|

市場調查報告書

商品編碼

1522844

汽車車道警告系統:市場佔有率分析、產業趨勢、成長預測(2024-2029)Automotive Lane Warning Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

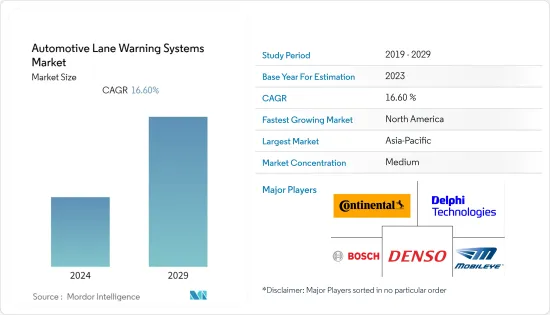

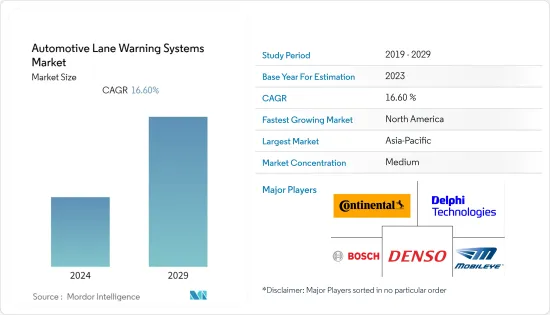

汽車車道警告系統市場規模預計到 2024 年為 59.4 億美元,預計到 2029 年將達到 147.9 億美元,在預測期內(2024-2029 年)複合年成長率為 16.60%。

由於道路安全意識的提高以及世界各國政府對車輛先進安全功能的指令不斷增加,汽車車道警告系統市場正經歷顯著成長。該市場是 ADAS(高級駕駛輔助系統)市場的一部分,反映了汽車行業向智慧、自動駕駛汽車的轉變。

隨著乘用車產量的增加以及汽車製造商將先進的安全功能作為標準配備,對車道警報系統的需求不斷增加。消費者的偏好越來越傾向於配備先進安全技術的汽車,部分原因是人們對交通安全問題的認知不斷增強,以及配備此類技術的汽車的高價值。

技術進步在這個市場中發揮了重要作用。攝影機、感測器和人工智慧技術的創新使車道警報系統更加準確和可靠。將這些系統與主動式車距維持定速系統和盲點檢測等其他安全功能整合,可創建更全面的安全解決方案,進一步推動市場成長。

從地區來看,歐洲和北美市場的採用率領先,這主要是由於嚴格的政府法規要求在車輛上安裝先進的安全系統。然而,隨著中國和日本等國家大力投資汽車技術和基礎設施開拓,亞太地區正成為成長最快的市場。

車道警報系統市場的未來充滿希望,這些系統與自動駕駛和半自動車輛的擴展相結合將帶來潛在的成長機會。

汽車車道預警系統市場趨勢

乘用車領域推動市場成長

乘用車領域正在推動汽車車道預警系統市場的發展,其中全球乘用車產量和銷售量的成長發揮了重要作用。隨著乘用車變得更便宜和可用,特別是在新興國家,對車道警報系統等先進安全功能的需求也增加。這些系統最初被認為是豪華或高階選擇,但在消費者對更安全汽車的需求和監管壓力的推動下,它們逐漸成為主流。

監管的影響確實是巨大的。包括歐洲和北美在內的許多地區都實施了嚴格的安全法規,要求或大力鼓勵新車配備先進的安全系統。此監管力道有效擴大了乘用車領域車道警報系統的市場。

先進感測器、攝影機和軟體的整合不僅提高了車道警報系統的有效性,而且隨著時間的推移也使其更具成本效益。隨著技術變得更加可用和生產成本下降,汽車製造商正在各種車型上安裝此類系統,包括中檔汽車。

消費者對道路安全問題和 ADAS(高階駕駛輔助系統)優勢的認知不斷提高,正在影響購買決策。消費者擴大選擇具有車道偏離警告等安全功能的汽車,這些功能被認為對於安全駕駛至關重要。

此外,聯網汽車和自動駕駛汽車的興起為乘用車領域的車道警報系統市場創造了進一步的成長機會。隨著汽車製造商投資半自動和自動駕駛汽車的開發,先進車道警報系統和其他 ADAS 技術的整合變得至關重要。

隨著 ADAS 創新使乘用車變得更加安全和更具吸引力,這一趨勢預計將持續下去。

北美是汽車車道預警系統的主要市場

北美已成為汽車車道警告系統的主要市場,這一趨勢是由多種因素推動的。該地區,特別是美國和加拿大,是世界上人均汽車持有率最高的地區之一,為包括車道警報系統在內的先進車輛技術創造了廣闊的市場。

這些國家的監管工作至關重要,採取積極措施鼓勵甚至要求在車輛中採用安全技術。這項監管推動與該地區強大的技術創新相輔相成,該地區許多領先的汽車和技術公司不斷開發尖端的駕駛員輔助系統。

此外,北美消費者對車輛安全的意識和重視程度很高。這種意識,加上對安全技術的投資意願,正在進一步推動車道警報系統市場的發展。此外,政府和組織的各種道路安全措施強調了汽車先進安全功能的重要性。

經濟因素也在發揮作用,北美強勁的經濟使得個人消費者和車隊營運商能夠投資於配備這些先進技術的更新、更安全的車輛。所有這些方面協同作用,使北美成為汽車車道警告系統的重要市場。

加拿大政府宣布對所有車輛進行安全測試,並部署自動駕駛和聯網汽車,同時提高人們對駕駛員輔助技術的認知。

- 2022 年 5 月,通用汽車宣布與 INRIX Inc. 建立建設性合作夥伴關係,根據通用汽車未來道路和 Inrix舉措的安全視圖,透過分析支援的雲端基礎的應用程式直接向美國運輸部提供安全解決方案資料。

- 2022 年 5 月,豐田宣布將在其北美組裝廠使用來自德克薩斯州奧斯汀新興企業Invisible AI 的電腦為基礎的視覺技術。該技術可以處理身體運動資料,以提高品質、安全性和效率。

由於上述因素,對車輛安全解決方案的需求預計將會增加。預計這將推動所研究市場從 2024 年到 2029 年的成長。

汽車車道預警系統產業概況

汽車車道警告系統市場由以下參與者主導: Continental AG、Delphi Technologies、Mobileye、Robert Bosch GmbH、Hitachi Ltd、ZF Friedrichshafen AG、DENSO Corporation 和 Magna International Inc.

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 安全意識的提高推動市場成長

- 市場限制因素

- 網路安全擔憂預計將抑制市場成長

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 功能類型

- 車道偏離警示系統

- 車道維持系統

- 感測器類型

- 視訊感應器

- 雷射感測器

- 紅外線感測器

- 銷售通路

- OEM

- 售後市場

- 汽車模型

- 客車

- 輕型商用車

- 大型商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Continental AG

- Delphi Technologies

- Mobileye

- DENSO Corporation

- Robert Bosch GmbH

- The Bendix Corporation

- Hitachi Ltd

- Iteris Inc.

- Nissan Motor Co. Ltd

- Volkswagen AG

- ZF TRW

第7章 市場機會及未來趨勢

The Automotive Lane Warning Systems Market size is estimated at USD 5.94 billion in 2024, and is expected to reach USD 14.79 billion by 2029, growing at a CAGR of 16.60% during the forecast period (2024-2029).

The market for automotive lane warning systems was experiencing significant growth driven by heightened awareness of road safety and increasing mandates from governments worldwide for advanced safety features in vehicles. This market is a segment of the broader advanced driver assistance systems (ADAS) market, reflecting the automotive industry's shift toward more intelligent and autonomous vehicles.

The demand for lane warning systems was being bolstered by the rising production of passenger vehicles and the integration of advanced safety features as standard offerings by automobile manufacturers. Consumer preferences were increasingly leaning toward vehicles equipped with advanced safety technologies, partly due to a growing awareness of road safety issues and partly due to the higher perceived value of these technologically-equipped vehicles.

Technological advancements played a crucial role in this market. Innovations in camera, sensor, and artificial intelligence technologies were making lane warning systems more accurate and reliable. The integration of these systems with other safety features, like adaptive cruise control and blind spot detection, creates more comprehensive safety solutions, further driving the market growth.

Regionally, markets in Europe and North America were leading in terms of adoption largely due to stringent government regulations requiring the incorporation of advanced safety systems in vehicles. However, Asia-Pacific was emerging as a rapidly growing market, with countries like China and Japan investing heavily in automotive technology and infrastructure development.

The future of the lane warning systems market appeared promising, with potential growth opportunities in the integration of these systems into the expansion of autonomous and semi-autonomous vehicles.

Automotive Lane Warning Systems Market Trends

The Passenger Cars Segment is Driving the Market Growth

The passenger car segment is leading the automotive lane warning system market, with the global rise in passenger car production and sales playing a significant role. With the increasing affordability and availability of passenger cars, particularly in emerging economies, the demand for advanced safety features like lane warning systems has also escalated. These systems, initially seen as luxury or high-end options, were becoming more mainstream, driven both by consumer demand for safer vehicles and by regulatory pressures.

Regulatory influences were indeed significant. Many regions, including Europe and North America, have been implementing stringent safety regulations mandating or strongly encouraging the inclusion of advanced safety systems in new vehicles. This regulatory push effectively broadened the market for lane warning systems in the passenger car segment.

The integration of sophisticated sensors, cameras, and software not only improved the effectiveness of lane warning systems but also made them more cost-effective over time. As technology became more accessible and less expensive to produce, automakers started incorporating these systems across a wider range of models, including mid-range vehicles.

Growing public awareness about road safety issues and the benefits of advanced driver assistance systems (ADAS) is influencing buying decisions. Consumers were increasingly opting for vehicles equipped with safety features like lane departure warnings, which they viewed as essential for driving safety.

Moreover, the rise of connected and autonomous vehicles presented additional growth opportunities for the lane warning system market within the passenger car segment. As automakers invested in developing semi-autonomous and autonomous vehicles, the integration of sophisticated lane warning systems and other ADAS technologies became crucial.

This trend is expected to continue with innovations in ADAS that further enhance the safety and appeal of passenger vehicles.

North America is the Leading Market for Automotive Lane Warning Systems

North America has emerged as a leading market for automotive lane warning systems, a trend driven by a confluence of factors. The region, particularly the United States and Canada, boasts one of the highest rates of vehicle ownership per capita globally, creating a vast market for advanced automotive technologies, including lane warning systems.

Regulatory initiatives in these countries have been pivotal, with proactive measures encouraging or even mandating the adoption of safety technologies in vehicles. This regulatory push is complemented by the region's strong technological innovation, with many leading automotive and technology companies based here continually developing cutting-edge driver assistance systems.

Moreover, there is a significant consumer awareness and prioritization of vehicle safety in North America. This awareness, coupled with the willingness to invest in safety technologies, has further propelled the market for lane warning systems. Additionally, various road safety initiatives by governments and organizations have emphasized the importance of advanced safety features in vehicles.

Economic factors also play a role as the robust economies of North American countries enable both individual consumers and fleet operators to invest in newer, safer vehicles equipped with these advanced technologies. All these aspects synergistically contribute to North America's position as a key market in the realm of automotive lane warning systems.

The Canadian government announced the safe testing of every vehicle and deployment of automated and connected vehicles while spreading awareness regarding driver assistance technologies.

- In May 2022, GM announced its constructive partnership with INRIX Inc. to provide safety solutions data directly to the US Department of Transportation through its analytics-assisted cloud-based application under its Safety View by GM Future Roads & Inrix initiative.

- In May 2022, Toyota Motors announced that it would use computer-based vision technology sourced from Austin, Texas-based start-up company Invisible AI in its North American assembly plants. This technology shall be able to process body motion data to enhance quality, safety, and efficiency.

Due to the factors above, the demand for vehicle safety solutions is likely to increase. This is expected to propel the growth of the studied market between 2024 and 2029.

Automotive Lane Warning Systems Industry Overview

The automotive lane warning system market is dominated by players such as Continental AG, Delphi Technologies, Mobileye, Robert Bosch GmbH, Hitachi Ltd, ZF Friedrichshafen AG, DENSO Corporation, and Magna International Inc.

Companies are engaging in partnerships and acquisitions to develop new products and expand within the market. For instance,

- In November 2023, Honda Motor Co. Ltd unveiled its latest innovation, the Honda SENSING 360, an all-encompassing safety and driver-assistance system. This advanced technology is designed to eliminate blind spots surrounding the vehicle, aiding in preventing collisions and lessening the driver's workload during operation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Safety Awareness is Driving the Market Growth

- 4.2 Market Restraints

- 4.2.1 Cybersecurity Concerns is Anticipated to Restrain the Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 Function Type

- 5.1.1 Lane Departure Warning System

- 5.1.2 Lane Keeping System

- 5.2 Sensor Type

- 5.2.1 Video Sensors

- 5.2.2 Laser Sensors

- 5.2.3 Infrared Sensors

- 5.3 Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Heavy Commercial Vehicles

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Continental AG

- 6.2.2 Delphi Technologies

- 6.2.3 Mobileye

- 6.2.4 DENSO Corporation

- 6.2.5 Robert Bosch GmbH

- 6.2.6 The Bendix Corporation

- 6.2.7 Hitachi Ltd

- 6.2.8 Iteris Inc.

- 6.2.9 Nissan Motor Co. Ltd

- 6.2.10 Volkswagen AG

- 6.2.11 ZF TRW