|

市場調查報告書

商品編碼

1521791

電子資料擷取系統:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Electronic Data Capture Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

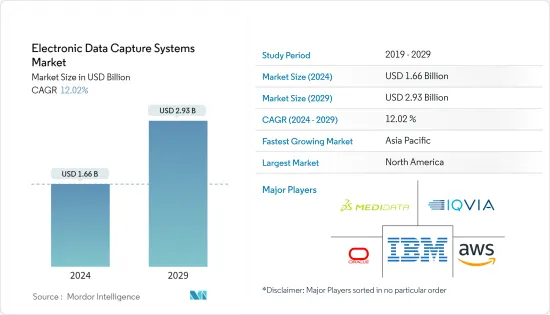

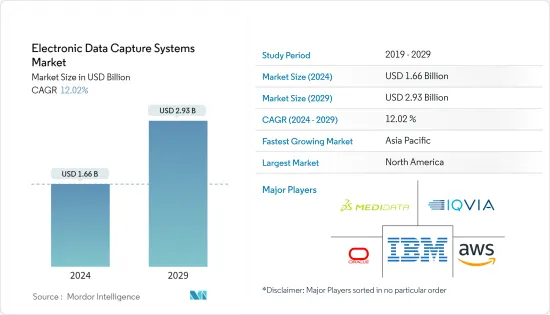

電子資料擷取系統市場規模預計到2024年為16.6億美元,預計到2029年將達到29.3億美元,在預測期內(2024-2029年)複合年成長率預計為12.02%。

分散臨床試驗的增加可能有助於 EDC 系統在醫學研究中獲得關注。根據 2023 年 4 月發表的一篇論文,大約 68% 的臨床試驗在大流行期間暫停,這導致虛擬和混合試驗模型的採用激增。 EDC 系統在分散式臨床試驗中發揮關鍵作用,因為適當的資料管理至關重要。臨床試驗服務公司正在透過合作和收購來擴大其產品範圍。例如,2023 年 7 月,Signant Health 宣布收購 DSG,該公司為分散式和基於現場的臨床試驗提供了一套直接資料資料技術的電子臨床套件。此次收購使該公司能夠為任何規模或類型的臨床試驗提供全面的數位解決方案。因此,新的市場進入者可能會加速現有的競爭力和效率。

美國FDA 等監管機構已向使用 EDC 系統記錄臨床試驗資料的最終用戶提出了建議。根據臨床實驗試驗方案,臨床試驗贊助者必須提供系統的詳細描述以及有關系統管理、系統使用人員培訓和存取控制的資訊。監管干預使公司能夠進行徹底的品質檢查並提供安全保障措施來保護資料,從而最大限度地降低產品缺陷的風險。因此,監管合規性和建議鼓勵最終用戶使用 EDC 系統,從而促進整體市場成長。

然而,系統許可和託管的高昂成本預計將阻礙市場成長。此外,新興經濟體的網路基礎設施不發達,這限制了最終用戶使用這些系統。

電子資料擷取系統市場趨勢

預計網路和雲端基礎市場將在預測期內佔據主要市場佔有率

預計雲端基礎的細分市場將在預測期內佔據重要的市場佔有率。雲端基礎的系統是集中式資料庫,允許專業人員將雲端資料庫客製化為本地或特定區域,以遵守本地資料共用法規。這些優勢使得研究人員更喜歡雲端基礎的方法。

資源有限地區的參與者正在與 Amazon Web Services (AWS) 和Oracle等雲端供應商合作。例如,總部位於德國的健康科技公司 Climedo Health 使用 AWS 為醫院、製藥公司、醫療設備製造商和 150 個公共衛生中心開發基於雲端基礎的可擴展電子資料擷取系統。該公司還於 2022 年 2 月籌集了 570 萬美元,以加強其在歐洲電子資料擷取系統市場的地位並擴大其在美國的業務。雲端基礎的解決方案使公司能夠更輕鬆地進行地理擴張,而不會產生額外的產品開發成本。

市場參與者的活動,例如合作、發布和核准擴大電子資料擷取系統的供應,預計將在預測期內推動該行業的成長。 2022年10月, 資料宣布與勃林格殷格翰續簽五年合作關係。根據協議, 資料將在全球提供Rave EDC系統,用於勃林格殷格翰的臨床試驗。

因此,資料的自由流動加上增強的資料保護通訊協定預計將提高網路和基於雲端基礎的電子資料擷取系統的採用率,從而導致該領域的成長。

預計北美將在預測期內佔據主要市場佔有率

預計北美在預測期內將佔據很大的市場佔有率。這是由於增加市場佔有率的策略性舉措的增加以及該地區臨床試驗數量的增加等因素所造成的。

北美在產品開發中採用數位化和實驗研究的比例很高。例如,2023 年 7 月,Astra Zeneca、IgniteData 和倫敦大學學院醫院 NHS 基金會信託基金 (UCLH) 共同評估了臨床試驗環境中從電子健康記錄(EHR) 到電子資料收集 (EDC) 的資料傳輸。此次合作的目標之一是擴大 EHR 到 EDC 技術在多個領域的使用。此外,該地區的新興企業發現資金籌措比其他地區相對容易。例如,2022 年 11 月,美國臨床試驗軟體供應商 YonaLink 宣布提供 600 萬美元資金籌措,用於擴展其 EHR 到 EDC 整合平台並提高 CRO 的採用率。透過資金籌措和研究合作帶來的投資預計將在預測期內推動該地區的市場成長。

醫療保健參與企業積極參與擴大 EDC 系統在該地區的使用也被認為是市場成長的關鍵決定因素。例如,根據國家醫學圖書館 2022 年 6 月發表的一篇論文,Discovery 重症監護研究網路復原力和應急準備計劃 (Discovery PREP) 可以解決美國緊急情況下多中心資料收集的挑戰。工具。本研究得出的結論是,EDC 工具對於季節性流感治療通訊協定的多中心資料收集和評估是可行的。此類研究將促進EDC在各種應用中的使用並擴大市場範圍。

因此,由於上述各參與者透過產品開發和市場開拓增加投資等因素,預計北美電子資料擷取系統市場在預測期內將保持其主導地位。

電子資料擷取系統產業概述

電子資料擷取系統市場是半穩固的,有多個大型參與者。這些大公司大多擁有全球業務,並積極參與收購和合作等策略性舉措。由於分散臨床試驗項目的增加,市場迅速擴大,新興國家正成為主要的競爭熱點。市場參與企業包括 Calyx、Castor、OpenClinica, LLC、Oracle、IQVIA Inc.、Medidata Solutions Inc.、IBM、Amazon Web Services Inc.、Veeva Systems 和 Wemedoo。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 臨床試驗分散化的進展

- 臨床試驗期間資料的複雜性

- 市場限制因素

- 實施成本高

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模-金額)

- 按規定形式

- 雲端基礎

- 本地

- 按發展階段分

- 第一階段

- 第二階段

- 第二階段

- 第四階段

- 按最終用戶

- 製藥和生物技術公司

- 醫院提供者

- 合約研究組織

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- GCC

- 南非

- 其他中東和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 公司簡介

- Calyx

- Castor

- OpenClinica LLC

- Oracle

- IQVIA Inc

- Medidata Solutions Inc.

- IBM

- Amazon Web Services Inc.

- Veeva Systems

- Wemedoo

第7章 市場機會及未來趨勢

The Electronic Data Capture Systems Market size is estimated at USD 1.66 billion in 2024, and is expected to reach USD 2.93 billion by 2029, growing at a CAGR of 12.02% during the forecast period (2024-2029).

An increase in decentralized clinical trials will likely assist EDC systems in gaining momentum in medical research. According to an article published in April 2023, the disruption of around 68% of clinical trials during the pandemic caused the surge in the adoption of virtual and hybrid trial models. Good data management is crucial in decentralized trials; therefore, the EDC system plays a vital role. Companies in clinical trial services are expanding their offerings through collaboration and acquisitions. For instance, in July 2023, Signant Health announced the acquisition of DSG, a direct data capture and electronic data capture technology provider in the eClinical suite for decentralized and site-based clinical trials. This acquisition enabled the company to offer comprehensive digital solutions to any size and type of clinical trial. Thus, new entrants in the market are likely to accelerate the existing competitiveness and efficiency.

Regulatory bodies, such as the US FDA, offer recommendations to end users who employ the EDC system to record data in clinical investigations. As per the clinical investigation protocol, the sponsor must provide an in-detailed description of the system and information on system management, staff training on the use of the system, and access control. The regulatory intervention minimizes the risk of product failure as companies ensure thorough quality checks and offer security safeguards in order to protect the data. Hence, regulatory compliance and recommendations encourage the use of EDC systems among end users, boosting overall market growth.

However, the high cost of licensing and hosting the system is anticipated to hamper market growth. Additionally, under-developed cyberinfrastructure in emerging economies restrains end users from utilizing the system.

Electronic Data Capture Systems Market Trends

The Web and Cloud-Based Segment is Expected to Hold a Significant Market Share Over the Forecast Period

The web and cloud-based segment is estimated to have a substantial market share during the forecast period. A cloud-based system is a centralized database that enables professionals to tailor the cloud database to the region or local specific to adhere to local data sharing regulations. Such advantages increase the preference for the web and cloud-based approach amongst researchers.

Regional players with limited resources collaborate with cloud providers, including Amazon Web Services (AWS) and Oracle. For instance, Climedo Health, a Germany-based health tech company, uses AWS to develop cloud-based and scalable electronic data capture systems for hospitals, pharmaceutical companies, medical device manufacturers, and 150 public health offices. The company also raised USD 5.7 million in February 2022 in order to strengthen its position in the European electronic data capture system market and expand its presence in the United States. Cloud-based solutions ease regional expansion for companies without incurring extra costs for product development.

The activities of market players, such as partnerships, launches, and approvals, to expand their electronic data capture system offerings are expected to boost the segment's growth over the forecast period. In October 2022, Medidata announced the renewal of the partnership with Boehringer Ingelheim for five years. Under this agreement, Medidata is expected to offer its Rave EDC system for Boehringer Ingelheim's clinical trials globally.

Hence, the free flow of data, coupled with strengthening the protocols for data protection, is likely to increase the adoption rate of web and cloud-based electronic data capture systems, resulting in the growth of the segment.

North America is Expected to Hold a Significant Market Share Over the Forecast Period

North America is anticipated to hold a substantial market share during the forecast period. This can be attributed to factors such as increasing strategic initiatives to enhance the market presence and the growing number of clinical trials in the region.

North America has a high adoption rate of digitalization and experimental studies in product development. For instance, in July 2023, AstraZeneca, IgniteData, and University College London Hospitals NHS Foundation Trust (UCLH) collaborated to evaluate data transfer from Electronic Health Records (EHR) to Electronic Data Capture (EDC) in a clinical trial setting. One of the purposes of this collaboration was to expand the usage of EHR-to-EDC technology across multiple domains. Additionally, funding accessibility for emerging players in the region is relatively easier than in other regions. For instance, in November 2022, YonaLink, a US clinical trial software provider, announced that it would raise USD 6 million in funding to expand its integration platform of EHR-to-EDC and increase its adoption rate amongst the CROs. The inflow of investments through funding and collaborative studies is expected to propel market growth in the region during the forecast period.

The active participation of healthcare professionals in scaling up the use of EDC systems in the region is also considered an important growth determinant of the market. For instance, in June 2022, an article published in the National Library of Medicine stated that the Discovery Critical Care Research Network Program for Resilience and Emergency Preparedness (Discovery PREP) collaborated with technology vendors to develop an EDC tool that can address multisite data collection challenges during the emergencies in the United States. The study concluded that the EDC tool is feasible for collecting multisite data and assessing treatment protocols for seasonal influenza. Such studies boost the use of EDC in various applications and enlarge the market scope.

Therefore, owing to the above-mentioned factors, such as the players' growing investments via product development and market expansion, the North American electronic data capture systems market is expected to maintain its dominant position during the forecast period.

Electronic Data Capture Systems Industry Overview

The electronic data capture systems market is semi-consolidated with several major players. Most of these major players enjoy a global presence and indulge in strategic initiatives such as acquisitions and collaborations. Emerging countries are becoming hotspots for significant competition due to the rapidly expanding market fueled by growing decentralized clinical trial programs. Some of the market players include Calyx, Castor, OpenClinica, LLC, Oracle, IQVIA Inc., Medidata Solutions Inc., IBM, Amazon Web Services Inc., Veeva Systems, and Wemedoo.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Decentralized Clinical Trials

- 4.2.2 Increasing Complexity of Data during the Clinical Study

- 4.3 Market Restraints

- 4.3.1 High Implementation Cost

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Delivery Mode

- 5.1.1 Web and Cloud-based

- 5.1.2 On-Premise

- 5.2 By Development Stage

- 5.2.1 Phase l

- 5.2.2 Phase ll

- 5.2.3 Phase lll

- 5.2.4 Phase lV

- 5.3 By End User

- 5.3.1 Pharmaceutical and Biotechnology Firms

- 5.3.2 Hospitals Providers

- 5.3.3 Contract Research Organisations

- 5.3.4 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Calyx

- 6.1.2 Castor

- 6.1.3 OpenClinica LLC

- 6.1.4 Oracle

- 6.1.5 IQVIA Inc

- 6.1.6 Medidata Solutions Inc.

- 6.1.7 IBM

- 6.1.8 Amazon Web Services Inc.

- 6.1.9 Veeva Systems

- 6.1.10 Wemedoo