|

市場調查報告書

商品編碼

1522852

丙烯腈 -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Acrylonitrile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

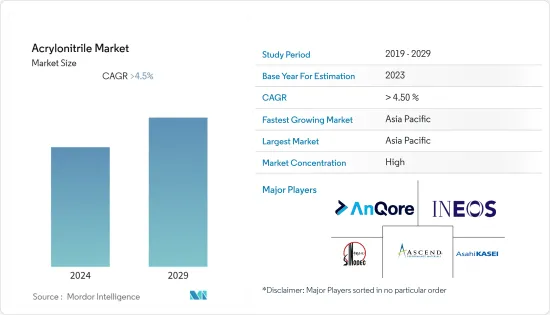

預計2024年丙烯腈市場規模為825萬噸,預計2029年將達到1058萬噸,預計在預測期內(2024-2029年)複合年成長率將超過5%。

2020 年市場受到 COVID-19 的負面影響。然而,由於工業活動增加,導致丙烯腈在丙烯酸纖維和丙烯腈-丁二烯-苯乙烯生產等各種應用中的消費量增加,市場在 2021-22 年顯著復甦。

主要亮點

- 從中期來看,汽車和建築業對丙烯腈丁二烯苯乙烯(ABS)的需求不斷增加以及紡織業的成長預計將推動市場成長。

- 另一方面,在嚴格的監管下,人們對毒性的認知不斷增強可能會阻礙市場的成長。

- 也就是說,新興的污水處理應用可能會為市場帶來新的成長機會。

- 預計亞太地區將在預測期內主導全球市場並佔據最大佔有率。

丙烯腈市場趨勢

丙烯腈-丁二烯-苯乙烯(ABS)對丙烯腈的需求增加

- 丙烯腈丁二烯苯乙烯(ABS)是一種熱塑性塑膠,具有耐化學性、耐熱性和耐衝擊性等多種性能。

- 家電領域ABS樹脂的用量不斷增加。 ABS 可應用於各種最終用戶產業,包括石油和天然氣、食品加工和設備、石油和天然氣、飛機、國防和航太。

- 丙烯腈丁二烯苯乙烯由於其低溫強度和耐久性等優異性能而廣泛應用於汽車和電子行業。丙烯腈丁二烯苯乙烯由於具有輕質、強度和低溫耐久性等優異性能,廣泛應用於汽車和電子產業。

- 此外,3D列印的發展在世界各地不斷取得進展,預計ABS的未來前景將在不久的將來擴大。

- EV Volumes的資料顯示,2023年新純電動車(BEV)和插電式混合動力汽車(PHEV)的交付量約為1,420萬輛,成長35%。這也可能增加了電動車製造商對丙烯腈丁二烯苯乙烯(ABS)的全球需求。

- 據電子和資訊技術部稱,印度致力於在2025-26年實現電子製造和出口價值3000億美元。國內電子產品產量經歷高速成長,從 2017 會計年度的 490 億美元成長到 2023 會計年度達到 1,010 億美元,複合年成長率為 13%。

- 所有上述因素預計將影響預測期內丙烯腈的需求。

亞太地區預計將主導市場

- 亞太地區預計將佔據市場主導地位並佔據重要佔有率。由於中等收入人均收入強勁成長,預計亞太市場的成長速度將快於其他國家,從而導致該地區消費品銷售增加。

- 隨著中等收入群體的增加,中國家電力市場可能會繼續成長,因為中等收入群體購買許多由ABS塑膠製成的耐用消費品。根據中華人民共和國國務院2024年5月發布的資料,中國已成為全球最大的家電製造地,產能佔全球的60-70%。

- 中國是電動車市場的全球領導者。中國政府提供強力的財政和非財政獎勵來促進電動車銷售。根據InsideEVs統計,2023年中國插電式汽車銷售將創下800萬輛的新紀錄。

- 根據印度汽車經銷商協會聯合會(FADA)統計,2023年印度電動車銷量達1,529,947輛,與前一年同期比較成長49.25%。

- 日本承諾2050年實現淨零排放,2030年排放減少46%。政府認知到向電動車的轉變是支持國家脫碳的一種手段。政府計劃讓消費者更買得起電動車。日本的補貼高達 80 萬日圓(7,000 美元)。

- 上述因素預計將在預測期內進一步提振丙烯腈市場的需求。

丙烯腈產業概況

丙烯腈市場是一個綜合市場,五家主要公司佔據了全球市場的大部分佔有率。該市場的主要企業包括英力士、中國石油化學集團公司、旭化成公司、奧升德高性能材料公司和江蘇盛虹集團。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 汽車和建築業對丙烯腈丁二烯苯乙烯 (ABS) 的需求增加

- 紡織工業的成長

- 抑制因素

- 丙烯腈的毒性和監管

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 供應概覽

- 生產概況

- 生產成本概覽

- 監理政策概覽

- 技術簡介

- 價格概覽(2018-2023)

- 價格總結(丙烯腈)

- 原物料價格

第5章市場區隔(市場規模)

- 工藝技術

- 氨氧化製程

- 其他製造程序

- 目的

- 腈綸纖維

- 丙烯腈-丁二烯-苯乙烯(ABS)/苯乙烯-丙烯腈樹脂(SAN)

- 丙烯醯胺

- 丁腈橡膠 (NBR)

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 拉丁美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他拉丁美洲

- 中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- AnQore

- Asahi Kasei Advance Corporation

- Ascend Performance Materials

- China Petrochemical Development Corporation

- China Petroleum & Chemical Corporation(SINOPEC)

- Cornerstone Chemical Company

- Formosa Plastics Corp.

- INEOS

- Jiangsu Shenghong Group Co. Ltd

- PetroChina(CNPC)

- SOCAR(Petkim Petrokimya Holding A)

- Taekwang Industrial Co. Ltd

第7章 市場機會及未來趨勢

- 探索性污水處理應用

The Acrylonitrile Market size is estimated at 8.25 Million tons in 2024, and is expected to reach 10.58 Million tons by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. However, the market recovered significantly in the 2021-22 period with the increase in industrial activities that propelled higher consumption of acrylonitrile in various applications such as acrylic fiber and acrylonitrile butadiene styrene production.

Key Highlights

- Over the medium term, the increasing demand for acrylonitrile butadiene styrene (ABS) in the automotive and construction industries and the growing textile industry are expected to drive the market's growth.

- On the flip side, growing awareness of toxicity amid strict regulations could hinder the growth of the market.

- Nevertheless, budding wastewater treatment applications are likely to provide new growth opportunities for the market.

- Asia-Pacific is expected to dominate the global market and account for the largest share during the forecast period.

Acrylonitrile Market Trends

The Demand for Acrylonitrile for Acrylonitrile Butadiene Styrene (ABS) is Rising

- Acrylonitrile butadiene styrene (ABS) is a thermoplastic that provides a diverse combination of properties, like resistance to chemicals, heat, and impact.

- The consumption of ABS resins is increasing in the consumer appliances segment. ABS finds application in various end-user industries such as oil and gas, food handling and equipment, oil and gas, aircraft, defense, and aerospace.

- Due to acrylonitrile butadiene styrene's superior properties, such as strength and durability at low temperatures, it is widely used in the automotive and electronics industries. Due to its superior properties, such as lightweight, strength, and durability at low temperatures, it is widely used in the automotive and electronics industries.

- Increasing developments in 3D printing around the world are also projected to increase the scope of application for ABS in the near future.

- As per the data of EV Volumes, about 14.2 million new battery electric vehicles (BEV) and plug-in hybrid vehicles (PHEV) were delivered during 2023, marking an increase of 35%. This might have also increased the demand for acrylonitrile butadiene styrene (ABS) from electric vehicle manufacturers globally.

- According to the Ministry of Electronics and Information Technology, India is committed to reaching USD 300 billion worth of electronics manufacturing and exports by 2025-26. The country witnessed a high growth in domestic electronics production, reaching USD 101 billion in fiscal year 2023, registering a CAGR of 13% from USD 49 billion in fiscal year 2017.

- All the aforementioned factors are expected to impact the demand for acrylonitrile during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the market with a significant market share. The Asia-Pacific market is expected to witness faster growth than other countries, owing to the significant increase in the per-capita income of the middle-income population and the resultant increase in consumer goods sales in the region.

- The appliance market in China is likely to continue to grow as the middle-income population grows since this group purchases more consumer-durable electronic goods that use ABS resins. According to the data released by the State Council of the People's Republic of China in May 2024, China became the world's largest manufacturing base for home appliances, accounting for 60-70% of global production capacity.

- China is the global leader in the electric car market. The Chinese government provides strong financial and non-financial incentives to boost electric car sales. Statistics from InsideEVs showed that in China, the sales of plug-in cars hit a new 8 million record in 2023.

- According to the Federation of Automobile Dealers' Association (FADA), in India, electric vehicle sales increased by 49.25% in 2023 over the previous year, reaching 1,529,947 units.

- Japan has pledged to become net zero by 2050 and reduce emissions by 46% by 2030. The government recognizes the shift to EVs as being a way of supporting the country's decarbonization efforts. The government plans to make EVs more affordable for consumers. The subsidies in Japan reached a maximum of JPY 800,000 (USD 7,000).

- The above-mentioned factors are expected to further drive the demand in the acrylonitrile market over the forecast period.

Acrylonitrile Industry Overview

The acrylonitrile market is a consolidated market, with the top five players accounting for the majority of the global market. Some of the major players in the market include INEOS, China Petroleum & Chemical Corporation, Asahi Kasei Corporation, Ascend Performance Materials, and Jiangsu Shenghong Group Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Acrylonitrile Butadiene Styrene (ABS) in the Automotive and Construction Industries

- 4.1.2 Growing Textile Industry

- 4.2 Restraints

- 4.2.1 Toxicity and Regulations of Acrylonitrile

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Supply Overview

- 4.6 Production Overview

- 4.7 Production Cost Overview

- 4.8 Regulatory Policy Overview

- 4.9 Technological Snapshot

- 4.10 Pricing Overview (2018-2023)

- 4.10.1 Pricing Overview (Acrylonitrile)

- 4.10.2 Raw Material Pricing

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Process Technology

- 5.1.1 Ammoxidation Process

- 5.1.2 Other Production Processes

- 5.2 Application

- 5.2.1 Acrylic Fiber

- 5.2.2 Acrylonitrile Butadiene Styrene (ABS)/Styrene-Acrylonitrile Resin (SAN)

- 5.2.3 Acrylamide

- 5.2.4 Nitrile Butadiene Rubber (NBR)

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AnQore

- 6.4.2 Asahi Kasei Advance Corporation

- 6.4.3 Ascend Performance Materials

- 6.4.4 China Petrochemical Development Corporation

- 6.4.5 China Petroleum & Chemical Corporation (SINOPEC)

- 6.4.6 Cornerstone Chemical Company

- 6.4.7 Formosa Plastics Corp.

- 6.4.8 INEOS

- 6.4.9 Jiangsu Shenghong Group Co. Ltd

- 6.4.10 PetroChina (CNPC)

- 6.4.11 SOCAR (Petkim Petrokimya Holding A)

- 6.4.12 Taekwang Industrial Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Budding Wastewater Treatment Applications

![丙烯腈市場:趨勢、機會與競爭分析 [2024-2030]](/sample/img/cover/42/1496981.png)