|

市場調查報告書

商品編碼

1521908

食品消費後回收 (PCR) 包裝:市場佔有率分析、行業趨勢和成長預測(2024-2029 年)Food-grade Post-Consumer Recycled (PCR) Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

根據以出貨量為準,食品消費後回收(PCR)包裝市場規模預計將從2024年的586萬噸成長到2029年的837萬噸,在預測期內(2024-2029年)複合年成長率為7.38% 。

主要亮點

- 減少能源使用、減少排放、促進循環經濟、實現永續性目標、減少包裝廢棄物的需求日益成長,以及 FDA 和其他針對敏感應用的法規和監管壓力,是推動消費後回收包裝解決方案需求的關鍵因素為了食品。

- 由於改善的回收基礎設施、先進的回收流程、有效的處理技術和政府的積極回應,全球包裝回收率正在不斷提高。因此,消費後回收材料的可用性正在增加。據環境局稱,英國的包裝回收目標預計到2024年終將達到80%,而2023年為77%。回收率的提高預計將有助於食品消費後回收包裝解決方案的成長。

- 最終用戶品牌希望遵守監管措施,以在競爭中保持領先地位,並回應消費者對消費後回收 (PCR) 包裝日益成長的認知。例如,美國飲料公司 Keurig Dr Pepper 承諾在 2025 年將其產品包裝組合中的原生塑膠使用量減少 20%,並增加其塑膠包裝的回收含量。

- 包裝製造商正在利用先進技術開發創新的觸敏式消費後回收包裝解決方案。此外,原料製造商、供應商和加工商採用最新的回收技術來提供食品級PCR材料。

- 2024 年,Borealis AG 收到了美國食品藥物管理局(FDA) 對 Borcycle M 的無異議通知 (LNO),Borcycle M 是一種用於食品包裝的消費後再生塑膠 (PCR)。這種材質對於化妝品、個人護理品和食品接觸等包裝應用非常敏感。該公司利用創新的機械回收技術開發了 Borcycle M 消費再生塑膠 (PCR)。這項技術以節能的方式為消費後塑膠廢棄物賦予新的生命。

- 除此之外,由於塑膠材料回收不當,對更多材料可用性的需求正在造成供應問題。包裝材料處理不當可能會在回收過程中造成污染問題並阻礙市場成長。回收商的持續努力和 EPR 增加的投資預計將改善回收收集和基礎設施。預計這將克服對材料可用性的擔憂。

食品消費後回收 (PCR) 包裝市場的趨勢

食品和飲料行業擴大採用回收 (PCR) 包裝解決方案

- 大多數食品和飲料都採用食品級包裝來包裝,以保持其品質並避免與包裝溶液接觸發生化學反應。這些解決方案包括由塑膠、玻璃、金屬和紙製成的瓶子、罐子、袋子、液體包裝等。

- 隨著人們對永續包裝解決方案的日益關注、監管和消費者意識的增強,品牌所有者擴大尋求消費後回收包裝解決方案。例如,2023年10月,可口可樂印度公司推出了250mL和750mL rPET瓶裝可口可樂。此外,2024年4月,可口可樂在香港推出了由rPET製成的500毫升瓶。到 2030 年,該公司的目標是在其包裝生產線上使用 50% 的回收材料。這標誌著公司在循環經濟和永續、環保的未來方面取得了進展。

- 包裝製造商還希望透過為食品接觸包裝提供創新的消費後回收包裝解決方案來利用不斷成長的商機。本公司致力於採用先進的回收工藝,以滿足食品接觸包裝和觸摸感應應用的監管要求。

- 2024年3月,Amcor Group GmbH與INEOS Olefins & Polymers Europe和百事公司合作,為百事公司的零食品牌「Sunbites Crisps」推出了新的零食包裝。這種新包裝由 50% 的再生塑膠製成。 Plastic Energy 的技術可轉變消費排放塑膠包裝廢棄物。使用熱解油作為傳統化石原料的替代品,生產和編譯回收材料以滿足食品接觸性能要求。

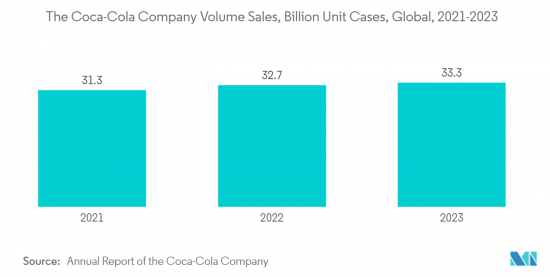

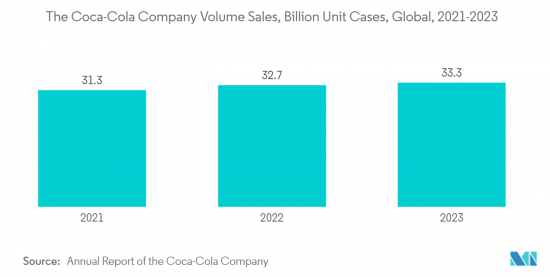

- 食品和飲料消費量的增加以及品牌對永續包裝的關注正在推動食品消費後回收 (PCR) 包裝解決方案的成長。飲料和食品品牌銷售的快速成長有助於市場成長。領先的非酒精飲料品牌可口可樂 2022 年銷售量為 327 億單位箱,而 2023 年為 333 億單位箱(一單位箱相當於售出 192 液美國成品飲料)。

將回收率納入包裝產品的區域監管壓力不斷增加

- 包裝廢棄物的增加導致各種環境問題,這產生了對永續包裝解決方案的需求,例如可回收、消費後回收材料和生物分解性。為了克服永續性問題,包括歐洲、加拿大和美國在內的各個地區的政府和其他監管機構正在推動在包裝解決方案中使用消費後材料。這會減少溫室氣體排放和能源消費量,從而促進循環經濟。

- 例如,2024年4月,歐洲議會通過了《包裝和廢棄物法規》(PPWR),有助於向循環經濟轉型。 PPWR 包含有關包裝解決方案的各種規定,包括市場上塑膠包裝材料的最低迴收率。

- 例如,一次性塑膠飲料寶特瓶有30%的PCR,接觸敏感的PET包裝有30%的PCR,其他接觸敏感的塑膠包裝有10%的PCR。這些最低百分比將從 2040 年起增加。該地區的此類規定預計將推動對食品消費後回收 (PCR) 包裝解決方案的需求。

- 同樣,加拿大環境部長理事會的零塑膠廢棄物行動計畫核准了一項規定,要求到2030年塑膠包裝產品的回收率達到50%。該系列包括飲料包裝容器、非飲料瓶和其他硬質容器和托盤。

- 2023 年初,加州、華盛頓州、新澤西州和緬因州通過了法律,要求塑膠包裝中含有消費後回收成分。加州法律要求到2025 年對玻璃和塑膠飲料瓶進行25% PCR,到2050 年進行50%,華盛頓州法律要求到2026 年對塑膠飲料瓶進行25% PCR,要求到2025 年對塑膠酒和乳製品容器進行15% PCR。

- 與食品接觸的產品必須採用食品級包裝,以避免損壞。關於在食品和飲料中使用消費後回收材料的規定和法規的增加預計將有助於食品消費後回收(PCR)包裝的成長。

食品消費後回收 (PCR) 包裝產業概述

食品消費後回收 (PCR) 包裝市場是細分的,包括各種全球和本地參與者。市場上的包裝商正在尋求為食品提供消費後回收 (PCR) 包裝解決方案,以應對日益增加的監管壓力、實現永續性目標並滿足包裝類型對最低 PCR 含量的要求。市場上的主要參與企業正在開發新的解決方案,以增強市場佔有率並獲得相對於競爭對手的優勢。

- 2024 年 4 月,Amcor Group GmbH 宣布推出一款 1 公升聚對苯二甲酸乙二醇酯 (PET) 瓶,其成分為 100% 消費者回收 (PCR),用於碳酸軟性飲料 (CSD)。該公司致力於擴大產品系列,並幫助客戶履行永續性承諾和要求。

- 2024 年 4 月,Klockner Pentaplast 宣布推出由 100% 再生 PET (rPET) 製成的食品包裝托盤。隨著 100% 再生 PET食品托盤的推出,該公司致力於在不影響品質或安全的情況下實現更永續的包裝產業。

- 2023 年 12 月,Novolex Holdings LLC 宣布食品包裝至少使用 10% 的消費後回收 (PCR) 材料。這些容器是可回收的。隨著新產品的推出,該公司減少了對環境的影響並支持循環經濟。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 評估地緣政治情境對產業的影響

第5章市場動態

- 市場促進因素

- 消費者意識不斷增強,需要減少溫室氣體排放以克服永續性問題

- 包裝產品中納入最低迴收率的監管壓力越來越大

- 市場限制因素

- 回收基礎設施不足導致材料供應不足和價格高昂

第6章 市場細分

- 按材質

- 塑膠

- 聚對苯二甲酸乙二酯 (PET)

- 聚乙烯(PE)

- 聚丙烯(PP)

- 其他塑膠

- 玻璃

- 金屬

- 紙板

- 塑膠

- 依產品類型

- 瓶子/容器

- 能

- 袋/袋

- 托盤和翻蓋

- 其他

- 按最終用戶產業

- 食品

- 飲料

- 個人護理和化妝品

- 醫療和製藥

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞洲

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 北美洲

第7章 競爭格局

- 公司簡介

- Berry Global Group Inc.

- Amcor Group GmbH

- Novolex Holdings LLC

- Tekni-Plex Inc.

- Klockner Pentaplast

- Coveris Management GmbH

- Hoffmann Neopac AG

- Silgan Dispensing Systems(Silgan Holdings Inc.)

- Greiner Packaging International GmbH

- Avery Dennison Corporation

- Nussbaum Matzingen AG

- Gallo Glass Company

- Great Little Box Company Ltd

第8章投資分析

第9章市場的未來

The Food-grade Post-Consumer Recycled Packaging Market size in terms of shipment volume is expected to grow from 5.86 Million tonnes in 2024 to 8.37 Million tonnes by 2029, at a CAGR of 7.38% during the forecast period (2024-2029).

Key Highlights

- The increasing need for reducing energy use, lowering emissions, promoting a circular economy, achieving sustainability targets, reducing packaging waste, FDA and other regulations for contact-sensitive applications, and regulatory pressure are the major factors propelling the demand for food-grade post-consumer recycling packaging solutions.

- Packaging recycling rates worldwide are increasing due to the development of recycling infrastructure, advanced recycling processes, effective processing techniques, and positive government response. This will result in increased availability of post-consumer recycled material. According to the Environment Agency, the packaging recycling target in the United Kingdom is expected to reach 80% by the end of 2024, compared to 77% in 2023. The increasing recycling rate is expected to aid the growth of food-grade post-consumer recycling packaging solutions.

- End-user brands are trying to adhere to regulatory measures to stay ahead of the competition and address the growing consumer awareness for post-consumer recycled packaging. For instance, Keurig Dr Pepper, an American beverage company, committed to reducing virgin plastic use by 20% across the company's product packaging portfolio by 2025 and increasing recycled content in plastic packaging.

- Packaging manufacturers are developing innovative, contact-sensitive, post-consumer recycled packaging solutions using advanced technologies. Furthermore, raw material manufacturers, providers, and converters are adopting the latest recycling technology to offer food-grade PCR material.

- In 2024, Borealis AG received letters of no objection (LNOs) from the US Food & Drug Administration (FDA) for its Borcycle M post-consumer recycled plastics (PCR) used for food-grade packaging. This material is sensitive to packaging applications, including cosmetics, personal care, and food contact. The company developed Borcycle M post-consumer recycled plastics (PCR) using transformational mechanical recycling technology. This technology offers post-consumer plastic waste another life in an energy-efficient way.

- Besides this, the need for more material availability due to the improper recycling of plastic material creates supply issues. The improperly discarded packaging material creates contamination problems during recycling, which may hamper the market's growth. The continuous effort by the recyclers and increasing investments driven by EPR are projected to improve recycling collection and infrastructure. This is expected to overcome the concern of material availability.

Food-grade Post-Consumer Recycled (PCR) Packaging Market Trends

Rising Adoption of Recycled Packaging Solutions in the Food and Beverage Industry

- Food and beverage products are mostly packed in food-grade packaging to maintain their quality and avoid any chemical reaction when in contact with the packaging solution. These solutions include bottles, cans, pouches, and liquid cartons made from plastic, glass, metal, or paper.

- Considering the increasing focus on sustainable packaging solutions, along with propelling regulation and consumer awareness, brand owners are looking for post-consumer recycled packaging solutions. For instance, in October 2023, Coca-Cola India launched Coca-Cola in 250-mL and 750-mL rPET bottles. Furthermore, in April 2024, Coca-Cola rolled out 500-ml bottles made from rPET in Hong Kong. The company aims to implement 50% recycled material across its packaging lines by 2030. This showcases the company's journey toward a circular economy and a sustainable and greener future.

- Packaging manufacturers are also trying to offer innovative post-consumer recycled packaging solutions for food contact packaging to take advantage of growing opportunities. The companies are focusing on adopting an advanced recycling process to cater to the regulatory requirements for food contact packaging and contact-sensitive applications.

- In March 2024, Amcor Group GmbH collaborated with INEOS Olefins & Polymers Europe and PepsiCo to launch a new snack packaging for PepsiCo's snack brand, Sunbites Crisps. The new packaging contains 50% recycled plastic. Post-consumer plastic packaging waste is converted using Plastic Energy's technology. Pyrolysis oil is used as an alternative to traditional fossil feedstock to produce recycled material and compile it to meet food contact performance requirements.

- The increasing consumption of food and beverage products and the brand's focus on sustainable packaging fuel the growth of food-grade post-consumer recycled packaging solutions. The surge in the unit volume sales of the beverage and food brands aids the market's growth. The major non-alcoholic beverage brand, the Coca-Cola Company, sold 33.3 billion unit cases (one unit case equal to 192 US fluid ounces of finished beverage) in 2023 compared to 32.7 billion unit cases in 2022.

Increasing Regulatory Pressure in Various Regions to Include a Minimum Percentage of Recycled Content for Packaging Products

- Increasing packaging waste, which leads to various environmental problems, has created the need for sustainable packaging solutions such as recyclable, post-consumer recycled material, biodegradable, and others. To overcome the sustainability concern, governments and other regulatory agencies in various regions, such as Europe, Canada, the United States, and others, are putting pressure on using post-consumer recycled material for packaging solutions. This would result in lower greenhouse gas emissions and lower energy consumption and contribute to a circular economy.

- For instance, in April 2024, the European Parliament adopted the Packaging and Packaging Waste Regulation (PPWR), which would contribute to the transition to a circular economy. It includes various provisions for packaging solutions, such as the requirement that any plastic packaging placed on the market contain a minimum percentage of recycled content.

- The minimum percentage of recycled content will depend upon the packaging type, such as 30% PCR for single-use plastic beverage bottles, 30% PCR for contact-sensitive PET packaging, and 10% PCR for contact-sensitive other plastic packaging. These minimum percentages would increase from 2040. Such provision in the region is expected to drive the demand for food-grade post-consumer recycled packaging solutions.

- Similarly, the Action Plan on Zero Plastic Waste by the Canadian Council of Ministers of the Environment endorsed a provision stating a 50% recycled content requirement in plastic packaging products by 2030. The scope includes beverage packaging containers, non-food bottles, and other rigid containers and trays.

- In early 2023, California, Washington, New Jersey, and Maine passed laws requiring post-consumer recycled content in plastic packaging. California's law requires 25% PCR for glass and plastic beverage bottles by 2025 and 50% by 2050, while Washington's law requires 25% PCR for plastic beverage bottles by 2026 and 15% PCR for plastic wine and dairy containers by 2025.

- Food-grade packaging is required for products that come in contact with it to avoid damage. The increasing provision and regulation over the use of post-consumer recycled material for beverage products is expected to aid the growth of food-grade post-consumer recycled packaging.

Food-grade Post-Consumer Recycled (PCR) Packaging Industry Overview

The food-grade post-consumer recycled (PCR) packaging market is fragmented, with various global and local players. The packaging players in the market are trying to offer food-grade post-consumer recycled packaging solutions to adhere to the growing regulatory pressure, attain sustainability targets, and cater to the demand for minimum PCR content for packaging type. The key players in the market are developing new solutions to strengthen the market share and stay ahead of the competitors.

- In April 2024, Amcor Group GmbH announced the launch of a one-liter polyethylene terephthalate (PET) bottle made from 100% post-consumer recycled (PCR) content for carbonated soft drinks (CSD). The company focuses on expanding the product portfolio for responsible packaging made from recycled content and helping customers meet sustainability commitments and requirements.

- In April 2024, Klockner Pentaplast announced the launch of food packaging trays made with 100% recycled PET (rPET). With the launch of 100% recycled PET food trays, the company is focusing on creating a more sustainable packaging industry without compromising quality or safety.

- In December 2023, Novolex Holdings LLC introduced packaging containers for food made with a minimum of 10% post-consumer recycled (PCR) content. These containers are recyclable. The launch of new products will help the company reduce the environmental impact and support the circular economy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Geopolitical Scenario Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Consumer Awareness and Need for Lowering Greenhouse Gas Emissions to Overcome the Sustainability Concerns

- 5.1.2 Increasing Regulatory Pressure to Include a Minimum Percentage of Recycled Content for Packaging Products

- 5.2 Market Restraint

- 5.2.1 Inadequate Recycling Infrastructure Leads to Improper Supply of Materials and Results in High Prices

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.1.1 Polyethylene Terephthalate (PET)

- 6.1.1.2 Polyethylene (PE)

- 6.1.1.3 Polypropylene (PP)

- 6.1.1.4 Other Plastics

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper & Paperboard

- 6.1.1 Plastic

- 6.2 By Product Type

- 6.2.1 Bottles and Containers

- 6.2.2 Cans

- 6.2.3 Pouches and Bags

- 6.2.4 Trays and Clamshells

- 6.2.5 Other Product Types

- 6.3 By End-user Industry

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Personal Care and Cosmetics

- 6.3.4 Healthcare and Pharmaceuticals

- 6.3.5 Other End User Industry

- 6.4 Geography***

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.5 Middle East and Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 South Africa

- 6.4.5.3 Egypt

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Berry Global Group Inc.

- 7.1.2 Amcor Group GmbH

- 7.1.3 Novolex Holdings LLC

- 7.1.4 Tekni-Plex Inc.

- 7.1.5 Klockner Pentaplast

- 7.1.6 Coveris Management GmbH

- 7.1.7 Hoffmann Neopac AG

- 7.1.8 Silgan Dispensing Systems (Silgan Holdings Inc.)

- 7.1.9 Greiner Packaging International GmbH

- 7.1.10 Avery Dennison Corporation

- 7.1.11 Nussbaum Matzingen AG

- 7.1.12 Gallo Glass Company

- 7.1.13 Great Little Box Company Ltd