|

市場調查報告書

商品編碼

1521827

NFC晶片:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)NFC Chips - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

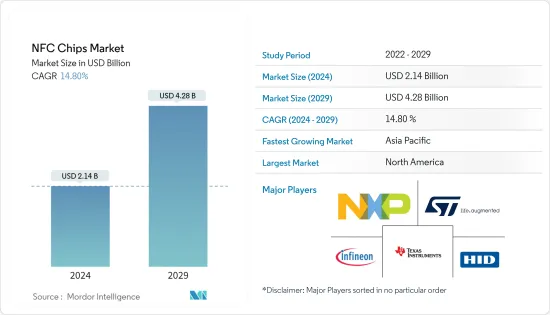

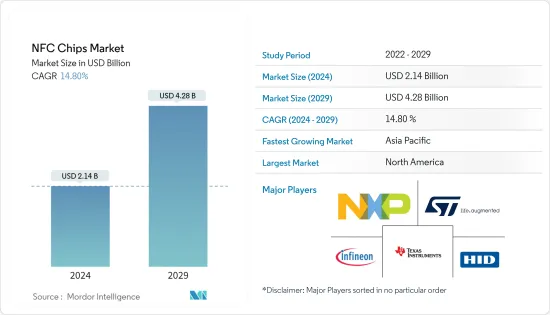

NFC晶片市場規模預計到2024年為21.4億美元,預計到2029年將達到42.8億美元,在預測期內(2024-2029年)複合年成長率為14.80%。

主要亮點

- NFC 晶片產生短程無線電訊號,用於傳輸敏感的金融和身份驗證資料。由於其便利性和偏好,非接觸式付款正在獲得大力支持。因此,各種穿戴式裝置製造商都將 NFC 晶片作為其大多數設備的標準配置,透過消除對實體錢包的需求來提供更大的便利性。

- 此外,技術進步預計將塑造 NFC 晶片市場的未來。市場開拓廠商正致力於開發具有安全、高效的生物識別功能的晶片,以提高非接觸式付款的普及率。隨著多家銀行使用 NFC 卡以及許多商家接受 NFC 卡支付,對 NFC 晶片的需求不斷增加。

- 由於研發工作量大以及透過嵌入式設備分析資料的複雜性,NFC 晶片開發的初始投資很高。維護和資料相關成本對於維護資料安全(例如加密和解密)也至關重要。

- 2023 年 6 月,近場通訊(NFC) 技術標準機構 NFC 論壇發布了技術藍圖,概述了到 2028 年的關鍵計畫和研究工作。在其創新重點中,NFC 論壇正在考慮將工作距離 (5mm) 擴大到 4 至 6 倍的範圍。論壇表示,範圍的略微擴大將使非接觸式交易和操作變得更容易、更快捷。

- 2023 年 6 月,國營肯亞商業銀行 (KCB)、Visa 和泰雷茲在肯亞推出近場通訊(NFC)付款。 KCB 的非接觸式付款透過 Garmin 穿戴式裝置和 Android 智慧型手機實現。 NFC 技術支援使用行動錢包(例如 Google Pay、Apple Pay 和非接觸感應卡)進行非接觸式付款。預計這些新興市場的開拓將在預測期內推動市場發展。

- 俄羅斯和烏克蘭之間的衝突對該行業產生了重大影響。這場衝突加劇了已經影響該行業的半導體供應鏈問題和晶片短缺。此次中斷導致鎳、鈀、銅、鈦、鋁和鐵礦石等關鍵原料價格波動,導致材料短缺。各種NFC晶片的生產因此受到影響。

- 此外,根據UkraineInvest的數據,2022年3月初銅價飆升至10,845美元/噸。俄烏戰爭、能源成本飆升以及歐洲更嚴格的排放標準被指出是銅持續短缺的主要原因。

NFC晶片市場趨勢

消費性電子佔很大佔有率

- 物聯網在智慧消費應用中不斷發展,預計將變得更加可自訂,為用戶提供更多控制並增強其家用電器的功能。近年來,受疫情後經濟繁榮影響,智慧型手機銷售量大幅成長,整體市場蓬勃發展。大多數大公司正在轉向混合或混合工作模式,這正在推動全球市場擴張。

- 隨著物聯網的不斷發展,透過網路連線越來越容易獲得更智慧的家用電器和設備。最新型號的智慧冰箱配備了NFC晶片,以改善客戶體驗。

- 根據GSMA預測,全球智慧型手機普及率將從2022年的68%增加到2023年的69%。幾乎所有智慧型手機和智慧型手錶都配備了 NFC 晶片。使用數位錢包進行非接觸式付款的使用不斷增加,推動了智慧型手機中 NFC 晶片的需求。 Google Pay 和 Apple Pay 率先在智慧型手機上採用 NFC 功能。

- 美國和加拿大的智慧型手機製造商正在為所有新行動電話配備 NFC 並允許應用程式與所有可用的 M-付款解決方案配合使用,使行動付款技術變得更加容易。

- 中國和日本是電視、洗衣機、智慧型手機、冰箱、投影機、相機、耳機和印表機等智慧家電的主要投資者,已廣泛部署 NFC,以實現輕鬆的非接觸式操作。例如,LG 洗衣機的某些型號帶有 LG NFC 標籤標誌,可與智慧型手機連接。

- 2023年5月,消費性電子製造商美的集團在巴西普索阿雷格里開始興建新廠。工廠總面積73,000平方公尺,年產產品130萬件。新工廠的建設對於美的集團全球業務的拓展至關重要,也將為市場帶來機會。

亞太地區正在經歷顯著成長

- 亞太地區 NFC 晶片市場主要由支援數位交易的政府計劃以及私營企業擴大採用 NFC 技術推動。例如,Nike在中國生產了超過 13 萬雙鞋,每雙鞋都配備了 NFC 晶片,可將其連接到數位雙胞胎。

- 此外,行動付款交易的成長,加上政府和私人公司越來越多舉措採用生物識別系統,預計將推動該國生物辨識市場的發展。

- 印度市場正在迅速發展,以滿足數位付款文化的需求,電子商務文化的興起導致數位錢包的興起。為了滿足日益成長的數位付款需求並確保交易安全,印度儲備銀行支援在該國的 UPI Lite 數位錢包中添加 NFC付款功能。

- 2023 年 9 月,印度國家付款公司 (NPCI) 宣布了四項新的 UPI 功能。憑藉這些產品,UPI 預計每月交易量將達到 1,000 億筆,而不是 300 億筆。

- 多家銀行正在發行非接觸式簽帳金融卡和信用卡,無需行動應用程式即可進行 NFC付款。用戶可以透過在非接觸式付款終端上刷卡來完成交易。隨著科技的發展,銀行也在改善其服務。 NFC付款中將添加指紋掃描等生物識別,以增強安全性並簡化使用者體驗。

- 近年來,韓國行動付款系統的採用迅速增加,許多消費者選擇非接觸式付款而不是傳統信用卡。蘋果最近在韓國推出了 Apple Pay,這標誌著在這個以接觸式付款基礎設施為主的國家,向非接觸式付款發生了巨大轉變。這些因素預計將增加該地區對 NFC 晶片的需求。

NFC晶片產業概況

NFC 晶片市場較為分散,由多家廠商組成,如 NXP Semiconductors、Infineon Technologies、HID World、 德克薩斯 Instruments Incorporated 和 Toshiba Electronic Devices & Storage Corporation。這些公司尋求透過推出新產品、擴大業務、策略併購、聯盟和合作來提高市場佔有率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19副作用和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 擴大非接觸式付款和身分驗證的接受度

- 家電領域對NFC晶片的需求增加

- 市場挑戰

- NFC晶片成本增加

- 輕鬆獲得藍牙等替代方案

第6章 市場細分

- 依產品

- 無補貼

- 輔助的

- 按終端設備

- 智慧型手機

- 電腦/其他家用電器

- 醫療設備

- 其他終端設備

- 按行業分類

- 消費性電子產品

- BFSI

- 資訊科技/通訊

- 零售

- 衛生保健

- 接待和交通

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- NXP Semiconductors NV

- STMicroelectronics NV

- Infineon Technologies AG

- HID Global

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

- Marvell Technology Group Ltd

- Qualcomm Technologies Inc.

- Renesas Electronics Corporation

- Zebra Technologies Corporation

第8章投資分析

第9章市場的未來

The NFC Chips Market size is estimated at USD 2.14 billion in 2024, and is expected to reach USD 4.28 billion by 2029, growing at a CAGR of 14.80% during the forecast period (2024-2029).

Key Highlights

- NFC chips produce a short-range radio signal and are used for sensitive financial and authentication data transmission. Due to their convenience and preference, contactless payments are gaining significant traction. As a result, various wearable device manufacturers are incorporating NFC chips as a standard into most devices to provide greater convenience by removing the need for physical wallets.

- Moreover, technological advancements are expected to shape the future of the NFC chip market. Market vendors are focusing on developing chips with secure and efficient biometrics, increasing the penetration of contactless payments. There is a growing demand for NFC chips as several banks are using NFC cards, and many merchants are accepting NFC cards for payments.

- The initial investments for NFC chip development have been high, owing to R&D activities and complications related to data analysis through an embedded device. The costs associated with maintenance and data are also critical for data security, such as encryption and decryption, which should be maintained.

- In June 2023, the NFC Forum, the standards body for near-field communication (NFC) technology, unveiled its Technology Roadmap outlining critical plans and research efforts through 2028. Among its innovation priorities, the NFC Forum is examining ranges four to six times the current operating distance (5 mm). According to the forum, a modest increase in range would make contactless transactions and actions more accessible and faster.

- In June 2023, the state-backed Kenyan Commercial Bank (KCB), Visa, and Thales launched near-field communication (NFC) payments in Kenya. KCB contactless payments are facilitated through Garmin wearables and Android smartphones. NFC technology enables contactless payments via mobile wallets like Google Pay, Apple Pay, and contactless cards. These developments are expected to drive the market during the forecast period.

- The conflict between Russia and Ukraine significantly impacted this industry. The conflict exacerbated semiconductor supply chain issues and chip shortages that had affected the industry for some time. The disruption resulted in volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, aluminum, and iron ore, resulting in material shortages. This, in turn, impacted the manufacturing of various NFC chips.

- Further, according to UkraineInvest, copper prices escalated to USD 10,845/mt in early March 2022. The Russia-Ukraine War, high energy costs, and stricter emissions standards in Europe have been noted as the primary reasons for the continued shortage of copper.

NFC Chips Market Trends

Consumer Electronics to Hold Significant Market Share

- The Internet of Things has been growing across smart consumer applications, and it is expected to become more customizable to give users more control and enhance appliance operating functions. Smartphone sales have increased significantly in the past few years, owing to the post-pandemic economic boom that has allowed the overall market to pick up the pace. Most major corporations are moving forward with complex or hybrid work models, which is assisting market expansion globally.

- As IoT continues to grow, smarter home appliances and devices are becoming readily available through internet connectivity. The latest models of smart fridges have NFC chips to enhance their customer experience.

- According to GSMA, the global smartphone penetration rate was 69% in 2023, up from 68% in 2022. Nearly all smartphones and smartwatches are equipped with NFC chips. The increasing use of contactless pay using digital wallets has increased the demand for NFC chips in smartphones. Google Pay and Apple Pay were the initial adopters of the NFC feature on smartphones.

- Smartphone manufacturers across the United States and Canada are making it easier to access mobile payment technology by including it in all new mobile phones and making the applications work across all available m-payment solutions.

- China and Japan, the major investors in smart consumer appliances such as televisions, washing machines, smartphones, fridges, projectors, cameras, headsets, and printers, extensively deploy NFC for easy and contactless operations. For instance, LG washing machines have an LG NFC Tag On Logo in several models, which allows them to be connected to a smartphone.

- In May 2023, appliance company Midea Group began construction work on its new factory in Pouso Alegre, Brazil. The plant will have a total area of 73,000 sq. m and produce 1.3 million products annually. This initiative of the new plant forms an integral part of the global expansion of Midea Group, which will create opportunities for the market.

Asia-Pacific to Witness Significant Growth

- The NFC chips market in the region is majorly driven by government programs supporting digital transactions and private players' rising adoption of NFC technology. For instance, Nike has produced over 130,000 pairs of shoes in China containing an NFC chip that connects each product to a digital twin that can be used to trace its provenance and authenticate the product.

- Further, increasing mobile payment transactions coupled with growing government and private corporation's initiatives towards adopting biometric authentication systems are expected to drive the biometric market in the country.

- The Indian market is rapidly evolving to meet the demands of the digital payment culture, and an increase in e-commerce culture is leading to a rise in digital wallets. To meet the increasing demand for digital payments and to secure transactions, The Reserve Bank of India supports adding NFC payments to the country's UPI Lite digital wallet.

- In September 2023, the National Payments Corporation of India (NPCI) launched four new UPI features. These products are expected to help UPI clock 100 billion transactions in a month instead of the previously set 30 billion transactions.

- Several banks are issuing contactless debit and credit cards that can be used for NFC payments without needing a mobile app. Users can tap their cards on contactless payment terminals to complete transactions. As technology evolves, banks are improving their services. Biometrics, such as fingerprint scanning, are added to NFC payments, enhancing security and streamlining the user experience.

- South Korea has seen a surge in the adoption of mobile payment systems in the past few years, with many consumers opting for contactless payment options over traditional credit cards. Apple recently launched Apple Pay in South Korea, signaling a seismic shift to contactless payment in the country's primarily contact-based payment infrastructure. These factors are expected to increase the demand for NFC chips in the region.

NFC Chips Industry Overview

The NFC chips market is fragmented and consists of several players like NXP Semiconductors, Infineon Technologies, HID Global, Texas Instruments Incorporated, and Toshiba Electronic Devices & Storage Corporation. These companies continuously try to increase their market presence by introducing new products, expanding their operations, or entering into strategic mergers and acquisitions, partnerships, and collaborations.

- September 2023: Zebra Technologies Corporation launched Zebra Pay to enable businesses to accept payment from all major credit card brands and payment technologies, including NFC-contactless chip, tap, and magnetic stripe for the hospitality, retail, field mobility, entertainment, and logistics industries.

- March 2023: NXP Semiconductors launched a chip PN7642 that integrates a microcontroller, an NFC front end, and security into a single IC. The PN7642 enables internal key storage and hardware crypto processing to accelerate the secure authentication in hardware.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Acceptance of Contactless Payments and Authentication

- 5.1.2 Rising Demand for NFC Chips in Consumer Electronics

- 5.2 Market Challenges

- 5.2.1 Higher Cost of NFC Chips

- 5.2.2 Easy Availability of Substitutes Such as Bluetooth

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Non-auxiliary

- 6.1.2 Auxiliary

- 6.2 By End Device

- 6.2.1 Smartphone

- 6.2.2 PCs and Other Consumer Electronics

- 6.2.3 Medical Equipment

- 6.2.4 Other End Devices

- 6.3 By End-user Vertical

- 6.3.1 Consumer Electronics

- 6.3.2 BFSI

- 6.3.3 IT and Telecommunications

- 6.3.4 Retail

- 6.3.5 Healthcare

- 6.3.6 Hospitality and Transportation

- 6.3.7 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 NXP Semiconductors NV

- 7.1.2 STMicroelectronics NV

- 7.1.3 Infineon Technologies AG

- 7.1.4 HID Global

- 7.1.5 Texas Instruments Incorporated

- 7.1.6 Toshiba Electronic Devices & Storage Corporation

- 7.1.7 Marvell Technology Group Ltd

- 7.1.8 Qualcomm Technologies Inc.

- 7.1.9 Renesas Electronics Corporation

- 7.1.10 Zebra Technologies Corporation