|

市場調查報告書

商品編碼

1521881

商務用照明控制:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Commercial Lighting Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

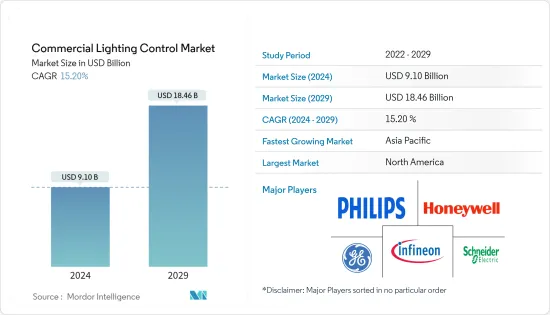

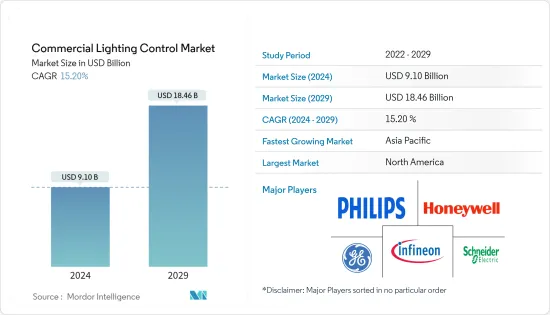

預計2024年商務用照明控制市場規模為91億美元,2029年將達到184.6億美元,預計在市場預測期間(2024-2029年)複合年成長率為15.20%。

*已開發國家經濟成長的加速、商業建築的擴張、人們對高效照明解決方案的認知不斷提高、促進LED採用的各種政府舉措等是推動所研究市場成長的關鍵因素。世界各地的許多政府都在透過性能標準、標籤和獎勵計劃迅速淘汰低效光源,其中包括十多年前就開始向 LED 過渡的歐洲。歐盟最近更新了單獨的法規,即《生態設計指令》和《有害物質限制指令》,計劃在 2023 年逐步淘汰幾乎所有螢光。

* 全球商業建設活動的活性化預計將為市場提供利潤豐厚的成長機會。根據中國國家統計局預測,2023年建築業將佔中國GDP的6.8%左右。房地產和基礎設施建設對國家經濟至關重要。在景氣衰退期間,政策制定者經常投資基礎設施以刺激經濟成長。

*新興國家的智慧基礎設施開發計劃不斷增加,例如新機場航站大樓、地下道路和高架鐵路。預計這將刺激商務用照明控制市場的需求。然而,購買和安裝智慧解決方案的高昂成本阻礙了市場成長。

*自然災害等供應鏈中斷和地緣政治緊張局勢等宏觀經濟因素會影響零件、原料和成品的可得性,包括 LED 驅動器、感測器、開關和調光器、繼電器裝置和閘道器,導致生產和交付延遲。阻礙市場成長。此外,農村和都市區基礎設施薄弱可能會阻礙照明控制的實施並限制市場成長機會。

商務用照明控制市場趨勢

硬體領域將經歷顯著成長

*連網型照明技術可額外節省。當使用者離開房間時,燈會自動關閉。當道路上沒有車輛或行人移動時,燈光會自動變暗。連結對於利用資料實現轉型也至關重要,例如:在預測期內,商務用照明控制的需求將會增加。這是因為能源效率是重中之重,而消費量、長壽命的LED照明技術在市場上佔據主導地位。

*此外,永續性促使客戶選擇環保照明解決方案,以減少碳排放並節省能源成本。符合人體工學的照明在辦公室中變得越來越重要。這種照明支持員工的晝夜節律,因為它模仿自然光條件。

*對先進照明控制系統不斷成長的需求正在推動供應商建立策略合作夥伴關係、推出新產品並在商務用照明控制市場中獲得競爭優勢。例如,2024 年 4 月,Acuity Brands Inc. 在其緊急照明中引入了 Connected STAR 和 STAR(自測試自動報告)系統。此更新透過提供新的部署方法來確保停電期間正確的緊急功能和照明,從而提高了大型計劃的法規遵循。

*隨著各邦政府、地方政府和體育機構對智慧照明系統的興趣日益濃厚,印度的連網型照明系統市場正在快速擴張。此外,根據Trading Economics的數據,2023年第四季印度建築業的價值預計將超過3.5兆印度盧比,與前幾年相比顯著成長。因此,印度商業建設活動的成長預計將增加對研究市場的需求。

*為商務用照明控制市場創造成長機會的其他因素包括感測器和無線技術的快速開拓,以及對智慧照明解決方案不斷成長的需求,以開拓街道照明和智慧城市的新興市場。

亞太地區實現顯著成長

*中國是最大的LED照明產品使用者、製造商和經銷商。該國也是世界上最大的建築市場。中國的「十四五」計畫強調交通、能源、水利系統和都市化等新型基礎建設計劃,進一步推動市場成長。

*隨著房地產投資信託的推出,印度的商業房地產市場已成為亞太地區組織最完善的市場之一。隨著房地產投資信託的推出,印度的商業房地產市場是亞太地區最發達的市場之一。印度製造等政府舉措以及房地產監管局 (RERA) 和商品及服務稅等改革極大地推動了該行業的發展。

*此外,建設局(BCA)預計新加坡2023年的建築總需求將在197.1億美元至233.6億美元之間。公共部門預計將佔建築總需求的約 60%。此外,在該地區開設的新工廠將採用各種功能來減少碳排放並實現碳中和。

*印度目前正在進行許多技術創新。印度製造宣傳活動的重點是增加國內產量並減少對外國產品的依賴。因此,LED產業設施的建設不斷增加,以適應國內LED生態系統的擴張。此外,2023年9月,Signify為其WiZ智慧照明系統推出了新穎的應用程式、功能和產品,以提高使用者的日常便利性。最新增加的功能包括 SpaceSense,這是一種用於照明系統的運動感應技術,無需安裝感測器。

商務用照明控制產業概況

商務用照明控制市場競爭激烈。商務用照明控制市場集中度高,參與企業規模各異。所有主要公司都佔有重要的市場佔有率,並致力於擴大其全球消費群。該市場的一些主要參與企業包括飛利浦照明公司、霍尼韋爾國際公司、通用電氣公司、英飛凌技術公司和施耐德電氣公司。在預測期內,一些公司正在透過結盟、合作夥伴關係、收購和推出創新新產品來增加市場佔有率,以獲得競爭優勢。

*2024 年 1 月,Cree LED 和 Current Lighting Solutions 同意授權 Current的KSF/PFS 紅色磷光體,用於採用 Pro9 技術的 Cree LED 產品。該合約涉及使用 KSF/PFS磷光體來提高 LED 組件的效率。此授權包括採用氟化矽鉀(KSF/PFS磷光體)的 Pro9(TM) 技術的 Cree LED 產品。這種磷光體用於提高 LED 組件的效率,特別是實現高 CRI(顯色指數)。

*2023 年 9 月,Advanced Lighting Technologies 宣布收購室內外 LED 照明市場領導者與創新者 Cree Lighting。此次收購標誌著我們雄心勃勃的成長策略邁出了新的一步,我們的目標是提高我們在 LED 產品市場的地位。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 對連網型照明解決方案的需求不斷成長支持市場成長

- 加大基礎建設投入

- 市場限制因素

- 初始實施成本高

第6章 市場細分

- 按類型

- 硬體

- LED驅動器

- 感應器

- 開關和調光器

- 繼電器單元

- 閘道

- 軟體

- 硬體

- 按通訊協定

- 有線

- 無線的

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 中東/非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- Philips Lighting NV

- Honeywell International Inc.

- General Electric Company

- Infineon Technologies

- Schneider Electric

- Acuity Brands Inc.

- Cree Inc.

- Lutron Electronics Co. Inc.

- Leviton Manufacturing Company Inc.

- WAGO Corporation

- Eaton Corporation

第8章投資分析

第9章市場的未來

The Commercial Lighting Control Market size is estimated at USD 9.10 billion in 2024, and is expected to reach USD 18.46 billion by 2029, growing at a CAGR of 15.20% during the forecast period (2024-2029).

* The growing economic growth of the developed countries, expansion of commercial buildings, rising awareness toward efficient lighting solutions, various government initiatives to promote LED adoption, etc., are the key factors driving the growth of the studied market. Many governments globally are rapidly phasing out inefficient light sources through performance standards, labeling, and incentive programs, including in Europe, where the transition to LEDs began over a decade ago. The European Union recently updated its regulations under the Ecodesign Directive and the Restriction of Hazardous Substances Directive to phase out virtually all fluorescent lighting in 2023.

* Rising commercial construction activities worldwide will create lucrative growth opportunities for the market. According to the National Bureau of Statistics of China, in 2023, the construction sector made up approximately 6.8% of China's GDP. Real estate and infrastructure construction are vital to the country's economy. During economic downturns, policymakers often invest in infrastructure to stimulate economic growth.

* Development projects involving smart infrastructures, such as new airport terminals, underground roads, and elevated railways, are rising in the countries. This is expected to spur the demand for the commercial lighting control market. However, the high cost of purchasing and installing smart solutions is hindering the market's growth.

* Macroeconomic factors, such as supply chain disruptions, such as natural disasters, and geopolitical tensions, can impact the availability of components, raw materials, and finished products, leading to delays in the production and delivery of LED drivers, sensors, Switches and Dimmers, Relay Units, and Gateways, thus hindering the market growth. Moreover, inadequate infrastructure development in rural and urban areas can hamper the adoption of lighting control, limiting market growth opportunities.

Commercial Lighting Control Market Trends

Hardware Segment to Witness a Significant Growth

* Connected lighting technology allows for even more savings. The light will automatically turn off when the user leaves the room. The lights will automatically dim when there is no vehicle or pedestrian movement on the road. Connectivity is also essential when leveraging data to enable the following transformation: data-driven services. The demand for commercial light control will increase over the forecast period, as it offers energy efficiency, which is a top priority, with LED lighting technology dominating the market due to its low energy consumption and longer lifespan.

* Additionally, sustainability drives customers to choose environmentally friendly lighting solutions that reduce their carbon footprint and save on energy costs. Human-focused lighting is becoming increasingly important in offices as people become more aware of its impact on their health and well-being. These lights support employees' circadian rhythms because they mimic natural light conditions.

* The growing demand for advanced lighting control systems also encourages vendors to form strategic partnerships, introduce new products, and gain a competitive edge in the commercial lighting control market. For instance, in April 2024, Acuity Brands Inc. introduced Connected STAR to its Emergency Lighting with Self-Testing Automated Reporting (STAR) system. This update improves code adherence for large-scale projects by offering a new deployment method that guarantees correct emergency functionality and lighting during power failures.

* India is a rapidly expanding market for connected lighting systems, as various State governments, local bodies, and sports authorities are demonstrating a growing interest in smart lighting systems. Furthermore, according to trading economics, in the fourth quarter of 2023, the construction sector in India was estimated to be worth more than INR 3.5 trillion, marking a substantial growth compared to earlier periods. Thus, India's growing commercial construction activities will leverage the demand for the studied market.

* Other factors creating growth opportunities for the commercial lighting control market include the rapid development of sensor and wireless technologies and the increasing demand for intelligent lighting solutions for developing street lighting and smart cities.

Asia-Pacific to Witness Significant Growth

* China is the biggest user, manufacturer, and seller of LED lighting products, and continuous governmental efforts are pushing its market toward total adoption of LED lighting. The country is also the world's largest construction market. China's 14th Five-Year Plan emphasizes new infrastructure projects in transportation, energy, water systems, and urbanization, further supporting market growth.

* India's commercial real estate market is one of the most well-organized in the Asia-Pacific region, with the introduction of Real Estate Investment Trusts. Government initiatives such as Make in India and other reforms, such as the Real Estate Regulatory Authority (RERA) and GST, have dramatically boosted the sector.

* Moreover, the Building and Construction Authority (BCA) projected that the total construction demand in Singapore in 2023 would range between USD 19.71 billion and USD 23.36 billion. The public sector is expected to contribute about 60% of the total construction demand. Additionally, the new factories opening in the region are incorporating various features to achieve carbon neutrality by reducing carbon dioxide emissions.

* Many technological advancements are currently taking place in the country. The Make in India campaign is centered around increasing domestic production and reducing dependency on foreign products. As a result, there has been an increase in the establishment of LED industry facilities, corresponding to the expansion of the LED ecosystem in the country. Moreover, in September 2023, Signify launched a novel application, characteristics, and merchandise for its WiZ intelligent lighting system to improve the daily convenience of users. The latest additions include SpaceSense, a motion-sensing technology for lighting systems that eliminates the need for any sensors to be set up.

Commercial Lighting Control Industry Overview

The commercial lighting control market is very competitive. The commercial lighting control market is highly concentrated due to various large and small players. All the major players account for a significant market share and focus on expanding the global consumer base. Some significant players in the market are Philips Lighting NV, Honeywell International Inc., General Electric Company, Infineon Technologies, Schneider Electric, and many more. Several companies are increasing their market share by forming collaborations, partnerships, and acquisitions and introducing new and innovative products to earn a competitive edge during the forecast period.

* January 2024: Cree LED and Current Lighting Solutions have agreed to license Current's patents for KSF/PFS red phosphor for Cree LED products with Pro9 technology. This agreement pertains to using KSF/PFS phosphor to enhance the efficiency of LED components. The license includes Cree LED products incorporating Pro9(TM) technology utilizing Potassium Fluoride Silicon (KSF/PFS phosphor). This phosphor is used to improve the efficiency of LED components, particularly those that provide higher CRI (Color Rendering Index).

* September 2023: Advanced Lighting Technologies announced the acquisition of Cree Lighting, a market leader and innovator of indoor and outdoor LED lighting. Through this acquisition, it aims to enhance its market position in the LED product marketplace and represents the achievement of another step in its ambitious growth strategy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Growing Demand for Connected Lighting Solutions will Support the Market Growth

- 5.1.2 Increasing Investments in Infrastructure Developments

- 5.2 Market Restraints

- 5.2.1 High Initial Cost of Installations

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 LED Drivers

- 6.1.1.2 Sensors

- 6.1.1.3 Switches and Dimmers

- 6.1.1.4 Relay Units

- 6.1.1.5 Gateways

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Communication Protocol

- 6.2.1 Wired

- 6.2.2 Wireless

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Middle East and Africa

- 6.3.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Philips Lighting NV

- 7.1.2 Honeywell International Inc.

- 7.1.3 General Electric Company

- 7.1.4 Infineon Technologies

- 7.1.5 Schneider Electric

- 7.1.6 Acuity Brands Inc.

- 7.1.7 Cree Inc.

- 7.1.8 Lutron Electronics Co. Inc.

- 7.1.9 Leviton Manufacturing Company Inc.

- 7.1.10 WAGO Corporation

- 7.1.11 Eaton Corporation