|

市場調查報告書

商品編碼

1521887

商務用冷凍設備:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Commercial Refrigeration Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

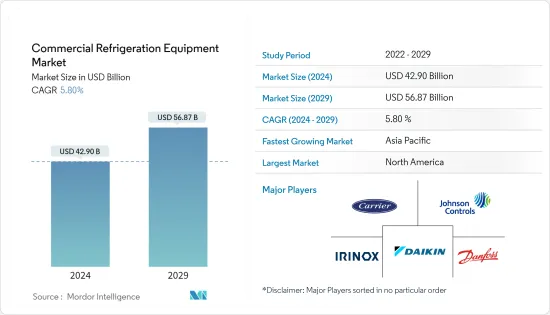

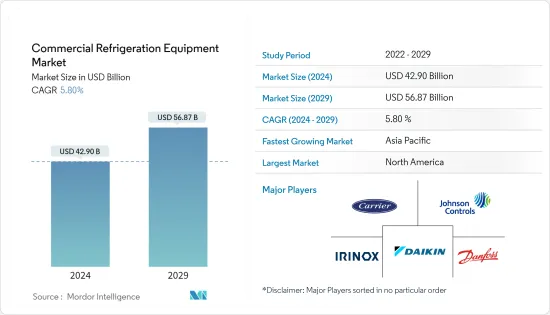

商務用冷凍設備市場規模預計到2024年為429億美元,預計到2029年將達到568.7億美元,在預測期內(2024-2029年)複合年成長率為5.80%。

主要亮點

- 由於飯店和旅遊業的快速擴張以及消費者外帶食品的偏好不斷增加,預計商務用冷凍設備市場在預測期內將成長。預計市場也將受益於全球暖化潛力較低的冷媒的採用以及監管壓力和環境考慮推動的持續技術進步。

- 由於國際食品貿易活動增加、食品和飲料行業投資增加、製藥和製藥行業需求增加、技術進步、製冷服務需求增加以及商務用製冷受到影響,商務用冷凍設備的銷售預計將增加。食品需求的增加和旅館業的快速成長。近年來,世界各地個人生活方式和飲食習慣發生了顯著變化,對冷凍和食品的需求食品增加。

- 隨著冰箱、冷凍庫和冷凍配備感測器、連接和資料分析功能,創新的物聯網功能的整合變得越來越普遍。這可以實現便捷的遠端監控、預測性維護和效能最佳化。一個典型的例子是 iMatrix Systems,這是一家工業物聯網 (IIoT) 科技公司,致力於幫助餐廳確保食品安全並最大限度地減少食品廢棄物。

- 然而,商務用冷凍系統由於其高效率而通常用於要求苛刻的應用。這些系統使用專為符合政府法規而設計的商務用冷媒。此外,為了滿足行業標準,這些系統的價格相對較高。因此,要獲得這些昂貴的冷凍系統需要大量的初始投資。同時,維護如此大型的設備對於各個行業的廣泛採用來說可能是一個挑戰。

- 能源價格波動等多種宏觀經濟因素會影響冷凍設備的營運成本,並影響市場對節能型號的需求。此外,全球供應鏈問題,包括地緣政治緊張局勢造成的問題,可能會影響冷凍設備零件和成品的可用性和成本。

商務用冷凍設備市場趨勢

冰箱和冷凍庫經歷顯著成長

- 冰箱和冷凍庫行業預計將顯著成長,這主要是由於旅行和旅遊業的全球擴張導致食品和餐廳數量的增加。此外,該細分市場還包括急速冷卻器,其主要用於在低溫下快速冷凍或冷卻物品,以防止儲存物品中的細菌生長。

- 由於旅行者和度假者擴大使用中等容量的飲料冷卻器,預計冰箱和冷凍庫的數量將會增加。此外,零售連鎖店旨在改善顧客購物體驗的得來速和送貨到店趨勢預計將在未來幾年推動飲料冷凍設備的需求。

- 影響商務用冷凍設備銷售的重要因素包括國際食品貿易活動的增加、食品和飲料行業投資的增加、製藥和製藥行業需求的增加、技術進步以及製冷需求的成長。 。

- 酒店業以及冷凍食品和食品和飲料的需求不斷成長預計將對餐廳冰箱、展示式冰箱、冰淇淋冰櫃和商務用冷凍庫的銷售產生重大影響。 Circana 報告稱,截至 2023 年 7 月的 12 週內,披薩是排名第一的冷凍食品類別,銷售額超過 15 億美元。

- 2023年7月,義大利Epta和德國菲斯曼冷凍解決方案公司同意組成合資企業,成為中歐和北歐商務用冷凍市場的主要參與者。此次合作將涵蓋 VRS 在德國、波蘭、捷克共和國和其他歐洲國家的商務用冷凍業務,並將整合兩家公司的商業活動。

預計亞太地區市場將顯著成長

- 由於經濟狀況改善、就業率穩定、可支配收入增加以及旅行和外出就餐等休閒支出預計將增加,亞太地區的產品需求將在未來幾年繼續成長。亞太地區的商務用冰箱市場預計將大幅成長,這主要是由於印度、中國、韓國和日本等國家對冷凍食品的需求不斷成長。該地區的食品製造公司正專注於生產當地生產的食品的冷凍品種,這有助於市場擴張。

- 馬來西亞、印尼和新加坡等國家的旅遊業蓬勃發展,這也在市場的成長中發揮重要作用。此外,隨著疫苗儲存設備廣泛應用於中國、印度等新興經濟體的研究機構和生物製藥公司,該市場提供了廣泛的機會。

- 據有機貿易協會 (OTA) 稱,有機食品行業預計將在食品領域顯著成長。消費者對健康、營養和有機食品的偏好日益增加,對低溫運輸製程和設備的依賴也日益增加。此外,超級市場和大賣場的擴張預計也將有助於亞太市場的成長。

- 中國日益都市化和不斷成長的收入潛力增加了購買和獲得新鮮有機農產品的願望。這些冰箱提高了新鮮度和衛生水平,滿足了對高品質食品不斷成長的需求。因此,各行業對商務用冷凍系統的需求不斷增加。此外,中國擁有大量的本土商務用製造商,為商務用冷凍設備的全球貿易提供了充足的市場機會。

商務用冷凍設備產業概況

商務用冷凍設備市場競爭激烈、集中度高,參與者規模各異。所有主要公司都佔有重要的市場佔有率,並致力於擴大其全球消費群。市場的重要參與者包括 Carrier Global、Johnson Controls、Irinox SpA、Daikin Industries Ltd 和 Danfoss AB。一些公司正在透過結盟、合作夥伴關係、收購和推出新的創新產品來擴大市場佔有率,以在預測期內獲得競爭優勢。

2024年5月,CAREL和工業數位化完整技術解決方案供應商SECO合作創建了新的解決方案,以支援CAREL業務部門基礎設施的數位轉型。這些公司正在開發先進的監控系統,該系統透過實現即時資料收集和遠端監控來有效管理冷凍過程至關重要。

2024 年 5 月,多佛工程系統部門旗下的營運公司多佛公司宣布,著名的商務用冷凍系統設計與製造商 Hill-Phoenix 將收購開利公司旗下部門 Tyler,交易完成。某些資產和知識產權。此次收購增強了 Tyler 在商務用冷凍產業的地位。經過短暫的調整期後,Tyler 客戶將能夠使用 Hill-Phoenix 產品來滿足他們的持續需求。該公司預計這將使 HillPhoenix 的年收益增加 30-40%。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 食品和飲料產品的有效期限增加

- 技術進步和智慧人工智慧/物聯網整合將推動需求

- 市場限制因素

- 對商務用和租賃商用冷凍設備的偏好日益增加

- 高昂的資金投入和維護成本阻礙了在各行業的廣泛使用

第6章 市場細分

- 依產品類型

- 急速冷卻器

- 冷凍冰箱

- 運送冷凍機

- 冷藏展示櫃

- 飲料冷凍庫

- 冰淇淋冷凍庫

- 冷藏自動販賣機

- 其他產品類型

- 依冷媒類型

- 碳氟化合物

- 烴

- 無機的

- 按用途

- 飲食

- 食品服務/配送

- 飯店/餐廳

- 麵包店

- 其他用途

- 零售

- 超級市場及大賣場

- 便利商店

- 其他零售店

- 化學

- 醫療保健與製藥

- 其他用途

- 飲食

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 中東/非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- Carrier Global

- Johnson Controls

- Irinox SpA

- Daikin Industries Ltd

- Danfoss AB

- Panasonic Corporation

- Dover Corporation

- Emerson Electric Co.

- AB Electrolux

- Tecumseh Products Co.

- Hoshizaki Corporation

- Carel Industries SpA

- Fujimak Corporation

- Imbera SA de CV

第8章投資分析

第9章市場的未來

The Commercial Refrigeration Equipment Market size is estimated at USD 42.90 billion in 2024, and is expected to reach USD 56.87 billion by 2029, growing at a CAGR of 5.80% during the forecast period (2024-2029).

Key Highlights

- The commercial refrigeration equipment market is expected to grow during the forecast period due to the rapid expansion of the hospitality and tourism sector and consumers' increasing preference for takeaway meals. The market will also benefit from adopting refrigerants with lower global warming potential and ongoing technological advancements driven by regulatory pressures and environmental considerations.

- Commercial refrigeration equipment sales are influenced by various factors, including an increase in international food trade activity, rising investments in the food and beverages industry, growing demand from pharmaceutical and drug industries, advancements in technology, an increasing need for cold storage services, rising demand for industrial refrigerators, and the fast-growing hospitality sector. The lifestyle and eating habits of individuals worldwide have undergone significant changes in recent years, leading to a substantial rise in the demand for frozen and packaged foods, consequently driving the potential of the commercial refrigeration equipment market.

- Integrating innovative and IoT-enabled features is increasingly popular as refrigerators, freezers, and chillers are equipped with sensors, connectivity, and data analytics. This enables convenient remote monitoring, predictive maintenance, and performance optimization. A prime example is iMatrix Systems, an industrial Internet of Things (IIoT) technology company that introduced innovative products aimed at helping restaurants ensure food safety and minimize food waste.

- However, commercial refrigeration systems are commonly utilized in demanding applications due to their high efficiency. These systems use commercial-grade refrigerants specifically designed to comply with government regulations. Moreover, the prices of these systems are relatively high to meet industry standards. Consequently, acquiring these expensive refrigeration systems necessitates a substantial initial investment. At the same time, maintaining such large-scale equipment may pose challenges to the widespread adoption in various industries.

- Multiple macroeconomic factors, such as fluctuations in energy prices, can impact the operational costs of refrigeration equipment, influencing the market demand for energy-efficient models. Also, global supply chain issues, including those caused by geopolitical tensions, can affect the availability and cost of refrigeration equipment components and finished products.

Commercial Refrigeration Equipment Market Trends

Refrigerator & Freezer to Witness a Significant Growth

- The refrigerators and freezers segment is expected to experience significant growth, primarily due to the global expansion of the travel and tourism industry, which increased the number of food establishments and restaurants. Additionally, the segment includes blast chillers, primarily utilized for quickly freezing or cooling items at lower temperatures to prevent bacterial growth in stored items.

- The refrigerator and freezer are expected to experience growth due to the increased utilization of medium-capacity beverage coolers by travelers and vacationers. Additionally, the trend of drive-thru and sip-and-shop in retail chains, aimed at enhancing customers' shopping experience, is anticipated to contribute to the demand for beverage refrigeration equipment in the coming years.

- Some of the significant factors influencing the sales of commercial refrigeration equipment include an increase in international food trade activity, rising investments in the food and beverages industry, growing demand from pharmaceutical and drug industries, advancements in technology, a rising need for cold storage services, a growing demand for industrial refrigerators, and a rapidly expanding hospitality sector.

- The hospitality sector and the rising demand for frozen food products and ready-to-drink beverages are anticipated to significantly impact the sales of restaurant refrigerators, display fridges, ice cream freezers, and commercial freezers. Circana reported that for the 12 weeks ending July 2023, pizza was the leading frozen food category in sales, surpassing USD 1.5 billion.

- In July 2023, Epta, an Italy-based company, and Viessmann Refrigeration Solutions, Germany, agreed to establish a collaborative venture to become a significant player in the commercial refrigeration market in Central and Northern Europe. This partnership will consolidate their respective commercial operations, encompassing VRS' professional refrigeration activities in Germany, Poland, the Czech Republic, and other European countries.

Asia-Pacific is Expected to Witness a Significant Market Growth

- Asia-Pacific is projected to see significant expansion in the coming years because of increasing product demand, fueled by improving economic situations, steady employment rates, disposable income growth, and higher spending on recreational activities like traveling and dining out. The commercial refrigeration market in Asia-Pacific is expected to grow substantially, mainly due to the rising demand for frozen food products in countries like India, China, South Korea, and Japan. Food manufacturing companies throughout the region emphasize producing frozen variations of local food products, which, in turn, contributes to the expansion of the market.

- The travel and tourism industry is thriving in countries like Malaysia, Indonesia, and Singapore, which also plays a significant role in its growth. Additionally, the market in developing economies such as China and India presents promising opportunities due to the widespread use of vaccine storage units in research institutions and biopharmaceutical companies.

- According to the Organic Trade Association (OTA), the organic food industry is projected to experience significant growth in the food sector. Consumers' growing preference for healthy and nutritious organic food products increases reliance on the cold chain process and equipment. Additionally, the expanding number of supermarkets and hypermarkets is expected to contribute to the growth of the Asia-Pacific market.

- The increasing urbanization in China and the growth in potential income have resulted in a greater desire for shopping and accessing fresh and organic produce. These refrigerators provide enhanced freshness and hygiene, catering to the rising demand for high-quality food. As a result, there is a growing need for commercial refrigeration systems across different industries. Moreover, China has numerous local manufacturers for commercial applications, providing ample market opportunities to trade commercial refrigeration equipment globally.

Commercial Refrigeration Equipment Industry Overview

The commercial refrigeration equipment market is very competitive and highly concentrated due to various large and small players. All the major players account for a significant market share and focus on expanding the global consumer base. Some significant players in the market are Carrier Global, Johnson Controls, Irinox SpA, Daikin Industries Ltd, and Danfoss AB. Several companies are increasing their market share by forming collaborations, partnerships, and acquisitions and introducing new and innovative products to earn a competitive edge during the forecast period.

In May 2024, CAREL and SECO, which offer complete technological solutions for industrial digitalization, collaborated on creating a new solution to help digitally transform the infrastructures in CAREL's operational sectors. The two companies are developing an advanced supervision system essential for managing refrigeration processes efficiently by enabling real-time data collection and remote monitoring.

In May 2024, Dover Corporation announced the transaction completion of Hill PHOENIX, an operating company within Dover's Engineered Systems division and a prominent designer and producer of commercial refrigeration systems, has acquired specific assets and intellectual property from Tyler Refrigeration, a division of Carrier Corporation. This deal will enhance its standing in the commercial refrigeration industry. Following a short adjustment period, Tyler's customers will have access to Hill Phoenix products to meet the ongoing requirements. The company anticipates this will lead to a 30 to 40% boost in Hill PHOENIX's annual revenue.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Shelf Life of Food & Beverages Products

- 5.1.2 Technological Advancements and Smart AI and IoT Integration will Boost Demand

- 5.2 Market Restraints

- 5.2.1 Rising Preference for Pre-used and Rented Commercial Refrigeration Equipment

- 5.2.2 High Capital Expenditure and Maintenance Costs to Obstruct Adoption Across Industries

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Blast Chillers

- 6.1.2 Refrigerator and Freezer

- 6.1.3 Transportation Refrigeration

- 6.1.4 Refrigerated Display Cases

- 6.1.5 Beverage Refrigeration

- 6.1.6 Ice Cream Freezer

- 6.1.7 Refrigerated Vending Machine

- 6.1.8 Other Product Types

- 6.2 By Refrigerant Type

- 6.2.1 Fluorocarbons

- 6.2.2 Hydrocarbons

- 6.2.3 Inorganics

- 6.3 By Application

- 6.3.1 Food & Beverages

- 6.3.1.1 Food Service & Distribution

- 6.3.1.2 Hotels & Restaurants

- 6.3.1.3 Bakeries

- 6.3.1.4 Other Applications

- 6.3.2 Retail

- 6.3.2.1 Supermarkets & Hypermarkets

- 6.3.2.2 Convenience Stores

- 6.3.2.3 Other Retail Stores

- 6.3.3 Chemicals

- 6.3.4 Healthcare & Pharmaceuticals

- 6.3.5 Other Applications

- 6.3.1 Food & Beverages

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Middle East and Africa

- 6.4.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Carrier Global

- 7.1.2 Johnson Controls

- 7.1.3 Irinox SpA

- 7.1.4 Daikin Industries Ltd

- 7.1.5 Danfoss AB

- 7.1.6 Panasonic Corporation

- 7.1.7 Dover Corporation

- 7.1.8 Emerson Electric Co.

- 7.1.9 AB Electrolux

- 7.1.10 Tecumseh Products Co.

- 7.1.11 Hoshizaki Corporation

- 7.1.12 Carel Industries SpA

- 7.1.13 Fujimak Corporation

- 7.1.14 Imbera S.A. de C.V.