以歸因於工業作為出口貿易中主要的二次包裝產品的持續需求。

- 隨著印度出口的持續成長,客自訂化散裝包裝解決方案對於印度製造商來說變得越來越重要,特別是在食品加工、製藥和化學領域。印度品牌資產基金會的數據顯示,印度藥品出口額從 2019 年的 191 億美元增加到 2023 年的 254 億美元。這種不斷成長的出口趨勢預計將推動整個市場對散裝集裝袋的需求。

- 印度政府鼓勵在包裝中使用可回收材料,而 FIBC 可以為此提供協助。各行業對客製化儲存和運輸解決方案的需求不斷增加,而技術純熟勞工的缺乏正在增加集裝袋的使用,因為集裝袋易於處理且具有成本效益。

- 根據印度軟性中型散裝貨櫃協會(IFIBCA)主席介紹,自FIBCA成立以來,印度每年生產FIBCA約1萬噸。目前,我們的年產量為 40 萬噸。印度是包括歐洲在內的全球最大的貨櫃出口國之一,美國是最大的進口國之一。從 2024 年到 2029 年,隨著全球市場需求的增加,產量預計將增加。

集裝袋產業概述

集裝袋市場目前已被分割,因為它由許多參與企業組成。市場上的幾家主要企業正在不斷努力實現進步。幾家知名公司正在透過成立合資企業來擴大其在新興市場的全球足跡,以鞏固其市場地位。主要市場參與企業包括 Greif Inc.、United Bags Inc.、Berry Global Group Inc.、Rishi FIBC Solutions Pvt Ltd. 和 J&HM Dickson Ltd.。

- 2023 年 5 月,FlexSack 推出了一款新型聚丙烯永續軟質中型散裝容器 (FIBC),由 30% 再生聚丙烯 (rPP) 製成。 FlexSack-eco 2023 含 30% (PCR) 是傳統聚乙烯袋的永續替代品。編織袋的最新發展已從尼龍線縫製的聚乙烯袋的組合發展到100%回收的聚丙烯袋。

- 2023 年 8 月,由澳洲家族經營的 Sadleirs Packaging 成為全國第一家推出 FIBC 的公司,這種 FIBC 為 100% 聚丙烯,30% 可回收。根據該公司銷售經理介紹,幾乎所有 FIBC 配置都可以遷移到新的 FIBC Green Bag,採礦、製造、建築、化學、乳製品和其他食品加工領域的客戶都渴望嘗試和遷移。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 最終用戶產業對軟質塑膠包裝解決方案的需求增加

- 擴大便利商店、電商等流通管道的利用

- 市場限制因素

- 原物料價格劇烈波動

第6章 市場細分

- 按類型

- A型

- B型

- C型

- D型

- 依設計類型

- U盤袋

- 擋板袋

- 圓形袋

- 4側板袋

- 其他設計類型

- 按最終用戶產業

- 食品/農產品

- 化學/石化

- 藥品

- 其他

- 按地區*

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 印度

- 日本

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Greif Inc.

- United Bags Inc.

- J&HM Dickson Ltd

- Berry Global Group Inc.

- Thrace Group

- Rishi FIBC Solutions Pvt Ltd

- Bulk Lift International LLC

- BAG Supplies Canada Ltd

- Plastipak Group

- Bulk Pack Exports Ltd

- Southern Packaging LP

第8章市場的未來

The FIBC Market size is estimated at USD 5.14 billion in 2024, and is expected to reach USD 7.22 billion by 2029, growing at a CAGR of 5.81% during the forecast period (2024-2029).

Key Highlights

- FIBCs are one of the fastest-growing packaging solutions in the industry. One of the main reasons for the FIBC market growth is the fast-paced industrialization in the world. Industries in the chemical industry and agriculture increasingly depend on FIBCs to transport various products, such as grain, rice, potatoes, cereals, and liquid chemicals. FIBCs also play an important role in storing and transporting construction materials, including carbon black, steel, alloys, minerals, cement, and sand.

- Automation and robotics have made a huge impact in many industries. Automation is just beginning to take hold in FIBC manufacturing. Automated production and filling processes for high-quality bulk bags are expected to be a big part of the future of FIBC marketing. In August 2023, Spiroflow, a key Automated Handling Solutions (AHS) company, introduced a next-generation twin-line bulk bag filling system. The auto-release hook and roller conveyor combine to simplify the filling process. Full bulk bags are transferred from the filler onto the conveyors smoothly and automatically. Also, automation reduces the amount of manual intervention.

- As environmental concerns increase, sustainability is now a top priority for businesses and consumers. FIBC producers and marketers are responding to the increasing demand for sustainable packaging solutions. For instance, in January 2024, Vaal Bulk Bags, a producer and supplier of cost-effective bulk bags, unveiled its focus on commitments to innovative packaging solutions with sustainability as the top priority. By focusing on environmental sustainability, the company's goal is to reduce the environmental impact of bulk packaging while preserving the quality and functionality of the products.

- Polyethylene (PE) and polypropylene (PPE) are two of the main raw materials used in most FIBCs and liners worldwide. However, raw material availability has been the most concerning issue both during and post-pandemic periods. Therefore, with disruptive market conditions (high demand, low supply), the FIBC industry witnessed a price rise. FIBC prices have witnessed significant price increases in the past few years that are being passed onto consumers.

- Further, the growth of varied industries involved in international trade is escalating the demand for FIBC or flexible bulk bags. According to the United Nations Conference on Trade and Development's (UNCTAD) most recent Global Trade Update, released on 21 June 2023, after a decline in the latter half of 2022, global merchandise trade bounced back in terms of both volume and value in early 2023. Such a rise in international trade is expected to bolster the demand for FIBC to transport goods across the world.

FIBC Market Trends

Increasing Demand from the Chemical and Petrochemical Segment

- Due to their high strength and chemical resistance, FIBC bags are essential in safely storing and transporting chemical and petrochemical materials. FIBCs are used for packaging and transporting dangerous substances such as powder, granules, and flammable materials. FIBC bags for this industry are often equipped with anti-static features and liners to avoid product contamination.

- Made from the finest polypropylene resin, FIBC bulk bags are impervious to virtually any chemical, water, contaminant, fire, or explosion. FIBC bulk bags carry various acids and bases, including sulfuric acid, sodium hydroxide, ammonia water, and bleach. Several companies across the world provide FIBC with robust capacity. For instance, FIBC jumbo bulk bags at Palmetto Industries can hold up to 4,000 pounds of several kinds of chemicals.

- Further, globalization and improved transportation networks drive cross-border trade of chemicals and petrochemicals, which drives the market. In addition, businesses are taking advantage of cross-border trade opportunities to expand their reach, diversify their revenue sources, and optimize their supply chains.

- According to the American Chemistry Council, the chemical manufacturing sector in the United States was projected to register a CAGR of 4.3% in 2022, recovering from a decrease in production in 2020 owing to the pandemic. In 2023, the sector was expected to grow by 2.1%. Such growth in chemical production is expected to widen in the upcoming years, consequently pushing down the demand for chemical packaging.

- The chemical packaging market focuses on producing and distributing packaging solutions specifically designed for storing and transporting large volumes of chemicals. These packaging solutions are designed to meet the highest safety and regulatory requirements, guaranteeing the chemical's integrity and stability throughout its life cycle. For example, UN FIBC bags are specially designed and tested for the safe transportation of hazardous materials, as they meet the UN's performance packaging standards. These FIBCs are specially designed and tested for the safe transportation of hazardous materials, as they meet the UN's performance packaging standards.

Asia-Pacific is Expected to Witness Robust Growth

- The FIBC market is expected to reach a high level in the next few years due to increasing demand from Asia and the rest of the global market. In Asia-Pacific, China is expected to hold the largest market share in intermediate bulk packaging. The growing Chinese food and beverages market is expected to contribute positively to the growth of the Asia-Pacific medium bulk liner market in the coming years.

- China is one of the world's largest economies and one of the largest trading countries in terms of the sum of its exports and imports. The country is known as the world's factory, and its export trade for manufactured goods is again rebounding after a sudden stagnation for a brief period. With the continued growth in the export trade, the market is expected to witness robust demand for bulk and sturdy intermediate flexible bags.

- China's exports rebounded slightly in November 2023, ending a six-month streak of decline and recovering the world's second-largest economy, according to official data published in the General Administration of Customs article in December 2023. Year-on-year exports rose by 0.5% in November. Further, as per the report published by China Customs in January 2024, the country's export value increased in the past few years, reaching around USD 3380.02 billion in 2023, up from USD 2,263.35 billion in 2017. Therefore, this consistent growth in export trade across the country would be attributed to the constant demand for industrial products as the key secondary packaging products for the export trade.

- As India's exports continue to grow, especially in the areas of food processing, pharmaceuticals, and chemicals, custom bulk packaging solutions are becoming increasingly important for Indian manufacturers. According to the India Brand Equity Foundation, the value of Indian pharmaceutical exports from India increased from USD 19.1 billion in 2019 to USD 25.4 Billion in 2023. This rising export trend is expected to have created a bolstered demand for bulk FIBC across the market.

- Governments are encouraging the use of recyclable materials for packaging in India, which is something that FIBCs can help with. There is an increasing demand for customized storage and transportation solutions for various industries, and the lack of skilled labor means that more and more FIBCs are being used due to their ease of handling and cost-effectiveness.

- According to the President of the Indian Flexible Intermediate Bulk Container Association (IFIBCA), since the inception of FIBCA, the country produced around 10,000 tons of FIBCs per year. At present, it produces 400,000 tons per year. India is one of the largest exporters of FIBCs in the world, including Europe, and the United States is one of the largest importers. The growth in production is expected to increase between 2024 and 2029 with the rising demand across the global market.

FIBC Industry Overview

The FIBC market is fragmented as it currently consists of many players. Several key players in the market are constantly making efforts to bring advancements. A few prominent companies are entering into collaborations and expanding their global footprints in developing regions to consolidate their positions in the market. The major market players are Greif Inc., United Bags Inc., Berry Global Group Inc., Rishi FIBC Solutions Pvt Ltd, and J&HM Dickson Ltd.

- In May 2023, FlexSack launched its new polypropylene sustainable, flexible intermediate bulk containers (FIBCs) containing 30% recycled PP (rPP). FlexSack-eco 2023 with 30% (PCR) is a sustainable alternative to the traditional polyethylene bag. The latest development in woven bags has evolved from a combination of polyethylene bags sewn with nylon thread to 100% recycled polypropylene bags.

- In August 2023, Australia-based family-owned business Sadleirs Packaging introduced a 100% polypropylene FIBC with 30% recyclable content for the first time in the country. As per the company's sales manager, almost all FIBC configurations can be migrated to the new FIBC Green Bag, and the clients in the Mining, Manufacturing, Construction, Chemicals, Dairy, and other food processing sectors are eager to trial and migrate.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Flexible Plastic Packaging Solutions across End-user Industries

- 5.1.2 Growing Utilization of Distribution Channels such as Convenience Stores and E-commerce

- 5.2 Market Restraints

- 5.2.1 Increasing Price Volatility of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Type A

- 6.1.2 Type B

- 6.1.3 Type C

- 6.1.4 Type D

- 6.2 By Design Type

- 6.2.1 U-Panel Bags

- 6.2.2 Baffle Bags

- 6.2.3 Circular Bags

- 6.2.4 4-Side Panel Bags

- 6.2.5 Other Design Types

- 6.3 By End-user Industry

- 6.3.1 Food and Agricultural Products

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Pharmaceutical

- 6.3.4 Other End-user Industries

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Greif Inc.

- 7.1.2 United Bags Inc.

- 7.1.3 J&HM Dickson Ltd

- 7.1.4 Berry Global Group Inc.

- 7.1.5 Thrace Group

- 7.1.6 Rishi FIBC Solutions Pvt Ltd

- 7.1.7 Bulk Lift International LLC

- 7.1.8 BAG Supplies Canada Ltd

- 7.1.9 Plastipak Group

- 7.1.10 Bulk Pack Exports Ltd

- 7.1.11 Southern Packaging LP